3M Company: Buy The Crisis, Collect The Dividends, And Sell The Turnaround

by Williams Equity ResearchSummary

- 3M is absorbing substantial restructuring costs and just announced 1,500 layoffs.

- The market's reaction to recent news is not totally unjustified, but we are not so easily swayed. Stoic investing is well rewarded, if not essential.

- Q4 produced strong margins and significant free cash flow. While the Chinese market, costly litigation, and other issues warrant attention, 3M is likely to bounce back in 2020.

- 3M is easily capable of generating $9.25-$9.50 in EPS for 2020. That's below a 17x multiple at our target entry, which historically yields favorable total returns on this AA- rated company.

Source: 3M Q3 Report

Nearly 120 years ago, a company called Minnesota Mining and Manufacturing was established. That firm has expanded into over 200 nations and owns in excess of 117,000 patents, many of which were obtained in the last decade.

These patents involve inventing masking tape, the Scotch brand, various abrasive coatings used in industrial facilities and garages around the world, the first synthetic grass for athletic fields, Post-it notes, ultra-compact LED-illuminated projection engines, the first respirators cleared by the FDA for use by the general public, many Bluetooth technologies, solar mirror films, and reflective materials quickly incorporated in safety apparatus of numerous types. That list is merely a small fraction of 3M's (MMM) accomplishments. In fact, I have a challenge for you: look for the 3M brand the next time you visit a home improvement store. You might leave thinking 3M owns the paint-related aisles and half of the others.

Before we get too far, here's a statement that will tell you more about this St Paul, MN based firm with operations in over 20 U.S. cities: 3M has increased its dividend for 61 consecutive years. For context, here's a Chevrolet Corvette sold 61 years ago.

Much more recently, 3M announced the $6.7 billion acquisition of Acelity. It's a good-sized purchase even for the ~$100 billion market capitalization 3M. Acelity firm specializes in healthcare products, which aligns well with 3M's offerings. Many of Acelity's products literally stop the bleeding from wounds.

Source: Yahoo Finance & WER

Ironically, the timing of the acquisition suggests an attempt at stopping the bleeding in the stock price as well. In all fairness, it likely required several quarters of due diligence by 3M prior to the deal being announced. The other major item is 3M's ongoing "transformation journey." As it has done almost countless times in the past, the firm is reinventing itself, and this time, through a new global operating model and more efficient structure. The latter involves laying off 1,500 jobs which are dispersed around the world. Now that we have a grasp on 3M's history, let's move toward the recent financial results to help us better gauge where the company is heading.

Q4 Release & 2019 Results

Source: 3M Q4 Report

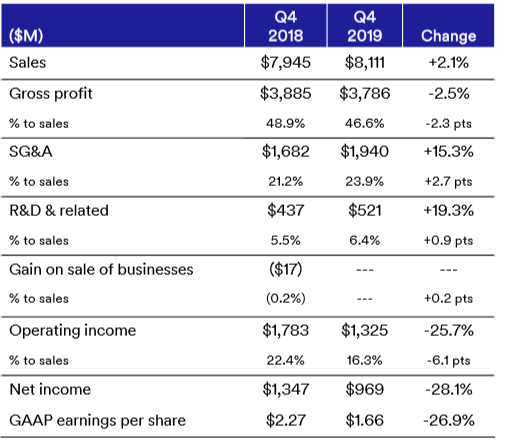

Given the sharp sell-off on the release of Q4's earnings, we'd expect areas of concern and a few negative signs.

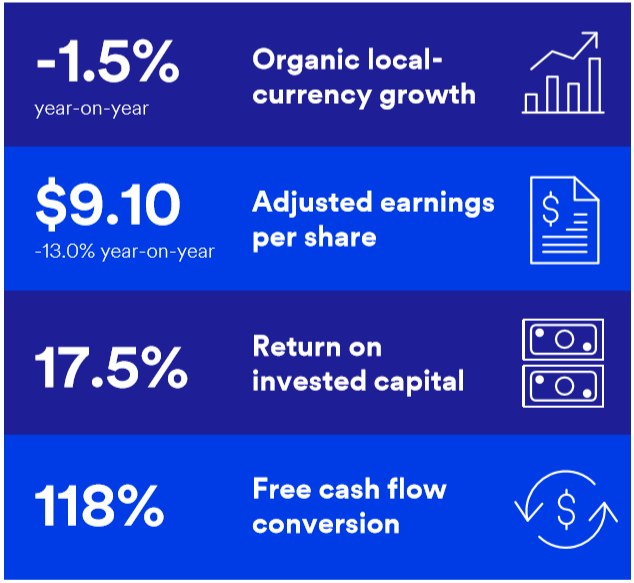

Source: 3M Q4 Highlights

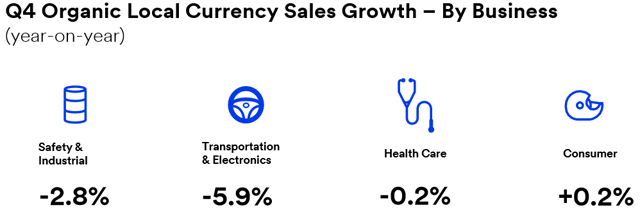

The most material weakness for Q4 specifically was a 2.6% decline in organic, currency-adjusted sales. Actual sales were up 2.1%. Adjusted earnings per share ("EPS") look weak on the surface with a 15.6% year-over-year decline to $1.95 versus $2.31 in 2018. A pre-tax restructuring charge of -$0.20 per share bridges most of that gap. The GAAP number 3M conveniently leaves out of the most noticeable charts in its Q3 Investor Presentation is the $1.66 EPS for Q4 due to another -$0.29 in litigation expenses. This is not an Altria Group (MO), big tobacco-type settlement by any means, but it has been costly to the tune of $234 million. 3M is engaged in mediation and resolution negotiations to get past the PFAS environmental litigation. This link is an easy-to-read overview on the subject, and details on 3M's legal battles are included in its quarterly filings on SEC.gov. Based on management's commentary, information included in 2019's 10-Qs, and our independent assessment, we see at least a 50% decline (improvement) in related expenses for 2020.

Source: 3M Q4 Report. Q4 Specifics.

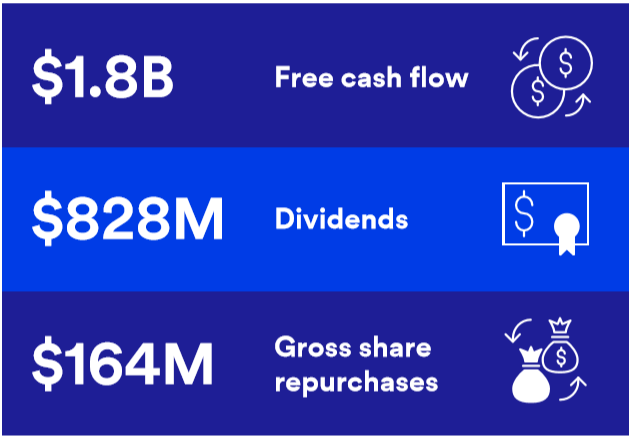

Despite several detractors, free cash flow was up modestly in Q4 to the tune of $1.8 billion, and operating cash flow of $2.3 billion was also strong. Thanks to these metrics, 3M was able to put $1.0 billion in shareholders' pockets in Q4 alone.

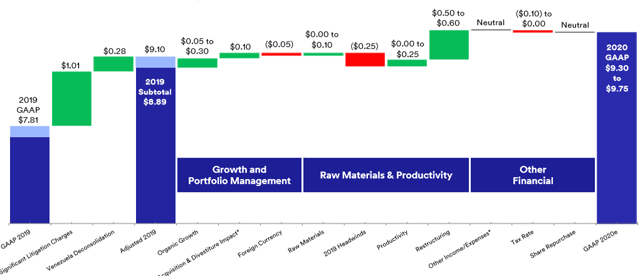

From a full-year 2018 to 2019 perspective, last year experienced a 1.9% decline in sales. GAAP EPS has a similar story here as the Q4 2018 versus Q4 2019 situation; the firm took a $1.01 per share hit from litigation expenses, a $0.28 per share non-cash charge related to the continued destabilization of Venezuela, and had divestiture gains of $0.21 per share. Despite adjusted EPS of $9.10, the GAAP number is much lower at $7.81. Net income is good to know, but cash flow is better to have.

Source: 3M Q4 Report. 2019 Specifics.

Operating cash flow for 2019 of $7.1 billion is good, but free cash flow's growth to $5.4 billion, a 10% gain compared to 2018, is even better. In fact, that cash flow figure is an all-time annual record for the company. 3M is a mature company with reasonable leverage and a responsible management team, and as a result, its 2019 CapEx of $1.7 billion is a nice balance in that it is sufficient to drive growth but not so large that it swallows more than 30-35% of free cash flow. 3M needs to dedicate significant resources to the development of new products; that's been its success story since day one back in 1902.

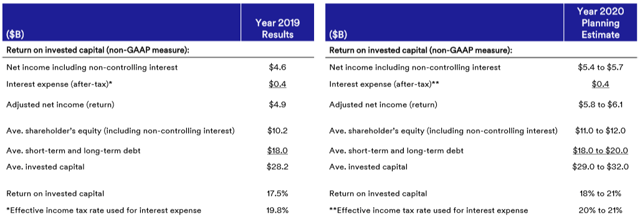

Return on invested capital ("ROIC") is a critical metric to determining a firm's long-term success. In 3M's case, 2019 saw a healthy 17.5% in this department. Margins were lower on a relative basis but were still 19.0%; this is a very solid metric for a firm of 3M's size and age. There is a useful albeit somewhat hidden document on 3M's website targeted at professional stock analysts.

Source: 3M

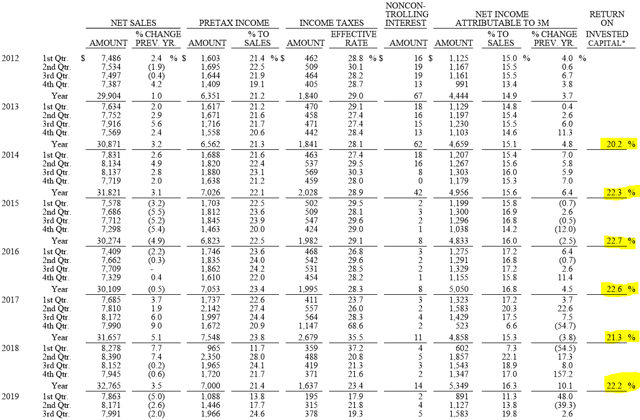

The return on invested capital is highlighted for your convenience and has never fallen below 20.2% over the period pictured above.

3M measured the impact of the reorganization and acquisition activity at -170 basis points and -140 basis points, respectively. That 310 basis points represents 91.2% of the decline in operating margins. At a high level, $8.1 billion in sales with nearly 20% operating margins generated by an established manufacturing facility is compelling. The contention is price.

In order to justify today's price-to-earnings ("P/E") ratio of 19.5x, 3M has to position itself for better long-term growth than experienced in 2018 and 2019. The fully-covered 3.28% current yield, which we'll discuss in more detail, does augment 3M's case.

3M Business Groups

Advantages attributable to some full-time professionals over most retail investor are time and resources. In my case, I spend most of every day reviewing data and analysis on foreign and domestic equity and fixed income sectors, individual companies, geopolitical trends, developments in alternative investments, including real estate and private equity, as well as legislation (e.g. decisions directly impacting taxes or currencies). On the resources end, my related job performing investment and operational due diligence for large institutions allow me to see a large amount of deal flow and all the underwriting behind it. Over time, and often from knowledge derived from the competitors of the firm I'm underwriting, I've learned which companies and strategies make the most sense and which do not. I've also learned to be suspicious of the confidence I put in management and myself regarding forward projections.

Looking through this lens, let's start with data associated with one of the most famous industrial companies in the U.S.: General Electric (GE). I don't write about GE publicly since it does not come close to the parameters established for our marketplace service but, nonetheless, follow the firm closely.

Source: GE Capital Q3 Report

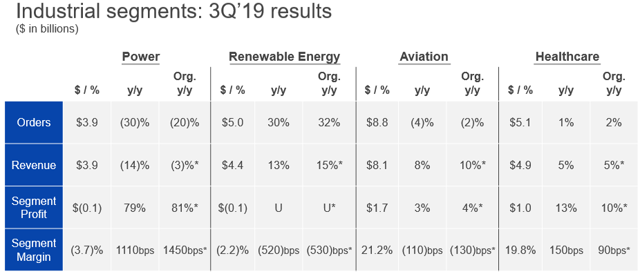

Because of this "behind the scenes" work, I know GE is experiencing substantial volatility across its major business lines. I also know that, like 3M, it has four main divisions, all of which have a meaningful impact on the bottom line.

Do not underestimate the tendency of large conglomerates to become emotionally attached to a losing division. In many cases, they funnel billions of capital from productive divisions right into their biggest loser. This is one of the many reasons diversified conglomerates like GE often reach a "peak" before going on decades of under-performance and embarking on consistently poor capital allocation. Current investors in GE are keenly aware of this trend. IBM (IBM) may not be far behind.

It's hard to come to any solid conclusions regarding GE's recent and year-over-year performance. It's all over the place with two divisions generating negative margins and the other two near 20%. Unsurprisingly, GE's dividend and profitability track record leave a lot to be desired.

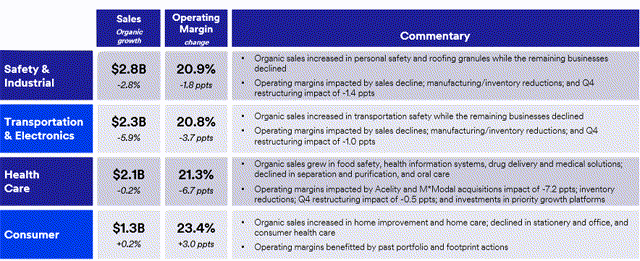

Source: 3M Q3 Report

Switching gears to 3M, we see many differences versus GE. First, no division dominates the landscape with the lowest at 15.3% and the largest at 32.9%. In addition, every single division's operating margin is within 150 basis points of 22.0%. That's remarkable consistency and signals low risk of 3M throwing good money after bad. At a more nuanced level, this also suggests a competent, long-term oriented management company with a defined strategy. That's what it takes to raise cash dividends for 61 consecutive years.

The result is categorically different performance; 3M is a cash flow machine that rarely stumbles while GE lost an incredible and accelerating $20.63 billion in 2018 alone. Despite the 36% price decline from 3M's peak in January 2018, the firm generated record cash flow in 2019.

Balance Sheet

Here's another area 3M differs considerably from its peer General Electric.

Staring with debt, below is a summary of key borrowing activities in 2019 are provided below from the last quarterly filing (emphasis mine):

In February 2019, 3M issued $2.25 billion aggregate principal amount of fixed rate medium-term notes. These were comprised of $450 million of 3-year notes due 2022 with a coupon rate of 2.75%, $500 million of remaining 5-year notes due 2024 with a coupon rate of 3.25%, $800 million of 10-year notes due 2029 with a coupon rate of 3.375%, and $500 million of remaining 29.5-year notes due 2048 with a coupon rate of 4.00%. Issuances of the 5-year and 29.5-year notes were pursuant to a reopening of existing securities issued in September 2018. In August 2019, 3M issued $3.25 billion aggregate principal amount of fixed rate registered notes. These were comprised of $500 million of 3.5-year notes due 2023 with a coupon rate of 1.75%, $750 million of 5.5-year notes due 2025 with a coupon rate of 2.00%, $1.0 billion of 10-year notes due 2029 with a coupon rate of 2.375%, and $1.0 billion of 30-year notes due 2049 with a coupon rate of 3.25%. In September 2019, 3M entered into a credit facility expiring in July 2020 in the amount of 80 billion Japanese yen. At September 30, 2019, 69 billion Japanese yen, or approximately $640 million at September 30, 2019 exchange rates, was drawn and outstanding. In conjunction with the October 2019 acquisition of Acelity (see Note 3), 3M assumed outstanding debt of the business, of which $445 million in principal amount of third lien senior secured notes (Third Lien Notes) maturing in 2021 with a coupon rate of 12.5% was not immediately redeemed at closing. Instead, at closing, 3M satisfied and discharged the Third Lien Notes via an in-substance defeasance, whereby 3M transferred cash equivalents and marketable securities to a trust with irrevocable instructions to redeem the Third Lien Notes on May 1, 2020. The trust assets are restricted from use in 3M's operations and may only be used for the redemption of the Third Lien Notes. These actions, however, do not represent a legal defeasance. Therefore, following the acquisition of Acelity, this debt will be included in current portion of long-term debt and the related trust assets will be included in current assets on the Company's consolidated balance sheet. As of September 30, 2019, the Company had no commercial paper outstanding, compared to $435 million in commercial paper outstanding as of December 31, 2018. In June 2019, 3M repaid $625 million aggregate principal amount of fixed-rate medium-term notes that matured.

Notice the incredibly low borrowing costs achieved by 3M during 2019. In addition, 3M was able to refinance Acelity's debt to a small fraction of its prior interest rate.

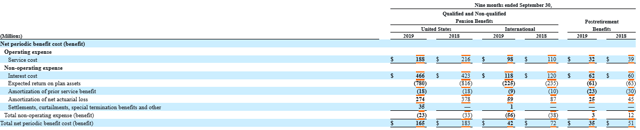

Whenever evaluation a firm with the length of operating history of 3M, pensions are usually involved. Most U.S. pensions were structurally underfunded from their inception due to misguided (at best) underwriting.

Source: SEC.gov

In May 2019 (as part of the 2019 restructuring actions discussed in Note 5), the Company began offering a voluntary early retirement incentive program to certain eligible participants of its U.S. pension plans who meet age and years of pension service requirements. The eligible participants who accepted the offer and retired by July 1, 2019, received an enhanced pension benefit. Pension benefits were enhanced by adding one additional year of pension service and one additional year of age for certain benefit calculations. Approximately 800 participants accepted the offer and retired before July 1, 2019. As a result, the Company incurred a $35 million charge related to these special termination benefits in the second quarter of 2019. In May 2019, 3M modified the 3M Retiree Life Insurance Plan post-retirement benefit to close it to new participants effective August 1, 2019 (which results in employees who retire on or after August 1, 2019, not being eligible to participate in the plan) and reducing the maximum life insurance and death benefit to $8,000 for deaths on or after August 1, 2019. Due to these changes, the plan was re-measured in the second quarter of 2019, resulting in a decrease to the accumulated projected benefit obligation liability of approximately $150 million and a related increase to shareholders' equity, specifically accumulated other comprehensive income in addition to an immaterial income statement benefit prospectively.

As noted above, part of 3M's restructuring efforts includes taking a little medicine now for better health in the future. These voluntary pension programs have a great return on investment and should be encouraged despite the $35.0 million charge in the last reporting period. 3M's pension liabilities are significant at $200 million annually (2019's total contributions) but are very manageable in the context of >$7.0 billion in annual operating cash flow.

For context, GE recently announced an emergency freeze of its pension system and plans to contribute $5.0 billion next year alone to try to plug the hole in the leaking ship.

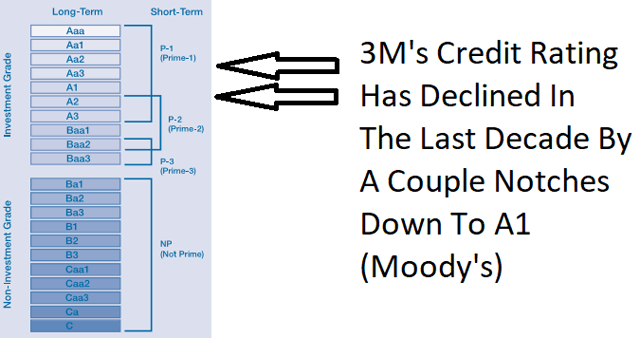

3M's leverage profile has declined in quality since 2014. The firm purposefully increased borrowings, share buybacks, and acquisitions. Credit agencies expected this due to guidance from management.

Source: Moody's

3M's annual interest expense is approximately $435 million. Compared to quarterly operating income of ~$2.0 billion, the firm has a >20x interest coverage ratio signaling low risk. The firm's total long-term debt as of 9/30/2019 was $17.5 billion, coupled with pension liabilities of $2.7 billion; Total assets at the time were $42.6 billion. 3M is in a strong position due to low borrowing costs, but we'd prefer if the firm avoids borrowing to buy back stock going forward.

Valuation & Risk Profile

Firms posting quarterly declines in adjusted operating income, adjusted net income, and adjusted EPS do not deserve to trade at 52-week highs. And those are adjusted figures, which is management's way of saying "ignore these annoying GAAP figures and look over here instead."

On the other hand, 3M generated $1.8 billion in free cash flow in Q4 2019 alone. Over the same period, it returned $1.0 billion to shareholders via dividends and buybacks while only requiring 55% of Q4's free cash flow to do so. On a full-year basis, 3M generated record free cash flow a full 10% higher than 2018. On top of that, management is guiding 2020 GAAP EPS of approximately $9.45 or a >20% year-on-year gain. The firm distributed $4.7 billion to shareholders in 2019 via dividends and share repurchases. As mentioned in the beginning of the article, 3M has increased its dividend for 61 straight years.

The firm certainly has value.

Source: 3M Q3 Report

We are generally skeptical of management's guidance and selection of certain reporting metrics over others (e.g. non-GAAP "adjusted" measures). In 3M's case, we are relatively confident that the "one-time" costs associated with the restructuring and litigation are included in 2020's guidance with reasonable accuracy.

Source: 3M Q3 Report

This chart does a good job of detailing the factors involved. We are still less convinced that the full $0.50 to $0.60 in restructuring "gains" will occur. Given management's track record on these issues, we think the lower end of the 2020 GAAP EPS range is a better number to use in our underwriting. Our underwriting shows EBITDA margins of 23-25% in 2020, which will bolster financial results.

Continuing the risk discussion, there is significant execution risk associated with an investment in 3M, even at these somewhat depressed levels.

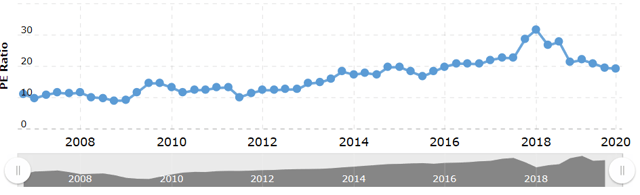

Source: Macrotrends.net

The above chart shows 3M's price-to-earnings ratio going back just before the financial crisis. The stock's earnings multiple was less than today's for approximately half this period. The market will not hesitate to send 3M lower if restructuring or litigation costs fail to dissipate in the first half of 2020. In addition, large corporations, on average, do not have good track records when it comes to timing share buybacks or completing "restructurings" within the initial budget. In my experience, it more resembles a construction project with "unexpected" costs expected 100% of the time.

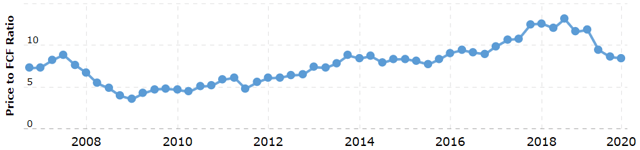

Source: Macrotrends.net

The situation is similar from a price to free cash flow perspective as shown above. There is at least one area which helps to move 3M from "fairly priced" to undervalued.

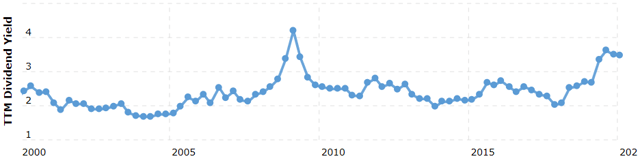

Source: Macrotrends.net

Because of the firm's excellent distribution coverage and nearly unrivaled and definitively uninterrupted dividend track record, its yield is unusually useful in determining relative value over time. The above data goes back 20 years and demonstrates there has only been one period that this dividend king has yielded higher: the 2008/2009 Financial Crisis. Obtaining 3M at >3.0% yield is a gift in of itself. Our target entry points are reserved for subscribers but is within 10% of the current share price. That figure was chosen as it is in the bottom decile of both free cash flow and earnings multiples over the last 20 years. In short, only the trough of the financial crisis provided a significantly better dividend yield.

Lastly, we want to reiterate a key positive and negative: margins and debt.

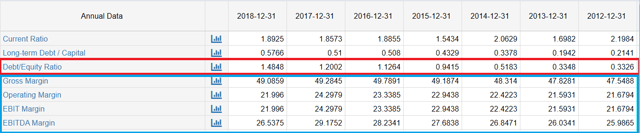

Source: Macrotrends.net

Highlighted in blue are gross, operating, EBIT, and EBITDA margins from 2012 through 2018 on an annual basis. The consistency is among the best we've come across, and the absolute numbers are peer-leading for an industrial company like 3M. On the other hand, we highlighted the debt-to-equity ratio in red. You can see it climb from a mere 0.33 to nearly 1.5x in the last six years. High leverage also equates to higher risk all other things equal. Management has been transparent along the way and alerted investors in advance that higher share buybacks and other activities would degrade its debt profile. Based on similar guidance, leverage is not expected to rise meaningfully. Management failing to abide by that is another risk and one that would have us reconsider our position.

Conclusion

This is an exceedingly rare opportunity for a firm with 3M's earnings and dividend track record, diversified business model, and unusual consistency. Investors should remain cognizant, however, of its increased financial leverage, other metrics leading toward its slide to a mid-tier investment grade credit rating, and uncertainty around its ongoing litigation and restructuring costs.

As always, thank you for reading and commenting. - WER Portfolio Managers

Thank you for reading.

Interested in more income recommendations across traditional and nontraditional asset classes including real-time alerts? Start a free trial of our Institutional Income Plus service. Learn about our institutional investing approach built through experience not just books. Join the community to access this week's recommendations, and specific entry and exit targets in real-time, involving BDCs, REITs, Preferred Equity, and many others. We have an all-inclusive income model portfolio, allocation guidelines, and issue bi-weekly market commentary.

Disclosure: I am/we are long MO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We have a limit buy order outstanding on 3M which may be executed at any time.