HCB Financial: A Modestly Overvalued Bank

by Carlton Getz, CFASummary

- HCB Financial is a solid community bank serving an area in southwestern Michigan.

- A conservative loan portfolio, however, offsets a remarkably low cost deposit base to limit the company's net interest income.

- The company appears to have few good options to improve a below average return on equity despite a highly favorable effective tax rate.

- The company's shares are likely modestly overvalued even though they currently trade below book value.

HCB Financial Corporation (OTCPK:HCBN) is the holding company for Highpoint Community Bank, a seven-branch community bank serving the area roughly compassed by Grand Rapids, Lansing, and Kalamazoo and reaching into the southern suburbs of Grand Rapids.

The company is a solid financial institution with a dominant insured deposit market share (48.9%) in its core market of Barry County, Michigan, and smaller market shares in adjacent counties where the company also has branches. However, the company has persistently underperformed its community banking peers both locally and nationally, resulting in below average returns on average assets and equity. Consequently, although the company's shares have trended down recently and trade at relatively modest valuation multiples, the current quotation remains excessive given the company's lackluster earnings potential.

Operating Overview

HCB Financial reported returns on average assets and average equity of 0.7% and 7.1%, respectively, for the year ended December 31, 2019. The results were well below average for community banks in our research range but generally consistent with (and even a little higher than) the company's recent annual results. The boost in the most recent year was largely driven by a reduction in the company's effective income tax rate from 10.2% to 3.6%; income before income taxes actually declined slightly year over year as growth in noninterest expenses exceeded growth in net interest income and noninterest income. The company's exceptionally low effective tax rate is driven by significant tax exempt income among other factors.

The company's substandard operating metrics are unusual in that the company has a number of attractive attributes. The company's asset quality, for example, is remarkably strong with no nonaccrual loans as of the end of the year. The company's total nonaccrual and past due loans amounted to $504,000, or 0.2% of total loans. In the meantime, HCB Financial's allowance for loan losses of $1.3 million, while low when compared to other institutions at only 0.6% of total loans, is not unreasonable given the company's strong asset quality and net charge-offs of only $25,000 in the last year. The company did have an elevated $166,000 in net charge-offs in 2018, but this has been an outlier in recent experience and is still quite modest given the company's loan portfolio and allowance for loan losses.

HCB Financial's deposit base is similarly attractive. The company has only 20.8% of total deposits in noninterest bearing accounts, roughly on par with fellow community banks, but a remarkable 79.5% of total deposits in noninterest or low interest bearing money market and savings accounts. A small 10.3% of deposits are in certificates of deposit and, as a result of very low money market and savings account deposit rates, the company actually pays more in interest expense on its $27.4 million in certificates of deposit than it does on its $211 million of money market and savings account balances.

Unfortunately, the company hasn't been able (or willing) to leverage these low deposit costs (and unusually low tax effective rate) into superior operating results. The lack of operating leverage appears to be in part associated with an overly conservative investment portfolio. The company's estimated average loan interest rate is a mere 5.0%. In combination with the even lower interest rates earned on the company's cash deposit balances and investment securities, the estimated average interest rate earned on all interest earning assets was an unusually low 3.8% in 2018. We believe this metric improved slightly, though not significantly, to approximately 4.0% in 2019. Interest on Home Loan Bank advances, which was actually more than twice the company's deposit interest expense in 2018, further impacts net interest margin.

The real challenge, though, is that while many underperforming community banks have a clear reason for their underperformance, often an overallocation of interest earning assets to investment securities relative to loans, large cash and deposit balances due to challenges originating loans, or high cost deposits, these factors are not present at HCB Financial. The company's cash and deposit balances are roughly typical of community banks, in the range of 10% of assets, while investment securities total less than a third of the value of the loan portfolio. In addition, loans have been growing albeit at a modest rate, leaving the company with few clear levers to boost returns without starkly shifting the company's risk profile.

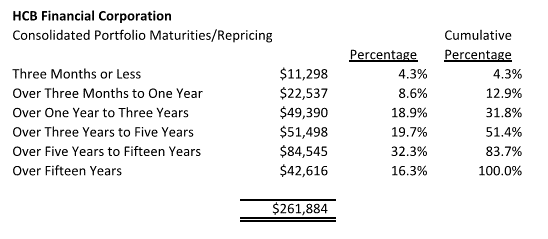

Moreover, the bank's investment securities and loan portfolio is not especially compelling from an interest rate sensitivity standpoint, as reflected in the following table:

Source: Winter Harbor Capital / Federal Financial Institutions Examination Council

The distribution of assets towards longer maturity and repricing schedules exposes the company to a degree of net interest margin risk in a rising interest rate environment with little meaningful protection against declining benchmark interest rates. In an environment where lower interest rates appear unlikely in the near future, this could represent a headwind to earnings should interest rates reverse their recent downward trend. The company would modestly benefit from falling benchmark interest rates in the short-to-intermediate term as liabilities reprice faster than assets although the already minimal cost of deposits limits the upside potential. A persistent decline, though, would negatively impact net interest margin given the inability to reprice already near zero deposit rates. On the other hand, rising benchmark interest rates would have a negative, if somewhat muted, impact on net interest margin, so the company finds itself in a challenging position either way.

Current expectations suggest benchmark interest rates will remain reasonably stable in the foreseeable future though that expectation, much as it did in the latter half of last year, is always subject to revision.

Acquisition Potential

HCB Financial could make an attractive acquisition for a larger community banking institution serving one of the surrounding urban areas which circle Barry County. The company has some exposure to the southern reaches of Grand Rapids and, though not a dense urban core, the city remains a reasonably attractive market. Moreover, the company's largely rural Barry County has decent demographic trends with consistent if modest population growth. On the other hand, the company's weak operating metrics make the bank somewhat less appealing, especially at the current valuation.

A significant potential barrier to an acquisition exists as well through the ownership of just over 20% of the company's outstanding shares by Habco & Company and Hastings Mutual Insurance Company, holders which would not necessarily be persuaded simply by an acquisition premium.

Dividends

HCB Financial pays quarterly dividends with a tradition of paying an additional special dividend at the end of the year. In the last year, the company paid dividends of $0.78, including a $0.10 special dividend, resulting in a dividend yield of 2.7%. The dividend yield quoted on this platform, it should be noted, is incorrect as it reflects a projection in the year ahead that includes the special dividend in the projected quarterly dividend, inflating the stated dividend yield.

Valuation

HCB Financial's shares currently trade at a modest 0.9 times book value although at 13.6 times earnings, reflecting the persistently low return on equity. We nonetheless believe the current quotation remains somewhat excessive given the company's operating issues, especially given the low effective tax rate. A more appropriate valuation in our view would be in the range of $23.50 to $25.70, roughly 0.8 times book value, such that the effective earnings yield on the market price was closer to 8% to 9%.

In an acquisition scenario, it's possible that the company would see a premium to the current valuation though an acquisition would be quite speculative.

Conclusion

HCB Financial is a solid financial institution with several characteristics we have come to appreciate in community banks serving more rural regions. The company's excellent asset quality and strong market share position are attractive, but the persistent operating underperformance detracts from these positive attributes. The core issue is that the company does not appear to have many levers available to improve base operating results, suggesting the company's below average return on equity will persist, limiting the potential for incremental growth in dividends and earnings.

We're inclined to avoid the company's shares at the current quotation for these reasons in favor of similar or stronger community banks with better operating performance and lower market valuations.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.