Range Resources: Leverage Risk Climbs Sharply

by Long PlayerSummary

- The credit line may not be available when the company most needs it.

- Cash flow in the third quarter dropped nearly 50% from the previous year.

- Fourth-quarter cash flow should continue the pattern of progressively lower cash flows despite the hedging program.

- The debt due profile remains unfavorable even after the latest bond redemptions.

- Debt/TTM EBITDAX was already unacceptable at 3.2. It will now deteriorate more for the foreseeable future.

Range Resources (NYSE:RRC) offers a lot of danger and a lot of appreciation. This is the kind of company that offers a large total return at the risk of total loss of principal. Ideally investors should probably use their "lottery money" only on a proposition like this one. Whether or not Range Resources survives the current downturn in its current form will depend a lot upon whether an investor believes that gas prices will rally sooner rather than later.

During the third quarter, the company announced an expansion of the credit line to $2.4 billion while selling a royalty interest that netted an additional $150 million. This action continued a rather brisk asset sale pace that enabled the company to pay down a material amount of debt. However, the current situation is bleak enough to halt accretive asset sales for the foreseeable future. That means the reported third-quarter leverage is probably going to be around for a while.

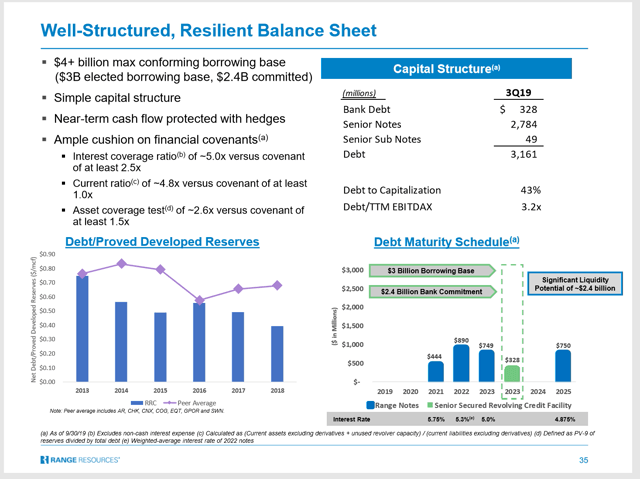

Source: Range Resources Goldman Sachs Global Energy Conference 2020 in January 2020

The debt due profile is very unfavorable for a company that is entering a cyclical downturn. The general rule of thumb is that the credit line remains unused during a crisis because banks tend to be very nervous about lending money when companies most need money at cyclical bottoms. One of the significant risks is that the credit line shown above could rapidly shrink as the gas pricing continues to decline. What looks very comfortable now could easily turn financially stressful or worse.

Far more importantly is that unsatisfactory Debt-to-TTM EBITDAX ratio shown above. That ratio is above most acceptable lending limits before the big decline in gas prices. Even a decent hedging program probably will not stop that ratio from deteriorating sharply.

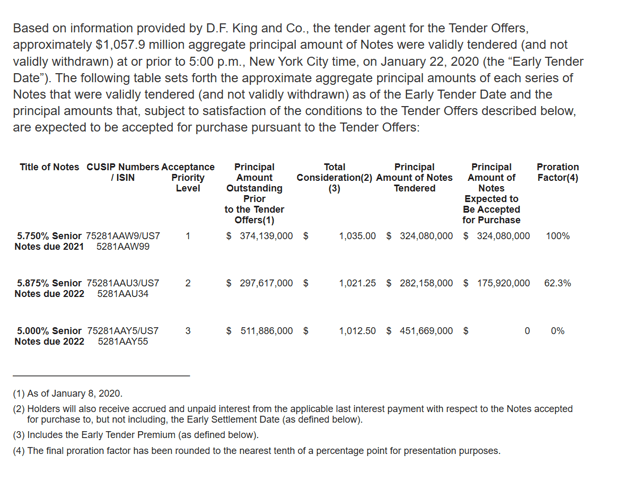

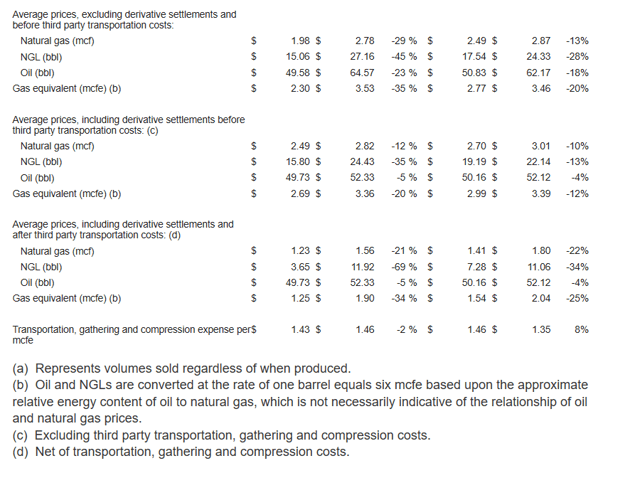

Source: Range Resources January 23, 2020, Press Release

Management has begun the challenging task of refinancing the notes coming due. The notes that will replace these notes carry a considerably higher interest rate of 9.25%. But the accomplishment of this refinance start proves that the debt markets are still "open for business" and that business includes oil and gas companies. Therefore all those stating that the oil and gas companies cannot refinance their debt are slowly discovering that even a heavily leveraged company like Range Resources has access to the debt markets for a price.

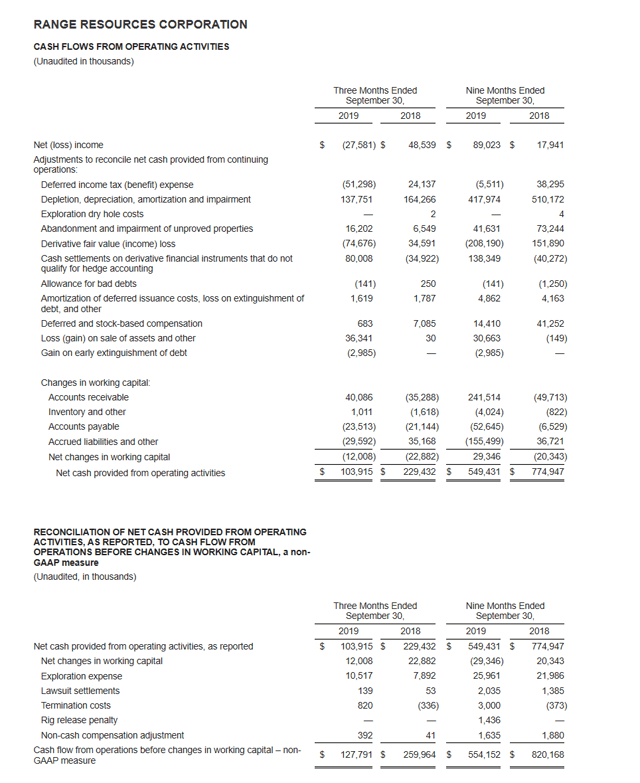

Source: Range Resources Third-Quarter 2019 Earnings Press Release

The huge problem for Range Resources is that the cash flow dropped nearly 50% in the third quarter from the previous year. Therefore, the debt ratio has already begun to deteriorate before the fourth-quarter numbers influence key ratios. Since prices are even softer in the fourth quarter, the cash flow numbers probably are not improving anytime soon.

In fact the fourth quarter and the first quarter could see some very poor cash flow numbers reported. Hedging does help somewhat. But the small exposure of the unhedged portion of the sales often produces fairly significant cash flow changes because cash flow is a percentage of sales. The change in selling price often goes to the bottom line without a lot of cost changes because production costs are not really influenced by sales price changes. Only royalties and taxes among other relatively small items would decline.

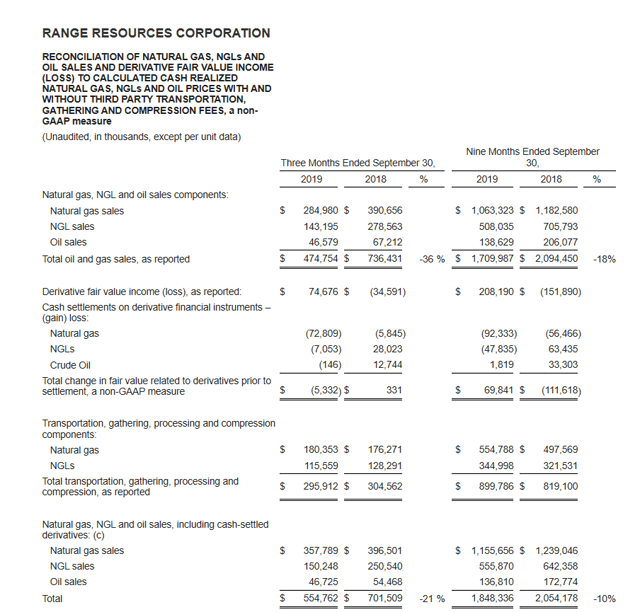

Source: Range Resources Third-Quarter 2019 Earnings Press Release

Note that the roughly 34% in pricing cost declines (including third-party transportation and settled hedging effects) led to about a 25% (roughly) decrease in revenue. But the cash flow drop was nearly twice the percentage of the revenue decline in the third quarter. As shown above, that drop includes the effect of hedging. Without those hedges, the selling price would have declined another $.39 MCFE with even worse cash flow consequences.

Oftentimes investors over-assume the protection of the hedging program. Even the hedging program can and often does allow for significant unfavorable cash flow changes when natural gas prices decline. This company does sell some oil and some natural gas liquids. Should the current lack of basin drilling activity result in a rally of those products, then the effect of the current gas price decline could be muted before the market expects any natural gas price rally.

In the meantime, the third-quarter cash flow figure annualized does not come close to properly servicing the debt. The continuing low natural gas prices can only mean that some key leverage and covenant figures will only deteriorate more. Those who believe that natural gas will come into balance quickly may want to chance an investment in this company. However, an extended natural gas pricing downturn could quickly cause some serious financial stress.

Management sold properties and overriding royalty interests while it felt it could get decent prices for shareholders. But current conditions may not allow a continuation of that strategy. Therefore about the only other lever available would be a premature liquidation of hedges to raise cash. That strategy may work because unconventional wells tend to decline sharply. Therefore the currently low rig activity in key basins could point towards an unexpectedly large decline in production. Possibly production and demand could be in balance by this summer.

Conclusion

This highly leveraged company will now become more leveraged as the natural gas prices bottom. Should the lenders perceive that natural gas prices will rally relatively quickly, then they may allow this company to use its bank credit line as needed. However, most lenders take the current situation and project that situation into the future. Should the lenders do that, this company is at risk of a serious financial crisis that would at least result in considerable shareholder dilution.

The debt ratio during better times should not have exceeded 2.5. In fact for a company this size, that debt ratio probably should have been closer to 1.5. Then there would have been considerable goodwill extended towards the company as one of the financially stronger companies in the industry.

Management tried "to beat the calendar" by selling enough assets and royalty overrides to pay down debt to acceptable levels before the significant gas price decline began towards a market bottom. Mother Nature threw a monkey wrench into that plan by delivering an abnormally warm winter. That leaves the shareholders at risk of losing much or all of their investments.

This management badly needs to deliver to the market an announcement of an accretive property sale or the sale of a significant overriding royalty interest. But neither may be possible in the current environment. Therefore investors are advised to watch this investment from the sidelines until it is clear that gas prices are beginning their cyclical recovery. In exchange for giving up the initial pricing recovery, investors would not risk losing their entire investment principal.

I analyze oil and gas companies like Range Resources and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company's filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.