When The Facts Change

by Colin LloydSummary

- The coronavirus is a human tragedy, but the markets remain sanguine.

- A slowing of global growth is already factored into market expectations.

- Further central bank easing is expected to calm any market fears.

- A pick-up in import price inflation has been discounted before it arrives.

My title is the first part of JM Keynes' famous remark, ‘When the facts change, I change my mind.’ This phrase has been nagging at my conscience ever since the Coronavirus epidemic began to engulf China and send shockwaves around the world. From an investment perspective, have the facts changed? Financial markets have certainly behaved in a predictable manner. Government bonds rallied and stocks declined. Then the market caught its breath and stocks recovered. There have, of course been exceptions, while the S&P 500 has made new highs, those companies and sectors most likely to be affected by the viral outbreak have been hardest hit.

Is the impact of Covid-19 going to be seen in economic data? Absolutely. Will economic growth slow? Yes, though it will be felt most in Wuhan and the Hubei region, a region estimated to account for 4.5% in Chinese GDP and 7% of autopart manufacture. The impact will be less pronounced in other parts of the world, although Korea’s Hyundai has already ceased vehicle production at its factories due to a lack of Chinese car parts.

Will there be a longer-term impact on the global supply chain and will this affect stock and bond prices? These are more difficult questions to answer. Global supply chains have been shortening ever since the financial crisis, the Sino-US trade war has merely added fresh impetus to the process. As for financial markets, stock prices around the world declined in January but those markets farthest from the epicentre of the outbreak have since recovered in some cases making new all-time highs. The longer-term impact remains unclear.

Why? Because the performance of the stock market over the last decade has been driven almost entirely by the direction of interest rates, whilst economic growth, since the financial crisis, has been anaemic at best. As rates have fallen and central banks have purchased bonds, so bond yields have declined making stocks look relatively more attractive. Some central banks have even bought stocks to add to their cache of bonds, but I digress.

Returning to my title, from an investment perspective, have the facts changed? Global economic growth will undoubtedly take a hit, estimates of 0.1% to 0.2% fall in 2020 already abound. In order to mitigate this downturn, central banks will cut rates - where they can – and buy progressively longer-dated and less desirable bonds as they work their way along the maturity spectrum and down the credit structure. Eventually, they will emulate the policy of the Japanese and the Swiss, by purchasing common stocks. In China, where the purse strings have been kept tight during the past year, the PBoC has already ridden to the rescue, flooding the domestic banking system with $173bln of additional liquidity; it seems, the process of saving the stock market from the dismal vicissitudes of a global economic slow-down has already begun.

Growth down, profits down, stocks up? It sounds absurd but that is the gerrymandered nature of the current marketplace. It is comforting to know the central banks will not have to face the music alone, they can rely upon the usual allies, as they endeavour to keep the everything bubble aloft. Which allies? The corporate executives of publically listed companies. Faced with the dilemma of expanding capital expenditure in the teeth of an economic slowdown - which might turn into a recession – the leaders of publically-listed corporations can be relied upon to do the honourable thing, pay themselves in stock options and buy back more stock.

At some point, this global Ponzi scheme will inflect, exhaust, implode, but until that moment arrives, it would be unwise to step off the gravy train. The difficulty of staying aboard, of course, is the same one as always, the markets climb a wall of fear. If there is any good news amid the tragic Covid-19 pandemic, it is that the January correction has prompted some of the weaker hands in the stock market to fold. When markets consolidate on a high plateau, should they then turn down, the patient investor may be afforded time to exit. This price action is vastly preferable to the hyperbolic rise, followed by the sharp decline, an altogether more cathartic and less agreeable dénouement.

Other Themes And Menes

As those of you who have been reading my letters for a while will know, I have been bullish on the US equity market for several years. That has worked well. I have also been bullish on emerging markets in general - and Asia in particular - over a similar number of years. A less rewarding investment. With the benefit of hindsight, I should have been more tactical.

Looking ahead, Asian economies will continue to grow, but their stock markets may disappoint due to the uncertainty of the US administration's trade agenda. The US will continue to benefit from low interest rates and technological investment, together with buybacks, mergers and privatisations. Elsewhere, I see opportunity within Europe, as governments spend on green infrastructure and other climate-conscious projects. ESG investing gains more advocates daily. Socially responsible institutions will garner assets from socially responsible investors, while socially responsible governments will award contracts to those companies whose behaviour is ethically sound. It is a virtuous circle of morally commendable, albeit not necessarily economically logical, behaviour.

The UK lags behind Europe on environmental issues, but support for business and three years of deferred capital investment makes it an appealing destination for investment, as I explained last December in 'The Beginning of the End of Uncertainty for the UK'.

Conclusions

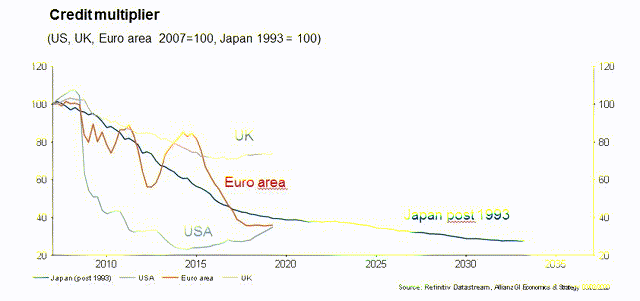

Returning once more to my title, the facts always change but, unless the Covid-19 pandemic should escalate dramatically, the broad investment themes appear largely unchanged. Central banks still weld awesome power to drive asset prices, although this increasingly fails to feed through to the real economy. The chart below shows the diminishing power of the credit multiplier effect - Japan began their monetary experiment roughly a decade earlier than the rest of the developed world:

Source: Allianz/Refinitiv

Like an addictive drug, the more the monetary stimulus, the more the patient needs in order to achieve the same high. The direct financial effect of lower interest rates is a lowering of bond yields; lower yields spur capital flows into higher-yielding credit instruments and equities. However, low rates also signal an official fear of recession, this in turn prompts a reticence to lend on the part of banking intermediaries, the real-economy remains cut off from the credit fix it needs. Asset prices keep rising, economic growth keeps stalling; the rich get richer and the poor get deeper into debt.

Breaking the market addiction to cheap credit is key to unravelling this colossal misallocation of resources, a trend which has been in train since the 1980s, if not before. The prospect of reserving course on subsidised credit is politically unpalatable, asset owners, especially indebted ones, will suffer greatly if interest rates should rise, they will vote accordingly. The alternative is more of the same profligate policy mix which has suspended reality for the past decade. From an investment perspective, the facts have not yet changed and I have yet to change my mind.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.