It’s Time to Plug into PLUG Stock

The big picture off and on the price chart look increasingly promising for Plug investors

For alternative energy outfit Plug Power (NASDAQ:PLUG), 2020 looks increasingly like a plug-and-play situation for its investors. But to avoid the larger risks with this type of investment, buying PLUG stock today goes beyond the price chart and simply seeing things optimistically.

No doubt 2019 was a good one for Plug investors. At the nadir of late 2018’s near-crippling market correction, shares traded as low as 99 cents. But bears trying to squeeze out that last bit of coin in share price have been punished.

The hydrogen fueling specialist continues to make strong strides in its plans of reaching $1 billion in sales over the next couple years. And shares have reacted strongly, rocketing higher the last 14 months by nearly 350% to $4.40. It’s not just wishful thinking on the part of management or investors, either.

Plug has defied skeptics by landing major deals with Walmart (NYSE:WMT) and Amazon (NASDAQ:AMZN) over the last couple of years. The company’s hydrogen fuel cell or HFC technology enables those retail giant’s forklifts to more efficiently power their commercial operations. And the buck, or should I say, the $60 million Walmart plans on sending Plug’s way this year or Amazon’s $70 million agreement, doesn’t stop there.

The most recent news is Plug has landed another major customer within this growing market as companies continue to look for innovative, less-costly and greener options to being competitive. The whisper is the $50 million deal could be with home improvement chain Home Depot (NYSE:HD). If that’s confirmed, could Lowe’s (NYSE:LOW) be far behind?

Bottom-line, the chase for retailers to remain competitive with the likes of Amazon and Walmart appears to be on its way. What’s more, there’s also plenty of fuel in the tank for a profitable ride on the price chart.

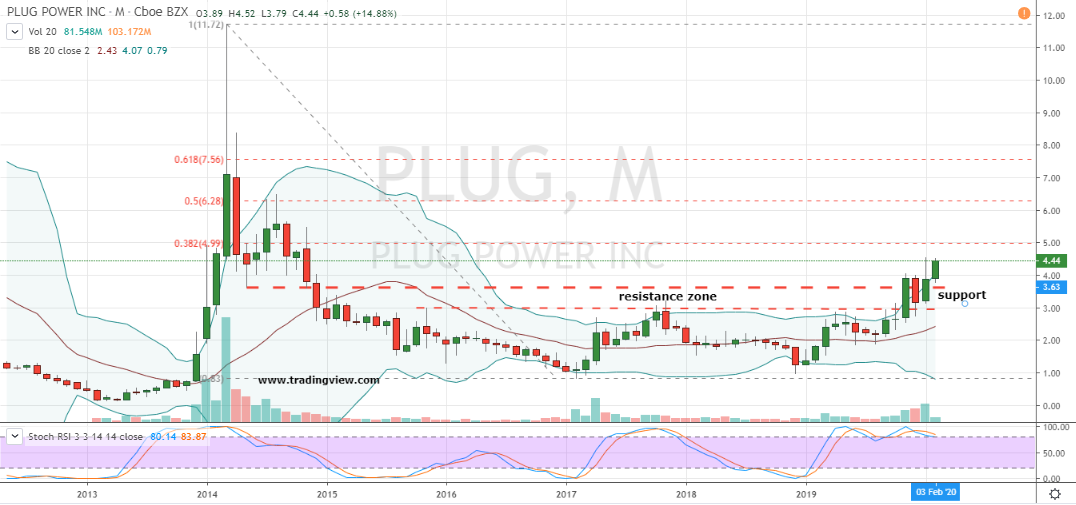

PLUG Stock Monthly Chart

Source: Charts by TradingView

It has been a nice ride to be certain for Plug investors that looked the other way when conditions appeared to be at their worst in December 2018. Technically, though, the stock has only just begun to turn the corner on the price chart. And PLUG stock looks ready to buy today for continued big-time profits.

As the monthly chart illustrates, the rally in Plug from sub $1 has just cleared a key area of price resistance. It’s bullish, but there’s more. Shares are now in an uptrend supported by higher highs and higher lows. Nice, right? Further, with nearly three months of testing this critically important zone before convincingly using it as technical support in February, this still small $1.3 billion stock is well-situated for a larger momentum cycle to take hold. Still, there are risks to consider.

Despite the positives supporting PLUG stock, shares are still more of a risk-asset than the large capitalization customers it’s serving. Also, our observation of shares being ripe for momentum can be a double-edged sword. I’d also be remiss if I didn’t note the price chart already maintains some of those risks tied to Plug’s stochastics and Bollinger Bands.

I view Plug’s prospects favorably. But as a name which also has its share of obvious and potentially larger risks, I’d suggest a collar or married put to go along with a stock purchase. Unlike simply holding shares as a standalone investment, these are two guaranteed spread strategies which can capture big-time profits while avoiding the always real possibility of a lights out situation off and on the price chart.

Investment accounts under Christopher Tyler’s management own positions in Plug Power (PLUG) and its derivatives, but no other securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional options-based strategies, related musings or to ask a question, you can find and follow Chris on Twitter @Options_CAT and StockTwits.