Some Potential Swaps To Consider (If You Own The Sell Fund)

by Alpha Gen CapitalSummary

- RVI to OPP, MMT to EHI, CIK to DHY, FLC/PSF to FPF, DSL to DBL, EFR to BSL, BLW to VLT.

- The "buy" candidate is not necessarily a buy on its own but it's cheaper and we think better to own here than the "sell" candidates.

- This is a good example of how fund swaps can produce alpha.

(This report was published to members of Yield Hunting on Jan. 28. All data herein is from that date.)

I wanted to go through some potential swaps that I think members should consider. Just to be clear, these are not "buy" recommendations but considerations if you own the "sell" fund. The "buy" candidate may not be a screaming buy, but it's cheaper than the "sell" fund and thus you can improve your position.

Let's go through some possibilities:

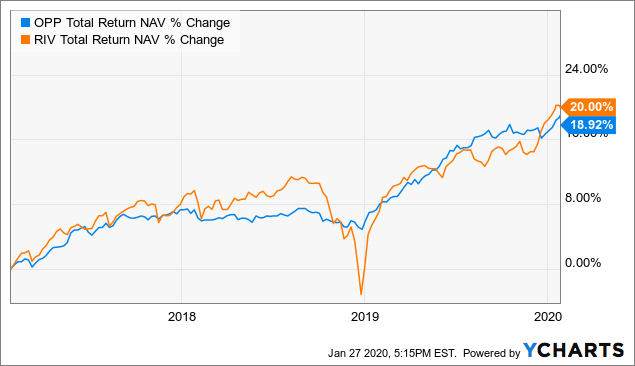

(1) RiverNorth Opportunities Fund (RIV) -----> RiverNorth/ DoubleLine Strategic Opp (OPP):

RIV now trades very close to par while OPP is trading below its 52-week average discount. Right there, from a valuation standpoint, this swap looks attractive. Both funds pay a low teen distribution rate which is supplemented with gains and/or RoC. These funds over longer periods of time have similar return profiles on NAV. But look at the volatility of RIV compared to OPP. The latter is far more stable. We think swapping from RIV to OPP makes sense from a valuation standpoint and even longer term.

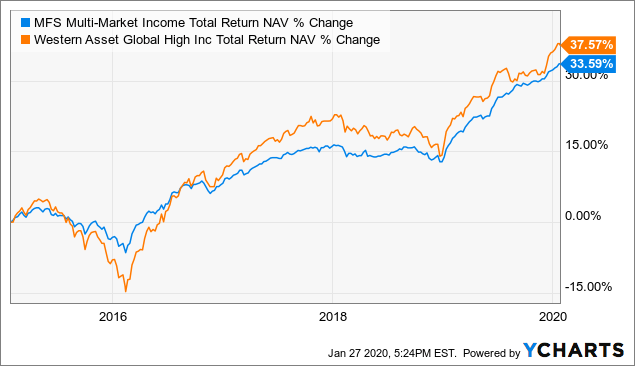

(2) MFS Multimarket Income (MMT) ----- > Western Asset Global High Income (EHI)

MMT recently moved to within 80 bps of NAV. This is one of those funds that's trading "better" thanks to a managed distribution policy that tends to attract novice CEF investors enamored with the higher yields. The 8.02% distribution is about 40% RoC and 60% net investment income. The portfolio is 58% high yield, 27% EM debt, and 26% investment grade. EHI is a fund we've discussed a lot lately and is on the optional substitutes list. The yield is comparable to MMT but is almost all NII. Risk is equivalent. These funds match well in terms of long-term NAV performance.

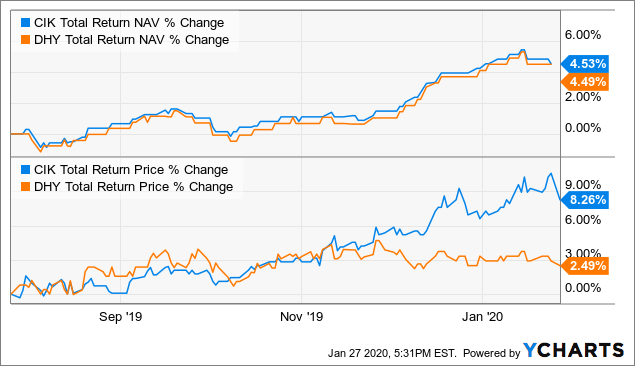

(3) Credit Suisse Asset Management Income (CIK) --------- > Credit Suisse High Yield Bond (DHY)

These are two high yield bond funds from Credit Suisse. Both funds are almost the same fund (should be merged in my opinion). The NAVs over long periods of time are very similar. They also have the same top holdings which you can see on CEFConnect.com. The charts below show the opportunity. In the top chart, the total return NAVs are equivalent (as you would expect from nearly identical funds). But the price gap is large in the second panel showing the lack of price movement for DHY. We think that eventually closes.

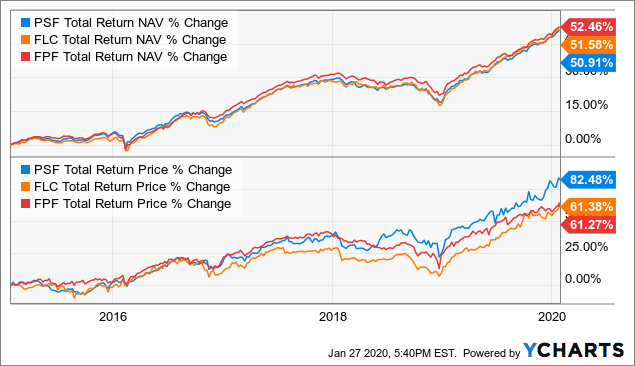

(4) Flaherty & Crumrine Total Return (FLC)/ Cohen & Steers Pref & Inc (PSF) ------------> First Trust Inter Duration Pref & Inc (FPF)

Here we have two sell candidates for the one buy. These are all preferred stock CEFs which tend to get a lot of attention when rates fall and prices rise. Doing the opposite here tends to produce good outcomes. FLC and PSF both are trading at high valuations. PSF is now at a 15%+ premium, when the one-year average is +9% and five-year average is right at par. No sense is paying a 15% premium here for a 6.5% yielder. FLC has seen a surge in buying lately, sending the premium to almost 6%. The one-year average is -0.6% with a five-year average of -2%. Clearly overvalued as well. With the 10-year dropping so much recently, we think you may want to position a bit more defensively on rates. FPF has a lower duration (less sensitive to rates) and trades at a nice discount. Longer term, the NAVs move in unison. This is a five-year chart below.

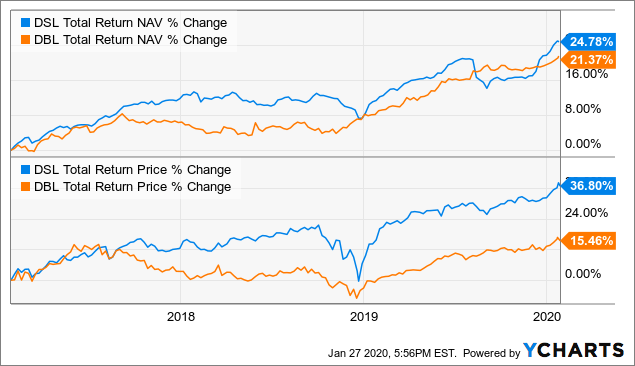

(5) DoubleLine Income Solutions (DSL) ----------- > DoubleLine Opportunistic Credit (DBL)

This is a bit different as the two funds have different mandates and strategies. I considered not including it. Also, DBL is not a screaming buy here. In fact, I wouldn't buy more shares (owned in the Core Portfolio) at these levels. A good buy area has been below -2% discounts. DSL has shot up recently and is now near a 3% premium. But the NAV appears to have stopped rising about a week ago and yet the price has continued higher. Like I noted, DBL is not cheap here but it appears to be a better option than DSL. You also could consider DMO for similar exposure to DBL. But you can see in the charts below that the NAVs have been similar for the last three years, but DBLs price has lagged, likely because of the lower yield.

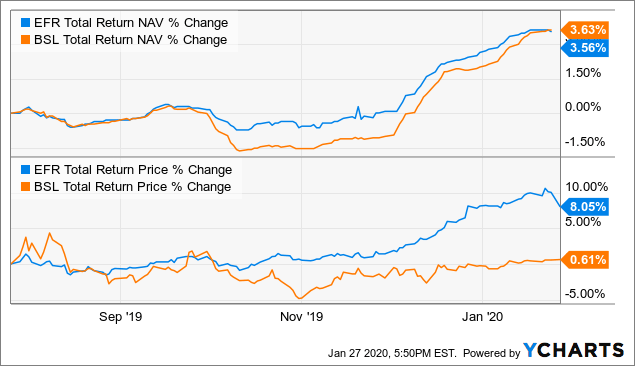

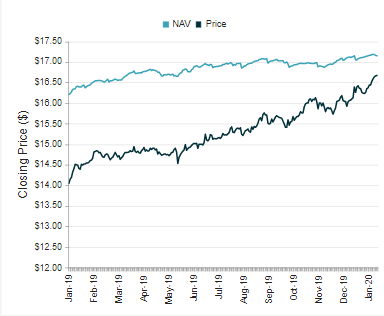

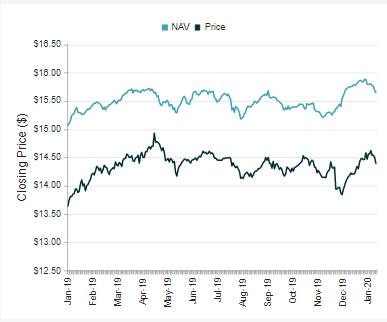

(6) Eaton Vance Sr Floating Rate (EFR) --------- > Blackstone/GSO Floating Rate Term (BSL)

These are both floating rate loan funds. BSL pays 7.44% and EFR pays 7.31%. Very similar funds with similar NAV performance. Here's a shorter-term chart of the NAV and then price performance. You can see the NAVs are on top of each other but the price charts do not conform. BSL has been a bit weaker.

(7) Blackrock Limited Duration (BLW) ------------- > Invesco High Income II (VLT)

Despite the naming and categorizing by CEFConnect, BLW is essentially a high-yield bond fund. It should be compared with other funds in the high-yield category. It has "limited duration" in the name and according to the website, has a duration of 3.1 years. Most high-yield bond funds are short duration by nature. The buy candidate we've talked about a few times lately. VLT is a high-yield bond CEF but also has a duration in the 3s. So it also could have the "limited duration" name on it. But that's just marketing. VLT remains cheap without any discount tightening while BLW has closed most of the discount. BLW:

VLT:

Concluding Thoughts

Staying abreast of valuations is a good way to generate alpha through fund swaps.

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.

Disclosure: I am/we are long OPP, FPF, BSL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.