Sentiment Stays Afloat

by Bespoke Investment GroupSummary

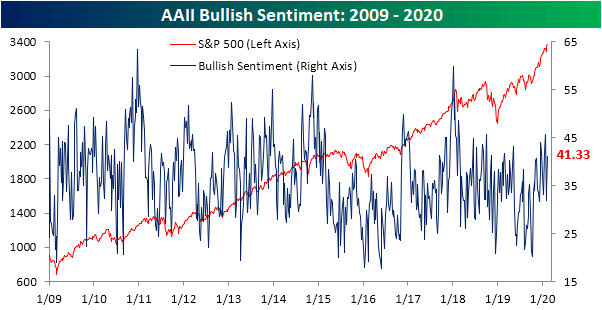

- The percentage of respondents reporting as bullish has risen to 41.33% from 33.87% last week.

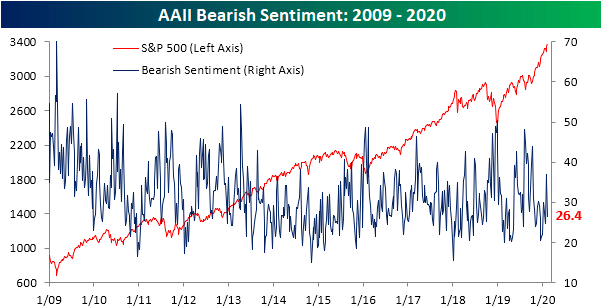

- Bearish sentiment fell 8.82 percentage points to 26.4%.

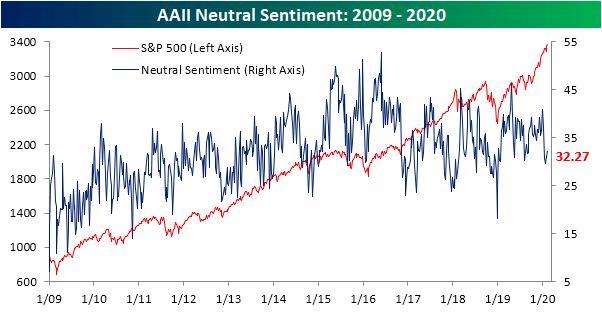

- Neutral sentiment also ticked higher this week, rising to 32.27% from 30.91% last week.

Overnight news that showed the number of confirmed coronavirus cases has spiked sent a negative tone rolling through markets today, but generally speaking, sentiment surrounding the issue has improved, which has been reflected in higher prices for risk assets. Given this, the percentage of respondents in AAII's weekly survey that have reported as bullish has risen to 41.33% from 33.87% last week. That 7.46 percentage point jump in bullish sentiment may sound like a lot, but just one month ago, bullish sentiment rose an even larger 8.76 percentage points to a similar reading of 41.83%. Though it has improved, bullish sentiment is not overly extended, as it is still within its normal historical range, albeit near the upper end of said range.

The rise in optimism came as bearish sentiment fell 8.82 percentage points to 26.4%. That was the largest decline in bearish sentiment since October, when it fell 12.91 percentage points in one week. It comes as a reversal from the massive 12.09 percentage point spike in bearish sentiment only a couple of weeks ago, which was the largest weekly increase in bearish sentiment since August.

While bearish sentiment is down, not all investors have immediately jumped aboard the bullish ship. The percentage of respondents considering themselves neutral also ticked higher this week, rising to 32.27% from 30.91% last week. In spite of that increase in neutral sentiment, this week's reading still stands in the 18th percentile of the past year's readings. With neutral sentiment and bearish sentiment as low as they are, the general tone of sentiment continues to have a positive bias, as investors have brushed off coronavirus concerns.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.