Vinda International: Favorable Tailwinds Persist

by The Value PendulumSummary

- Vinda International recorded its highest quarterly gross margin in history at 36.0% for 4Q2019, largely due to low wood pulp prices.

- Vinda International's revenue growth slowed in 4Q2019, but the company remained the market leader in China's tissue market.

- Vinda International's personal care segment has significant potential for growth in the medium to long term, accounting for only 18% of the company's FY2019 revenue.

- The impact of Wuhan coronavirus is mixed, with increased demand for hygiene products a positive, but potential disruption to Vinda's manufacturing operations is a risk factor.

- Vinda International currently trades at 16.6 times consensus forward next twelve months P/E and offers a consensus forward FY2020 dividend yield of 1.9%.

Elevator Pitch

I maintain my "Bullish" rating on Hong Kong-listed Asian hygiene company Vinda International Holdings Limited (OTC:VDAHF) (OTCPK:VDAHY) [3331:HK]. Favorable tailwinds such as low wood pulp prices and a growth in revenue contribution from premium products have persisted. The key downside risks are a spike in wood pulp prices and a potential disruption to its manufacturing operations due to the Wuhan coronavirus.

Please refer to my initiation article on Vinda International published on July 26, 2019, and my prior update on the stock published on November 6, 2019, for more details of the company's background. Vinda International's share price has increased by +28% from HK$14.76 as of November 5, 2019, to HK$18.94 as of January 30, 2020, since my last update where I upgraded the rating for Vinda International from "Neutral" to "Bullish".

Vinda International, currently, trades at 16.6 times consensus forward next twelve months P/E versus its historical five-year and 10-year average forward P/E multiples were 20.8 times and 19.0 times respectively. The stock also offers a consensus forward FY2020 dividend yield of 1.9%.

Readers are advised to trade in Vinda International shares listed on the Hong Kong Stock Exchange with the ticker 3331:HK, where average daily trading value for the past three months exceeds $2 million and market capitalization is above $2.8 billion. Investors can invest in key Asian stock markets either using U.S. brokers with international coverage, such as Interactive Brokers, Fidelity, or Charles Schwab, or local brokers operating in their respective domestic markets.

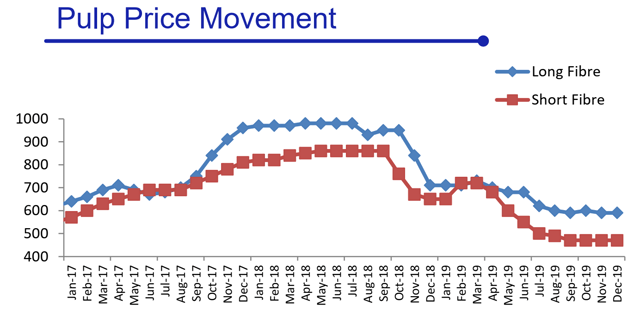

Record Gross Profit Margin In 4Q2019 Given Low Wood Pulp Prices

Vinda International recorded its highest quarterly gross margin in history at 36.0% for 4Q2019, representing a +470 basis points QoQ expansion from 31.3% in 3Q2019. On a full-year basis, the company's gross margin increased by +290 basis points from 28.1% in FY2018 to 31.0% in FY2019. Favorable wood pulp prices are the key reason for Vinda International's improvement in gross margin on a QoQ and a YoY basis. Given that Vinda International holds more than four months of inventories, the company's gross margin should remain resilient till 1H2021 at the very least.

Pulp Prices Between January 2017 And December 2019

Source: Vinda International's FY2019 Results Presentation

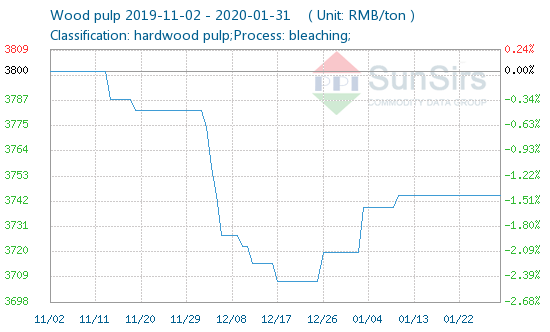

However, Vinda International cautioned at the company's FY2019 earnings call on January 22, 2020, that "we have reached the bottom of the pulp price", but added that "we do not see a very significant uptick in 2020" which implies that wood pulp prices could still remain favorable this year. As per the chart below, there has a minor rebound in Chinese wood pulp prices since end-December 2019. Market consensus expects Vinda International's gross margin to further expand from 31.0% in FY2019 to 33.0% in FY2020, but moderate to 32.5% for FY2021. FY2020 gross margin of 33.0% seems reasonable, but FY2021 gross margin of 32.5% could potentially be too high.

Chinese Wood Pulp Prices In The Recent Three Months Up To End January 2020

Source: SunSirs Commodity Data Group

Another minor factor contributing to Vinda International's higher gross margin is increased revenue contribution from premium brands and products. Notably, Vinda International disclosed at the company's FY2019 results briefing on January 22, 2020, that one of its key premium brands, Tempo, is growing at a rate of over +40% in China, and the Tempo brand currently accounts for approximately 8% of the company's overall revenue.

Tempo is a German brand of premium tissue that was started in 1929. Tempo was added to Vinda International's brand portfolio in recent years, after Swedish timber, pulp and paper manufacturer, Svenska Cellulosa AB (OTCPK:SVCBF) (OTCPK:SVCBY), or SCA acquired a 51% equity interest in Vinda International to became its largest shareholder in 2013. SCA's Greater China and South East Asia hygiene businesses were integrated with that of Vinda International's in 2014 and 2016 respectively.

Revenue Growth Slowed in 4Q2019 But Company Remained Market Leader

Vinda International achieved a YoY revenue growth of +5.2% in 4Q2019, which was slower than the +16.2% YoY revenue growth for 3Q2019. The company's top line grew +8.0% YoY to HK$16,074 million for full-year FY2019. In my earlier article on Vinda International published on November 6, 2019, I had highlighted that low wood pulp prices could potentially lead to more intense price competition in the tissue market in 4Q2019, and that was the main reason for Vinda International's slower YoY revenue growth in the recent quarter.

At Vinda International's FY2019 earnings call on January 22, 2020, the company attributed that the slower top line growth in 4Q2019 to "the market reacting to the lower pulp prices", while Vinda International "didn't move too much on prices." Vinda International had disclosed at its 3Q2019 results briefing on October 25, 2019, that premium brands and products accounted for approximately 20% of the company's 9M2019 revenue. Going forward, Vinda International's continued focus on premium brands and products should help to mitigate any negative impact from price competition, especially in the lower-priced segments of the Chinese tissue market.

Putting quarterly revenue growth momentum aside, Vinda International remained the market leader in China's tissue market with a market share of 18.1% in 2019, representing a slight increase from the company's market share of 17.4% in 2018.

Notably, Vinda International performed well at last year's annual Double 11 or Singles Day online shopping festival in November created by Alibaba (BABA), which is similar to Black Friday or Cyber Monday in the U.S. The Vinda brand of tissue was the best selling brand on all the Chinese e-commerce platforms during the Double 11 festival in November 2019, according to research by Guotai Junan Securities. Furthermore, Vinda International's Tempo and Tena brands were the top brands in the premium tissue and incontinence care segments respectively.

Vinda International has been managing the e-commerce sales channel well, with e-commerce sales growing in the double-digits YoY for FY2019. E-commerce accounted for 29% of the company's overall sales and 37% of China's revenue in FY2019.

Growth Potential Of Personal Care Segment

The personal care segment only accounted for 18% of Vinda International's FY2019 revenue, with the core tissue business still contributing 82% of the company's top line in the past year. Vinda International's personal care segment comprises of feminine care, baby care, and incontinence care products.

Vinda International relaunched its personal care brand Libresse in Mainland China with new product lines in June 2019; Libresse is the best selling feminine care brand in Malaysia with a 30% market share last year. Vinda International also consolidated its factories and warehouses in Southeast Asia in FY2019 with the aim of increasing localized production of its personal care products.

Vinda International has been very successful in the personal care segment in the Southeast Asian markets. The company's Libresse feminine care brand and Drypers babycare brand are the No.1 brands in Malaysia; while its incontinence brand Tena is the leading brand in Malaysia and Singapore. Looking ahead, Vinda International hopes to leverage on the success of its personal care business in Southeast Asia and Malaysia and replicate something similar in Mainland China.

At the company's FY2019 results briefing, Vinda International emphasized that "in the long term, our Personal Care business would be our very important strategy."

Potential Impact Of Wuhan Coronavirus Is Mixed

The potential impact of the Wuhan coronavirus on Vinda International is mixed.

On one hand, Vinda International could potentially see higher revenue in 1QFY2020 due to higher demand for hygiene products such as wet wipes. Vinda International's share price has increased by +16% from HK$16.32 as of January 21, 2020, to HK$18.94 as of January 30, 2020. This is partly due to the company's 4Q2019 and FY2019 results announcement on January 22, 2020, and also the fact that the market perceives Vinda International to be a potential beneficiary of the Wuhan coronavirus.

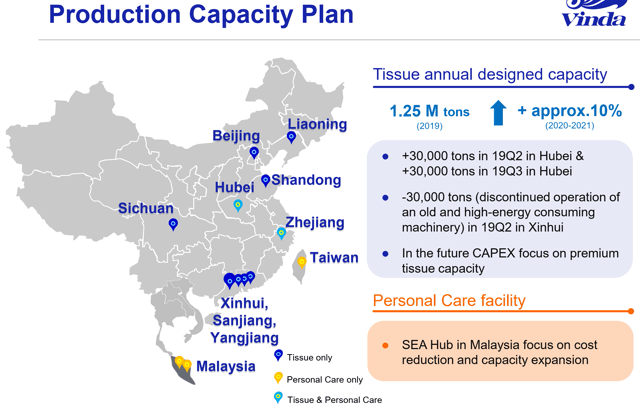

On the other hand, there is a potential risk of disruption to Vinda International's manufacturing operations in China. The company disclosed at the recent 4Q2019 earnings call that it had added 60,000 tons of new production capacity at its production facility located in Xiaogan city, Hubei province in 2Q2019 and 3Q2019. Wuhan is the capital of Hubei province and Xiaogan is among the Chinese cities where public transport has been suspended since January 23, 2020.

Location Of Vinda International's Production Facilities

Source: Vinda International's FY2019 Results Presentation

Valuation

Vinda International trades at a trailing twelve months P/E of 19.9 times and a consensus forward next twelve months P/E of 16.6 times based on its share price of HK$18.94 as of January 30, 2020. In comparison, the stock's historical five-year and 10-year average forward P/E multiples were 20.8 times and 19.0 times respectively.

Vinda International is valued by the market at 10.2 times trailing twelve months EV/EBITDA and 8.9 times consensus forward next twelve months EV/EBITDA. The stock's historical five-year and 10-year average forward EV/EBITDA multiples were 11.3 times and 11.1 times respectively.

Vinda International offers consensus forward FY2020 and FY2021 dividend yields of 1.9% and 2.0% respectively. The company increased its final dividend per share by HK$0.06 to HK$0.21 for 2H2019, which implied a full-year FY2019 dividend payout ratio of 29% including its interim dividend per share of HK$0.07.

Risk Factors

The key risk factors for Vinda International are a spike in wood pulp prices, increased price competition, a slower-than-expected growth for its personal care segment, and the Wuhan coronavirus potentially disrupting its manufacturing operations.

Asia Value & Moat Stocks is a research service for value investors seeking value stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like "Magic Formula" stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.