LogicBio: A Speculative Buy For Their GeneRide Platform Based Gene Therapies

by C. C. AbbottSummary

- LogicBio Therapeutics develops gene therapies to treat rare genetic diseases in pediatric patients with significant unmet medical needs.

- Their treatments, based on their proprietary GeneRide platform, have the potential to be safe and durable.

- On Feb. 10, the company announced that the FDA has placed a clinical hold on their IND (Investigational New Drug) submission for their lead candidate LB-001 for MMA (methylmalonic acidemia).

- As the result of the news, the stock declined by >30%. In my opinion, this clinical hold will be lifted, once the company resolves the FDA's concerns satisfactorily.

- For those who have the appropriate risk tolerance and investment time frame, LogicBio Therapeutics is a speculative BUY for their potential in treating rare genetic diseases in pediatric patients safely and durably.

Introduction

LogicBio Therapeutics (NASDAQ:LOGC) is a genome-editing company focused on developing treatments to treat rare genetic diseases in pediatric patients. Their treatments are based on their proprietary platform called GeneRide™ (more details later), which the company believes has the potential to be safe and have a durable treatment effect.

On Feb. 10, the company announced that the FDA has placed a clinical hold on their IND (Investigational New Drug) submission for their lead candidate LB-001 for MMA (methylmalonic acidemia).

Previously (Jan. 10, 2020), the company announced that they had submitted the IND to support their plan to start a phase 1/2 MMA trial in H1 2020, with preliminary data in H2 2020.

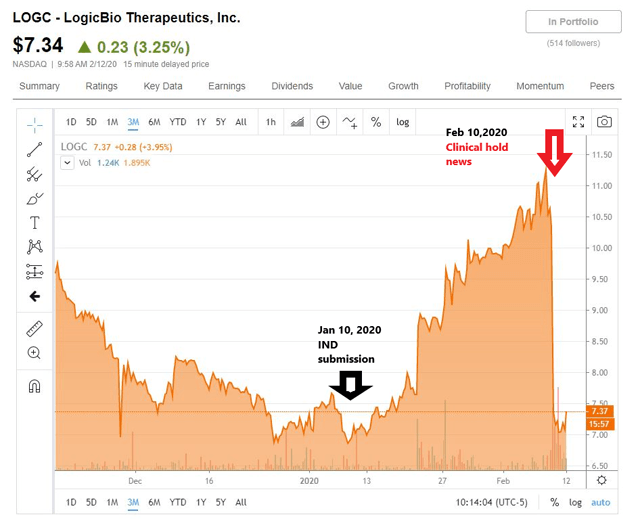

The price actions corresponding to these two news items can be seen in the chart below.

(Source: Seeking Alpha)

As the news was released post market on Feb. 10, the stock closed down 31.96% on Feb. 11, from the previous close ($7.11 from $10.45)

In the clinical-hold news, the company indicated that the FDA will provide their questions in writing within a month, and the company will work with the agency to resolve these questions as soon as possible.

Let us now turn to the company and look at their approach and competitive potentials.

Approach

This is how the company describes itself:

At LogicBio, we are committed to delivering genetic medicine to pediatric patients with rare diseases. We are initially targeting rare liver disorders where it is critically important to treat patients early in life, before irreversible damage occurs. We believe our foundational platform technology, GeneRide, is well-suited to this goal because - unlike traditional gene therapy - it harnesses the cell's natural DNA repair process to integrate a corrective gene directly into the patient's chromosomes. This approach is designed to provide a durable therapeutic benefit from a single treatment."

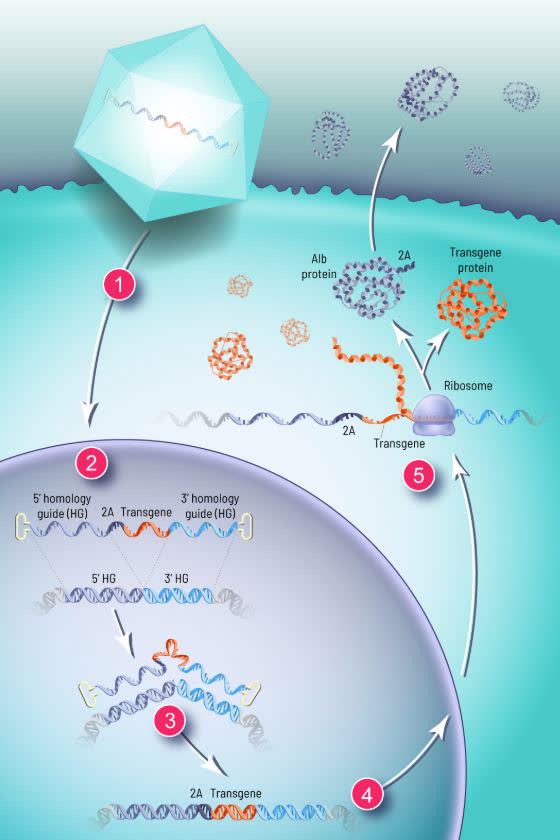

Please do check out the link of GeneRide that explains the scientific rational of their approach.

LogicBio, similar to Homology Medicines (NASDAQ:FIXX), uses a naturally-occurring DNA repair process called homologous recombination as the way of integrating the therapeutic transgenes.

(Source: LogicBio website)

The company believes that such an approach (i.e. harnessing the naturally-occurring homologous recombination process vs. other gene-editing technologies such as CRISPR/Cas9, TALEN, and zinc fingers) may have "the potential to provide safety and efficacy benefits over existing technologies."

LogicBio describes the advantage of their approach in three major areas: Durability, Precision, Safety.

Needless to say, these are very significant advantages over any potential competing gene therapy that is based on other editing technologies, if LogicBio can demonstrate (prove) them successfully in trials.

Let us now take a closer look at their proprietary GeneRide platform.

GeneRide platform

One potential challenge for gene therapy companies harnessing the homologous recombination process is that some scientists think that the process may not occur often enough, as expressed in this 2017 article.

Another example can be seen in a 2019 SA news item, a scientific abstract questioning the validity of nuclease-free gene-editing technology.

LogicBio's answer to this challenge is their GeneRide platform.

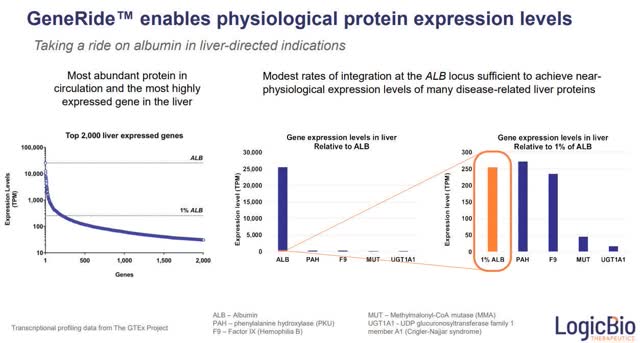

The therapeutic transgenes, developed on this platform, contain both albumin and the desired therapeutic protein. They are engineered to be integrated into the site (gene) of albumin, the most highly expressed liver protein. Albumin production then co-produces the therapeutic protein.

The company believes that their preclinical data from animal models shows that, even with only 1% expression of albumin, cells can produce 'near-physiological expression levels of many disease-related liver protein.'

(Source: Company presentation; Slide 9)

In other words, these therapeutic genes (which will express correctly the needed liver proteins to treat the rare liver genetic diseases) take a ride on the albumin transgene (instead of being on their own), thus overcoming the challenge of the low occurrence of the homologous recombination process.

Even if only 1% of liver cells take on the transgenes (via homologous recombination process), the company believes that it will be sufficient to achieve a durable treatment benefit.

Furthermore, according to a recent news, LogicBio reported that the modified cells may have a selective advantage over the unmodified cells, which suggests that the percentage of expression may increase over time (i.e. strengthening the basis for producing a durable treatment benefit).

Finance

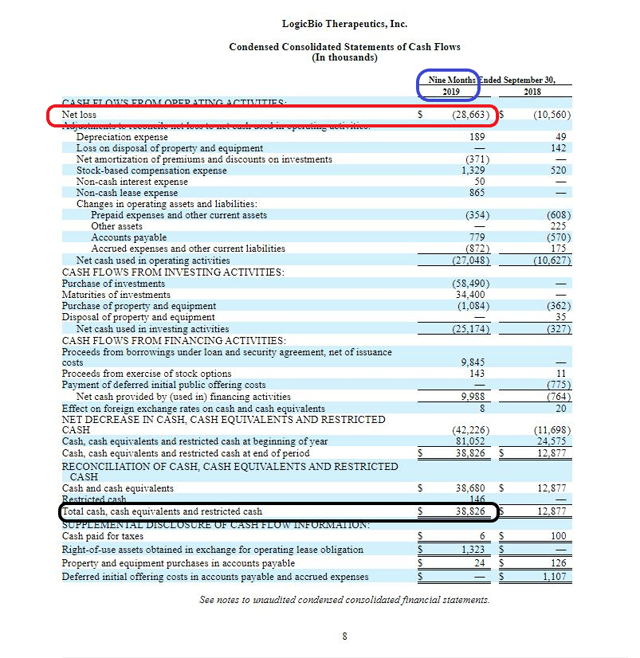

According to the latest 10-Q form, the company had a cash position of $38.8M on Sept. 30, 2019 and a net loss of $28.7M for the first 9 months in 2019, suggesting an approximately 1-year cash runway, from Sept. 30, 2019.

(Source: 10-Q form, p8)

Two other related news items:

On Nov. 5, 2019, the company has filed a prospectus for a $200M mixed shelf offering.

On Jan. 10, 2020, the company announced a research collaboration with Takeda Pharmaceutical (OTCPK:TKPHF).

Discussion

A >30% decline in valuation for a clinical-hold news for an IND submission, though understandable, may be overdone.

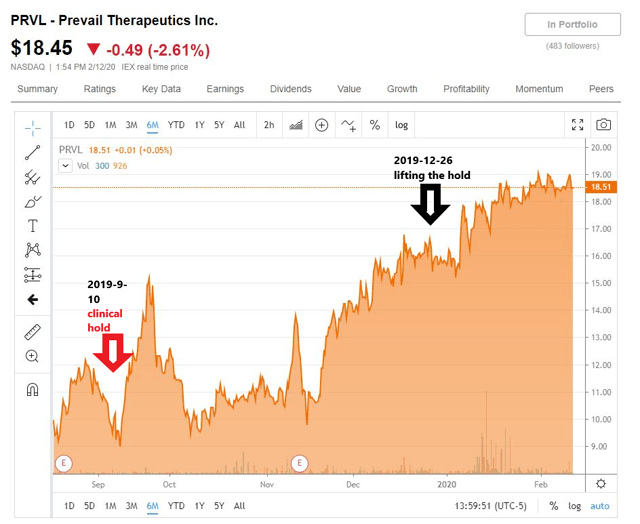

For example, another gene therapy company, Prevail Therapeutics (NASDAQ:PRVL) has recently gone through a clinical hold for their IND submission (Clinical hold news on Sept. 10, 2019; lifting-the-hold news on Dec. 26, 2019)

The chart below shows the price actions of the stock around the times of these news.

(Source: Seeking Alpha)

Granted, these are two different companies that have their own specific circumstances.

However, perhaps a point can be made that it's not uncommon for the FDA to put a clinical hold on an IND submission and that companies such as PRVL or LOGC should be able to work with the FDA to resolve the issues successfully.

Once the company resolves the issues successfully with the FDA, I think that it is most likely the stock will recover to its pre-clinical-hold news level or higher, as one observes in the case of PRVL.

The current market cap of LogicBio is around $187M (or a price $7.84 on Feb. 13, 2020), which is inexpensive among its peers.

Homology Medicines, which is the most similar peer in their approach, has a market capitalization of ~$853M (or a price of $18.48 on Feb. 13, 2020), granted that they are more advanced in their lead treatment's development (e.g. reporting early data from their phase 1/2 study on Dec. 17, 2019).

Before the clinical hold, LogicBio expected to start their phase 1/2 trial in H1 2020, with the early data in H2 2020. Thus, they are approximately one year behind* in term of the development of their lead candidate.

(*Note: not for the same indication. Only in term of developmental stage).

Risks

With any clinical-stage biotech companies, clinical trial failures are the most significant material risks, regardless of how solid their scientific rational and strong the preclinical animal data are.

It is also possible that the current clinical hold placed by the FDA will present an insurmountable challenge, which the company will be unable to resolve successfully, though such an extreme scenario is highly unlikely, in my opinion.

Financial risks of dilution by equity offers are perhaps a necessity, for most clinical-stage biotech companies.

In the case of LogicBio, a partnership with Takeda or any other future partnership will certainly help, but not completely do away, with the need to raise additional funds in the future.

Final remarks

LogicBio has a solid approach, and their gene therapies based on their GeneRide platform have the potential to be safe and durable gene therapies for several rare genetic diseases in pediatric patients, starting with liver diseases.

In my opinion, their competitive advantages over other more better-known gene-editing technologies are very significant, if LogicBio is successful.

Therefore, for any investor who has the appropriate risk tolerance and a long-term investment time frame, I think that LogicBio is a speculative BUY!

Thanks for reading.

Disclosure: I am/we are long LOGC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: My articles are not investment recommendations, and I am not an investment adviser. Small/micro cap, clinical stage biotech stocks are highly volatile, speculative, and risky. No clinical trial is guaranteed to succeed, even with strong science, prior positive results, or bullish SA articles. When a trial fails (and the company stops the program), small/micro cap biotech stock can decline very significantly. Also, since these companies have negative revenue, the financial risks such as dilution or insolvency are always present. Investing in these stocks may result in a partial or complete loss of investment. Conduct your own due diligence before making any investment decision. You are responsible for your own investment decisions.