Axfood And ICA 2019 Reports - Dividend Increases

by Wolf ReportSummary

- In this article, we'll review both Axfood and ICA-gruppen FY19 results. Both companies increased their dividends for the year, albeit only in the 3-4% range.

- Both companies provided excellent FY19 performance, beating overall food indexes handily.

- Both companies look appealing as companies going into 2020 - but despite a report-day drop of 5-6% since results did not live up to expectations, we cannot call them "Undervalued".

(Author's Note: Investors should be mindful of the risks of transacting in securities with limited liquidity, such as AXFOF and ICCGF. The Axfood and ICA International listings in Stockholm, STO:AXFO and STO:ICA, offers stronger liquidity).

In this article, we'll consolidate the FY19 results and dividend increases/expectations for the two major publically listed Grocery FMCG's in Sweden - Axfood (OTCPK:AXFOF) (OTCPK:AXFOY) and ICA Gruppen (OTC:ICCGF). I regularly cover the results these companies give us, and they've essentially been unbuyable from an investment standpoint for a full year.

In this article, I'll reiterate once again why you should consider investing in Swedish grocers when the market turns - and what sort of characteristics these companies have going into 2020.

Let's begin with the larger holding - Axfood.

FY19 - Excellent

As I wrote in my last article on the company, 3Q19 was even better than in previous quarters. This trend of continuing outperformance follows us into 2020.

Results reported for 4Q19 show us that:

- Net sales increased by 5.4% organically.

- 14.6% increase in operating profit, with a 3.7% op. margin.

- EPS increased to 1.68 (1.54).

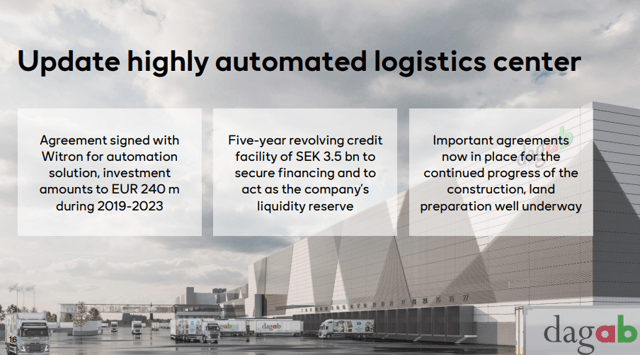

- The Witron automation contract is going forward, and expectations are in line with previous communication.

More importantly, the company gave us annual results including:

- Net sales increase of 5.5% and an operating profit increase of 13%. Margins increased 30 bps to 4.5%, and the company increased full-year EPS to 7.87 SEK/share (7.41 2018).

- The company communicated an intended dividend increase of 0.25 SEK/share, now up to 7.25 SEK/Share. This gives us an excessive EPS payout ratio of 92.1%.

I personally did not expect a dividend increase from Axfood. The company probably shouldn't have increased the dividend, given the massive CapEx Axfood is taking on with its new logistical solutions and new central warehouses. While I have zero worries about Axfood's debt covenants or the company's ability to raise capital, a >90% payout ratio for a non-REIT is always a bit of a concern, given my focus of high rates of growth over a long time which requires Axfood to maintain a very high growth rate indeed.

This also means that my current YoC on Axfood is now just north of 5%, with the current yield being 3.63% based on the new company dividend. The company also - and I'm very happy that more companies are doing this - is moving to a bi-annual payout model, with dividend payouts on two occasions during the full year.

Aside from the dividend, a few important items. First off, the company expects CapEx for 2020 to be around 1B SEK - and this excludes potential M&As and right-of-use assets. The company also expects to open 5-10 new stores during the year.

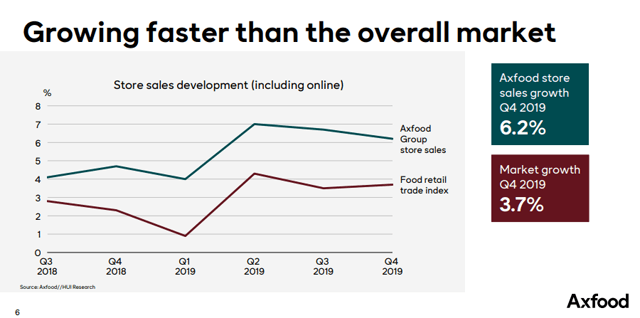

As usual for the past quarters, the company beat the overall food retail index in Sweden.

(Source: Axfood FY19 Results)

In terms of sales, there weren't really any worrying trends in any of Axfood's segments aside from Hemköp, which experienced a small (0.9%) sales decrease, made up for by high single-digit and low double-digit joint group sales increases. Despite the sales drop, Hemköp's operating profit was also actually up.

CapEx during 2019 amounted to almost 1.5B SEK, which means that it would be estimated higher than 2020 - though this includes right-of-use and M&As as well. The main point when it comes to Axfood at the moment is their laddering and expectations for CapEx - sales, as I see it, aren't in any sort of danger in the short to medium term as there really are very few competitors on par with Axfood.

(Source: Axfood FY19 Results)

The CapEx allocated to the technology itself, delivered by Witron in Germany, is about 2.4B SEK in total. Out of this, 20% was paid in 2019, 25% will be paid in 2021, and the remaining in 2022-2023. This, of course, only marks a portion of the total CapEx required. The company has signed new leases, but these are based on the construction cost, and total lease amounts won't actually be clear until the facility is finished.

To finance the entire operation, Axfood has signed a five-year revolver with Swedbank (OTCPK:SWDBF) and SEB (OTCPK:SKVKY), giving Axfood access to 3.5B SEK as a liquidity reserve.

Seeing how Axfood is dialing up leverage in accordance with their plans, it's a good thing that cash flows from operations are as stable and growing as can be expected. Axfood's new equity ratio target, following the adoption of IFRS16, is a minimum of 20% and an operating margin of 4% or above. And while the current cash flow is actually negative (-774M SEK for FY19), most of that negative comes from the 1.4B SEK spent on paying down current debt. The company's FCF continues to look good, coming in at well above 2B SEK even after the heavy growth CapEx we're currently seeing.

Once Axfood gets its logistical solutions finished and can focus on paying down the very likely mountain of debt it will at that point have racked up, we should have a clearer picture of what sort of maintenance CapEx Axfood's new structure will bring, and how quickly the debt is paid off.

(Source: Axfood FY19 Results)

Closing the books on FY19, it was a great year for Axfood all things considered. They delivered on most ambitions, though results were below analyst expectations. Net profit above all came in below expectations, but that was pretty much it. Part of the risk the market is no doubt seeing is the increased CapEx, the higher leverage/debt position and the fact that most of us know that projects sometimes run well over expected budget/costs.

If Axfood wants to maintain its sky-high 90%+ dividend payout, while also claiming a dividend policy which states a >50% earning payout (I'm not saying it's incorrectly stated, just saying 90% is well above 50%), and while investing as they are, I believe they'll be forced to take on debt simply to service that dividend/debt if things run slightly different than the company expects.

Not a desirable situation - and certainly part of my current stance - to "HOLD" Axfood, but not buy it, even if it might go up from here.

ICA FY19 - Also excellent

ICA's results landed on a similarly positive note. On a quarterly basis, the company saw:

- Organic sales growth of 3.8%, adjusted for divestment of Hemtex.

- Ramp-up of the Pharmacy logistic center according to plans, with better efficiency. Rimi Baltic launched an e-commerce platform.

- Improved margins of 20 bps, up to 4.1%, near-identical to Axfood.

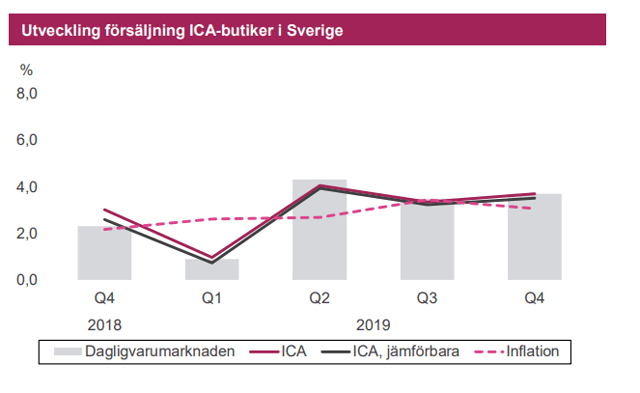

(Source: ICA FY19 Results)

Unlike Axfood, ICA does not by far outperform the overall food retail index when it comes to sales in Sweden. In fact, in terms of their Baltic operations, sales are actually lower than Baltic indexes, which grew 4-5% as opposed to Rimi's 2.6%. Pharmacy results are better than overall pharmacy indexes, but mostly due to prescription medication, which the ICA pharmacy began with last quarter.

Full-year results are positive:

- The ICA Group increased net sales by 2.6%, and operating profit grew to 10.193 B SEK (9.850 B YoY 2018)

- Some impairments and losses on sales of non-current assets drove profit for the period down to 3.45 BSEK (3.5B)

- Operating margin improvement to Axfood levels of 4.5%

- Small EPS drop to 17.06 SEK/share, down from 17.35 SEK/share 2018.

Just like with Axfood, I did not expect a dividend increase, but we nonetheless got a small one, with the company increasing the dividend from 11.50/share to 12 SEK/share, representing a dividend increase of 4.17%.

Highlights during the year? There were plenty.

Aside from ICA's concept and stores maintaining the largest market share in the nation, the company is moving forward with its priorities in e-commerce, logistics meal solutions and higher personalization - much like Axfood. ICA, I would argue, has a far stronger customer loyalty program, which actually rewards customers with cash bonuses, whereas Axfood mainly focuses on personalized discounts. Both companies are obviously trying to garner customer loyalty long term, but ICA, given its market position and current model, is faring much better.

ICA's bank is also performing very well, with increased volumes and higher earnings. ICA has started providing insurance to customers, and this saw a small profit during the full year, which isn't bad considering the limited time it's been around.

Company non-Swedish operations, which Axfood does not have, are also going well, despite it not keeping up with local indexes. Profitability in the Baltics is excellent and with strong conversions. Additionally, one has to remember that ICA contends with Lidl in these geographies, which has a much stronger presence here than in the Scandinavian locations - so some softness in sales, while profits are strong, can be forgiven.

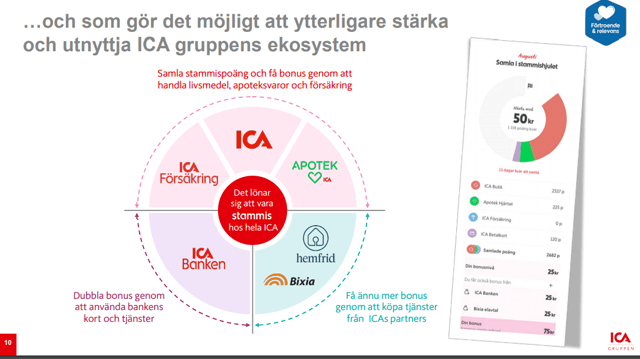

Unlike Axfood, ICA is developing an ecosystem.

(Source: ICA FY19 Presentation)

This ecosystem contains everything from insurance, banking, pharmacy, groceries to utilities (Bixia), where ICA tries to motivate customers to purchase from ICA partners. The potential benefits to such a system are obvious - cross-channel sales and profits. The potential drawbacks are equally clear - unprofitable operations can weigh down results quickly, as they have before.

ICA has tried diversification before, in trying to sell textiles, home improvement, and furniture. None of these things worked out, and these operations are now all divested. While I think this idea and these operational targets make more sense, there's no guarantee, as competition on each of these markets is fierce.

Add to that the fact that ICA does not actually compete with competitive pricing all that much, but with product quality/offerings, and I see this as a bit more of a risk than others do. I'm confident in ICA core, banking, and insurance. As far as pharmacy and "partners" go, more of a wild card going forward and far more exposed to a fickle overall market.

However - 2019 was good.

2020 looks to be equally profitable for the company as ICA expands its pharmacy offerings, 16-20 new stores in the Baltics, and each segment of the company is set to grow. ICA also has significantly lower CapEx going forward into 2020, estimating somewhere around 450 MSEK for the year, to be compared to the 1B of Axfood.

Let's look at valuation.

Valuation

Valuation for both of these giants remains prohibitively high.

Even with FY19 EPS guiding P/E-valuations, we're looking at multiples of ~25X for Axfood and ~24X for ICA-Gruppen. This just doesn't work, even with the unparalleled quality and safety for both of these companies (Despite Axfood's ramp-up in spending).

It's a 2.8-3% dividend yield on a company which more commonly trades around 3.5-4.5%. Additionally, where is the upside when you're buying a company in this sector that's trading near 2-3 times of its tangible book value? There's certain to be some continued earnings growth as food prices are growing each year, as is the population - but space for both these companies to grow earnings in double digits for the next 10-20 years just isn't there, as I see it.

As such, paying such a high earnings multiple isn't something I'd be interested in. A more general downturn will bring these companies down to at the very least below 19-20 times earnings, and a 16-18 times P/E-ratio is something I could consider acceptable, given all of the aforementioned benefits for these companies. At such a prospective valuation, Axfood would trade at a price of 126-145 SEK/share, which gives us at the very least a 27% downside on today's share price. For ICA, the same numbers are near-identical, coming in at a 26% downside to a target price of ~300 SEK/share. Even with all of the growth initiatives these companies have, I'm not expecting either of them to translate this to more than a single-digit long-term annual EPS growth going forward.

Out of the Nordics, only Sweden is seeing such valuations for its publically-listed grocers. In Finland and Norway, you can find cheaper prospects, though as we speak, these are also growing in terms of valuation. The trend of the past few months, where finding value is becoming harder and harder, is certainly continuing.

This forms the basis of my thesis for Swedish grocers.

Thesis

Great companies at too expensive a price.

While that certainly isn't a unique situation in today's market, it's nonetheless represented very accurately by the current state and valuation of these two companies. They're not fairly valued, nor undervalued - but have shown overvaluation for at least a year.

In terms of stock market history, a year is no more than a quick blip. Both Axfood and ICA will come down once more - either as the result of challenges in home markets or as the result of a more general market drop. It's at this time that I'd be wanting to increase my allocation to these companies.

In the end, non-Swedish challengers have tried and failed to enter Sweden. (Lidl doesn't even have 4.5% of the Swedish grocery market). ICA is by far the largest, with Axfood and non-listed competitor Coop in second place. ICA and Axfood have reached positions where they can buy up any competitors threatening their market share - as seen when the companies bought out the leading e-grocers and transformed them into their own operations. I believe Coop's market position will slowly fade as a result of poor adaption and slumping results as well as a failing business model, but I don't see a scenario where an entrant is allowed a leading market position - this would have to be a company on the order of Amazon (AMZN), and the margins in Sweden for it to be a compelling business idea just aren't there.

As I see it, this means that Axfood and ICA will continue to dominate the market, and that's an oligopoly you want to be invested in - just not at this price.

Thank you for reading.

Stance

Due to continued overvaluation, both ICA and Axfood are "HOLDS," and I'm clarifying my position to "Neutral" here, despite them potentially growing further.

Disclosure: I am/we are long AXFOF, AXFOY, ICCGF, SKVKY, SVKEF, SWDBF, SWDBY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.