Coronavirus In Context

by Brendan AhernSummary

- Experts are projecting that the current outbreak may get worse before it gets better.

- However, the mortality rate is below that of SARS with the elderly and people with pre-existing conditions being more susceptible.

- Despite the tragic human toll, it seems that a prolonged economic effect at a macro level is unlikely.

Summary

- The regular closure of Mainland markets for the Lunar New Year has been extended to February 3, 2020.

- The MSCI China All Shares Index, which tracks stocks listed in Hong Kong, the US, and the Mainland, has fallen by -5.22% since Monday last week.1

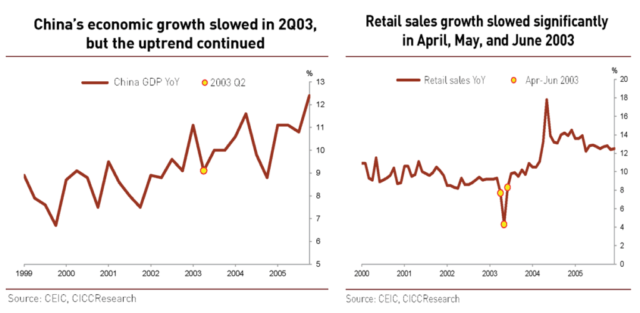

- To put the coronavirus outbreak in context, the SARS outbreak in 2003 caused some slowing of GDP growth (1Q: 11.1% vs. 4Q:10%), but sales growth rebounded within the year and foreign trade and fixed asset investment remained largely unchanged. The overall effect on the economy was minor and short-lived.

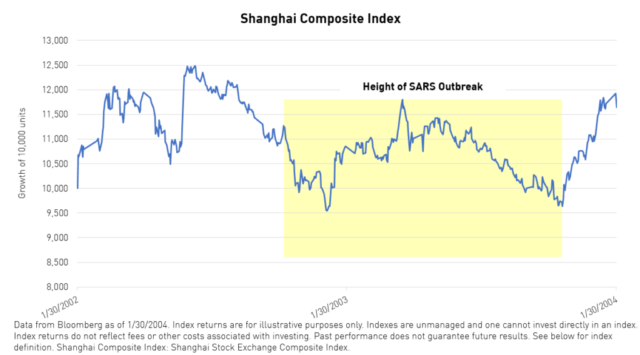

- From November 2002 to June 2003, when the SARS outbreak was at its most severe, the Shanghai Composite declined 13% but rebounded shortly thereafter, ending 2003 up by 11.58% for the year.

- Tourism (airlines, hotels, restaurants) and transportation stocks took the brunt of the financial impact in 2003. The current outbreak has had an outsized impact on travel stocks in China such as Trip.com (NASDAQ:TCOM)

Experts are projecting that the current outbreak may get worse before it gets better. However, the mortality rate is below that of SARS with the elderly and people with pre-existing conditions being more susceptible. Despite the tragic human toll, it seems that a prolonged economic effect at a macro level is unlikely.

Coronavirus vs. SARS

It is believed that the source of the virus was a wildlife market in Wuhan. Wildlife trading is an ancient industry in China in which wild animals are bought and sold for use in local delicacies and traditional medicine, but a blanket ban on the trade has been enacted and is currently being enforced. Residents are being advised to stay home for the time being. 450 military doctors are being dispatched to Wuhan while a new 1,000-bed hospital and possibly others are being built, all in order to contain the over 8,000 confirmed cases of coronavirus. Regular Lunar New Year holiday market closures are being extended until February 3, 2020.1

The virus has had an outsized impact on the brick-and-mortar retail and travel sectors in China but is hitting global markets indiscriminately. Markets were negatively impacted last week in both Europe and the US. Gold rose on the uncertainty, while oil has slumped on the potential for a decrease in demand.

The SARS outbreak of 2003 is an apt reference point for the current outbreak. SARS, which stands for Severe Acute Respiratory Syndrome, broke out in Hong Kong and Guangdong Province in Southern China in November, 2002 and resulted in 774 deaths in 17 different countries.2 Noting the similarities and differences between SARS and Coronavirus serves to contextualize the current outbreak. In 2003, China's GDP growth declined somewhat during the year (1Q: 11.1% vs. 4Q:10%). Nonetheless, foreign trade, fixed asset investment, interest rate policy, and the overall macro policy stance were largely unchanged throughout the year. Retail sales slipped significantly but rebounded fully within the year. Furthermore, SARS had more of an effect on Hong Kong's economy than it did on the Mainland. All told, the effect on the economy was largely balanced out by the end of the year.3

Much has changed in the time since the SARS outbreak. Technology has progressed, making it easier for people to stay home and share information. Social media was virtually nonexistent in 2003. Its proliferation is of great benefit to those impacted by the virus because people are more informed about the situation. However, social media can also exacerbate hysteria. Perhaps the most meaningful difference between the two outbreaks is that this time the government launched an immediate, decisive, and all-encompassing response. Premier Li Keqiang has visited Wuhan in solidarity with its people. In 2003, on the other hand, the Chinese government was criticized for not doing enough to stem the spread of disease.

Increases in the ease of travel both within and outside of China may make the disease spread faster. However, as this outbreak is occurring during the Lunar New Year holiday, many have likely already stocked up on food and necessities and therefore will not need to go outside for supplies as much as they might have had this occurred at a different time of year. Finally, the coronavirus' geographical distribution is different from that of SARS in 2003. Having originated in China's geographic center, the virus is likely to be felt most severely in the central Mainland and may largely spare coastal cities such as Hong Kong and Shanghai.

Given the valuation differential between US and Chinese markets, the dip in Chinese stocks spurred by the outbreak may provide an opportunity to capitalize on a meaningful discount in equity markets in China. The Shanghai Composite's current price to earnings ratio is 14.17, compared to the S&P 500's 21.96.1 Many stocks that will be hit by the outbreak may fall only in the short-term, meaning investors may profit from holding certain positions through the rebound. In the US, declines may be short-term as well, but hard-hitting given that most gains in the US stock market last year were the result of multiple expansion. The CNN Fear & Greed Index moved from 90, representing extreme greed in the US stock market, a month ago to 58 today, which is near neutral.4 Further sentiment reversal could pose a threat to US stock prices.

The travel and retail sectors in China will be immediately affected. Trip.com has fallen nearly 10% since the outbreak as flights to and from Wuhan, a travel hub, are banned. The healthcare sector in China is seeing an onslaught of demand from healthcare professionals and individuals as efforts to cure and stem the spread of the disease are afoot. Large pharmaceutical companies such as Jiangsu Hengrui (SSE:600276, 8.49% of KURE net assets as of 12/31/2019) may see revenues increase from the sale of pain medicine and antibiotics. Traditional Chinese medicine stocks such as Tong Ren Tang (SSE:600085, 0.98% of KURE net assets as of 12/31/2019) may also see revenues increase as people may turn to alternative treatments given the crowding of conventional hospitals and clinics.

As people remain inside and in need of entertainment, we can reasonably expect to see a surge in volume for gaming and video platforms, benefitting stocks such as Netease and IQiyi. Paradoxically, even certain E-Commerce stocks may see benefits, especially JD.com, which has recently made inroads into the provision of healthcare needs. Alibaba's (NYSE:BABA) health arm AliHealth (0241 HK, 2.41% of KURE net assets as of 12/31/2019) provides healthcare services and technologies to both patients and practitioners.

If the coronavirus outbreak of 2020 is at all similar to the SARS outbreak in 2003, the overall impact on China's economy should be short-term and diminutive. While equity markets around the world will suffer short-term losses, the virus is likely to widen the already vast valuation gap between Chinese and US markets. Additionally, efforts to contain the virus may actually provide a catalyst for stocks in the healthcare and entertainment sectors. China's healthcare market can be captured at a low cost through the KraneShares MSCI All China Health Care Index ETF (KURE).

Citations:

- Data from Bloomberg as of 1/30/2020.

- Smith, Richard D. "Responding to global infectious disease outbreaks: Lessons from SARS on the role of risk perception, communication, and management," Social Science & Medicine. Elsevier Science Direct. Volume 63, Issue 12, p. 3113-3123. December 2006.

- Liu, Liu. "China Macro Brief: Review of Economic Impact of SARS in 2003," CICC Research. January 21, 2020.

- Arora, Nigam. "Extreme greed in the stock market is producing a bad setup as earnings season starts," Market Watch. January 18, 2020.

Index Definition:

MSCI China All Shares Index: The MSCI China All Shares Index captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐chips, P‐ chips and foreign listings (e.g. ADRs). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen and outside of China. It is based on the concept of the integrated MSCI China equity universe with China A-shares included. The index was launched on June 26, 2014.

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

Shanghai Stock Exchange Composite Index: The Shanghai Stock Exchange Composite Index is a capitalization-weighted index. The index tracks the performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. The index was launched on July 15, 1991.

CNN Fear & Greed Index: The CNN Fear & Greed Index is meant to measure the degree to which the emotions of fear and greed are powering investment decisions in the US marketplace. To arrive at a value for the index at a given time, equal weights are given to the deviation from the mean of seven indicators: stock price momentum in the S&P 500 Index, stock price strength on the New York Stock Exchange, stock price breadth, put/call ratios, junk bond demand, market volatility (measured by the VIX Index), and safe-haven demand.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.