The Peak Season For Cotton Prices Is Approaching

by Andrew HechtSummary

- Cotton has moved lower from the mid-January high.

- A very volatile soft commodity - higher lows since 2000.

- China has weighed on the price of the fiber.

- Seasonality favors buying on dips over the coming weeks.

- BAL is the cotton ETN product.

Cotton was looking like it was prepared to take off on the upside in mid-January. The price of the fluffy fiber that trades in the futures market on the Intercontinental Exchange moved over 70 cents per pound in early January since May 2019. Like many other commodities, cotton had been a victim of the ongoing trade war between the US and China. Both countries are significant producers of the fiber, but China is one of the world's leading consumers.

The price of cotton rose to an all-time high of $2.27 per pound in 2011. Before 2010, it had never traded above $1.1720. The explosive move to the upside caused many consumers, including China, to turn to synthetic fibers as substitutes. Cotton inventories rose as producers increased output after 2011, and by 2015 there was enough of the fiber in storage in the US and China to produce two pairs of jeans for every man, woman, and child on our planet. The price fell to a low of 55.66 cents per pound in 2016, which remains the significant bottom and level of critical support. Last summer, the price came close to testing the 2016 lows.

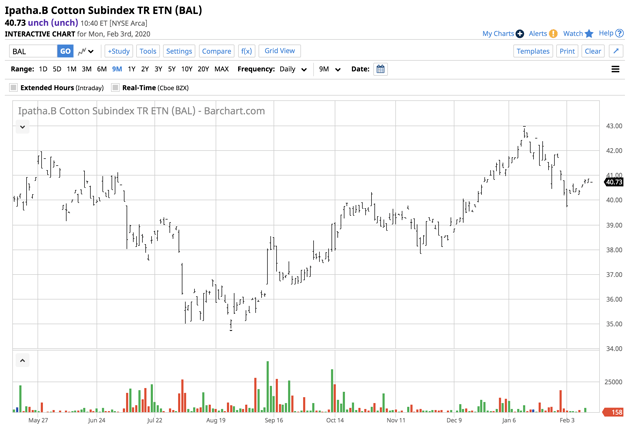

The iPath Series B Bloomberg Cotton Subindex Total Return ETN product (BAL) follows the price of cotton futures higher and lower.

Cotton has moved lower from the mid-January high

Nearby March ICE cotton futures reached a high of 71.96 cents per pound on January 13. The de-escalation of the trade war between the US and China that led to the signing of a "phase one" agreement on January 15 lifted the price of cotton futures to the most recent high.

Source: CQG

As the daily chart highlights, the March futures ran out of upside steam at just below the 72 cents per pound level. The price of cotton futures had moved into overbought territory when it came to the price momentum and relative strength indicators. After rising to the highest level since May 2019, the price corrected to a low of 66.75 cents on February 3. The correction took the technical indicators below neutral readings. Since then, March cotton futures have traded in a narrow range between the February 3 low and 69.41 cents. The futures were trading at 68.80 per pound on Thursday, February 13.

A very volatile soft commodity - higher lows since 2000

The price of cotton tends to trend higher or lower for extended periods.

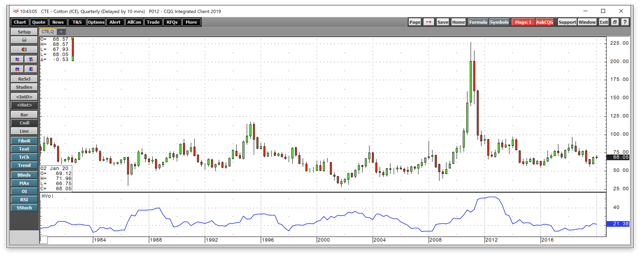

Source: CQG

The quarterly chart dating back to the early 1970s illustrates that price variance in the cotton market has ranged from 12.19% to 52.21%. At 21.38%, the metric was below its midpoint on February 13. The move to $2.27 per pound and the decline that followed drove historical volatility to the all-time peak.

Meanwhile, since the turn of the century, cotton has made higher lows. In 2001, the bottom was at 28.20 cents. In 2008, 36.70 cents was the low, and in 2016, cotton fell to a nadir of 55.66 cents.

China has weighed on the price of the fiber

The latest correction in the cotton market came immediately following an event that should have sent the price of the fiber to higher levels. The trade deal between the US and China was bullish for the cotton futures market. However, the outbreak of coronavirus trumped the trade agreement as it caused the Chinese economy to grind to a halt. The growing number of fatalities and new cases have weighed on the price of markets across all asset classes. The US and China are both producers of the fiber, and China is one of the leading consumers in the world. As manufacturing companies have closed their doors to prevent the spread of the virus, which causes inventories of cotton, the rise at a time when cotton prices usually experience seasonal strength.

Seasonality favors buying on dips over the coming weeks

In March 2011, the price of cotton rose to an all-time high of $2.27 per pound. After price carnage took the price to a low of 66.10 in 2012, cotton reached a high of 93.93 cents in March 2013. The peak in 2014 came in March at 97.35 cents. After falling to its most recent bottom at 55.66 cents in March 2016, cotton rose to a peak of 87.18 cents in May 2017.

Source: CQG

The weekly chart displays that highs for the year in 2018 came in May and June at over 96.40 cents. Last year, the peak at 79.31 cents came during April. We are moving into the time of the year when cotton prices tend to rally. However, that depends on the news on coronavirus over the coming weeks. If fears subside, we could see a significant rally that could take the price of cotton back over 70 cents per pound.

Moreover, the trade deal with China and the de-escalation of trade tensions could lift the price of futures to the 80 cents per pound level. As we head into the peak season over the coming months, history suggests that risk-reward favors the upside at below 70 cents per pound. Buying cotton on a scale-down basis could be the optimal approach to the market if risk-off conditions do not return over the coming days and weeks.

BAL is the cotton ETN product

The most direct route for a risk position in the cotton market is via the futures and futures options that trade on the Intercontinental Exchange. For those market participants that do not venture into the highly leveraged and volatile world of the futures arena, the iPath Series B Bloomberg Cotton Subindex Total Return ETN product provides an alternative. The fund summary for BAL states:

The investment seeks return linked to the performance of the Bloomberg Cotton Subindex Total Return. The ETN offers exposure to futures contracts and not direct exposure to the physical commodities. The index is composed of one or more futures contracts on the relevant commodity (the index components) and is intended to reflect the returns that are potentially available through (1) an unleveraged investment in those contracts plus (2) the rate of interest that could be earned on cash collateral invested in specified Treasury Bills. Source: Yahoo Finance

Cotton's volatility can lead to liquidity problems at times. Therefore, the BAL ETN has a low level of net assets of $9.90 million and trades an average of 3,029 shares each day. BAL charges an expense ratio of 0.45%. I would only execute positions in the ETN when the cotton futures market is operating and would be cautious when it comes to stops as wide bid-offer spreads during off-hours could lead to stop hunting by market markets and electronic traders. Meanwhile, the ETN does an excellent job tracking the price action in the nearby cotton futures contract over time.

The price of March futures moved from 57.65 cents in late August to a high of 71.96 cents in mid-January or 24.8%.

Source: Barchart

Over the same period, BAL rose from $34.80 to $42.89 per share or 23.2%. If cotton is going to follow its seasonal trading pattern, we could see a rebound over the coming months.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls, directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.