PBF Energy: A Mexican Billionaire Can't Get Enough Of This New Jersey Refiner

by Edward Vranic, CFASummary

- Billionaire Carlos Slim's fund has indiscriminately bought up over 8 million shares in PBF since May to increase its stake to 17.6%.

- Slim's involvement in PBF is not immediately clear, though it may be a bet on the company's ability to refine low sulphur fuel amid favorable regulations.

- Given Slim's history as an activist investor, this situation will likely end well for patient shareholders and provide short term profit opportunities for flippers.

PBF Energy Inc (PBF) is a petroleum refiner out of New Jersey that has caught the attention of Mexico's richest man and most prolific investor. Inversora Carso, S.A. de C.V., which is owned by the family trust of billionaire Carlos Slim, has targeted PBF as its sole focus of investment for U.S. listed stocks over the last year. The financial media picked up on the purchases several months ago, but neither the fund nor the company have disclosed a reason for it.

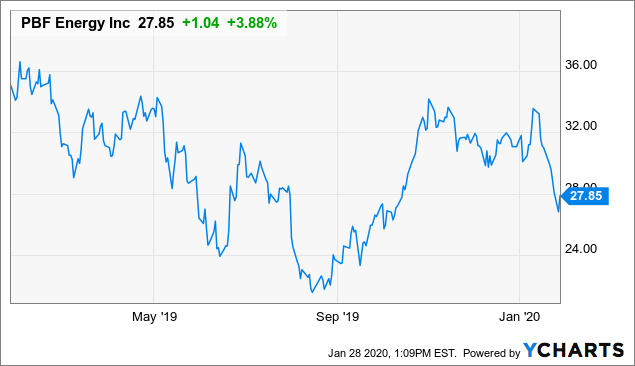

Shareholders and potential investors need to monitor the situation closely as the buying has come in waves and is price agnostic. Purchases have been as low as $21.38 in August and as high as $32.68 in November. This type of unbridled, aggressive buying by Slim may have a larger goal in mind as he has a history of being an activist shareholder and successful business builder, though not all of his attempts go smoothly. PBF shareholders who are patient enough to see it through will likely be rewarded by the efforts of a man who is not afraid to get his hands dirty in order to turn a profit.

Data by YCharts

Over 8 million shares have been purchased since May

A summary of Inversora Carso's Form 4 filings can be seen here. The latest purchases as of January 24 have increased the fund's stake in PBF to 21,132,430 shares, approximately 17.6% of total shares outstanding. The buying spree started on May 23, 2019 when the fund purchased 1,609,796 shares in the span of two days. Since May 24, an additional 6,745,249 shares have been purchased. Interestingly, several other insiders sold shares on May 23 while Inversora Carso was buying. There was more insider selling at the end of October above $32. That includes 28,133 shares sold by CEO Tom Nimbley, 18,469 shares sold by President Matt Lucey and 17,855 shares sold by CFO Erik Young. All three were awarded stock options at a $32.71 strike price at the same time so these sells appear to be driven more by cash bonuses than a willful reduction in their holdings.

Investors and analysts generally have a positive view on PBF compared to peers such as HollyFrontier Corporation (HFC) and Delek US Holdings, Inc. (DK). PBF is better positioned to operate under new environmental regulations as it is able to produce low sulphur fuel. The International Maritime Organization, the regulatory authority for international shipping, introduced a cap on sulphur content in marine fuels that came into effect on January 1. The new regulation mandates a maximum sulphur content of 0.5% in marine fuels globally in an attempt to reduce the air pollution created by the shipping industry. Perhaps Slim is betting on PBF's margins rising as the demand for low sulphur fuel increases but PBF's stock price remained choppy throughout 2019, seemingly not impacted by hype over the imminent favorable change to regulator standards.

PBF owns five refineries located in Delaware City, Delaware, Paulsboro, New Jersey, Toledo, Ohio, New Orleans, Louisiana and Torrance, California. So there is no location that immediately stands out as a refinery that Slim would be interested in for leveraging his Mexican oil and gas operations or for any other infrastructure project in the country. While his involvement remains a mystery, investors can surmise that he is not buying up PBF shares to lose money. Nor does it look like he is suddenly going to stop his purchases.

Shareholders and swing traders have two options to try to profit on Slim's interest in PBF. Longer-term shareholders may choose to sit back and collect the 4% dividend while watching this story play out. More active traders can view Slim's purchases above $32 as a sign that he expects the stock price to be above $32 at some point in time. Anything below $32 can be considered a point where he is likely to purchase more shares. So a buy in the $27's may provide an opportunity to flip shares above $30 if he purchases more shares and puts upward pressure on the stock. Particularly if there is increased hype around PBF's Q4 results and 2020 guidance or Q1 2020 financials amid speculation on the favorable IMO 2020 regulations.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I will be monitoring the situation closely for potential long positions.