Is It Finally Time to Be a Believer in Tesla Stock?

With Tesla, it isn’t all about the high profile arguments from the bulls and bears

It’s one of the market’s most notorious and contentious battleground stocks. But in the world of he said, she said arguments in today’s market, no stock comes close to what’s driving Tesla (NASDAQ:TSLA) stock traders into a frenzy.

Let me explain.

Tesla is no stranger to controversy. Even Netflix (NASDAQ:NFLX) or a hotly contested Shopify (NYSE:SHOP) can’t hold a candle to the upstart EV auto manufacturer. But this month conditions have grown more heated.

The escalation follows two very high profile and countering assertions, which fight for those who hate Tesla and those who love the company. And make no mistake, Tesla stock is going to run one of them over shortly.

In support of Tesla’s steadfast pessimists and the stock’s heavily shorted bear population, perversely enough, it was well-known consumer advocate Ralph Nader who declared shares need to be investigated.

Mr. Nader recently expressed that the U.S. Securities and Exchange Commission should protect investors and determine if any insider trading or possible market manipulation in Tesla’s share price occurred. Did someone forget to send Ralph the memo that Tesla stock rallied upwards of 125% at its best this year?

For the bulls, ARK Invest’s Catherine Wood, a long-time bull on Tesla, revised its longer-term price target on shares to $7,000 by 2024. And if their thesis really plays out as anticipated, the stock could trade above $15,000. The latest call comes after the firm’s research team performed a deep dive into TSLA stock’s gross margins, capital efficiency and the adoption of autonomous driving.

So, who are you going to believe? I’d advise that when it comes to Tesla stock right now, it’s best to leave those matters to the price chart.

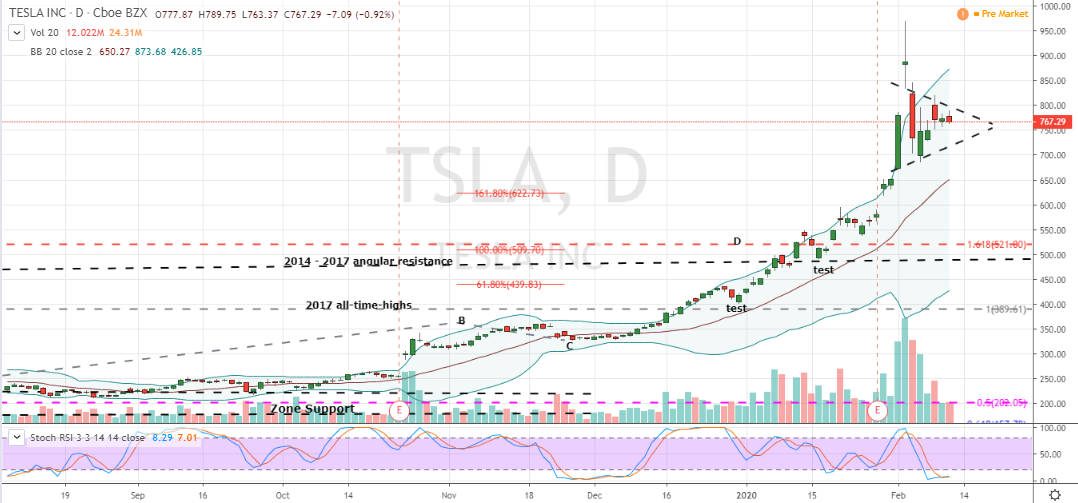

Tesla Stock Daily Chart

Source: Charts by TradingView

Since last writing about Tesla stock in December and offering a bullish risk-adjusted entry, shares have rocketed higher. In fact, the discussed purchase looks almost conservative and safe in consideration of Tesla’s ensuing blast-off towards $1,000 over the past month. But I’d also say investors shouldn’t believe the bears and think TSLA is well past being able to be bought. It’s not.

Over the past several sessions Tesla has consolidated its gains following what some technicians will qualify as a blow-off topping pattern. I’m not so sure. What is observed with more authority is the reduced price volatility is taking the shape of a symmetrical triangle. And most often, these formations offer traders profitable continuation entries into a stock.

A move in Tesla above $810 is where I’d recommend getting long. This entry allows for a small bit of technical wiggle room through pattern resistance while clearing the well-watched $800 level. As with our last recommendation in Tesla, a 10% stop looks smart. This exit would be placed beneath $720 and exits the long before any bearish chart dynamics below triangle support might really challenge shares. Of course, if $720 is broken prior to a rally out of the pattern, all bets are off the table.

Alternatively, another route to stronger risk-adjusted returns would be to buy a slightly out-of-the-money bull call spread with a duration of a couple months. I’d still look to enter and exit the spread with the described price action above. But regardless of what happens on the price chart thereafter, this strategy offers guaranteed protection and exceptional bang for the buck not possible with a Tesla stock position.

Disclosure: Investment accounts under Christopher Tyler’s management do not currently own positions in any securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional options-based strategies and related musings, follow Chris on Twitter @Options_CAT and StockTwits.