Dividend Growth Or Higher Yields, You Choose

by Colorado Wealth Management FundSummary

- If you're blinded by a high yield, FRT may not be for you. FRT offers a strong balance sheet, consistent dividend growth, and great management.

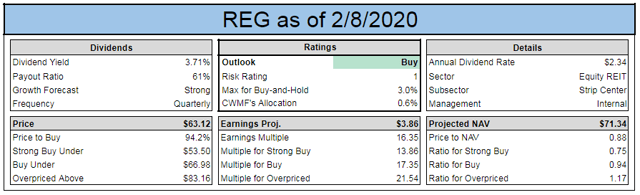

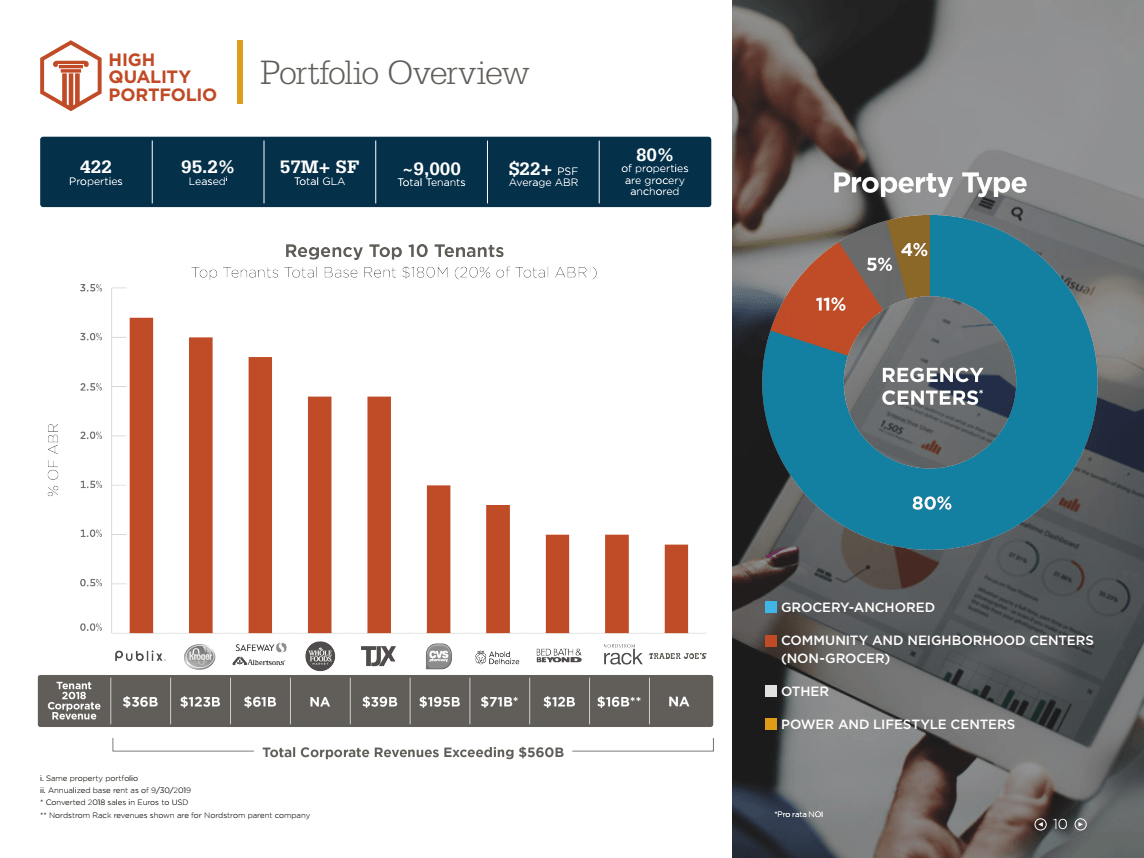

- REG trades a lower multiple of FFO than investors would expect for a REIT with a solid credit rating and strong growth in FFO per share.

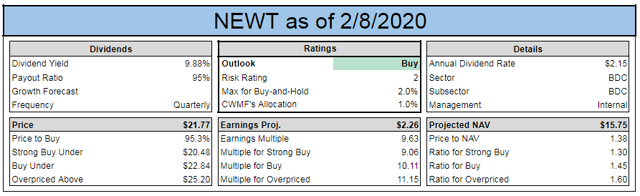

- NEWT is a good investment for investors looking for a higher yield. It's a smaller BDC with a high yield, but internal management is the bigger benefit.

You came to the right place for your portfolio.

At The REIT Forum, we like to optimize upside while not taking on a stupid amount of risk. One great method for income investors to build yield while maintaining a reasonable risk structure is including real estate. However, buying real estate directly creates an enormous amount of additional work for most investors. Consequently, we prefer to use REITs.

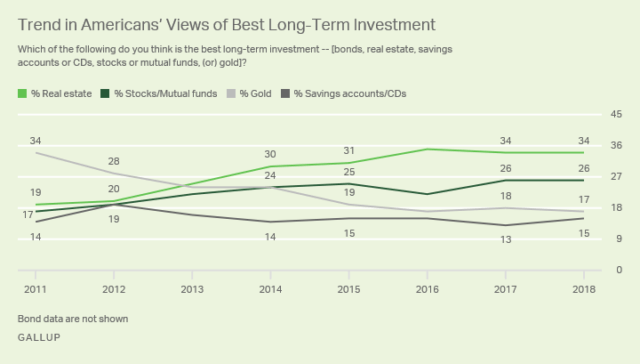

Most investors like real estate:

Real estate is the most popular investment for long-term wealth creation. It has won each year since 2013. That makes sense. Many investors have earned a fortune off real estate. Investing in real estate can be a very simple method to build wealth and many investors are familiar with the concept if they’ve purchased their own home.

The biggest difference between buying a home and purchasing real estate for investment is the rental income. Buying a home is useful because it allows the investor to avoid paying rent. Owning rental property is great because it allows the investor to receive rent. When investors are looking for consistent cash flow to give them greater financial freedom, real estate is a natural choice.

Many investors don’t realize that investing in equity REITs is very similar to buying physical rental properties. REITs are generally lumped in with other stocks, but over the long term, their performance will more closely match the performance of the real estate they own. That makes sense when we think about it.

If a large investor wanted to create a publicly-traded REIT, how much would it cost? There are some expenses with creating a company, but the largest expense would be buying the properties. The cost to build a REIT is very similar to the cost of acquiring those properties. At the inception, the cost of making a REIT is the value of the properties.

If a large investor were to acquire all the shares of a REIT, they would simply own the properties. It would be a portfolio of real estate acquired in one quick move. The value of the portfolio would be measured based on what investors would bid for individual assets. Whether real estate is held directly or held through a REIT, the value of the real estate isn’t impacted by the ownership structure.

So You Like REITs

Yes, we like REITs. However, after our two REITs we're going to highlight a BDC (Business Development Company). Many investors like BDCs because they usually offer very high dividend yields. When it comes to BDCs, you'll spend more time evaluating the share price relative to NAV (net asset value). Most BDCs are externally managed, but internally managed BDCs often trade at higher valuations. In many cases, the higher valuation is worth it because internally managed BDCs can utilize their premium pricing to grow net asset value per share by issuing new shares at a premium when they have attractive investments to acquire.

With that said, it is time to begin covering the individual stocks.

FRT

How about Federal Realty Investment Trust (FRT)?

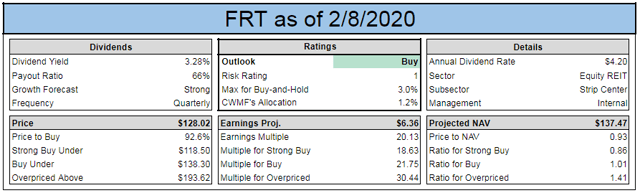

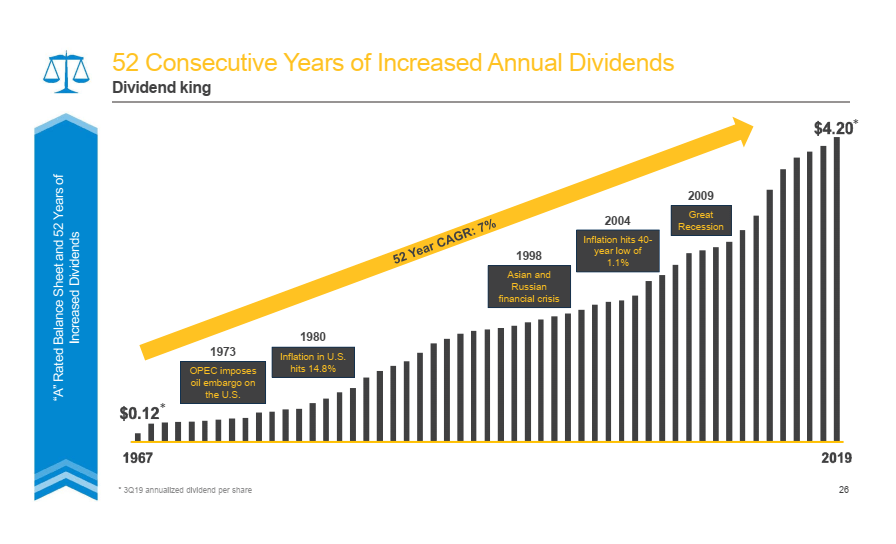

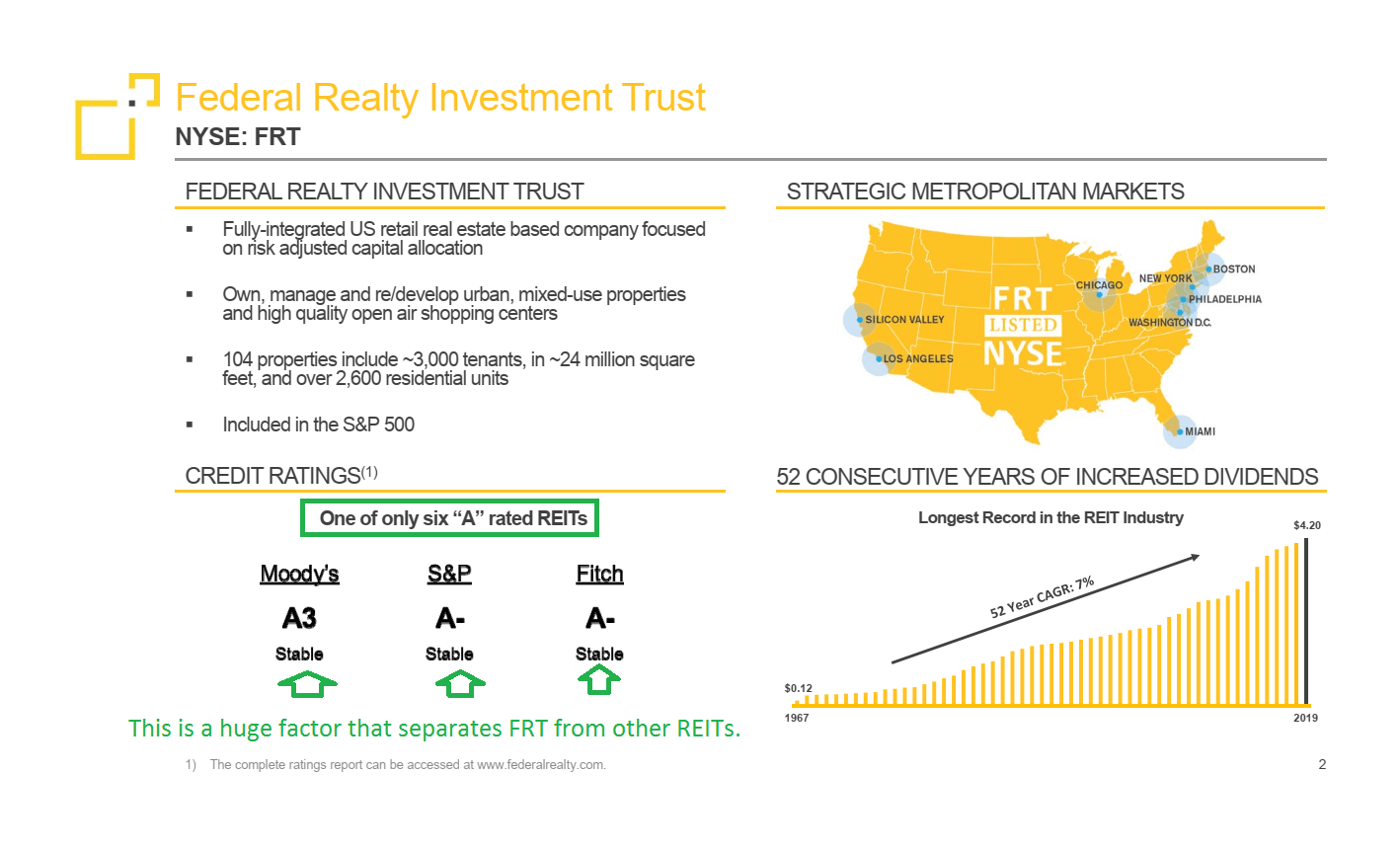

The company has an outstanding history of growth in FFO per share, 52 years of consecutive dividend increases, an impeccable balance sheet (rated A-), and great leadership. Shares carry a 3.10% dividend yield and solid expectations for continual growth.

We believe the market is focusing on 2020 projections and ignoring the rest of the coming decade, though management keeps emphasizing long-term value creation. Management is undertaking multiple projects to enhance its long-term growth rate, but values are negatively impacted in the short term.

Dividends

FRT’s dividend yield is the lowest among the strip center REITs at 3.10%. Some investors may be discouraged by the lower yield, but FRT has a very reasonable payout ratio (64% on consensus FFO estimates) and a great track record of growth.

Source: FRT

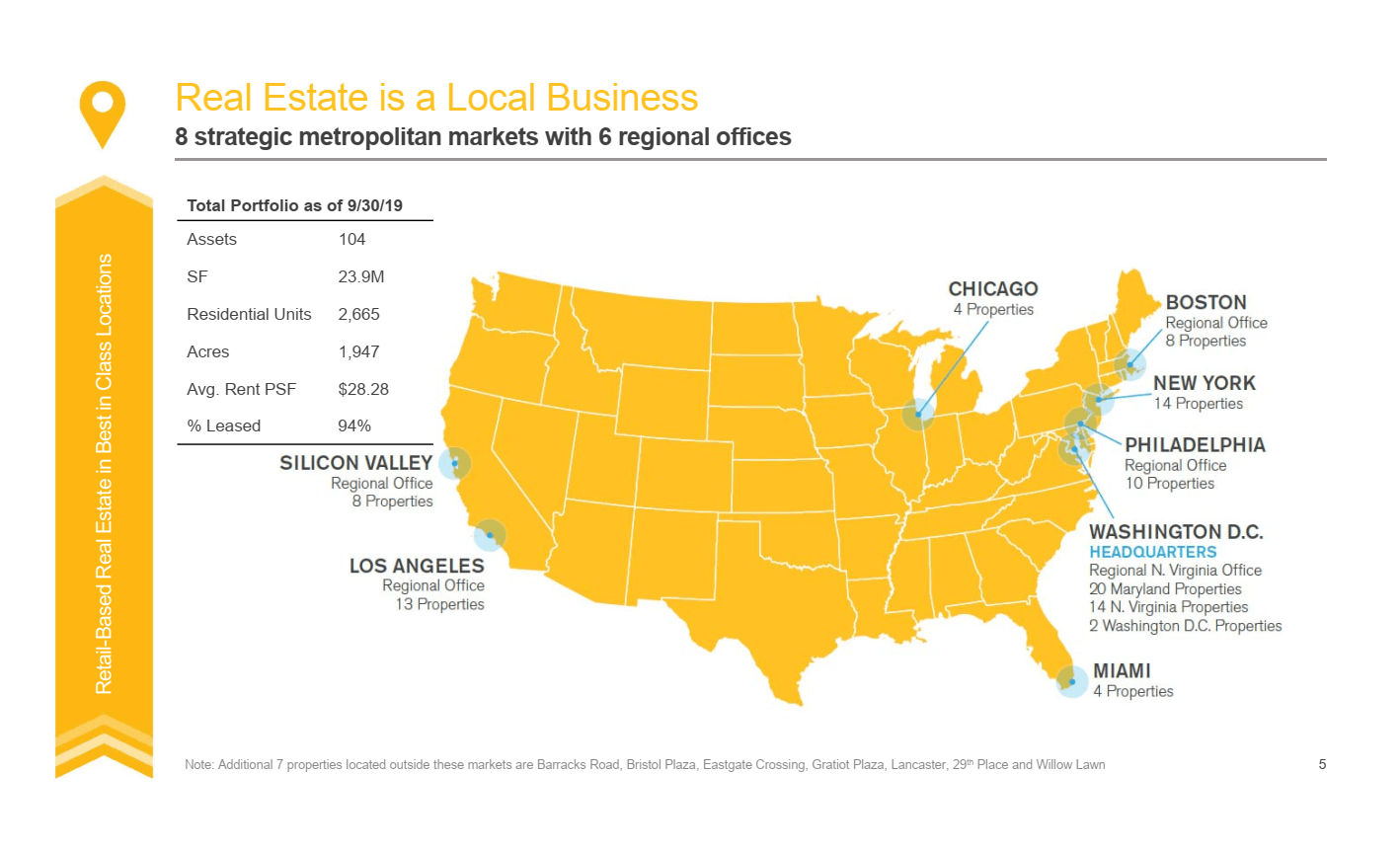

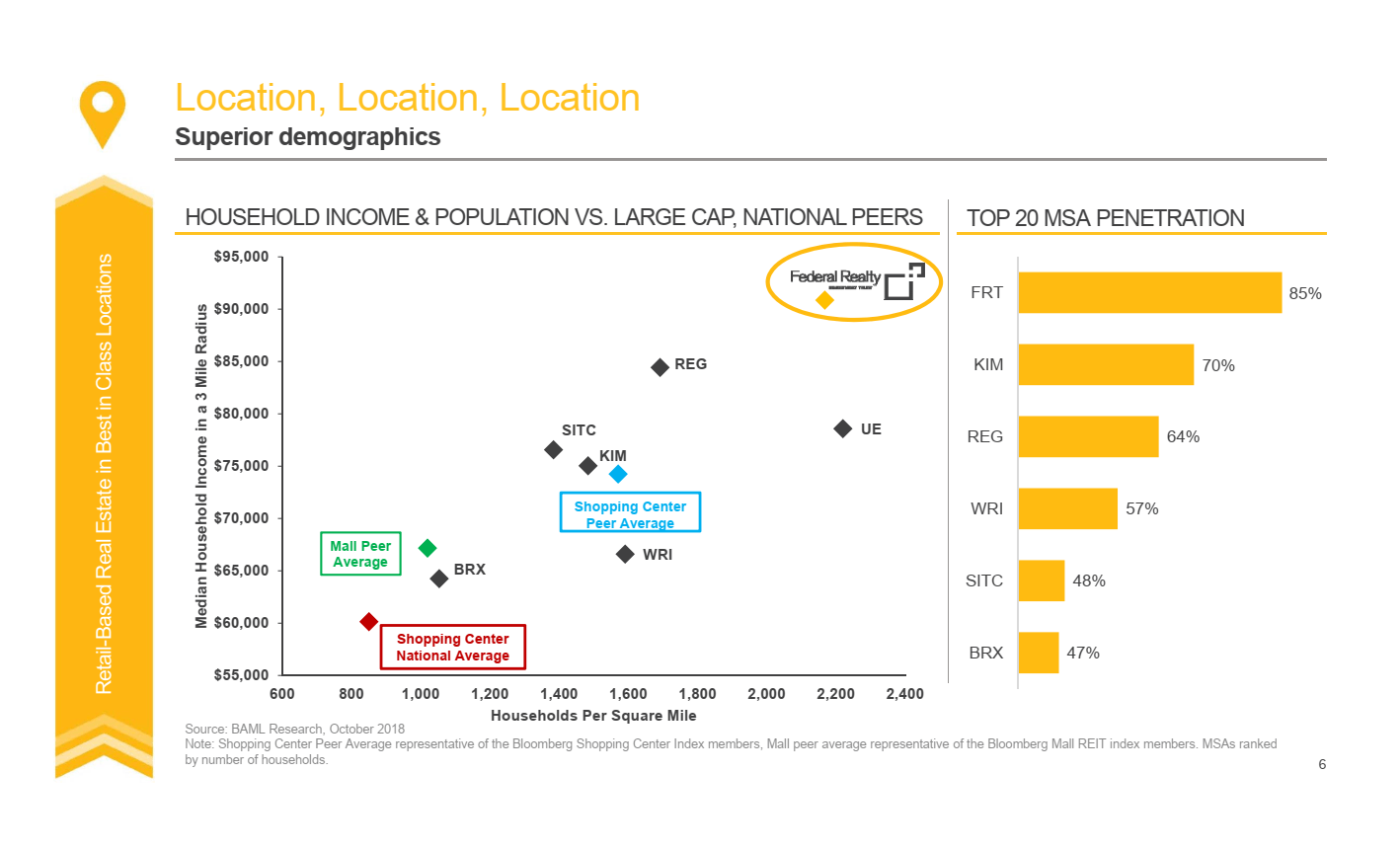

FRT put a huge emphasis on the quality of their portfolio. This is something many investors overlook at times. FRT’s properties command higher prices because they have a better growth profile. These properties are located through several of the largest markets in the United States.

Source: FRT

The surrounding areas have higher population density, higher income per household, which implies more income available for spending within the retail spaces which exist.

Source: FRT

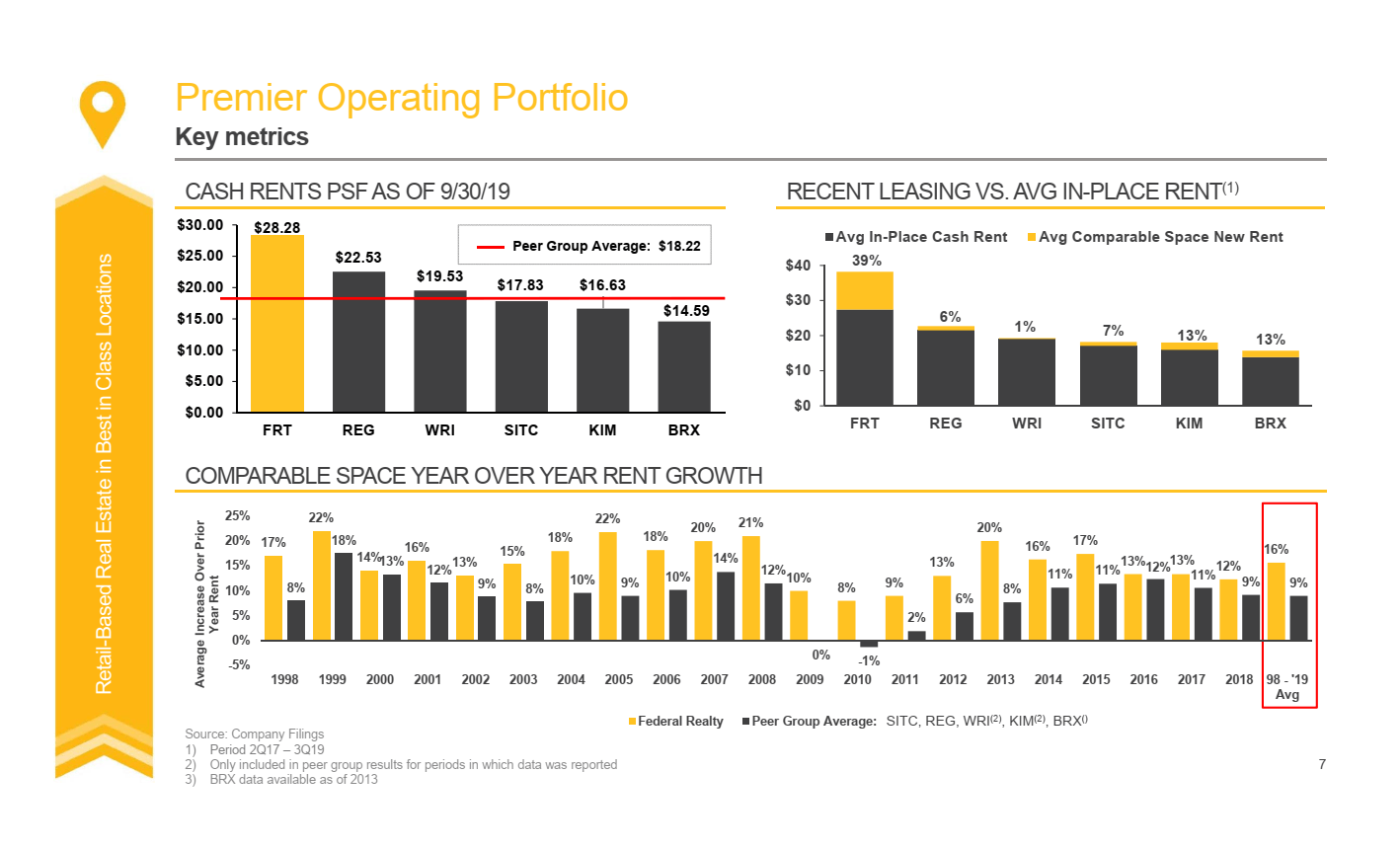

The stronger consumers within that market enabled FRT to charge higher rents and to raise those rents faster.

Source: FRT

You can see they had the highest cash rent PSF (per square foot), shown in the top left corner. In the top right corner, you can see that they are still raising rents faster than many peers.

Across the bottom you can see that for the last 21 years their leasing spreads were materially better than average for the sector. In fact, their leasing spreads beat the sector average in every single year. Sometimes it was by 1% and sometimes it was by more than 10%, but they were consistently better.

Growth in rental rates was a significant factor for FRT and it remains in effect today. The last few years have seen a smaller difference in the growth rates, but FRT maintains a competitive advantage here. The edge in rental rate increases still exists today.

The Balance Sheet Empowers Dividend Growth

They are one of only 6 REITs with an “A” credit rating:

Source: FRT

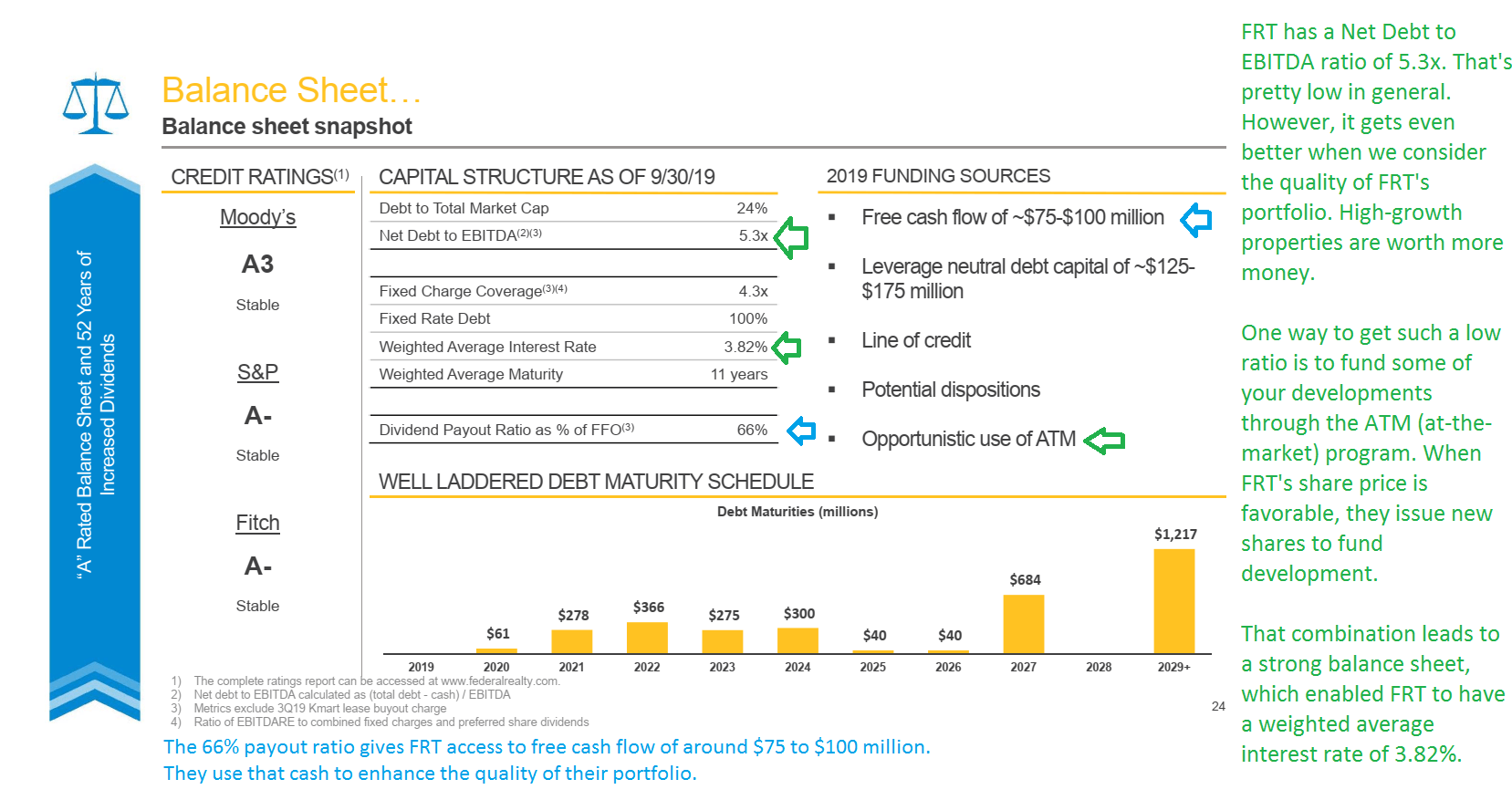

Let’s drill a bit deeper into the lower risk profile here. In the slide below, green arrows relate to comments in green and blue arrows relate to comments in blue.

Source: FRT

We believe FRT is still offering a compelling valuation today.

REG

Regency Centers (REG) is one of our favorite strip-center REITs and is within our buy range.

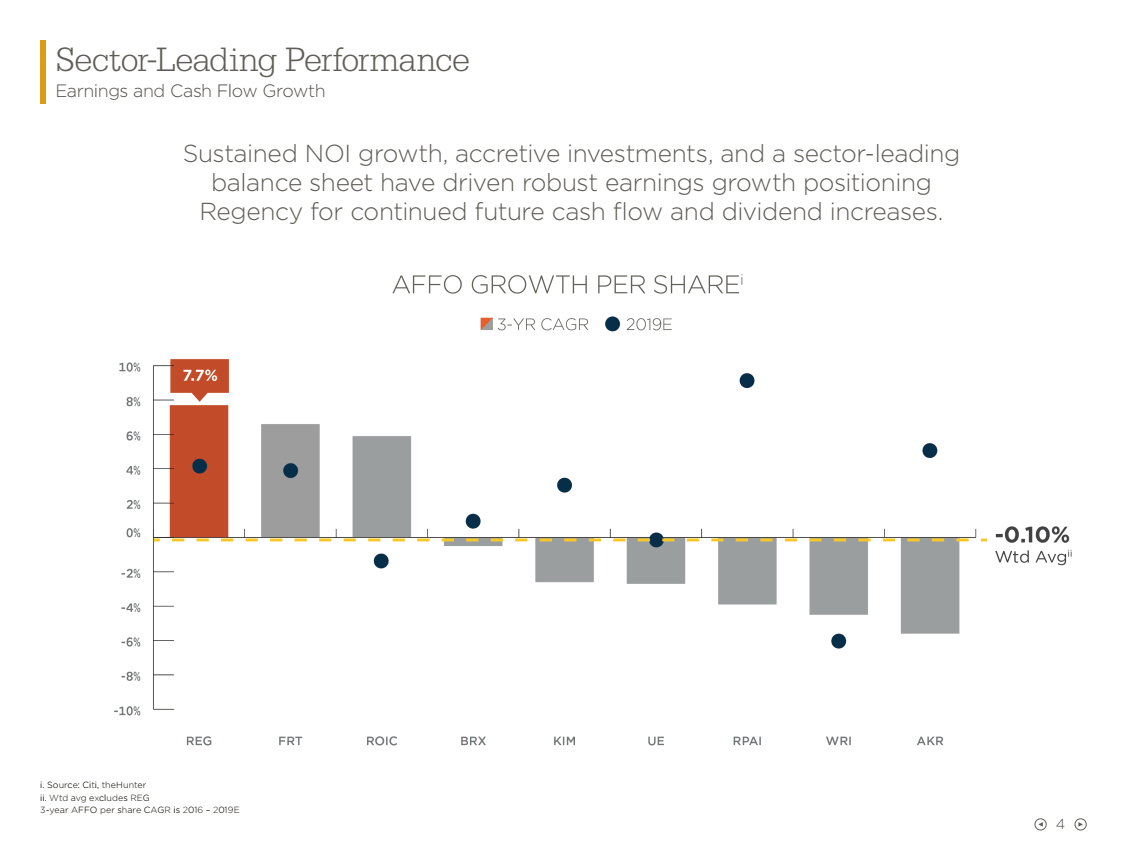

REG has several traits that we like. They have a solid history of growing FFO per share:

Source: REG

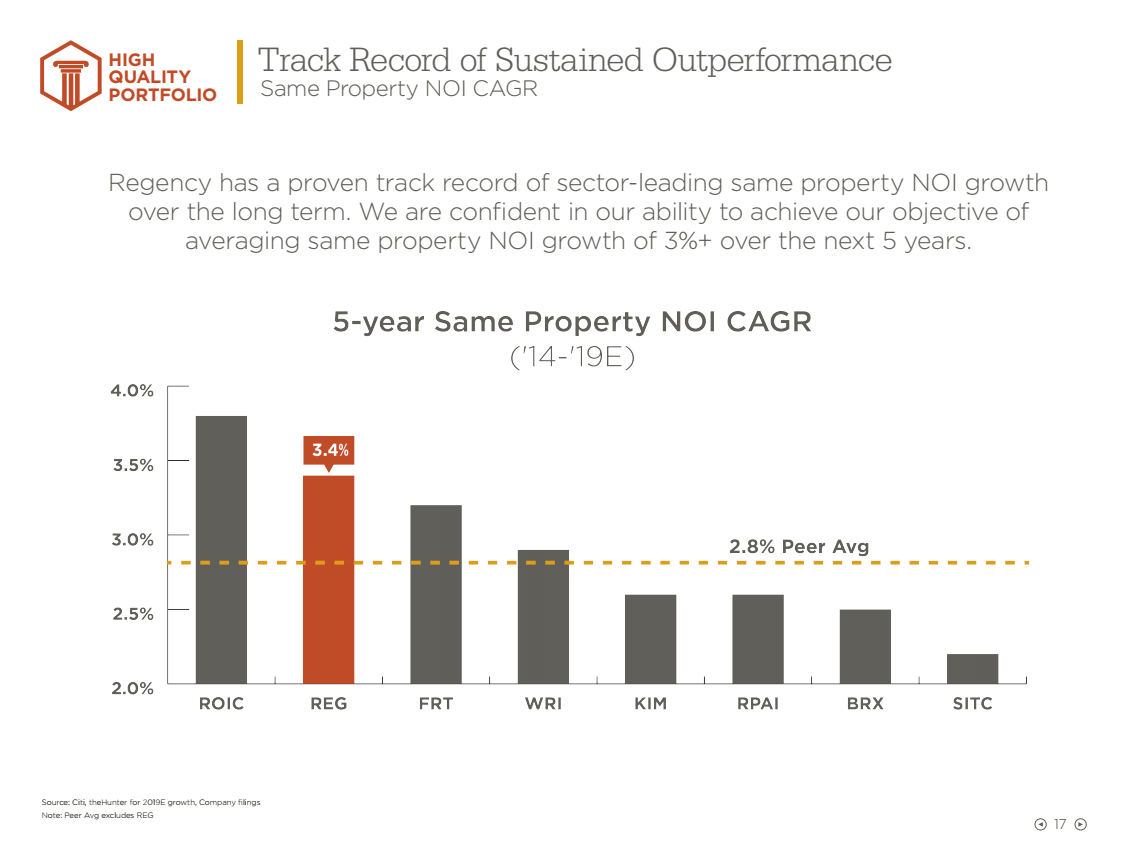

And same-property NOI:

Source: REG

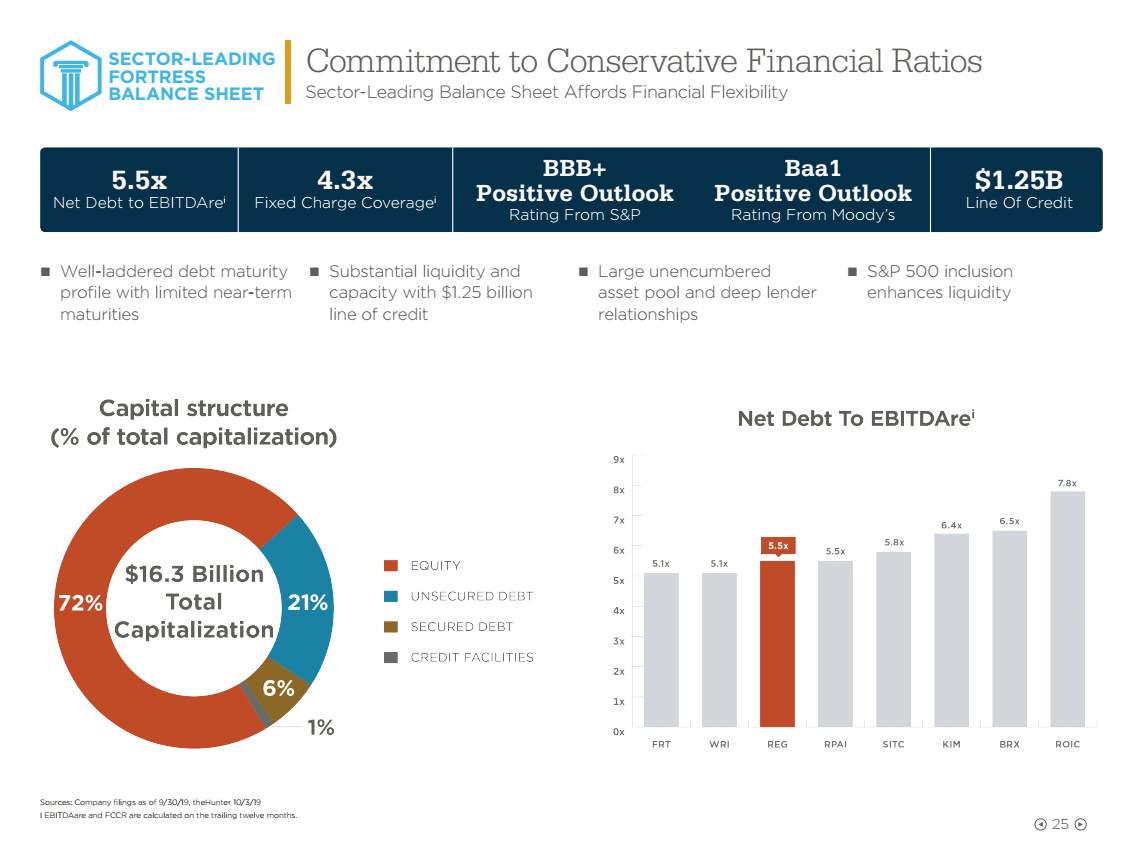

They are large enough to have great economies of scale on employing an excellent management team. They have an excellent balance sheet:

Source: REG

Regency Centers has a BBB+ rating from S&P. REG also has a "Net Debt To EBITDAre" of 5.5x. We like to see companies being frugal when it comes to debt. The strength of the balance sheet and the history of same-property NOI growth both speak to management's emphasis on quality.

This is a portfolio designed for the long term. Some investors will find REG boring because they have a conservative dividend yield of 3.71%. However, they also have a very reasonable payout ratio. A few of my favorite traits for any REIT are a strong balance sheet, a good management team, and a conservative payout ratio. Your dividend is facing far less risk if the company is prudently managing the balance sheet. Dividend cuts happen when REITs are aggressive with their payout ratio and struggle with large debt loads. REG is unlikely to face either challenge at any point in the foreseeable future.

Despite the strong balance sheet and high quality of their portfolio, they trade at a very reasonable FFO multiple (16.35x).

Some investors will assume lower multiples for strip centers simply reflect problems for retail REITs. Don't throw that theory at REG. Their same-property NOI growth laughs in the face of the retail apocalypse. REG continues to sign high-quality tenants to fill their strip centers.

Source: REG

These strip centers were not packed with the over-leveraged, under-shopped garbage retailers that are going bankrupt. REG didn't want that trash in their portfolio. Their leasing team didn't want to infect the portfolio with an overabundance of terrible apparel retailers.

Because REG was proactive in controlling their tenant base, they put themselves in a better position for the future. Their biggest apparel tenant is The TJX Companies (TJX). TJX is one of the few successful companies in the category.

Strip centers are getting some attention because they have incredible opportunities for enhancing shareholder value through redevelopment. Strip centers are often the center for building mixed-use properties. We love mixed-use properties as a technique for redevelopment.

NEWT

Perhaps you're not interested in REITs or simply don't like strip-center REITs? Alright, we'll swap to an alternative sector with a BDC pick. One of the best is Newtek Business Services Corp. (NEWT):

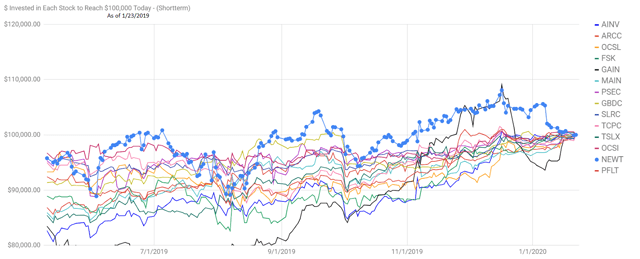

We're going to open the examination using a $100k chart. If you're not familiar with the chart, see our guide to the $100k charts. The tool is designed to demonstrate how much an investor needed to invest on any given day to reach $100,000 today. It assumes dividends are reinvested. NEWT has underperformed over the last several months:

Source: The REIT Forum

NEWT is the blue line with all the circles added to it. We've charted it against 14 peers.

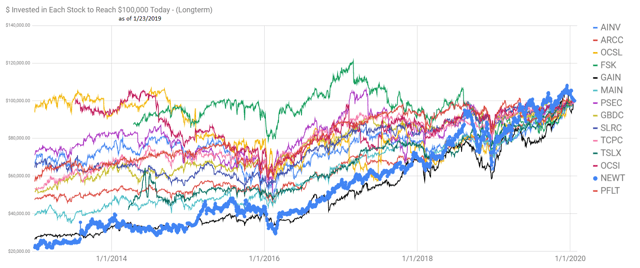

While the last several months have seen a fairly meager gain for NEWT, the longer picture shows it dramatically outperforming:

How can it outperform over the last several years? One positive factor is internal management. Internal management for a BDC is relatively rare and can lead to a dramatically higher price-to-book ratio. In the case of NEWT, the price-to-estimated-book is running at about 1.38x. Yes, that sounds high, but NEWT is able to outperform because of internal management.

If you've read our research for a while, you may be familiar with the technique used by triple-net lease REITs. They trade above net asset value per share, they issue new shares (at the premium), and then buy new assets with the cash. The result is a trend higher in net asset value per share.

As of NEWT's latest report on share issuance, the company has issued 1,571,362 shares under their program. Total net proceeds are $31,821,000. We did a little math and found that between 11/12/2019 and 1/10/2020 it must've issued 766,363 shares at a weighted average price of about $22.71. Of course, Scott Kennedy already incorporated that into his estimates of net asset value. However, most shareholders haven't and I doubt many analysts have done it either. NEWT is pretty small with a market capitalization of less than $500 million. Most of the stocks we cover are much larger, but being relatively small can be an advantage for an internally managed BDC. Since internally managed BDCs often trade at a premium to NAV (net asset value), they will issue new shares gradually to increase NAV and fund new investments. For a small BDC, this can create a very material increase in NAV.

Conclusion

If investors want some low-risk picks for strip centers, FRT and REG should be their first options. Both have excellent balance sheets, low overhead expenses, and solid management teams. Both cover their dividends with some room to spare and are quite successful in their development projects.

If you prefer to go for a higher yield or simply want to avoid owning assets tied to "retail," then you may find NEWT is a much better match for your needs. They offer a materially higher yield, though investors are still stuck paying a significant premium to net asset value. That can be painful, but over the long-term we expect the REIT to grow NAV per share from issuing above NAV.

Want the best research? It’s time to raise your game. Get access to several features you won’t find on the public side.

You can get access to everything we have to offer right now. Try our service and decide for yourself.

Disclosure: I am/we are long REG, FRT, NEWT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.