J. C. Penney Needs To Do Significantly Better Than Department Store Peers

by Elephant AnalyticsSummary

- J. C. Penney's Analyst Day is scheduled for April 7 and it is expected to provide a three-year financial outlook then.

- This outlook is constrained by the need to reach certain targets by 2022 in order to avoid restructuring, and thus may need to be taken with a grain of salt.

- Macy's three-year outlook calls for close to flat comps and earnings.

- J. C. Penney will need to do significantly better than that.

- Reaching near $1 billion EBITDA would reduce its debt to 4.1x EBITDA, which is the overall multiple that Macy's is currently trading at.

J. C. Penney (JCP) has scheduled its Analyst Day for April 7, where it is expected to provide a three-year financial outlook, while also providing more details about its turnaround initiatives. J. C. Penney's last three-year outlook (from 2016) proved to be wildly optimistic. This time it is likely to be less exuberant, but is faced with the challenge of needing to show certain targets, as merely holding earnings around flat (as Macy's is targeting for 2022) would be a straight path to bankruptcy for J. C. Penney.

Thus I will likely take J. C. Penney's targets with a grain of salt, and it will need to prove itself quickly via actual results. I am continuing to avoid J. C. Penney's common stock. Its stock will probably increase quite a bit if it does show good results, but J. C. Penney would need to deliver $1+ billion EBITDA to trade for a similar multiple as Macy's, which would be close to double its expected 2019 results.

The 2016 Analyst Day Outlook

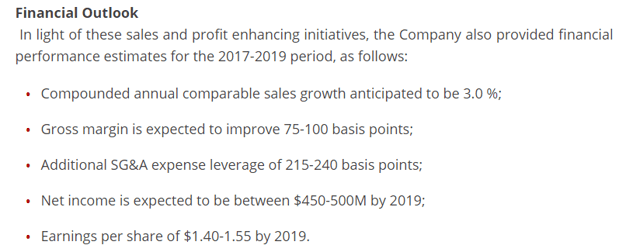

J. C. Penney's last three-year plan (presented in August 2016 under different management) could hardly have gone more off track. At that time, J. C. Penney estimated that it could grow comparable-store sales by +3% per year from 2017 to 2019, improve its gross margin by 75 to 100 basis points and reach EPS of $1.40 to $1.55 by 2019.

Source: J. C. Penney

Instead, 2019 results seem to have ended up at almost the reverse. J. C. Penney's 2019 guidance implies roughly -3.5% per year comps from 2017 to 2019. While its gross margins have improved in 2019, it is still expected to be down 120 basis points since 2016, and it may report a net loss of $0.75 to $1.00 per share for the full year.

Macy's Expectations

Macy's released its own three-year financial outlook recently, and this shows the magnitude of the challenge facing J. C. Penney.

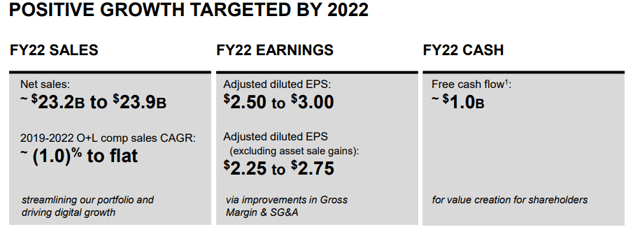

Macy's is basically attempting to hold earnings flat in 2022 compared to its current expectation for $2.35 to $2.40 EPS in 2019 (excluding asset sale gains). Sales (both comparable-store sales and net sales) are expected to fall slightly, while it attempts to improve its margins and cut costs.

Source: Macy's

Macy's expects to continue to spend around $1 billion per year in capex (over 4% of net sales) in order to help keep its comps close to flat. J. C. Penney likely can only budget around 3% of net sales for capex and will likely need to deliver sustained low-single digits positive comps over multiple years.

In terms of valuation, Macy's is trading at around 4.1x its 2022 EBITDA if it hits its 2022 targets. If J. C. Penney reached $1 billion EBITDA by 2022, a 4.1x multiple might not value its shares much above $1 (although that would also depend on debt reduction in the intervening years).

Notes On Compliance

J. C. Penney noted that it was no longer in compliance with the NYSE continued listing criteria, as its closing share price averaged less than $1.00 over the previous 30 consecutive trading-day period.

J. C. Penney has six months to regain compliance, and in the interim period it has its Q4 2019 and Q1 2020 earnings reports, and Analyst Day on April 7, 2020. Any of those items could serve as a catalyst to get its stock over $1.00 if there is good news involved, while a reverse-split could be implemented if that doesn't occur. In this case, a required reverse-split would be a negative because it would signify that J. C. Penney has not delivered decent results (by Q1 2020) and its outlook (from guidance and Analyst Day) either is uninspiring or considered unrealistic.

Conclusion

J. C. Penney will provide a three-year financial outlook in April. The last time it did this (albeit under different management), it missed by a tremendous amount. The challenge facing J. C. Penney is that it will need to grow sales and improve earnings while spending less on capex (as a percentage of net sales) than Macy's, which is attempting to hold sales and earnings close to flat. J. C. Penney is probably less optimized than Macy's currently, so it does have that advantage. However, due to its large debt burden, even if it does manage to significantly improve its results, its stock would theoretically have limited intrinsic value based on department store multiples. Macy's is trading at around 4.1x EBITDA, while J. C. Penney will need to increase its EBITDA to close to $1 billion before its debt will go down to 4.1x EBITDA or below.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.