Dairies Are Desperate to Get Americans to Drink Milk Again

Dairy producers bet on innovations such as new flavors and cartons with cookies to rescue the troubled industry

by Laura YinIf you give Americans a cookie, will they finally start buying milk again?

Dairy producers are betting on it. Facing an unprecedented and protracted slump in demand, the industry is coming up with all sorts of innovations. That includes new flavors like wild blueberry, dips like fiesta sour cream, new packaging and, sometime next year, cartons with cookies attached.

“People love cookies in milk,” said Tony Sarsam, chief executive officer of Borden Dairy Co., which is planning the cookie-marketing strategy for 2021. “It will be a size that you can actually eat in the car. Put it in the cup holder -- and you can dip the cookie.”

Sure, it might be a bit of a long shot -- trying to lure people with cookies when they’re ditching milk to be healthier. But for an industry that pumps out about $35 billion of the stuff annually, the bid to win back demand is starting to get a bit desperate. Producers are pushing more flavored options, creating new dairy-based products, re-branding to boast about dairy’s benefits, basically pulling out all the stops to try to rescue the troubled industry. Two of its giants filed for bankruptcy reorganization in recent months: Dean Foods Co. and Borden.

It’s hard to say if that will be enough.

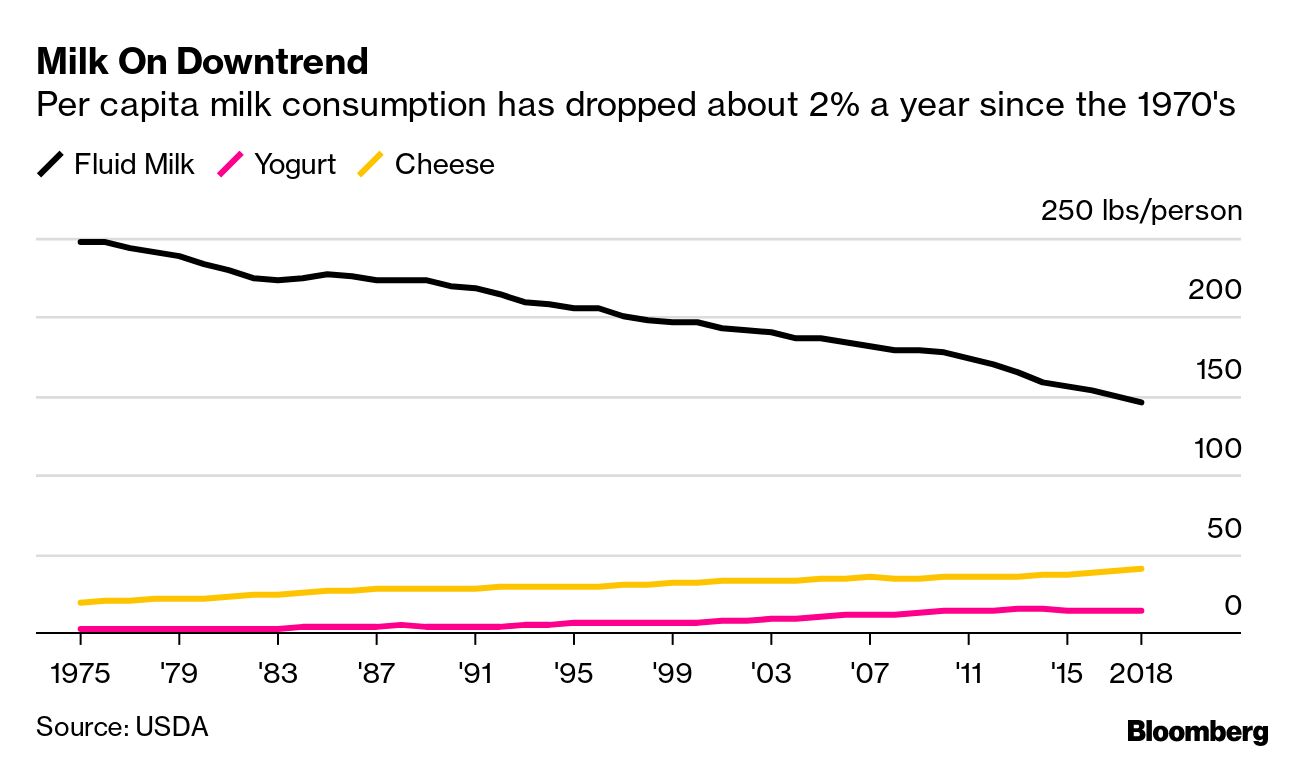

U.S. consumption of cow milk has fallen about 2% each year since the 1970s, government data show. The industry’s been saddled with consumer concerns over health and environmental impact. Plus, in the last decade plant alternatives swooped in to capture the zeitgeist.

Some expect things will only get worse. A 2019 Statista report forecasts consumption in the U.S. will drop further to 155.3 pounds per person in 2028 from an estimated 161.7 pounds last year. The tally was 194.9 pounds in 2010.

Milk used to have superstar status in the U.S. Hark back to the “Leave It to Beaver” days, when a frothy glass was as ubiquitous on dinner tables as it was poured over cereal and served alongside dessert.

But even by the time the “Got Milk?” ads rolled out in the 1990s, with celebrities from Bill Clinton to Britney Spears and Dennis Rodman donning a white beverage mustache, consumption was flagging. There were warnings of the links between high dairy intake and heart disease, cancer and weight gain.

Big Dairy and Plant-Based Working Together as Cow Milk Flounders

In the last decade, environmental concerns mounted -- cattle emit the greenhouse gas methane as part of their digestive process (think cow burps, farts and manure). Starbucks Corp. just announced a shift to emphasize non-dairy options to reduce its carbon footprint.

Producers say innovation is the cure to all this negative sentiment. Borden has a series of new products in the pipeline, with seven dairy dips hitting the market this month, and new light chocolate-flavored and vanilla-flavored beverages that target adult women will be launched by the end of the year. The company plans to double its spending on product innovation over three years, CEO Sarsam said without providing a dollar figure

Dairy Farmers of America, the cooperative that plans to buy some of Dean’s assets, is investing in manufacturing plants to make more shelf-stable products, which can be stored at room temperature until they’re opened. The group also sees flavors as a key area for growth and has experienced recent success with wild blueberry and coffee under its Oakhurst brand, according to Doug Dresslaer, director of cultural innovation. Last year, they launched a beverage branded Dairy Plus Milk Blends, which blends cow and plant products.

“Consumers demand for energy, comfort, health -- you will see a lot more products introduced to meet those needs,” said Paul Ziemnisky, executive vice president of global innovation partnerships for marketing group Dairy Management Inc. “Valued-added beverages are in that arena, like high protein and low sugar.”

Big Beef Battles to Scrub Polluter Image as Faux Meat Booms

Dairy is also trying to win back consumer trust. While that means working to showcase the benefits of the beverage, a high source of protein, calcium and a host of vitamins and minerals, it also includes going on the attack against plant-based beverages, or impostors, as the industry sometimes calls them.

Groups like the National Milk Producers Federation are fired up about the Dairy Pride Act, legislation introduced in Congress to force the Food and Drug Administration to police labels. Under the proposal, labeling something “milk,” for example, must mean the product comes from a “hooved mammal.”

“Consumers are being misled into believing that these imitation products are as healthy as their dairy counterparts,” Eric Beringause, president and CEO of Dean Foods, said in a statement in response to questions from Bloomberg. “It is time we stood up for the dairy industry, for our nation’s dairy farmers, for the integrity of our milk products, and for the families who rely on them for adequate nutrition.”

Meanwhile, marketer Dairy Management is emphasizing the innovative farm practices and new technologies that have helped make the industry greener. Fluid milk accounts for only about 2% of total greenhouse gas emissions in the U.S., according to the group.

“Milk has better nutrition components than alternative competitors, it does better in a taste study and is significantly cheaper -- so it’s just about reinventing itself,” said Tom Bailey, a senior analyst at Rabobank.