Digital Turbine Is Likely To Catch A Second Wind

by Shareholders UniteSummary

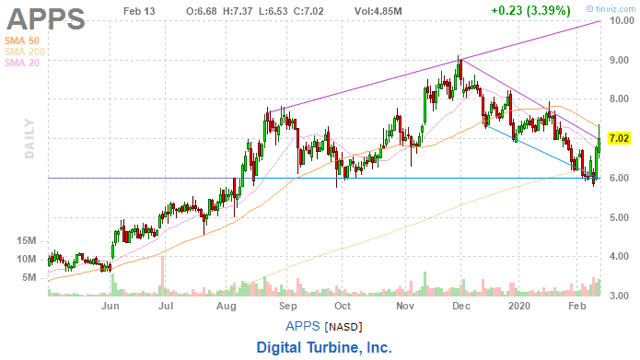

- After a strong rally, consolidation set in, and the shares fell back to where they were in the summer of last year.

- However, we think the elements are in place for the company to recharge growth, driven by new products, new partners, and a smart acquisition.

- Operationally, things have kept on improving, and the company now generates considerable amounts of cash.

Digital Turbine (NASDAQ:APPS) has been a runaway success with its share price exploding, but in recent months, the share price has been consolidating. We think we're close to a second leg-up as the company keeps in raking new partners and introducing new products.

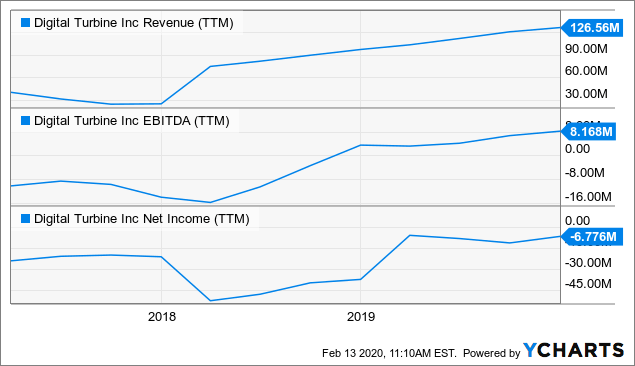

The progress of the company has been similarly spectacular:

Data by YCharts

GAAP net income was still negative for the past 12 months, but it was already positive in Q3 ($3.3M) despite a one-off $0.9M loss from the impact of the change in fair value of derivative liabilities connected to outstanding warrants issued related to the company's retired convertible notes.

Non-GAAP earnings are already well into positive territory ($4.2M in Q1, $4.1M in Q2 and $5.0M in Q3 or $13.3M for the first nine months of fiscal 2020).

Growth

The company has three main growth drivers:

- New OEMs and carriers

- New products

- Rates: RPD north of $3 with US carriers

There are likely to be several additional growth drivers:

- Acquisition revenue synergies (see below)

- 5G phones, as long as there is no Apple (NASDAQ:AAPL) 5G phone

OEMs and Carriers

The main part of Digital Turbine's revenues comes from its US carriers. Q3CC (our emphasis):

Verizon, AT&T, Cricket and U.S. Cellular increased year-over-year, despite a decline in the total combined devices sold and represented just over 70% of our total revenues

But the company has been diversifying its customer base with the likes of:

Samsung is of course a very significant win, and it has now been installed on 7M of its unlocked phones in 75 countries, with more to come. Q3CC:

On the great news about Samsung as you're well aware they move north of 200 million smartphones a year. So the fact that, we're talking about now getting out into kind of mid-seven figures, approaching eight figures in devices, we got a lot of room to grow that relationship.

The company is focusing on Brazil as one of its growth markets, with partners Samsung, America Movil and Telefonica all having a large presence (Q3CC):

We currently believe that we have line of sight to have in our software and the vast majority of devices in the Brazilian market by the end of this calendar year.

That would be quite a coup, needless to say. In Mexico, the company announced a cooperation with AT&T Mexico which has 20M customers in that country. Management argued it is close to start launching with Telefonica as well.

The company also announced a global partnership with LG on the day of the Q3CC, and it argues it is in talks with many more OEMs, particularly in China. The latter might face some headwinds due to the coronavirus outbreak.

As the company doesn't have any partnerships in China, its exposure is limited. Management argues it actually has a "China out" strategy, which involves helping Chinese OEMs and app developers to expand beyond China.

New products

The company has introduced a host of new products:

- Single Tab

- Folders

- Notifications

These new products are now responsible for 20% of revenue, up from 13% a year ago. One might want to consult SA contributor Cobiaman's excellent take on one of these, Single Tab. He argues there is a good chance in near-term acceleration of Single Tab's use and associated revenue.

While it has been installed in some 150M phones, actual use has lagged significantly due to a backlog in the necessary custom integration with advertisers, but the company has engaged four leading attribution and analytics companies to speed things up here, and we should see the results of that coming in over the coming quarters. Indeed (Q3CC):

We continue to work with many other high profile partners on Single-Tab including names such as Pinterest, Twitter, Epic Games, which owns the fortnight franchise to name a few.

Revenue from new products is not only increasing as a percentage of overall products, but it's also contributing to a rise in RPD or revenue per device. RPD increased from $2.50 a year ago to over $3 in Q3 for its core American carrier customers with the rise coming both from new products as well as media partners paying higher rates.

Mobile Posse acquisition

The company is buying Mobile Posse (company website):

Mobile Posse turns telecom companies into mobile media leaders through its Firstly Mobile™ content discovery platform. The Firstly Mobile Platform creates a better smartphone experience by presenting engaging curated content-without having to open…load…search…or wait. With billions of frictionless mobile content experiences delivered each month, Firstly Mobile drives greater consumer engagement and boosts advertising revenues for carriers and OEMs. And it presents a proven and brand-safe mobile media opportunity for advertisers.

A few noteworthy items:

- Mobile Posse is expected to generate some $55M in revenue in 2019.

- All of its revenues are recurring, and after the close of the merger, the combined company will generate more than a third of its revenue from recurring sources.

- Mobile Posse generates strong operating leverage, profits and positive cash flow and will be immediately accretive to Digital Turbine.

- The company pays $66M in cash, $41.5M at closing and another $24.5M in earn-outs depending on certain metrics over a 12-month period.

- The acquisition is financed out of existing cash, cash flow and debt. The amount of cash it would need would be $5M-$15M and management is talking about $20M-$25M of debt.

Management described what the company does in some detail (Q3CC):

Mobile Posse has many different mobile products that are complementary to our App install products. They have a minus one screen that you swipe left off the home screen for content, a product that powers the mobile operators content portals, home screen products, and also a product similar to our Media Hub product that curates news, weather, sports, and other content through an application and or a widget on the home screen. They monetize these products by way of programmatic advertising. And their platform works with the largest advertisers such as highly recognized recognizable names like Google, The Trade Desk and Rubicon to name a few. That is their demand and their source of revenues. And similar to us, they then to pay their supply partners via revenue share, such as T-Mobile, MetroPCS, Boost, AT&T, Blue and Cricket.

While there are some cost synergies, the rationale of the acquisition centers on revenue synergies. Mobile Posse's revenue comes entirely from the US and management is convinced it can leverage its solutions to its own customers, both in the US and especially abroad.

But there are also opportunities for Digital Turbine to leverage some of the clients of Mobile Posse with the opportunity to sell products onto some of Mobile Posse's clients like T-Mobile (NASDAQ:TMUS) and MetroPCS.

There is also something else (Q3CC):

we start thinking about televisions and advertising on televisions and how good of a job Mobile Posse does of doing that on home screens of smartphones. It's a natural extension. So that that's absolutely something that we're thinking about

That would open up a whole new ball game, needless to say, even if it's a little early to get overly excited as no time frames were given. But it's interesting to know there are opportunities beyond mobile phones.

Q3 results

Revenue growth (18%) was somewhat disappointing and caused by a weak November for Android phones in the US. Management offered iOS promotions as an explanation, but this soft patch seems already behind us.

Otherwise, results were firm, with $7M in free cash flow, $5M above last year's quarter, an outstanding result. Adjusted EBITDA rose from $3.8M last year to $5.6M in Q3.

Guidance

Management expects revenue for Q4 to grow between $33.2M and $34.5M, representing growth of 24% at the midpoint of this range, and expects adjusted EBITDA to grow to between $3.5M and $4.0M.

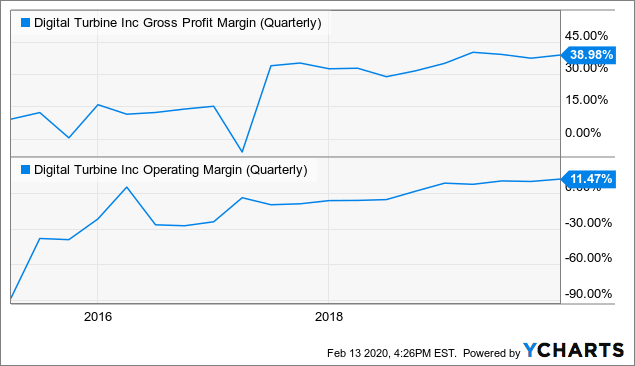

Margins

Data by YCharts

Non-GAAP gross margin expanded 300bp to 40%, driven by a diversification of partners and products. Operating expenses increased from $8.2M a year ago to $9.9M in Q3 or non-GAAP (that is, cash) at $8.9M. There is a considerable amount of operating leverage.

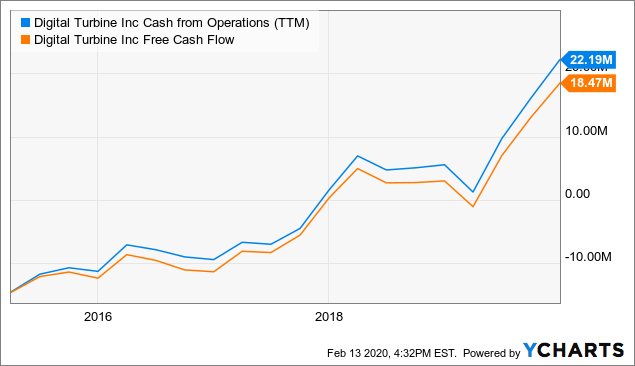

Cash

Data by YCharts

This is the sort of graph investors like to see with a strong acceleration in cash flow, which is now enabling the company to engage in acquisitions like that of Mobile Posse. In Q3, the company generated $7M in free cash flow, $5M more than in last year's quarter.

The company had $33.7M in cash and no debt at the end of the quarter, up from $10.9M a year ago.

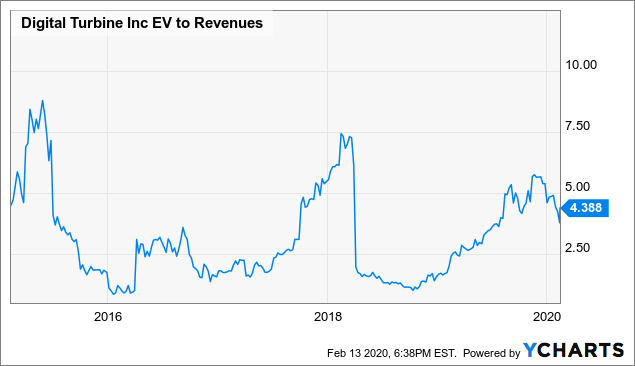

Valuation

Data by YCharts

Analysts expect an EPS of $0.17 for this year (which needs only a $0.02 fourth quarter EPS) rising to $0.24 the next. We're not sure how these figures are going to be impacted by the acquisition, but we think it's likely they will go up:

- Mobile Posse is immediately accretive

- There are important revenue synergies (and some cost synergies)

We're not the only ones who see good value here, the CEO just bought 12.5K shares on Thursday (February 13) on the open market, which isn't something you see every day.

Conclusion

Even without the Mobile Posse acquisition, the company still has lots of growth opportunities in front of it, especially in the field of foreign carriers and Chinese OEMs.

And the new products like Single Tab have a long way to go even on their existing customer base, but it's the revenue synergies of the acquisition that should get investors excited again, especially the opportunities of leveraging Digital Turbine's rolodex for the Mobile Posse's products.

Another thing we very much appreciate is the fact that Mobile Posse's revenues are all recurring. With the renewal cycle in mobile phones slowing, this is an important force to keep the momentum going as well as produce more stable and visible revenues.

The balance sheet of Digital Turbine can easily handle the acquisition, given the strong surge in cash flow and the existing strength.

We have wondered how the stock price drifted back to $6, but that's what small caps like Digital Turbine often do in the absence of news. But as the acquisition news and the consequences sink in, we think shares are already taking off for a next leg up.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in APPS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.