FTSE 100 CAPE Valuation And Long-Term Forecast

by John KinghamSummary

- Over the last 30 or so years, the FTSE 100's CAPE ratio has averaged 18.4. The current value of 15.6 is obviously below that, so the FTSE 100 is cheap, right?

- Looking at CAPE data for multiple indices globally over many decades, I think a ratio of 16 is, for now, a better estimate of the true long-term average.

- A dividend yield of 4.4% for the FTSE 100 is below the average yield of 3.6%, so on a dividend yield basis the FTSE 100 also looks somewhat cheap.

In this article, I calculate the cyclically adjusted PE ratio (NYSEARCA:CAPE) for the FTSE 100, compare the current value to its historic average and forecast the index's expected value in 2030.

Updating the FTSE 100's CAPE ratio for 2020

Robert Shiller's CAPE ratio is one of the best long-term valuation ratios we have. It's much better than the standard PE ratio because the standard PE ratio compares price to earnings over a single year, and earnings over a single year can be volatile and highly misleading.

To get around that, CAPE uses ten-year average inflation-adjusted earnings, which strips out most of the volatility that comes with annual earnings. The result is a ratio which is much better at comparing current price to future earnings potential, and in the end that's what really matters.

I calculate CAPE using a yearly snapshot of the FTSE 100's earnings, so with 2020 underway it's about time I updated my CAPE calculations. Here's how I do it:

- Go to the FT World Markets at a Glance report (PDF)

- Note the index's price and PE

- Calculate CAPE

Unfortunately, the World Markets report is only available for today and not for historic dates, so you have to download it on the day you want your snapshot.

I downloaded the FT World Markets report on Jan 1st and this is what it said:

- FTSE 100 price = 7542

- FTSE 100 PE = 16.45

From there it's easy to calculate the FTSE 100's earnings for 2019:

FTSE 100 2019 earnings = 7542 / 16.45 = 458.5 index points

The next thing we need is CPI inflation for 2019, which we can get from the Office for National Statistics website.

According to the ONS, CPI inflation in 2019 was 1.7%. Inflation is currently indexed to 100 points in 2015, and with that information we can calculate the FTSE 100's ten-year inflation adjusted earnings:

| Year | Nominal earnings | CPI index | Real earnings |

| 2010 | 486.0 | 90.1 | 581.7 |

| 2011 | 553.9 | 93.5 | 638.7 |

| 2012 | 512.0 | 95.9 | 575.4 |

| 2013 | 489.4 | 98.1 | 537.7 |

| 2014 | 432.8 | 99.6 | 468.5 |

| 2015 | 363.3 | 100.0 | 391.7 |

| 2016 | 211.9 | 101.0 | 226.2 |

| 2017 | 346.2 | 103.6 | 360.1 |

| 2018 | 600.7 | 106.0 | 610.9 |

| 2019 | 458.5 | 107.8 | 458.5 |

Table 1. FTSE 100 inflation adjusted earnings

With these updated inflation-adjusted earnings we can calculate CAPE:

ten-year average inflation adjusted earnings = 485 index pointsFTSE 100 CAPE = 7542 / 485 = 15.6

So the CAPE ratio at the start of the year was 15.6, but this doesn't really tell us very much unless we compare it to CAPE's long-term average.

If CAPE is currently below average, then its probably cheap, although how cheap depends on how far it is below average. If it's above average then it's expensive, again depending on how far above average it is. And if it's close to average then it's close to fair value. That's the theory anyway.

Is the FTSE 100 expensive, cheap or somewhere in between?

Over the last 30 or so years, the FTSE 100's CAPE ratio has averaged 18.4. The current value of 15.6 is obviously below that, so the FTSE 100 is cheap, right?

Not so fast.

The last 30 years includes the dot-com bubble, which was the largest stock market bubble in history. The FTSE 100 CAPE ratio exceeded 30 at the peak of that bubble, and this materially increases the CAPE ratio's long-term average over that period.

Looking at CAPE data for multiple indices globally over many decades, I think a ratio of 16 is, for now, a better estimate of the true long-term average.

Note: I couldn't find the exact report which I used to come to that conclusion several years ago, but it was written by Meb Faber of Cambria Funds, a known CAPE expert, and here's his collection of links covering everything you need to know about the CAPE ratio.

15.6 is only very slightly below that estimated long-term average of 16, so CAPE is telling us that the FTSE 100 is very slightly cheap relative to historic norms.

This is not exactly earth-shattering news and I said basically the same thing at the tail end of 2017 when the FTSE 100 was at 7,400.

However, I still think it's important to let investors know that the FTSE 100 is in no way expensive by any normal measure. Yes, the index's price is at near-record levels, but it's also more or less where it was in 1999, more than 20 years ago.

So while 7,000 was bubble territory 20 years ago, thanks to inflation and real earnings growth it's pretty close to fair value today.

And if you like to use yield as your measuring stick, then on Jan 1st, 2020 the FTSE 100's dividend yield was 4.4%, which is comfortably north of the 30-year average of 3.3%.

As with CAPE though, the average dividend yield may have been affected by the dot-com bubble's sub-2% yield. We can fix that by looking at dividend yield since 2003 (the trough of the dot-com crash), where the average turns out to be 3.6%.

A dividend yield of 4.4% for the FTSE 100 is below the average yield of 3.6%, so on a dividend yield basis the FTSE 100 also looks somewhat cheap.

In summary then, both CAPE and dividend yield suggests the FTSE 100 at 7,500 is probably below fair value, although not by a huge amount.

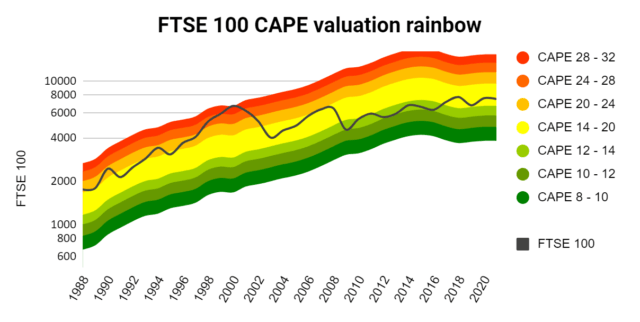

FTSE 100 CAPE valuation rainbow

I should probably explain the rainbow chart from the top of this article. Here it is again:

The range of likely CAPE values from expensive (red) to cheap (green)

The chart is an attempt to show a range of reasonable values that CAPE could have had at any point in the past. It works like this:

The long-term average CAPE is 16 if you ignore the dot-com bubble, and history suggests that CAPE spends almost all of its time within a range from about half to double that average. In other words, a range from 8 to 32.

The chart shows the range of FTSE 100 values that CAPE range would have produced, with red showing where the FTSE 100 would be if CAPE was 32 (i.e. very expensive) and green showing where the FTSE 100 would have been if CAPE was 8 (i.e. very cheap). The FTSE 100's actual value is overlaid in black.

I find this a useful visualisation tool.

For example, in 1999 when CAPE was above 30, almost all the reasonable CAPE values lay below 30, so it was very likely (although not inevitable) that CAPE would fall and that the FTSE 100 would fall with it. And that's exactly what happened.

In contrast, at the start of 2009 most of the likely range of values lay above the FTSE 100's actual CAPE value at the time of 12, so the likely (but not guaranteed) direction of travel for CAPE and the FTSE 100 was upward. And again, that's exactly what happened.

Today the FTSE 100 sits in the middle of that reasonable range, so the odds are about 50/50 that CAPE will increase or decrease in the years ahead (or it might even stay close to fair value).

So that's where we are today, but what about the future?

10-Year FTSE 100 forecast

Stock market forecasts are of course a bad idea because they almost never come true.

Even so, I still think a sensible forecast can tell us something about the outcome we should expect, even if the actual outcome is unknowable.

For this forecast I'll make three reasonable assumptions:

- Over the next ten years inflation stays close to the post-2000 average of 2%

- Over the next ten years real average earnings growth (where "real" means growth above inflation) stays close to its post-2000 average of 2.4%

- Dividends grow at the same rate as average earnings

- Ten years from now in 2030 the FTSE 100's CAPE ratio will be at its long-term average of 16

Under those assumptions, by 2030 we'll have:

- CPI inflation index at 131.6

- FTSE 100 cyclically adjusted earnings of 743

- FTSE 100 dividends of 505 index points

- FTSE 100 price of 11,884

- FTSE 100 dividend yield of 4.2%

So under a reasonable set of assumptions, I think we can reasonably expect to see the FTSE 100 reach about 12,000 by the end of this decade.

And the annualised return from this scenario, including capital gains and dividend income, would be 9.4% per year.

That's slightly above the long-term average, partly because of a small tailwind from CAPE's upward mean reversion to 16, but mostly because of the index's above average dividend yield.

One problem with this forecast is that it gives very precise figures, whereas in reality we have no way of knowing what level the FTSE 100 will be at next week, let alone in 2030.

In reality, CAPE could be anywhere within a reasonable range of values from about 8 to 32. The extreme ends of that range suggests we could see:

- The FTSE 100 fall as low as 5,950 in 2030 (this would be a depression valuation)

- The FTSE 100 climb as high as 23,800 in 2030 (this would be a bubble valuation)

Both these outcomes are extremely unlikely, but not impossible, and which one is better depends on your point of view.

Retirees about to buy an annuity will want the bubble valuation to maximise their selling price, while new investors just starting out will want the depression valuation to minimise their purchase price.

Personally, I don't like extremes so I'll be hoping for something in the middle, and 12,000 in 2030 has a nice ring to it.

And in case you're interested, here's my FTSE 250 valuation and forecast.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.