Philips: High Margin Of Safety And A 10% IRR Make This Medical Imaging Play A Buy

by Belgian And BullishSummary

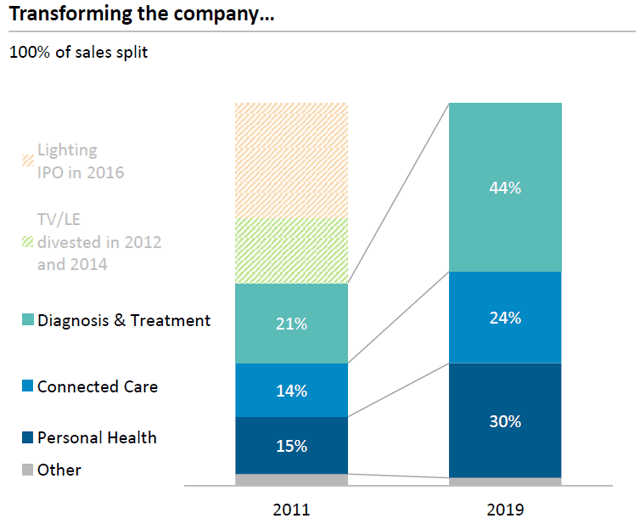

- Philips has transformed from an industrial conglomerate to a leader in several fields within the medical technology space.

- The company is a global leader in the oligopolistic medical imaging space.

- The upcoming sale of the domestic appliances division will bring Philips closer to becoming a pure-play medical technology company.

- Mid-single digit revenue growth, margin improvement, a clean balance sheet, and high ROIC create attractive future prospects for Philips.

This article was highlighted for PRO+ subscribers, Seeking Alpha's service for professional investors. Find out how you can get the best content on Seeking Alpha here.

The medical imaging industry

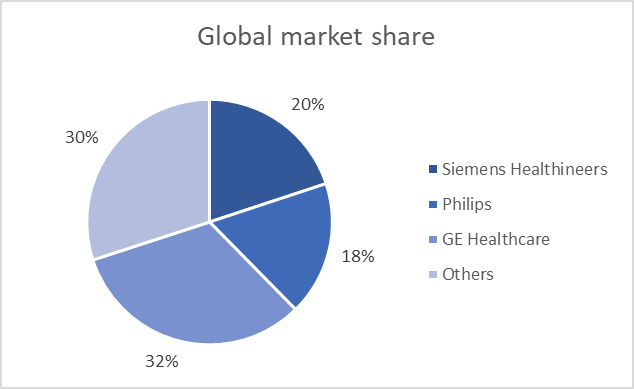

The medical imaging space is a growth industry that is characterized by low capital intensity, high margins, high free cash flow, clean balance sheets and thus high returns on capital. The origins of these attractive characteristics can be found in the structure of the industry. The medical imaging space is an entrenched oligopoly where the top three players cumulatively represent 70% of the market.

The three large players in the industry are GE Healthcare (GE), Siemens Healthineers (ETR:SHL) (OTCPK:SMMNY), and Philips (PHG). The 30% market share that is not controlled by these three players belongs to players such as Canon (CAJ), Hitachi (OTCPK:HTHIY) (TYO:6501), Fujifilm (OTCPK:FUJIF) (TYO:7751), and Toshiba (OTCPK:TOSBF) (TYO:6502).

Source: Author's own graph, Industry reports, Company presentations

Imaging has a unique and important position in hospitals because:

- It is by far the most connected to other departments within the hospital. Virtually every other department touches on radiology and this across the whole journey of prevention, diagnosis, treatment, and check-up/monitoring.

- Imaging/radiology (together with laboratory) is one of the money-making departments of a hospital, subsidising other loss-making areas where labour/care is more dominant.

- Radiology/imaging becomes the prime place for a hospital in terms of its efforts to build integrated software/data platforms that span all departments. The sheer amount of data that is generated by Imaging provides it with a unique asset for future monetization.

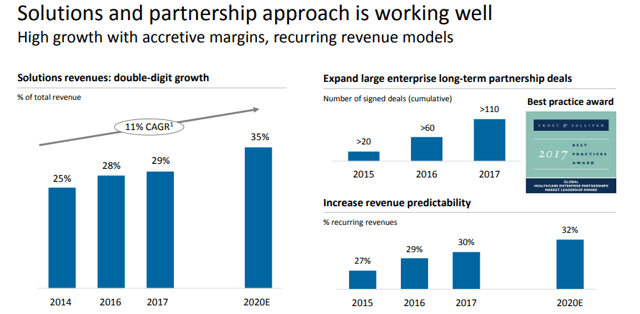

Source: Investor presentation Siemens Healthineers

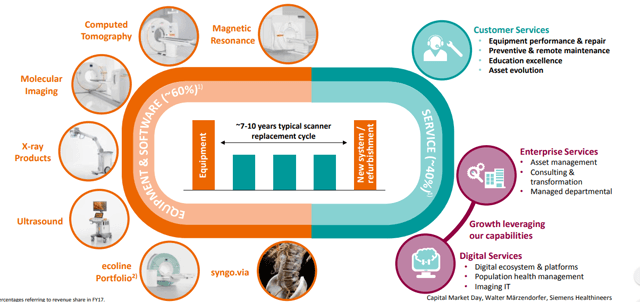

The expanding importance and focus on medical imaging are creating a new role for the big equipment manufacturers within this space. The direct consequence of the incorporation of big data and AI in medical imaging is that Siemens/Philips/GE are turning into long-term software partners rather than hardware transaction sellers. This trend increases the share of recurring revenues and is beneficial to margins of the aforementioned players.

Recurring revenues/services already present 30-40% of sales in the typical 7-10 years scanner replacement cycle and this percentage is poised to increase.

Source: Investor presentation Philips

Source: Investor presentation Siemens Healthineers

The three industry leaders also enjoy the benefit of new applications within medical imaging that further spur market growth. 20 years ago, Imaging was only used as a diagnostic tool. Today, it is increasingly used in preventional, therapeutic and interventional settings (see image below).

Source: Investor presentation Siemens Healthineers

In this report, we will focus on Philips, the most underrated player in the industry.

Koninklijke Philips NV: Not the company you think it is

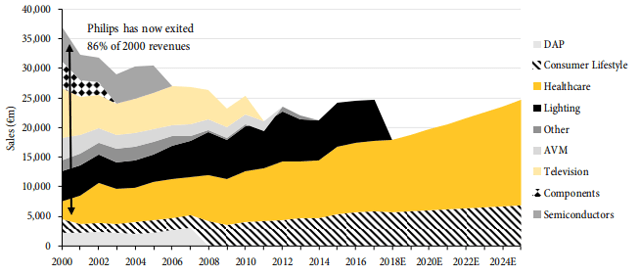

While Philips is a well-known brand that has brand recognition all over the world, most people would not associate it with being a leader in the medical imaging space. This is because the company used to be a large industrial conglomerate that was active in several end-markets. Philips, however, underwent a significant transformation, where the spin-off of the lighting division, Signify (NA:LIGHT), was the latest major step. This large transformation is excellently displayed in the graphs below.

Source: Redburn Research

Source: Investor presentation Philips

The market, however, does not seem to be aware that this transformation took place and that Philips is now a growing leader in the medical imaging space. This is clear in the earnings multiple that they are willing to assign to Philips. This creates an interesting opportunity for investors that are willing to wait until the market becomes aware of the changes that took place.

The other divisions

An argument that can be raised is that Philips is not yet a pure play on medical imaging and that there are still two other divisions that represent around 62% of the current operating profit that the company makes. These are the Personal Health and the Connected Care division.

Connected Care: The bulk of this business is ECG monitoring in hospitals, where Philips is the global leader within the industry. It's a very nice, sticky business with >40% recurring revenues that is similar to medical imaging in terms of margins, cash flow, etc. It's a great asset to have to establish the long-term software partnerships with hospital groups. At the start of 2019, the sleep and respiratory care business line was transferred from the Personal Health division to the Connected Care division. The latter is an incredibly valuable division that provides some hidden value within the company. If one looks at the stock listed peers in sleep care such as ResMed (RMD) and Fisher & Paykel (OTCPK:FSPKF), it can be seen that these stocks both trade at over 40 times forward earnings. This sheds an interesting light on the value of Philip's sleep and respiratory care business line.

The Connected Care division represents 15% of the overall operating income (excluding corporate overhead)

Source: Investor presentation Siemens Philips

Personal Health: Personal Health represents nearly 50% of current earnings and consists of several business lines in which Philips is a world leader. The business lines are situated in the fields of oral care, male grooming, garment care, and mother & child care. This division is still growing revenues at a very healthy mid-single digit rate and currently features the highest EBITA-margins of all divisions within the company.

While the presence of the Personal Health division may be one of the main reasons that the market is currently refusing to value Philips as a MedTech company, it must be noted that the Personal Health division is anything but an unattractive segment. In the contrary, the division offers the following attractive features:

- Niche consumer goods positions where Philips is very dominant.

- Product categories where brands are valuable as it deals with health, babies, etc.

- The segment has averaged organic growth above 5% over the past 3 years.

- Future growth is driven by both several new product launches (e.g. OneBlade) and the fact that the end markets are underpenetrated (80% of the world population still brushes manually)

- 40% of sales is generated in emerging markets.

- The segment has high margins/CF and generates returns on capital of c. 20%.

Another shift towards becoming a pure play medical technology company

On the 28th of January 2020, Philips reported its Q4 and Full Year 2019 results alongside the message that they are seeking to divest the Domestic Appliances business line that resides within the Personal Health division. The rationale behind this decision is that this segment has become non-core for Philips.

The market paid little attention to this initiative to further move towards becoming a pure medical technology company. Instead, the market focused on the disappointing bottom-line results that faced significant pressure from the US-China trade wars this year.

We, however, believe that the sale of the Domestic Appliances is another step towards a rerating for Philips due to the following two reasons:

- It will nearly complete Philips' transition from an electronics conglomerate to a MedTech player

- The proceeds of the sale will enhance the already healthy balance sheet and provide Philips with enough ammunition to engage in accretive M&A in the medical imaging space.

- The sale will be accretive to margins as the DA business line has subpar margins

This, however, assumes that Philips is successful in finding a buyer that is willing to pay a fair price for this division. We are confident that the company will succeed in this endeavour. Philips management stressed their belief that there should be plenty of interest and Philips holds dominant leadership positions in this market.

Bank of America estimates that a sale could bring in between 3.5-4 billion euro. We believe that this estimate is rather aggressive and expect an amount between 2.5-3 billion Euro to be more realistic. We base ourselves on the EUR 2.3 billion in sales that the business line generated in 2019 and an estimated 12% EBIT-margin. Assuming that Philips gets at least 10 times the derived EBIT, then the price should be at least 2.75 billion euro. This would eliminate a large part of the current 4 billion Euro net debt position and place Philips in an ideal position to engage in accretive M&A or to start a new capital returns program. The company expects the sale to take up to 12-18 months to be completed.

Does Philips meet the other requirements for a rerating?

As a part of our bullish conviction relies on our belief that Philips should trade at a multiple similar to its closest competitor, Siemens Healthineers, we feel obliged to compare both players so that reader can determine whether the difference in trading multiples is justified.

What are the similarities between Philips and Siemens Healthineers?

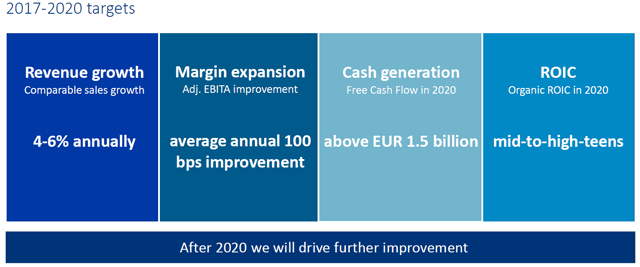

- Siemens and Philips have generated similar organic growth rates in the past. Both companies have a sales growth target of 4-6% organic growth for the group

- They spend same percentage of sales on R&D

- They have similar free cash flow conversion

- Both companies have a relatively clean balance sheet with net debt/EBITDA standing at 1.1x for Philips and 1.2x for Siemens Healthineers

- Philips and Siemens Healthineers are expected to generate operating income of respectively €2.5 billion and €2.7 billion in 2020

- Both companies have the same strategy: constant innovation, betting on digital/AI and increasing the share of recurring revenues by entering into long-term strategic partnerships with its clients.

- Both companies are asset-light, with capex as a percentage of sales ranging between 3-4%. This is split half-half between capex on PP&E and additions to intangibles.

What are the differences between Philips and Healthineers?

There are two major differences between Philips and Siemens Healthineers: mix and margins.

- First of all, the Medical Imaging activities of Philips and Siemens are not exactly the same. Within medical imaging, Philips has a far better mix of activities than Siemens, as it is dominated by image-guided therapy and ultrasound, the two fastest-growing applications within the sector. We have talked about image-guided therapy earlier in this article. It plays on the shift towards using imaging not only as a diagnostic tool but also in the operating room for minimally invasive surgery. Ultrasound is the largest, but also fastest-growing modality within imaging, as it is increasingly used for new applications (obstetrics, cardiovascular, gastro-intestinal, ...) using portable solutions plugged into your iPhone or iPad. Both ultrasound and IGT grow close to double-digit organically.

In our research, we have spoken to industry experts, including former Philips C-suite members who confirmed our belief that Philip's technology is at least as good and probably even better than that of Siemens Healthineers.

- The second big difference between Philips and Siemens is margins. Philips' 13.0% adjusted EBIT margin is light versus Siemens' 17.2% margin. The first reaction would be that this is simply due to group mix, i.e. Personal Health having a lower margin. This is not the reason, quite the contrary in fact.

Source: Investor presentation Siemens Philips

This highlights that Siemens Healthineers has significantly higher margins for its imaging department than Philips for its Diagnosis and Treatment department. This indicates that there is potential for significant margin improvement at Philips, which management has confirmed is one of its key focus points (see slide below).

Source: Investor presentation Philips

What about that other competitor?

The other big competitor is GE healthcare. It is much harder to extract the exact size and margins of the medical imaging applications from the total GE Healthcare business. These aren't disclosed separately.

The key consensus, however, is that both Philips and Siemens Healthineers are key benefactors of General Electric's decision to not completely sell or spin-off GE healthcare. As those who are familiar with GE know, the company is undergoing a shaky turnaround and the company is strapped for cash as it is facing a high debt burden. This is causing the company to siphon cash from high cash generative division such as GE healthcare to pay off debt. This limits the amount of money that GE healthcare can spend on R&D and marketing. Philips and Siemens Healthineers have taken advantage of this by stealing away some of GE's market share.

What kind of returns are we looking at?

Assuming that there will be no rerating in the multiple at which Philips trades, despite the clear shift towards becoming a medical technology company, we estimate returns as follows:

Philips will grow sales at around 5% per year and it will improve its margins by 100bps each year. This alone is sufficient to drive double digit EPS growth. This, however, does not include potential share buybacks and accretive M&A, something which will surely happen if the domestic appliances division gets sold.

So if in order to create a margin of safety, one excludes the gains from multiple rerating, M&A and share repurchases than one is looking at around 10% EPS growth per year for the next two-three years. We, therefore, place a $65+ price target within three years.

While a 10% yearly return is not eye-popping, it must be noted that we were very conservative in deriving our price target. At the current price, Philips offers the opportunity to build a stake in an attractive long-term compounder with very limited downside potential.

Conclusion

Philips is a global leader in the various medical technology-related fields. Its leading role in the oligopolistic medical imaging space is the most noteworthy but its position is respiratory and sleep care is also worth a special mention. The market however still perceives Philips as an industrial conglomerate.

This provides investors with the opportunity to build a stake in a leading MedTech player that is active in various industries that are benefiting from secular growth trends. The company has a mid-single digit top-line growth rate, improving margins, a clean balance sheet and high returns on invested capital.

Our very conservative price target of $65 in three years implies a yearly return of 10%. We would not be surprised to see the stock perform much better as we do see potential for multiple rerating, share buybacks and accretive M&A. More importantly perhaps is that at the current price levels, the downside potential is very limited. A feature that should not be overlooked in this price elevated environment. Buying Philips at the current price levels should enable any investor to sleep at night while the company compounds value for many years to come.

Disclosure: I am/we are long PHG, ETR:SHL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.