Falling Oil Prices An Economic Warning Sign

by Lance RobertsSummary

- Global demand has already been falling for the last several months, and oil prices are sending warnings that "market hopes" for a "global reflation" are likely not a reality.

- Falling gasoline prices have historically equated to lower personal consumption expenditures, and not vice-versa.

- Importantly, falling oil prices are a bigger drag on economic growth than the incremental "savings" received by the consumer.

On Tuesday morning, I got engaged in a debate on the recent decline in oil prices following my report on COT Positioning in the space. To wit:

"The inherent problem with this is that if crude oil breaks below $48/bbl, those long contracts will start to get liquidated which will likely push oil back into the low 40's very quickly. The decline in oil is both deflationary and increases the risk of an economic recession."

It didn't take long before the debate started.

"Aren't low oil prices good for the economy? They are a tax cut for the consumer?"

There is an old axiom which states that if you repeat a falsehood long enough, it will eventually be accepted as fact.

Low oil prices equating to stronger economic growth is one of those falsehoods.

Oil prices are indeed crucial to the overall economic equation, and there is a correlation between the oil prices, inflation, and interest rates.

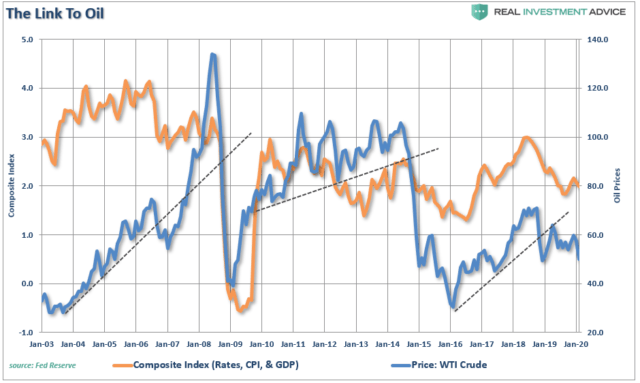

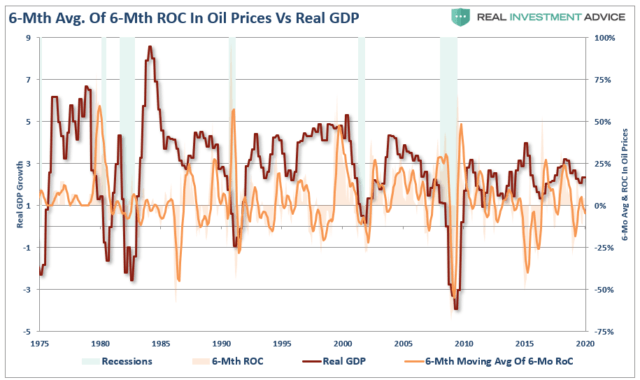

Given that oil is consumed in virtually every aspect of our lives, from the food we eat to the products and services we buy, the demand side of the equation is a tell-tale sign of economic strength or weakness. We can see this clearly in the chart below which combines rates, inflation, and GDP into one composite indicator. One important note is that oil tends to trade along pretty defined trends (black trend lines) until it doesn't. Importantly, since the oil industry is very manufacturing- and production-intensive, breaks of price trends tend to be liquidation events which have a negative impact on manufacturing and CapEx spending and feeds into the GDP calculation.

"It should not be surprising that sharp declines in oil prices have been coincident with downturns in economic activity, a drop in inflation, and a subsequent decline in interest rates."

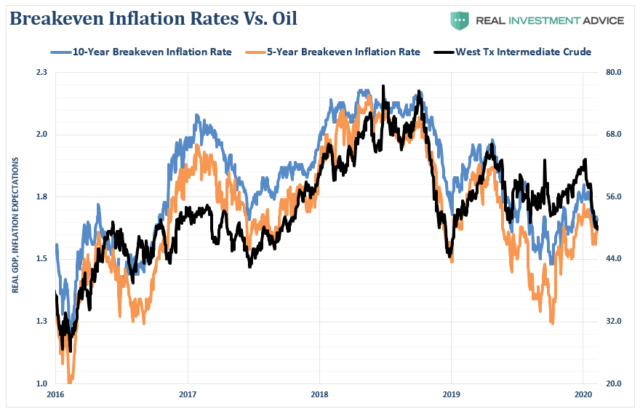

We can also view the impact of oil prices on inflation by looking at breakeven inflation rates as well.

The short version is that oil prices are a reflection of supply and demand. Global demand has already been falling for the last several months, and oil prices are sending warnings that "market hopes" for a "global reflation" are likely not a reality. More importantly, falling oil prices are going to put the Fed in a very tough position in the next couple of months as deflationary pressures rise. The chart below shows breakeven 5-year and 10-year inflation rates versus oil prices.

Zero Sum

The argument that lower oil prices give consumers more money to spend certainly seems entirely logical. Since we know that roughly 80% of households in America effectively live paycheck-to-paycheck, they will spend, rather than save, any extra disposable income.

However, here is the most important part of the fallacy:

"Spending in the economy is a ZERO-SUM game."

Falling oil prices are an excellent example since gasoline sales are part of the retail sales calculation.

Let's take a look at the following example:

Oil Prices Decline By $10 Per Barrel Gasoline Prices Fall By $1.00 Per Gallon Consumer Fills Up A 16 Gallon Tank Saving $16 (+16) Gas Station Revenue Falls By $16 For The Transaction (-16) End Economic Result = $0

Now, the argument is that the $16 saved by the consumer will be spent elsewhere, which is true. However, this is the equivalent of "rearranging deck chairs on the Titanic."

So, let's now extend our example from above.

Oil and gasoline prices have dropped, so Elaine, who has budgeted $100 to spend each week on retail-related purchases, goes to the gas station to fill up.

Elaine fills up her car for $60, which previously cost $80. (Savings +$20) Elaine then spends her normal $20 on lunch with her friends. She then spends her additional $20 (saved from her gas bill) on some flowers for the dining room. -----------------

Total Spending For The Week = $100

Now, economists quickly jump on the idea that because she spent $20 on flowers, there has been an additional boost to the economy.

However, this is not the case. Elaine may have spent her money differently this past week, but she still spent the same amount. Here is the net effect on the economy.

Gasoline Station Revenue = (-$20)

Flower Store Revenue = +$20

------------------

Net Effect To Economy = $0

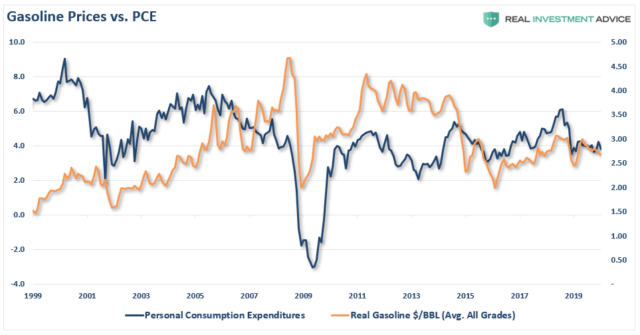

Graphically, we can show this by analyzing real (inflation-adjusted) gasoline prices compared to total Personal Consumption Expenditures (PCE). I am using "PCE" as it is the broadest measure of consumer spending and comprises almost 70% of the entire GDP calculation.

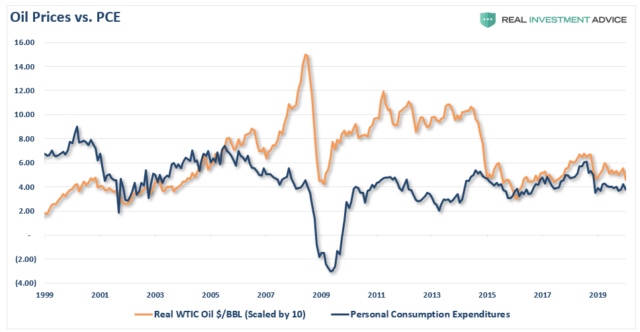

As shown, falling gasoline prices have historically equated to lower personal consumption expenditures, and not vice-versa. In fact, higher oil and gasoline prices have actually been coincident with higher rates of PCE previously. The chart below shows inflation-adjusted oil prices as compared to PCE.

While the argument that declines in energy and gasoline prices should lead to stronger consumption sounds logical, the data suggests this is not the case.

What we find is there is a parity between oil price and the economy. Like "Goldilocks," prices which are too hot, or too cold, have a negative impact on consumption and economic growth.

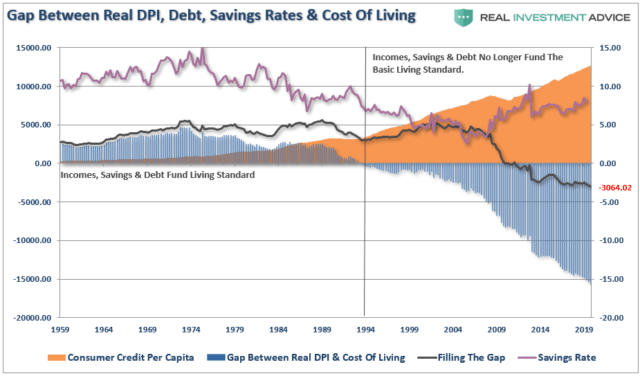

Importantly, regardless of the level of oil prices, the only thing which increases consumer spending are increases in income, not savings. Consumers only have a finite amount of money to spend. They can choose to "save more" which is a drag on economic growth in the short term (called the "paradox of thrift"), or they can spend what they have. But they can't spend more, unless they take on more debt.

Which is what has been occurring as individuals struggle to fill the gap between the cost of living and incomes. (Read more on this chart)

A Bigger Drag Than The Savings

Importantly, falling oil prices are a bigger drag on economic growth than the incremental "savings" received by the consumer.

The obvious ramification of the plunge in oil prices is to the energy sector itself. As oil prices decline, the loss of revenue eventually leads to cuts in production, declines in capital expenditure plans (which comprises almost 1/4th of all CapEx expenditures in the S&P 500), freezes and/or reductions in employment, not to mention the declines in revenue and profitability.

Let's walk through the impact of lower oil prices on the economy.

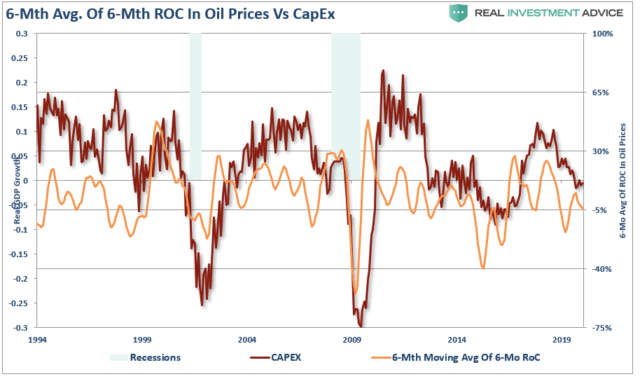

Declining oil prices lead to declining revenue for oil and gas companies. Given that drilling for oil is a very capital-intensive process requiring a lot of manufactured goods, equipment, supplies, transportation, and support, the decrease in prices leads to a reduction in activity as represented by Capital Expenditures (CapEx.) The chart below shows the 6-month average of the 6-month rate of change in oil prices as compared to CapEx spending in the economy.

Of course, once CapEx is reduced the need for employment declines. However, since drilling for oil is a very intensive process, losses in employment may start with the energy companies, but eventually, all of the downstream suppliers are impacted by slower activity. As job losses rise, and incomes decline, it filters into the economy.

Importantly, when it comes to employment, the majority of the jobs "created" since the financial crisis has been lower wage-paying jobs in retail, healthcare and other service sectors of the economy. Conversely, the jobs created within the energy space are some of the highest wage-paying opportunities available in engineering, technology, accounting, legal, etc.

In fact, each job created in energy-related areas has had a "ripple effect" of creating 2.8 jobs elsewhere in the economy from piping to coatings, trucking and transportation, restaurants and retail.

Given that oil prices are a reflection of global economic demand, falling oil prices have a negative feedback loop in the economy as a whole. The longer oil prices remain suppressed, the negative impacts of loss of employment, reductions in capital expenditures, and declines in corporate profitability will begin to outstrip any small economic benefit gained through consumption.

Simply put, lower oil and gasoline prices may actually have a bigger detraction on the economy than the "savings" provided to consumers.

Newton's third law of motion states:

"For every action, there is an equal and opposite reaction."

In any economy, nothing works in isolation. For every dollar increase that occurs in one part of the economy, there is a dollars' worth of reduction somewhere else.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.