Luckin Coffee Should Perk Up Your Portfolio

by Jeff Vande HeySummary

- Luckin is growing at a breakneck pace.

- Profitability is on the horizon.

- The business and growth plan seem solid.

- The recent price drop provides a good entry point.

As an investor, I have been intrigued by Luckin Coffee (NASDAQ:LK) for about a month now, and I have had it on my official watch list for exactly two weeks. However, with a stock price of $50.02 on January 17, I couldn't justify jumping in. At that time, I crunched the numbers and decided that I would give it a legitimate look if the stock pulled back to $42 or lower. Fast forward to today and, at least in part because of coronavirus, the stock opened at $37.12 and, in my estimation, is ripe for the picking. In the balance of this article, I will explain why at the current stock price, I feel the upside outweighs the risks.

Luckin Coffee kiosk. Source: Luckin

For those who need a quick primer, Luckin Coffee is a relative upstart in the Chinese coffee industry. The company's rise has been dramatic and quick. Just three years ago, this company did not even exist and now it is considered a legitimate competitor with Starbucks (NASDAQ:SBUX) to become the top player in the Chinese coffee scene. And, while Luckin is a Starbucks competitor, it operates in a much different fashion. While Starbucks bills itself as "third place" or home away from home, Luckin generally conducts business in a "grab and go" fashion through its kiosks and smart vending machines.

Unprecedented Growth

Seriously, I don't know if I have ever seen a retail company grow this fast. As mentioned above, Luckin did not have one store just three years ago and first debuted on the public markets on May 17th, 2019. Now, by most accounts, Luckin is the largest coffee chain by number of stores in China. At year-end, the company reported having 4,507 self-operated retail stores.

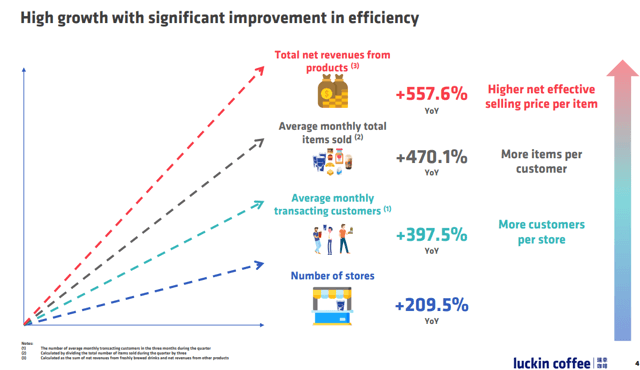

Now, if Luckin was opening stores at a breakneck pace, but those new store openings were not translating into equal or better revenue and profit growth, we might have a problem. It looks like that is a problem we don't have to worry about. The graphic below shows store count growing 209% year over year. With that came an almost 400% increase in customers per store and a whopping 557% increase in revenue. All of those metrics seem to be going in the right direction.

Luckin Coffee Growth Metrics. Source: Q3 Earnings Release

Of course, revenue growth is one thing, but eventually that revenue has to transfer to the bottom line. That metric also seems to be trending in the right direction as store-level operating profit in the quarter was RMB186.3 million (US$26.1 million), or 12.5% of net revenues from products, compared to a loss of RMB126.0 million in the third quarter of 2018.

More Than Coffee

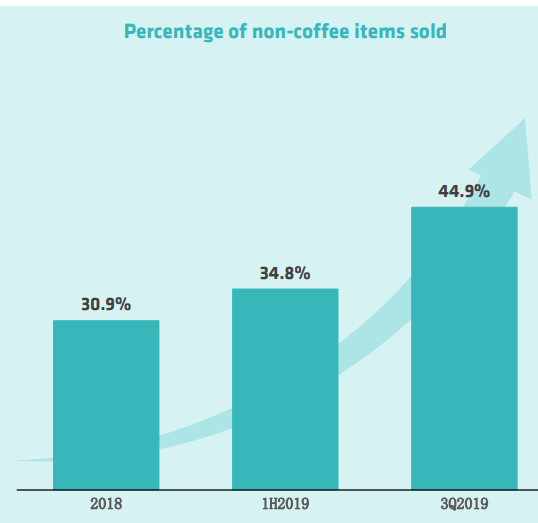

Some might say that if Luckin can step in and grow at a breakneck pace, why couldn't another coffee come in and do the same, thereby stealing some of Luckin's thunder. That is a fair conversation. My response would be that in addition to being a first-mover as a quick-serve coffee chain, Luckin has also expanded and differentiated its product offerings significantly since it came onto the scene. Almost half of Luckin's sales come from non-coffee items and it is determined to become China's largest freshly made tea player.

Luckin-Non Coffee Sales Source: Q3 Presentation

Efficiency

Luckin is still losing money. While that may be a critique, expansion and physical store growth for a new company does not come cheap. At the same time, the company is doing everything in its power to rein in expenses and is expected to turn the corner to profitability in two years. As noted above, Luckin already boasts a store level operation profit of 12.5%. The company's investments in technology and artificial intelligence and commitment to a 100% cashier-less experience should all help profit margins going forward.

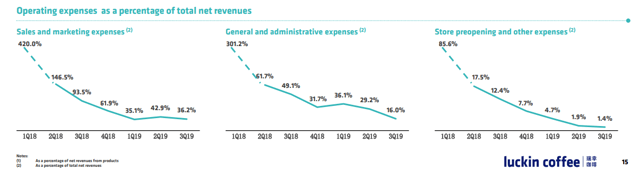

And improved efficiency is not just speculation. One cup of coffee currently costs the company $1.34 in expenses whereas a year ago, that same cup was costing almost double that amount. The percentage of delivery orders, which are more costly to the company, is less than a quarter of what it was just one year ago. Finally, as shown below, Luckin's expenses as a percentage of net revenues continue to trend downward in all areas.

Luckin Expenses. Source: Luckin Q3 Presentation

Valuation

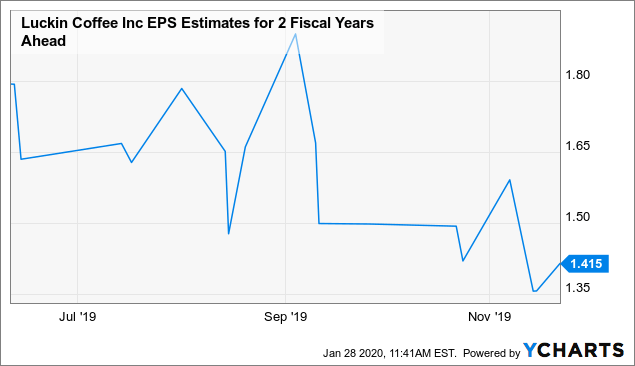

As an investor, I need to have a specific entry point where I am comfortable and that entry point has to be based on earning projections I believe in. We have already mentioned that Luckin is not yet profitable, which is understandable as it invests large amounts of capital in growth and expansion. However, YCharts projects Luckin to have $1.42 in earnings two years from now, which, with a $42 price tag (I actually got in much cheaper), would give it a PE of 29.68. That is not far away from Starbucks' forward PE of 25.86 and seems very reasonable for a company on the growth trajectory of Luckin.

Data by YCharts

EPS Estimates Two Years Ahead: Data by YCharts

Caution Flags

Let's start with the fact that Luckin is in China. Investing in China sometimes has inherent risks of its own. I won't factor the trade war in here for a couple of reasons. However, I will note that it is not unusual for investors to question whether a Chinese upstart's numbers are real and voice worries that the Chinese government could affect the company's operations going forward as we have seen with MOMO (MOMO) and Baidu (BIDU).

The skepticism whether numbers are real was more prevalent 5-10 years ago in China. Further, I think the fact that retail is very visible as well as the fact that Ernst & Young serves as an auditor for Luckin gives me comfort in those areas. As far as government interference, I would be more worried in sectors where the government has a vested interest like telecoms or where censorship is more likely. Coffee and tea should not be high on the government's radar.

There is also concern over the coronavirus and each investor will have to make his or her own decision on the level of risk there.

Finally, there is some concern as to whether a consumer beverage company has any moat or if anyone could step in tomorrow and compete. I personally believe being a first mover in the "fast-moving consumer brands" area gives them built-in advantages for a while. Specifically, Luckin has brand awareness, economies of scale, and corporate relationships that give it a built-in advantage.

Final Word

Obviously, I am a believer. I believe Luckin has a niche that is different than Starbucks and business momentum that will continue for the foreseeable future. While the sample size is small, it has exceeded expectations in recent quarters, and I believe that trend will continue.

I personally got in yesterday at a price of $37.78 and through options with a cost basis of $26.44. In my opinion, Luckin's stock is a buy under $42, and if you are on the fence and need a little more cushion, entering through a cash-secured put can give you just that.

Disclosure: I am/we are long LK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.