Investment Implications Of Unravelling Of Post WW2 World Order: The Case Of Turkey

by Zoltan BanSummary

- While the world is now accustomed to the likes of China challenging the post-WW2 world order, the challenge by smaller actors such as Turkey is something new.

- Multinationals, ranging from oil and gas producers to airplane manufacturers are set to be increasingly affected as the world changes.

- By the end of the decade, the post-WW2 world order will be so transformed that investment experience of the past seven decades will no longer be a guide going forward.

Given 75 years of relative tranquility, uninterrupted stability, and a constant global order, which was never seriously challenged until very recently, it is understandable why Western society is failing to grasp the severity of the changes. It is even more difficult for people to comprehend what these changes mean. There are changes that are occurring at an accelerated pace, which will have a very significant effect on global trade, investments, and on the overall economy. While we became accustomed to hearing more and more about rising economic powers such as China challenging the Western World for hegemony, we now have a growing number of smaller regional players imposing their will and pursuing their interests, which suggests that the process of disintegration of the post-WW2 order has now accelerated. Looking at Turkey's moves of the past few years suggests that by the end of the decade, there will be very little left of the world we became accustomed to in the past seven decades. Investors need to adjust and view the world accordingly or risk being blind-sided by the effects of these changes.

Turkey coup attempt was the point of pivot

The reason I wanted to focus on Turkey instead of the usual suspects such as China or India in regards to how the world is changing is that I want to highlight the fact that even middle-sized states can now play a major role in dismantling the current world order. Turkey is a middle income country with 84 million inhabitants. Its GDP does not bring it into the prestigious Trillion-dollar club, at least not yet. It does not hold any resources of global strategic interest. Its main asset is a strategically important geographical location, which Turkey is increasingly utilizing to its fullest potential.

Until very recently, its strategic position was considered to be more of an asset to its NATO allies than a position from which Western interests and institutions are likely to be challenged. With its control of the Bosporus Strait and its robust military, it is considered an important counterbalance to Russia in the Black Sea region. It also became an increasingly important transit country for oil and gas headed from the Caspian and ME regions, towards Europe. In this regard too, it was considered to be an important intermediary meant to check the oil and gas dominance of Russia in the EU.

The events of 2016 seem to have changed all these calculations. Soon after the failed military coup, which Turkey's president Erdogan seems to regard as an attempt to remove him from power, which at the very least may have had some Western sympathizers, Turkey's relations with its NATO allies seem to have soured. Turkey is increasingly pursuing its interest with ever-diminishing regard for Western World interests and concerns. Russia may have warned Erdogan about the impending coup, at least according to some media reports. Since then, just to use an example of how events are changing, the current world order, Turkey no longer seems to accept limits on arms procurement activities to only weapons produced mostly within NATO. It decided to purchase the S-400 air defense system from Russia to the detriment of Lockheed Martin (LMT), which will no longer be able to sell the F-35 fighter jet to Turkey, because the Russian air defense system is considered a threat in terms of exposing its vulnerabilities. Turkey's decision in this regard may encourage others to do the same, meaning that Lockheed's ability to export the fighter jet may be limited by a new-found desire for independence from US exclusivity demands in this regard.

Boeing (BA) and Airbus (OTCPK:EADSY) may also suffer a heavy blow due to the blossoming Russia-Turkey relations. The increasingly close relationship could lead to a significant deal for Turkey to import the soon to be commercially released Russian MC-21-300 passenger plane, which will be a direct competitor to Boeing's 737 series. Word is that Turkey and Russia are in discussions for such a deal. Such a deal by itself will not make much of a dent into the Boeing-Airbus near duopoly dominance of the global aircraft market. It does provide an emerging competitor with more momentum in terms of gaining market share, just when Boeing, in particular, is facing some significant difficulties.

Turkey's new relations with Russia go far beyond arms deals or other trade issues. They partnered up in order to settle the Syria conflict, which even now they are on opposite sides of, yet they found ways to wind it down in a managed manner. The US and the EU are increasingly being excluded from the final settlement of the conflict. It is still believed that they can buy into a final settlement by holding up the prospect of providing reconstruction funds in exchange for influence, but that looks increasingly unlikely. The EU may end up paying some reconstruction money in the end, just so it can help stabilize the situation so it will end the threat of millions of Syrian and other migrants pouring into the EU like it happened in 2015-2016.

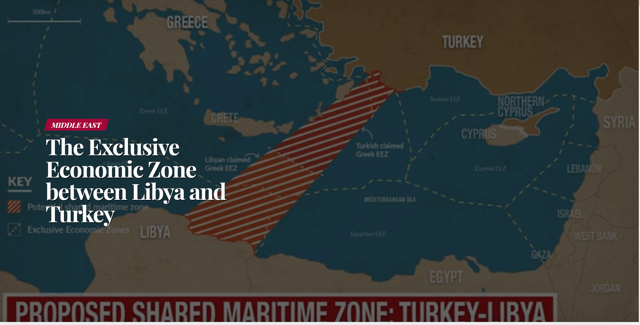

A similar pattern is emerging in Libya, where Russia is providing assistance to a faction that currently dominates most of Libya's territory, while Turkey partnered up with the besieged UN-recognized Libyan government. Both countries are in effect setting up to become the dominant power brokers, as was the case with Syria, despite the fact that the size of their nominal economies combined is less than a fifth of the EU, which one would think should have a far greater say in these matters than it manages to currently. The results are already showing, with Turkey and Libya having recently signed a maritime agreement, which in effect splits the Mediterranean and gives them the capability to block energy and other projects.

Source: Moderndiplomacy.

As the map shows, Turkey's move cuts off EU member Cyprus, as well as Syria, Lebanon, Israel and Egypt off from the EU. While this maritime agreement does not create an opportunity to fully control shipping traffic, it does give Turkey some control over future infrastructure projects, such as the proposed natural gas pipeline starting in Israel, going through Cyprus and on to Greece. Just to illustrate how this will affect business in the future which can, in turn, affect investors, Noble Energy (NBL) is a prominent developer of the natural gas fields discovered off of Israel's shore. This will restrict Noble Energy's ability to market its gas. Gazprom (OTCPK:OGZPY) on the other hand is seeing a potential competitor on the European market being obstructed from reaching the EU market, which is good news for its long-term outlook.

In addition to the Libya deal, Turkey is also drilling off the coast of Cyprus, invoking continental shelf rights, as well as the rights of the Turkish-dominated break-away state of Northern Cyprus which is not recognized as a state by any other country aside from Turkey. While this is technically a violation of the sovereignty of an EU member state, the EU is proving to be powerless to stop Turkey. It cut pre-accession funds to Turkey worth a few hundred million Euros, but at the same time, Germany is apparently considering channeling further aid to Turkey's efforts to take care of Syrian refugees, which will offset the financial effects of the cuts in pre-accession funds. It goes to show just how significant are the consequences of the EU mishandling of the migrant crisis in 2015-2016. Turkey emerged as the EU's gatekeeper as a result.

The EU also managed to bolster Turkey's role as an energy transit route, through questionable decisions made a few years back. In 2014 it obstructed the South Stream pipeline which would have taken gas from Russia directly to the EU. The end result has been the implementation of the Turkstream pipeline which helps to position Turkey as an increasingly indispensable intermediary between sources from Russia, Caspian and ME countries and Europe. It helps to extend Turkey's influence in the Balkan and Central European region, which will further hinder EU efforts to formulate a common regional strategy.

As a result of the Turkey-Libya deal, Somalia apparently is now expressing interest in forming a partnership with Turkey, which could involve Turkey exploring Somalia's offshore area for oil & gas. This comes on top of already on-going security relations between Turkey and Somalia's internationally recognized government. It should be noted that in the past such invitations would have been made first and foremost to mostly Western oil majors, such as Exxon Mobil (XOM), Chevron (CVX), Shell (RDS.A), or BP (BP), with the US and perhaps some European partners receiving an invitation to help out with the security issue in parallel. China or Russia would have been the only alternative options and only more recently. Three decades ago, when the West was declared the winner of the Cold War, there was only one global power that seemed to count the fact that Turkey received this invitation instead, speaks volumes in regards to just how things have changed. Turkey's economy is roughly 25 times smaller than that of the US, yet it is starting to find spaces where it can impose its will abroad. With these changes, the fortunes of companies like the oil majors I mentioned are set to change for the long-term as well. Their participation may still be coveted mostly due to their technical expertise. But with the clout of the Western World waning, they are set to lose out more and more to other emerging players. This is also increasingly the case for airplane manufacturers as well as weapons producers, as I already pointed out. In fact, most industries are likely to be affected, with the global playing field becoming more difficult to navigate.

It is increasingly hard to deny that the post WW2 order is breaking down. The example of Turkey is a confirmation of the fact that the breakdown has accelerated. The number of actors who are establishing themselves and imposing their interests as regional players are multiplying. It is no longer just the usual suspects such as China The ability of the Western World to continue to impose its will and push for its interests or that of its corporate and financial structures is therefore waning. This is in my view the decade which will see us transition into a new era in which the center of economic gravity will no longer be located in the Western World. It is important for investors to understand the implications of this shift. This article only looks at the impact of the actions of a relatively minor player on the global stage is having on the overall balance of power and influence in the ME-Africa region, as well as how it can affect business in the region. If we contemplate the effect of a growing number of assertive actors around the world, including heavyweights such as China, it becomes clear that the post-WW2 world order is already on its way out. Investors need to adjust accordingly by among other things identifying how these trends are affecting individual companies, as my examples I provided in this article illustrate. We need to start thinking differently in order to adjust to a new paradigm.

Disclosure: I am/we are long OGZPY, RDS.A, CVX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.