Misguided Attempts To Improve The Housing Situation

by NZ Property Investors FederationToday there have been calls to rehash the capital gains tax argument and restrict the ability for rental property owners to borrow funds. These are misguided calls.

The aim of this new proposal is to reduce house prices in order to help people about to buy their first home. But what about the unintended consequences?

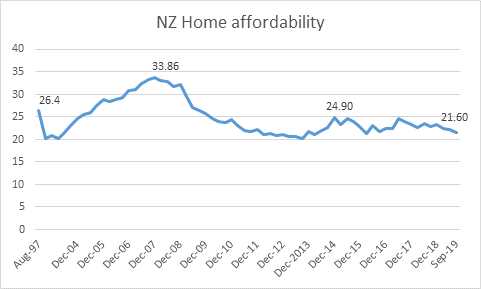

Massey University’s Home Affordability Study shows that housing is more affordable now than during most of the previous 25 years.

It has always been, and probably always will be, difficult to own your first home.

Today’s proposal would be particularly hard on those who have purchased their first home over the last few years. If house prices fall these young people could easily see their equity disappear and banks call in their loans.

In addition, we shouldn’t try to make it easier for today’s first home buyer by making the rental crisis worse.

Over the last ten years we have seen many changes that have made providing rental property more difficult. This includes removing depreciation deductions, increasing LVR requirements, ringfencing rental losses and making it harder to manage tenancies.

The result of these measures has been to raise rental prices and make it harder for first home buyers to save a deposit. They have not slowed down house price growth let alone reverse it.

The new proposal will not improve this situation and therefore should not be supported.