Enphase: Promising Growth Vision

by Simple Investment IdeasSummary

- Enphase is widening its addressable market by integrating technologies like storage and energy monitoring.

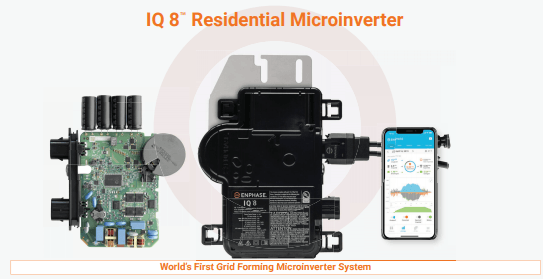

- Enphase's IQ 8 microinverter will be a building block for the company's larger energy product ecosystem.

- Despite Enphase's growing dominance in the MLPE industry, the company is set to face growing competition.

Enphase (ENPH) has become one of the most interesting solar stories in recent memory. The company has transformed from a pioneer in the relatively niche MLPE (module-level power electronics) industry to a major solar powerhouse. Despite the fact that Enphase does not even focus on manufacturing solar panels, the company has managed to become one of the most valuable solar companies in the industry.

Enphase grew its annual revenue and operating income to $619 million and $122 million respectively. The revenue figure represents an impressive 96% Y/Y increase and the operating income figure represents an even more impressive 495% Y/Y increase. Clearly, Enphase still has an enormous amount of momentum even as competition in the MLPE space heats up.

Enphase has helped transform the inverter industry with its microinverter product. The microinverter, which allows the optimization of single solar panels, has allowed Enphase to gain a strong foothold in promising solar markets like residential. Whereas traditional string inverters limit the capabilities of solar systems to their weakest performing panels, microinverters do not have such problems. Enphase has used its increasingly popular microinverter product as a springboard to enter even larger and potentially more promising markets.

Moving Beyond Microinverters

Microinverters will likely always be a core part of Enphase's business model. The success of Enphase's microinverters is now allowing the company to expand its business to other promising energy sectors. While the inverter market still offers incredible growth opportunities, Enphase has the chance to significantly grow its serviceable available market by capitalizing on other emerging markets like storage.

Enphase's new IQ 8 microinverter will be a building block for the company's larger energy ecosystem.

Source: Enphase

Enphase gave investors an overview of its long-term vision at the most recent Analyst Day. By Enphase's own estimation, the company can increase its serviceable addressable market from $3.3 billion in 2019 to $12.5 billion in 2022 by expanding to markets like storage and off-grid solar. Enphase is uniquely well positioned to penetrate these markets given the company's growing technological expertise in innovative grid-related technologies.

The serviceable addressable market of residential solar, residential storage, small commercial storage, and off-grid solar/storage stands at approximately $4 billion, $3 billion, $1.5 billion, and $4 billion respectively. Enphase already has industry-leading technology that it could help leverage in all of these emerging industries, from its new generation microinverters to its Encharge energy storage technology.

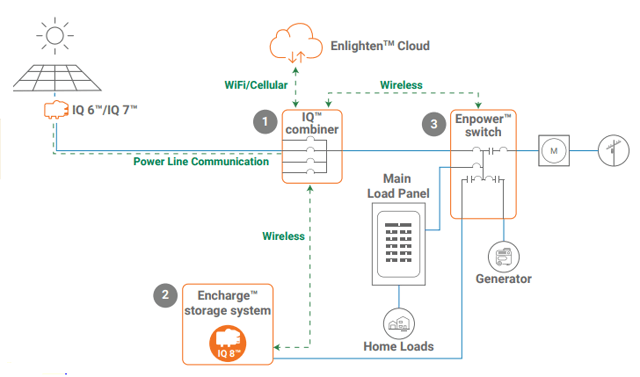

Enphase's Ensemble epitomizes the company's ambitions to move beyond purely microinverters. Ensemble, which includes the IQ 8 microinverter, the Enpower switch, the Encharge battery, and the Enlighten monitoring tool, is one of the industry's first grid-agnostic technologies. Given how large the off-grid market is especially in developing countries like India, Enphase has a real opportunity to be one of the first movers in this growing market.

The Ensemble integrates many of Enphase's products to form a comprehensive energy management solution.

Source: Enphase

The energy storage market is especially promising given how rapidly energy storage technology is advancing. The rise of electric vehicles, in particular, has massively accelerated the development of lithium-ion battery technology. The rapid innovations taking place in lithium-ion battery technology will be incredibly beneficial to Enphase given that its Encharge battery is lithium-ion based. The cheaper lithium-ion battery technology becomes, the greater the addressable market will be for Enphase given how vital storage is for solar.

By integrating many different components of solar, energy storage, and energy management, Enphase is becoming a one-stop shop for customers. This should give Enphase a competitive edge over traditional inverter companies in the long-term. As MLPE's like microinverters and power optimizers continue to gain steam, Enphase will likely take more and more market share.

Challenges Still Remain

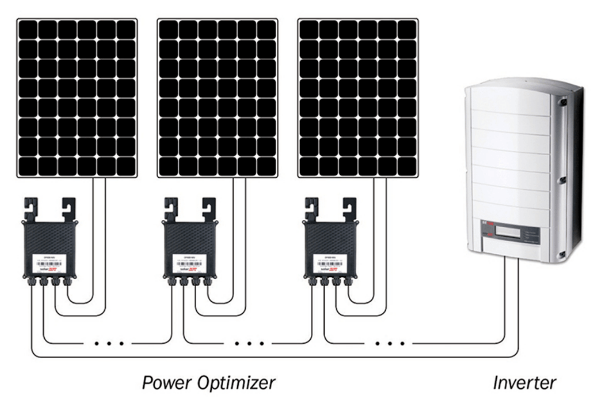

SolarEdge still remains Enphase's largest threat in the increasingly competitive environment. SolarEdge's power optimizer also has the ability to optimize solar panel output by managing individual panels. One major advantage of power optimizers is that they are more scalable than microinverters. Microinverters have their own advantages as well, such is not requiring a central inverter. This means that microinverters could prove cheaper in smaller-scale projects. Given how young the MLPE industry is, it is so far from certain which technologies will dominate the solar space.

Power optimizers have advantages similar to those offered by microinverters. Most noticeably, power optimizers have the ability to monitor individual panels as opposed to the entire system.

Source: SolarEdge

It is very likely that both Enphase and SolarEdge have long-term staying power in the industry. Enphase and SolarEdge currently control approximately 80% of the US residential PV inverter market. With SolarEdge experiencing similar momentum as Enphase, SolarEdge will likely be a huge threat to Enphase for the foreseeable future. What's more, SolarEdge is also moving into new markets that Enphase is also trying to penetrate. For instance, SolarEdge is investing in lithium-ion batteries in order to build a energy ecosystem similar to that of Enphase.

Enphase and SolarEdge (SEDG) have transformed the solar inverter market by introducing highly innovative MLPE products. In fact, these companies are now some of the most valuable companies in the entire solar industry at market valuations of $3.7 billion and $4.7 billion respectively. These companies' success are unsurprisingly drawing in serious competition. Generac's (GNRC) reported interest in the inverter market is the latest example of growing interest in the industry.

Conclusion

Enphase is making innovative moves in the energy sector. As a pioneer in the growing MLPE industry and a first mover in grid-agnostic technologies, Enphase has a huge opportunity in front of it. Investors should definitely look into Enphase at its current market capitalization of $3.7 billion and forward P/E ratio of 37. Given Enphase's strong top-line growth and leadership position in multiple promising solar sectors, Enphase is a highly attractive investment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.