Kinross Gold: Q4 Performance Puts The Company Back On Track

by Vladimir ZernovSummary

- Kinross Gold reports Q4 2019 results.

- Higher gold price helps and the company delivers significant operating cash flow.

- Production guidance for the next year is slightly down from 2019 numbers, but Kinross is positioned for good cash flow generation if gold stays near current levels.

Kinross Gold (KGC) has recently reported its fourth-quarter results, beating analyst estimates on both earnings and revenue. The company reported revenue of $996.2 million and adjusted earnings of $0.13 per share, a material improvement from third-quarter results which included revenue of $877.1 million and earnings of $0.05 per share. Kinross Gold produced 645,344 gold equivalent ounces (GEO) at all-in sustaining costs (AISC) of $1050 per ounce. The high gold price boosted the company’s operating cash flow which came at $408.6 million. As a result, Kinross’ yearly operating cash flow of $1.22 billion exceeded capex of $1.1 billion.

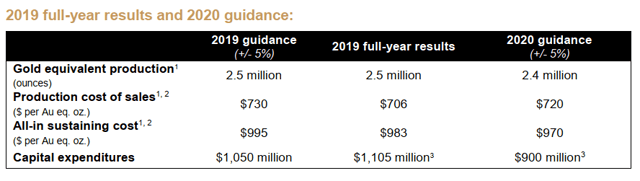

Source: Kinross Gold Q4 report

In 2020, Kinross Gold expects to produce 2.4 million GEO at AISC of $970/oz, down from 2.5 million GEO at AISC of $983/oz in 2019. Importantly, capital spending in 2020 and 2021 is expected to decline, which bodes well for the company’s future financial performance in the light of higher gold prices.

At this point, Kinross’ main projects for the future include Chulbatkan in Russia, Tasiast expansion in Mauritania and re-start of La Coipa project in Peru. The Chulbatkan deal was announced back in July 2019. Kinross agreed to pay $283 million ($113 million in cash and $170 million in Kinross shares at the time of the announcement). The company targets exploration activities up to 2023, followed by a two-year construction period. Preliminary estimates indicate a mine life of six years, total production of 1.8 million ounces, AISC of $550/oz and initial capex of $500 million. The target of the company’s other Russian mine, Kupol, is to extend its mine life through exploration until Chulbatkan is ready to deliver production. In 2019, 400,000 GEO were added at Kupol through exploration activities, extending the mine life to 2024. Kupol has a great story of reserve additions so it looks like Kinross’ plan in Russia will work well.

At Tasiast, Kinross has secured a $300-million financing agreement. This is a working mine where Kinross targets to increase throughput from a record 17,300 t/d to 21,000 t/d by end of 2021 and 24,000 t/d by mid-2023. La Coipa targets to produce 690,000 GEO from 2022 to 2024 at AISC of $670 per ounce. In short, no major changes to production are expected in the coming few years.

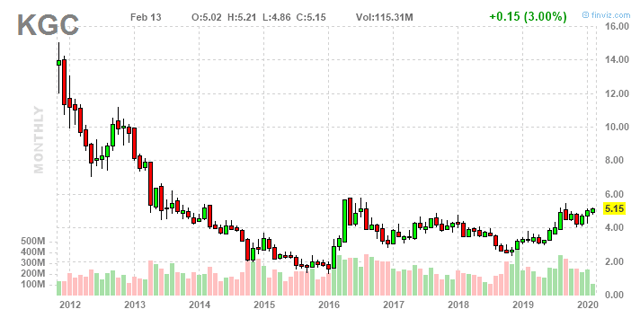

However, being a stable ~2.5 million ounces producer with AISC below $1000 per ounce is a strong point in itself. Kinross shares have so far struggled to reach 2016 highs. I believe that the primary reason for this is the decline in investor interest towards the gold mining segment, which was caused by multi-year underperformance of the gold equities. This decline is very visible on the chart above – trading volume has been declining from 2016 to 2018 and is yet to pick up despite that gold looks ready to breach $1600 per ounce.

In fundamental terms, Kinross performed much better as a business compared to 2016. The company had earnings of $0.57 per share in 2019 compared to a loss of $0.08 per share in 2016. Operating cash flow increased from $1.1 billion in 2016 to $1.2 billion in 2019 and is set to increase further thanks to higher gold prices. In short, Kinross Gold shares look ready to continue their current upside assuming gold prices stay above $1550 per ounce (I’m bullish on gold). As usual, I’ll point to the company’s bloated share count (1.25 billion at the end of 2019) that prevents its stock from making stronger moves as each cent of additional earnings per share requires significant cash flow generation. For any strong move, Kinross shares will need a material improvement in the price of gold. At the same time, the stock remains a safe way to play the gold price momentum.

If you like my work, don't forget to click on the big orange "Follow" button at the top of the screen and hit the "Like" button at the bottom of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: i may trade any of the above-mentioned stocks.