Analyzing The Safety Of Goodyear's 5.4% Yielding Dividend

by Wealth InsightsSummary

- Goodyear Tire & Rubber has had a tough year with earnings contracting, and shares losing roughly half of their value.

- The company's dividend now yields 5.4% and is currently viable despite the near-term headwinds that Goodyear is working through.

- Assuming the company rebounds over the coming 12-24 months, the current deep discount on the stock is a potential value trade.

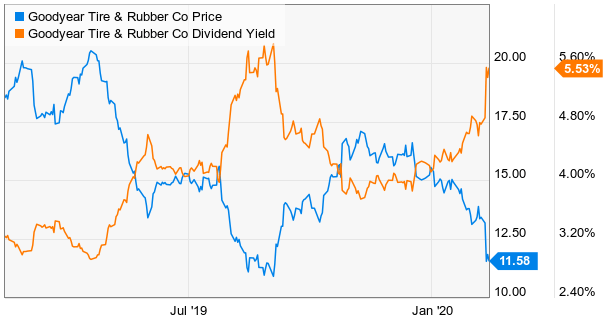

The Goodyear Tire & Rubber Company (NASDAQ:GT) has had a rough year, with shares falling from highs of $20 to $11 (in a market at all-time highs nonetheless). The company faces a tough operating environment, and the pressure on shares has jacked up the dividend's yield to 5.4%. With the yield at such a high level relative to its historical norms, it's fair to question the sustainability of the payout. We will walk through the company's operating metrics to illustrate that the dividend currently remains viable. Additionally, the company (and analysts) expect things to straighten out over the next couple of years. Assuming this happens, the stock is currently discounted to historical norms - making Goodyear a potential value play in a hot market.

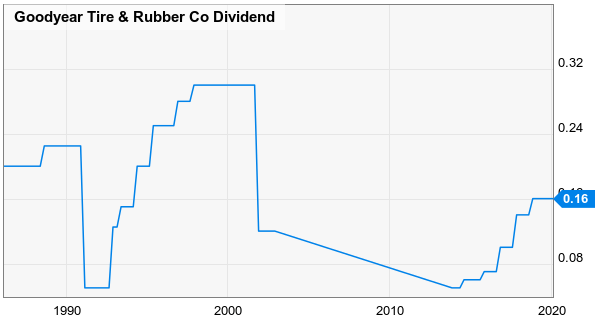

So where does the dividend currently stand? Goodyear has raised its dividend for each of the past six years. The current payout totals $0.64 per share and yields a whopping 5.4% on the current share price. This figure is what will likely attract the attention of investors.

Source: YCharts

Pressure on the stock over the past year has pushed the dividend yield to very elevated levels. As a comparison, 10-year US Treasuries are currently yielding just 1.60% at the moment.

Earlier this week, Goodyear Tire closed out its fiscal 2019 year, posting full-year EPS of $1.08 on an adjusted basis. This represents a sharp drop from 2018 EPS of $2.32. Based on these earnings, the dividend's current payout ratio is still relatively modest at 64%.

And when it comes to having a financial backstop, Goodyear Tire is pretty well covered in this regard as well. The company is currently sitting on $908 million, enough to cover the dividend (which has an annual cost of approximately $154 million) many times over.

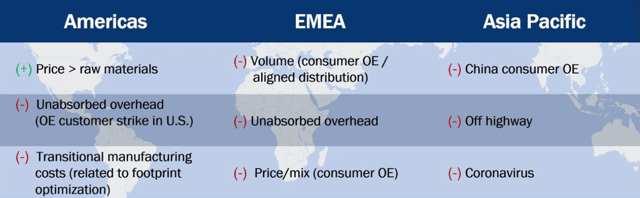

Now while Goodyear's current financial position is strong, the operating environment is indicating that the business could struggle a bit in 2020. Operating results over the next few years will be influenced from some positive and negative factors.

Source: The Goodyear Tire & Rubber Company

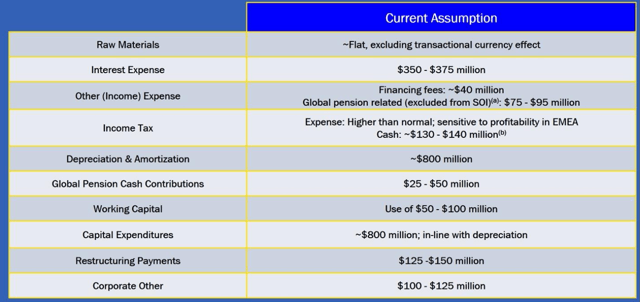

The company is benefiting from lower oil prices. Approximately 44% of COGS (cost of goods sold) is raw material driven, and 68% of those raw material costs are influenced by oil prices. However, the global economy has softened considerably, and this has timed poorly with some restructuring of distribution in Europe. These headwinds are currently anticipated by management to outweigh benefits on raw material costs.

Management is also currently forecasting higher tax expenses in 2020, as well as restructuring costs of between $125 and $150 million. Management's multi-year forecast is more positive. By 2022-2023, Goodyear will be past the restructuring process in Europe which should help volumes recover in that region. In addition, the company will benefit from a reduced financial footprint due to cost cuts.

Source: The Goodyear Tire & Rubber Company

Our bottom line on the dividend is that it appears to be safe from our vantage point. The dividend is covered well enough financially that further erosion of the business in 2020 would be endurable under most scenarios. If needed, Goodyear has ample cash to cover short-term stress to the payout.

It is important to note that Goodyear has cut its dividend at multiple points in the past, but we believe that the current financial position of the company is solid enough to negate most of this risk. Management currently has a positive outlook two-three years out, but a prolonged recessionary environment would certainly change these circumstances.

Source: YCharts

When it comes to determining whether shares are currently attractive, we need to dive into Goodyear's valuation some. The company just closed out its 2019 fiscal year earning $1.08 per share on an adjusted basis. This would apply an earnings multiple of 10.73X to the stock. This is a 23% discount to the stock's 10-year median PE ratio of 13.92X.

This is an attractive discount (provides a margin of safety) as is, but long-term investors could possibly realize further upside. Despite immediate headwinds, analysts are currently projecting Goodyear to earn roughly $2 per share in 2020. This would imply a very modest forward PE of just 5.36X.

If such a low multiple were justified, it would signal that Goodyear is a company on the verge of going bankrupt. However, the company's position as a leading tire manufacturer (a product for which demand will remain stable) and solid financial footing dispute this notion. The company will likely experience poor growth over the next five years as a result of short-term headwinds, but a large starting yield and potential for PE expansion offer enough upside to make Goodyear Tire & Rubber an intriguing value idea for potential investors.

If you enjoyed this article and wish to receive updates on our latest research, click "Follow" next to my name at the top of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.