This 6% Yield Is Not Fat, It Is Just A Little Husky

by Rida MorwaSummary

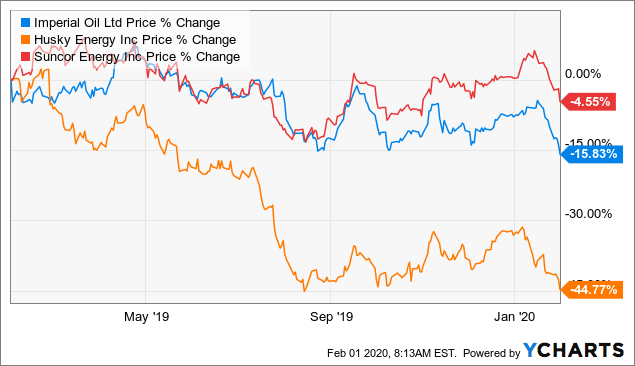

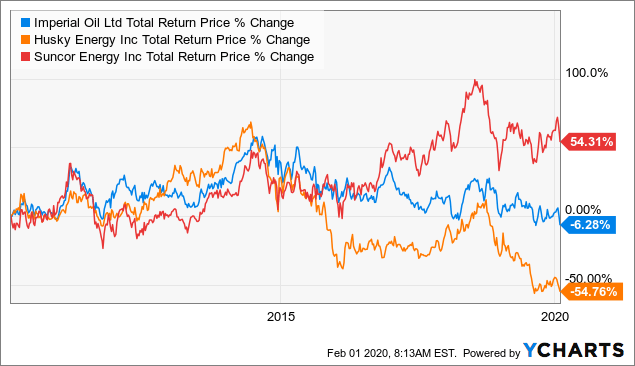

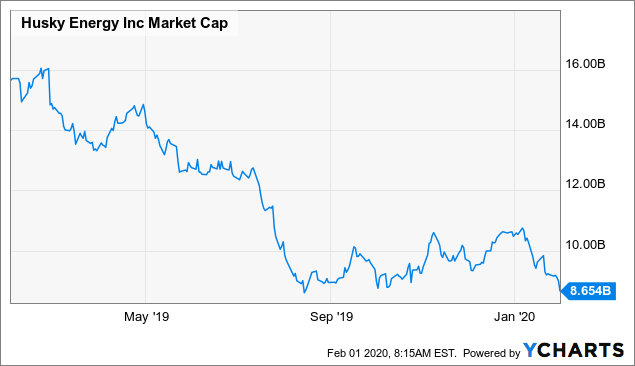

- Husky Energy has delivered one of the worst returns among the Canadian large cap energy space.

- At the core of the issue is the "fat capex" which prevent meaningful free cash flow generation.

- We examine the issue in light of our price outlook for crude oil and make a recommendation.

Co-produced with Trapping Value

Husky Energy (OTCPK:HUSKF) has struggled to convince the markets of its long term vision. While the likes of Suncor (SU) and Imperial Oil (IMO) have been using their cash flow to power shareholder returns, Husky has been stuck with its big capex cycle. As a result, the stock has noticeably lagged its integrated peers.

This is true regardless of what time frame you focus on and whether you include dividends or not.

However, our purpose today is not to dwell on the past but to evaluate whether this represents a juicy opportunity or if we should take a pass on this company.

The Business

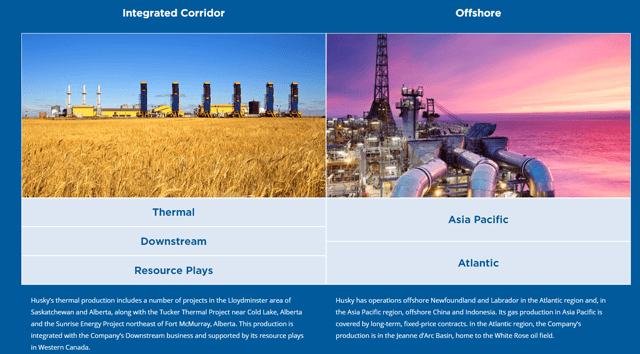

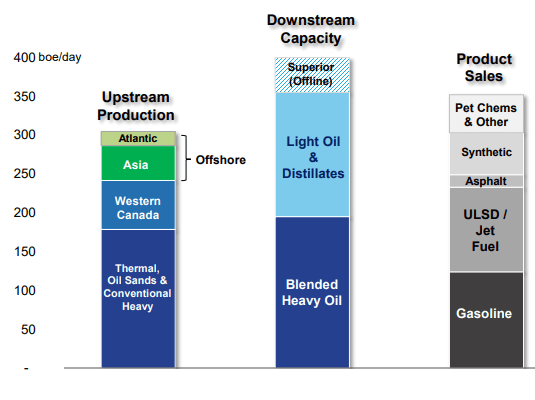

Husky Energy is an integrated oil and gas firm hailing from Calgary, Alberta. It has been around for 80 years and is controlled by Hong Kong billionaire Li Ka-Shing. The company has assets in thermal and heavy oil production alongside a falling natural gas asset base in Canada. It also has natural gas processing and downstream operations in the US & Canada, that give it stable revenues in times of lower commodity prices. The company recently expanded its Atlantic Canada presence via offshore drilling. Outside of North America, it also operates in China and Indonesia. Those assets currently account for about 15% of its oil and gas production barrels.

Source: Husky Investor Presentation

The company has been in a rut since the oil price collapse, as it has found it difficult to generate the cash flow necessary to stabilize its operations. That price collapse was also what led to Husky divesting some of its assets in 2016.

CALGARY, AB--(Marketwired - April 25, 2016) - Husky Energy (TSX: HSE) has reached an agreement under which 65 percent of its ownership interest in select midstream assets in the Lloydminster region of Alberta and Saskatchewan will be sold to Cheung Kong Infrastructure Holdings Limited and Power Assets Holdings Limited (PAH). Husky will receive $1.7 billion of gross cash proceeds, will have a 35 percent interest in the assets and will remain the operator. The sale price represents about 13 times the expected 2016 EBITDA of approximately $180 million.

Source: Market Wire

Current results and guidance

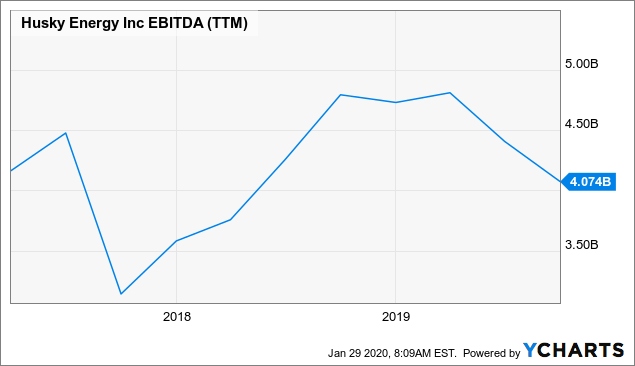

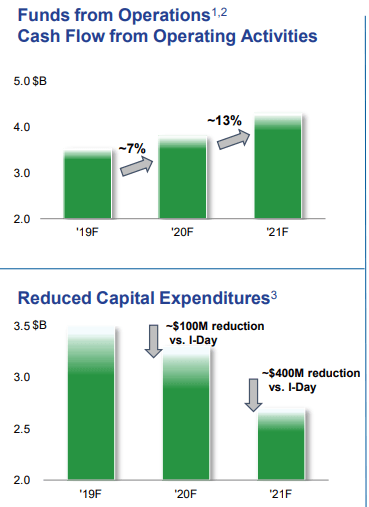

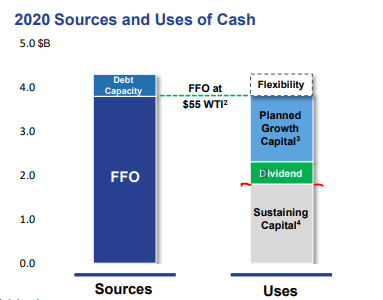

Husky plans to spend close to CDN$3.5 billion in 2020 on capital expenditures. This is close to the amount it spent in 2019 as well. That is a truly massive amount in relation to its EBITDA.

In fact, in both 2019 and 2020, Husky's capex and dividend would exceed its cash flow. Obviously, this is heavily disliked in the current environment of disgust for the oil and gas sector. We get the logic and certainly have been hypercritical of companies that do not understand that capex should pursue shareholder returns and not growth. That said, we do find three reasons to be bullish today.

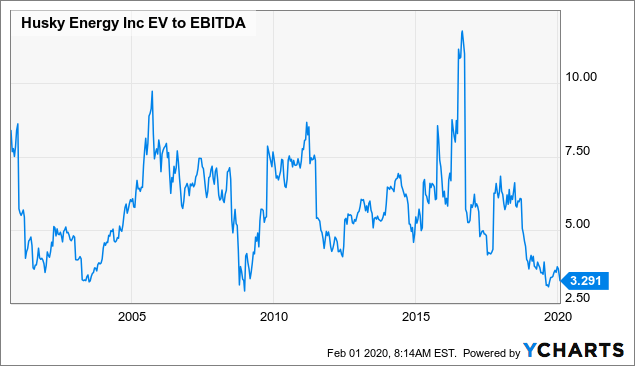

A most compelling valuation

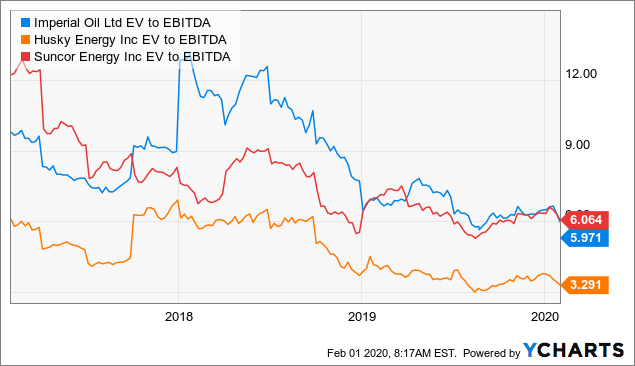

Nobody rings a bell at the top, and at the bottom all you hear are the sighs of anguish from disgruntled longs. But Husky's valuation is likely to get contrarian investors interested to at least take a second look. At an EV to EBITDA of 3.3X, with similar numbers for 2020, it has a rather bombed-out valuation.

We can see in the chart that on a valuation basis this has acted as support in the past. While EV to EBITDA is a good start, we always glance at the capex, as that is an important part of the thesis. As stated above, the capex has been rather humongous and will continue at that pace for 2020. But there is a light at the end of the tunnel. The past investments alongside decreasing projects on the horizon have started to line up for the company from 2021.

Source: Husky Investor Presentation

Free cash flow yield looks amazing, if you can wait two years

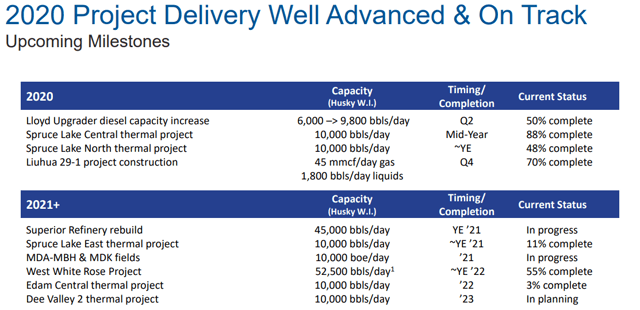

Husky's project lineup for 2020 is rather large and it scales back a little in 2021.

Source: Husky Investor Presentation

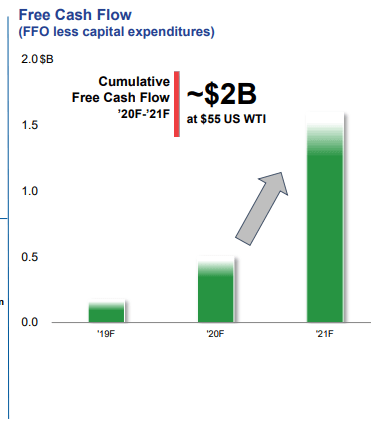

But even with these expected levels of capex, 2021 shows a robust free cash flow outlook of CDN$1.4 Billion.

Source: Husky Investor Presentation

That is certainly a scintillating amount in relation to the $8.65 billion market capitalization.

The free cash flow yield approaches that of Imperial Oil in the same year. But in the year ahead, things get even better. Husky is projecting to sustain capex in the range of CDN$1.7-$1.8 billion a year.

As growth projects wind down, free cash flow at USD$55/barrel could eventually exceed CDN$2 billion a year. That is a rather massive free cash flow potential, even without taking into account the increase from higher oil prices.

The right repositioning

When we see such optimistic projections, we always take a step back and see whether we are missing something. A key aspect here is the breakdown between sustaining capex and growth capex. Very often these terms are misused. The lines between these terms are also presented as sharply demarcated, whereas the opposite is true. From our perspective, Husky's move over the last five years has been in the right direction. It has allowed its Canadian natural gas and conventional oil production to decline while focusing capex on oil sands. As a result, its oil production from the oil sands will make up 46% of its production in 2020 versus just 16% in 2014. At the same time, the Western Canadian natural gas production will have declined from 25% of total barrels to 15%. These are very meaningful moves. We can see the oil sand assets moving close to 60% by end of 2022. If we extend our vision till there and ask whether we would want to own this company, the answer would be a resounding "yes".

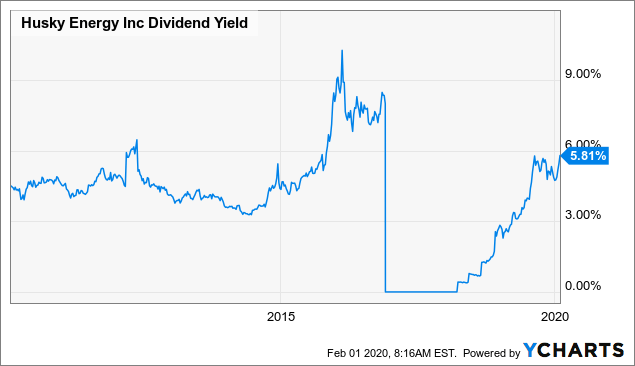

Paid to wait

Husky's dividend yield is now at a delicious 5.81%. However, before one gets too comfortable, we have to look at what a chart of its yield looks like.

While shareholders would love to believe that the yield went to 0% because Husky share price briefly grazed infinity, the reality was that Husky did suspend the dividend. While we do not expect another move to US$25 oil, do remember that Husky does not hedge, and it will suspend the dividend should prices move meaningfully lower again. Our take here is that the marginal source of oil production (shale oil) is free cash flow negative even at US$60/barrel oil and over the long term, oil will have to rise meaningfully to even maintain current oil production. This bullish thesis can be made even at US$55/barrel, as free cash flow yield should approach 20-25% over the next 3 years.

Another point we would add to the bullish case is that Husky is a "bottom-heavy" integrated producer. What we mean, is that its downstream operations exceed its upstream production.

This is the opposite of Cenovus (CVE) where upstream runs the financials. Husky's downstream-heavy operations give it more insulation from lower oil prices and also protects it from widening heavy oil differentials in Western Canada. In fact, Husky alongside Suncor and Imperial protested Alberta production cuts as it was actually benefiting from the wider differentials.

Conclusion

Husky requires some patience and investors need to have a neutral to bullish view of oil to make the long case. The integrated operations are selling for as cheap as they have ever got and Husky does trade at a big EV to EBITDA discount compared to its peers.

But on the flipside, both Suncor and Imperial are generating huge surplus cash flows today while Husky is holding on to that dream for the future. The asset base is getting setup well and we think it will deliver. We too had a negative opinion on Husky until we dived deep into the numbers. The amounts represent the cost of transitioning to a low sustaining capex company. While Husky comes off as a company with a fat capex budget we beg to differ.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +4000 members. We are looking for more members to join our lively group and get 20% off their first year! Our Immediate Income Methodgenerates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long HUSKF, VET, OXY, BP, BGR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.