Tactical Asset Allocation Views (February 2020)

by Invesco USSummary

- China and the rest of Asia are likely to see the most pronounced decline in growth for Q1 2020, as economic activity is disrupted from quarantines, factories shutdowns and canceled transportation services.

- In summary, over the next few months, we expect our leading economic indicators to deteriorate-especially in China and emerging markets and play "catch-up" with the information already baked into the market.

- Following these developments, we have rotated a portion of our equity exposure in the Invesco Oppenheimer Global Allocation Fund from emerging to developed markets, resulting in a net underweight EM position relative to the benchmark.

By Alessio de Longis, CFA, Senior Portfolio Manager, Invesco Investment Solutions

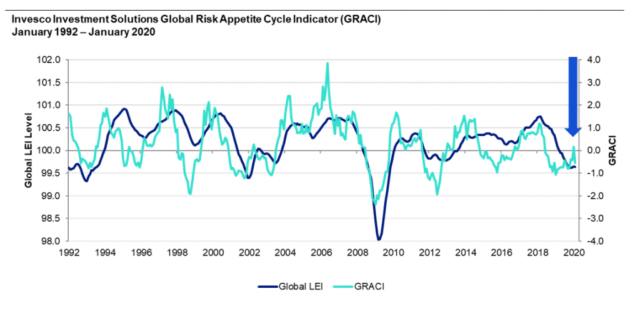

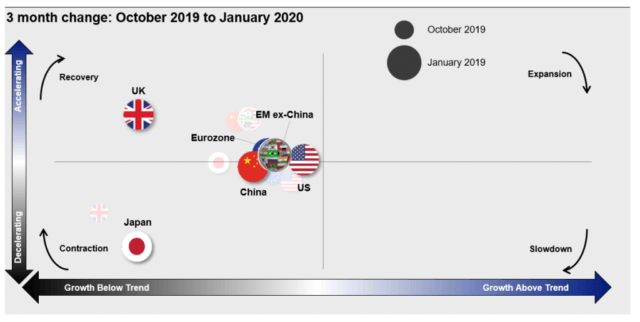

The coronavirus presents a sudden exogenous shock to the global growth cycle at a time when the world economy was on the cusp of a synchronized cyclical upswing. This negative shock led to a noticeable decline in our market sentiment indicator, with a drastic drawdown in future growth expectations, particularly in China and the rest of emerging Asia (Figures 1 and 2). In our last update, our leading economic indicators suggested that this region was likely to lead the potential global recovery. However, the regional concentration of the coronavirus directly challenges this thesis, at least for now. In light of this new information, our framework places the global economy in a contraction regime for the near term (i.e., growth below-trend and expected to decelerate). The duration of this regime will likely depend on two things: 1) the duration of the virus outbreak and 2) its impact on the economy.

1. Duration of the virus outbreak: likely over by the spring

The virus alone is unlikely to derail the global growth outlook for 2020, as it is reasonable to assume the outbreak will follow the typical path of any seasonal flu, which hits most of the northern hemisphere this time of year and largely runs its course within 2-3 months (i.e., by the spring). In fact, this is also what we experienced with SARS in 2003, when markets took a hit in the winter months before running its course by mid-April. Therefore, by itself, the outbreak can be considered a temporary economic event.

2. Impact on the economy: temporary and longer-lasting shocks

China and the rest of Asia are likely to see the most pronounced decline in growth for Q1 2020, as economic activity is disrupted from quarantines, factories shutdowns and canceled transportation services. Revenues from consumer spending, travel and tourism services are likely to suffer the most given most celebrations were canceled for the Lunar New Year holidays. However, this should only be a one-off, temporary drag on growth. That said, the industrial sector is likely to experience both a near-term and elongated shock to growth. The loss of Chinese output in Q1 may lead to a sharp drawdown in inventories, followed by a similarly sharp rebound in production in Q2 and Q3, depending on the degree of disruption to global supply chains and global demand outside the region. Given the large share of global GDP coming from China today (~18% compared to 5% in 2003), the impact on global growth is likely to be larger than the SARS epidemic. On the bright side, the meaningful decline in industrial commodity and energy prices (10% year-to-date) may provide some support to industrial and consumer demand going forward.

In summary, over the next few months, we expect our leading economic indicators to deteriorate-especially in China and emerging markets and play "catch-up" with the information already baked into the market. The impact on our developed markets leading indicators will likely be more modest, but negative nonetheless. More importantly, we will continue to monitor trends in global risk appetite to gauge whether economic data will surprise positively or negatively versus financial markets expectations.

Exhibit 1: Coronavirus shock to market sentiment challenges the nascent growth recovery, increasing near-term downside risks in a below-trend growth environment.

Sources: Bloomberg L.P., MSCI, Citi, Barclays, JPMorgan, Invesco Investment Solutions research and calculations, from January 1992 to January 2020. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the macroeconomic trend level. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets' risk sentiment.

Exhibit 2: Leading Indicators likely to dip back into contraction, especially for China and emerging markets.

Source: Invesco Investment Solutions team proprietary research, January 2020.

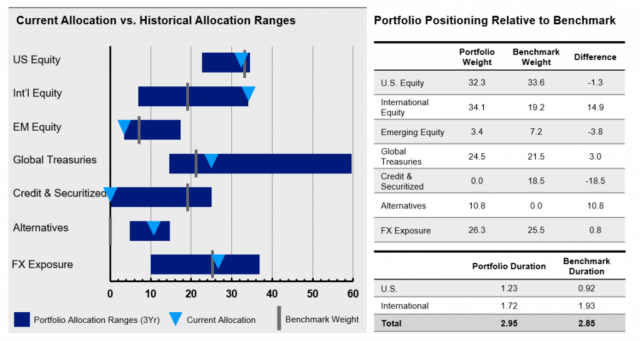

Following these developments, we have rotated a portion of our equity exposure in the Invesco Oppenheimer Global Allocation Fund from emerging to developed markets, resulting in a net underweight EM position relative to the benchmark1 (Figure 3). The recent deterioration in the macro environment has also led to a meaningful outperformance in defensive equity factors such as quality and low volatility, which we expect to continue in an environment of increasing risk aversion and downward revisions to growth. Finally, barring renewed easing rhetoric by global central banks, the decline in bond yields over the past month and recurrence of flattening yield curves seem to appropriately reflect the increased risk aversion in the markets.

Exhibit 3: Global Allocation Strategy positioning

Allocations as of February 1, 2020

Source: Invesco, 2/1/2020. Portfolio allocations are displayed in terms of notional value and may exceed 100% as a result of exposure to derivatives. Notional Allocation refers to exposure gained through the use of derivative instruments when there is not an offsetting cash position. Holdings are subject to change and do not represent a recommendation from Invesco Ltd.

Footnotes

1. 60% MSCI ACWI & 40% The Bloomberg Barclays Global Aggregate Bond Index (USD Hedged)

All data sources from Bloomberg L.P. as of 1/31/2020, unless otherwise stated.

Important Information

Duration measures interest rate sensitivity. The longer the duration, the greater the expected volatility as rates change.

The MSCI ACWI Index is an unmanaged index considered representative of large- and mid-cap stocks across developed and emerging markets. The index is computed using the net return, which withholds applicable taxes for non-resident investors.

The Bloomberg Barclays Global Aggregate Bond Index is an unmanaged index considered representative of global investment-grade, fixed-income markets.

The opinions expressed are those of Alessio de Longis as of January 14, 2020, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Diversification does not guarantee a profit or eliminate the risk of loss.

MSCI Inc. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI's express written consent.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Derivatives may be more volatile and less liquid than traditional investments and are subject to market, interest rate, credit, leverage, counterparty and management risks. An investment in a derivative could lose more than the cash amount invested.

Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa.

An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer's credit rating.

Junk bonds involve a greater risk of default or price changes due to changes in the issuer's credit quality. The values of junk bonds fluctuate more than those of high-quality bonds and can decline significantly over short time periods.

Because the Subsidiary is not registered under the Investment Company Act of 1940, as amended (1940 Act), the Fund, as the sole investor in the Subsidiary, will not have the protections offered to investors in U.S. registered investment companies.

The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.

The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risks associated with an investment in the Fund.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.'s retail products and collective trust funds, and is an indirect, wholly-owned subsidiary of Invesco Ltd.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.'s retail products and collective trust funds. Invesco Advisers, Inc. and other affiliated investment advisers mentioned provide investment advisory services and do not sell securities. Invesco Unit Investment Trusts are distributed by the sponsor, Invesco Capital Markets, Inc., and broker-dealers including Invesco Distributors, Inc. Each entity is an indirect, wholly-owned subsidiary of Invesco Ltd.

©2019 Invesco Ltd. All rights reserved.

Tactical Asset Allocation Views (February 2020) by Invesco US

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.