Trade setup for Budget day: Nifty has strong support at 11,900, 11,850

On the upside, NSE Nifty has resistance at 12,125 and 12,200 levels.

by Milan Vaishnav CMT MSTA

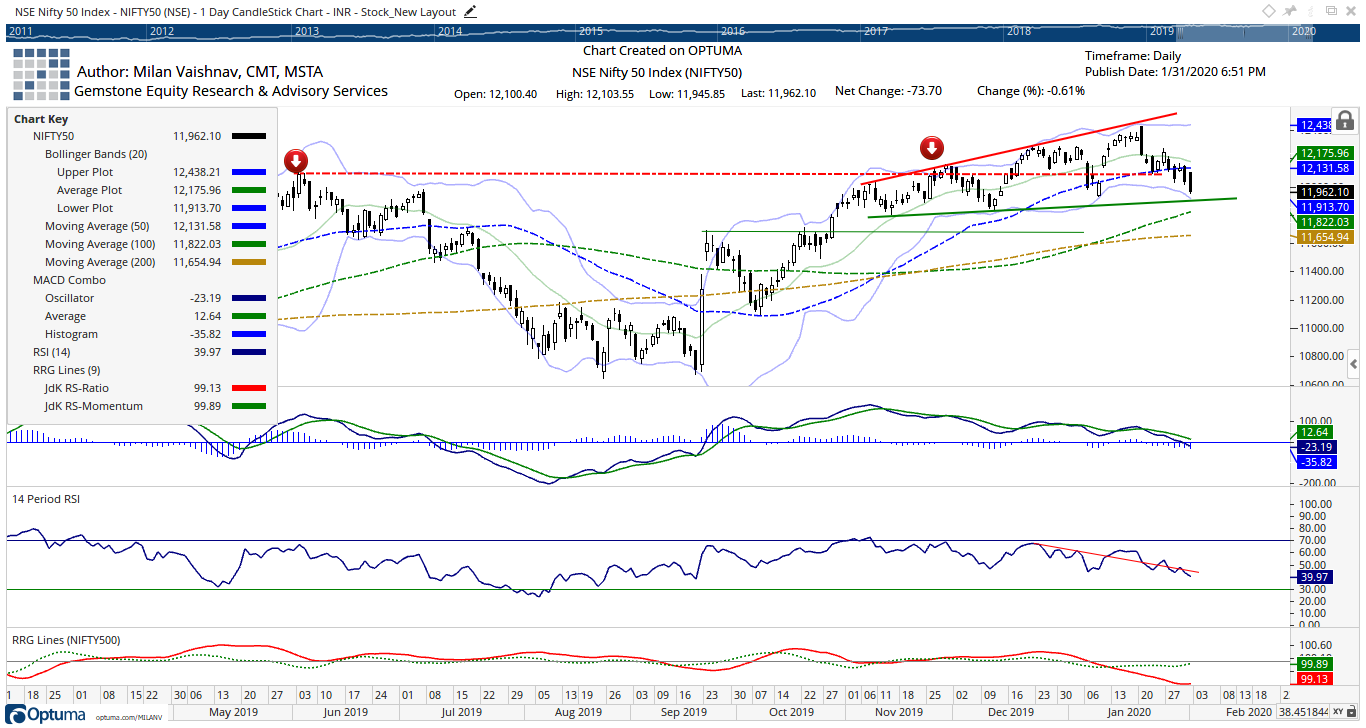

Falling for a second straight session, NSE Nifty on Friday slipped below the psychologically important 12,000 level and ended 73.70 points or 0.61 per cent lower at 11,962.10.

Union Budget, which is on Saturday, is one of the most important events for capital markets. Given the importance of the event and the volatile moves that the market usually makes, it would not be prudent to make a mechanical reading, as technical levels tend to get violated on either side while reacting to such events. It would make more sense if we look at the broader levels that the headline index is dealing with.

Nifty on Saturday is expected to make a stable start, but no major directional moves are expected in the morning session. We may see Nifty staying sideways in a defined range until Budget proposals start rolling in, which may increase volatility.

There is a large number of short positions in the system. Nifty ended in the negative zone on Friday, but futures saw an open interest (OI) addition of 12.66 lakh shares or 12.46 percent. Options data shows similar amount of Call, uniformly at 12,100, 12,200, and 12,300 strikes. Moreover, despite the index ending below the 12,000 mark, the maximum Put OI remained at 12,000.

The bearish setup is evident on the technical charts, but short positions also indicate possibilities of short covering, if Budget surprises positively.

In the event of any downside, technical support exists at 11,900 and 11,850, but may get breached momentarily. On the upside, Nifty has resistance at 12,125 and 12,200 levels.

We would again point out that these are merely technical levels, and they might get breached on either side during the volatile reactions to the Budget on Saturday.

We would strongly recommend traders to create significant positions only after the Budget is fully presented and entirely digested by the market. Before that, the movements are likely to be absolutely speculative in nature with no sustained directional bias on either side.

(Milan Vaishnav, CMT, MSTA, is a Consulting Technical Analyst and founder of Gemstone Equity Research & Advisory Services, Vadodara. He can be reached at milan.vaishnav@equityresearch.asia)