Ziopharm Stands Out, But Still Riskier Than Cellectis

by Christiana FriedmanSummary

- Ziopharm’s TCR approach targets solid tumors by recognizing neoantigens unique to each patient's cancer.

- The Sleeping Beauty solid tumor treatment is still autologous and doesn’t address cost issues plaguing CAR-T market pioneers.

- However the approach may still be more effective on solid tumors than an allogeneic approach.

- Overall, I still favor the risk/benefit profile of Cellectis over Ziopharm, and near term upside catalysts also seem to favor Cellectis.

The CAR-T landscape is replete with different permutations of the technology that are often arcane and difficult to grasp for even seasoned investors. Each formulation has its own advantages and disadvantages critical to understand in order to get a decent hold on a company’s long term viability in this area. The combination of the clinical data so positive yet so unproven in the market can get traders caught in honey traps.

At this point, a company associated with CAR-T is almost expected to show stellar efficacy data in its trials, so buying in on efficacy alone can be quite a dangerous move, especially with major buyouts seemingly behind us. What matters now is market viability, which is a much more intricate question than simply efficacy.

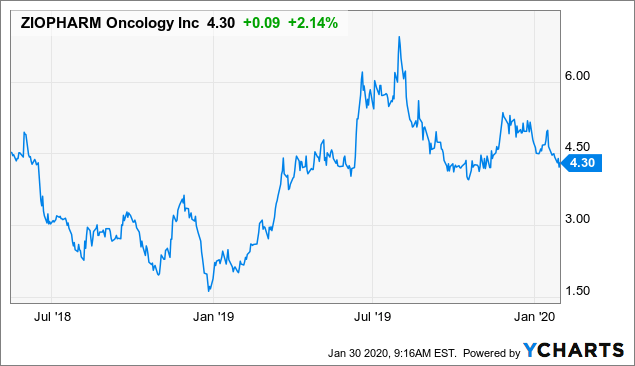

I have recently received requests to cover Ziopharm (ZIOP), and I will do so here in this context. Its approach to CAR-T is unique and also exciting as most of these companies are, though as we’ll see, Ziopharm’s approach is in my opinion riskier compared to its peers. The stock has been very volatile but net unchanged since my previous coverage in May 2018 when it scrapped an IL-12 monotherapy pivotal trial in favor of pursuing a combination treatment with Bristol Myer’s Squibb (BMY) checkpoint inhibitor Opdivo. Shareholders were understandably unhappy with this, so the stock proceeded to plunge to 10-year lows over the next 6 months. Since then it staged a large rally and settled back to the same range just prior to that trial suspension.

Data by YCharts

Where are we headed now? Like everyone else I cannot know for sure, but what I can say is that the danger of another sharp selloff at this point looks reduced from what it was back in 2018 after the pivotal trial suspension. I still think, however, that its approach to CAR-T carries more risk than the relatively more conservative approaches of Cellectis (CLLS) and Atara (ATRA), even though both of these are also risky and speculative. Ziopharm’s relatively riskier approach has only moderate-to-minor chances of higher reward in my view, and I still prefer Cellectis. Here I’ll explain why.

Three Basic Approaches, Ziopharm in the Middle

Let’s group the CAR-T space into three basic subgroups. First, we have the pioneers and market leaders, Gilead’s (GILD) Yescarta and Novartis’s (NVS) Kymriah. These are first generation CAR-T treatments for blood cancers, the main advantage obviously being that they are first to market. The two main disadvantages are safety and cost, which unfortunately may not be overcome for these two drugs. If second generation approaches addressing safety and cost prove successful, the pioneers could ultimately be replaced entirely.

On the other side of the industry are players like Cellectis and Atara. Both are attempting to deal with safety and cost issues simultaneously with off-the-shelf allogeneic solutions equipped with off switches that obviate the need for personalized autologous manufacturing. Cellectis I just covered recently and I refer readers to my previous analysis to get a better grip of what it is trying to do. I will refrain from reinventing the wheel here.

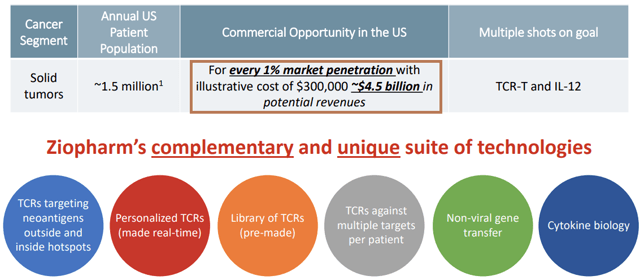

Ziopharm occupies a space somewhere in the middle between these two roads. Its most advanced candidate is based on what it calls the “Sleeping Beauty” system. Like Cellectis and Atara, this system comes equipped with an off switch to prevent cytokine storms from getting out of control, a serious problem with 1st generation CAR-T treatments that can be fatal to patients. However, the flagship Sleeping Beauty candidate remains an autologous system that only marginally addresses cost issues. (There is a Sleeping Beauty allogeneic candidate I will mention later.) If you take a look at Ziopharm’s most recent investor presentation page 6, you’ll see the cost figure of $300,000 used illustratively to give investors an idea of revenue generating potential. Obviously this is not a definitive figure on Ziopharm’s part, but it shows you the general direction in which the company is thinking. Sleeping Beauty cancer treatments are going to be very expensive.

This by itself is not a red flag. It could even be advantageous, provided the treatment is more effective than alternatives. It could indeed prove to be so. The main (potential) advantage of the autologous Sleeping Beauty treatment is that it targets solid tumors, which Kymria, Yescarta, and Cellectis’s allogeneic UCART treatments do not. (True, there is some evidence that UCART may be effective on solid tumors as well, but as of now it Cellectis is not directly targeting this.)

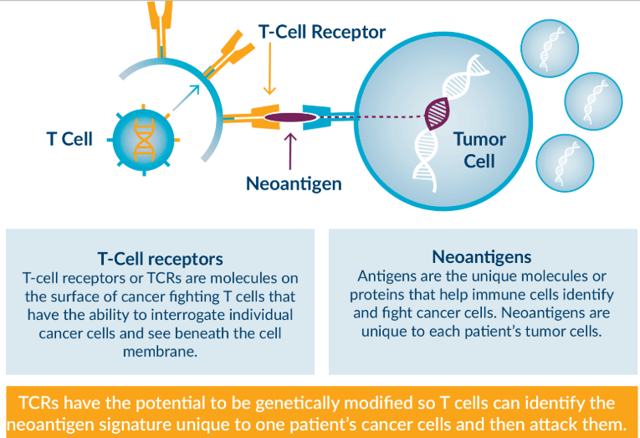

Technically speaking, Sleeping Beauty is not really a CAR-T treatment at all, but rather its cousin so-to-speak, called TCR-T for T-cell receptor. The difference is subtle, but critical for understanding what sets Ziopharm apart.

CAR-T vs TCR-T

The CAR-T treatment approach takes antigens on the cell membranes common to many many cancer types and attaches them on to a patient’s T-cells. Say a patient’s cancer tests positive for a known cancer antigen displayed on the cell membrane. That antigen is then added to the patient’s T-cells in an autologous procedure, creating the treatment for readministration. With TCR-T however, the approach is inverted. TCRs recognize “neoantigens” which are new uniquely mutated antigens recombined by cancer cells. They are not previously recognized by the immune system and are unique to each person.

TCRs unlike CARs can recognize tumor-specific neoantigens on the inside of cancer cells rather than only standard cancer antigens displayed on the outside. Fragments of these unique neoantigens appear on the cell membrane which is how TCRs can read what’s on the inside of the cell, but the key is they are unique to that specific cancer of that specific person.

Theoretically, this approach is even more targeted than CAR-T which makes use of widely known cancer antigens that are not unique to each patient. This is what enables Sleeping Beauty to potentially be effective against solid tumors, which are full of unique neoantigens. That is the biggest advantage for Ziopharm’s approach. However, the fact that TCRs are unique to each patient requires that the Sleeping Beauty approach be autologous, and therefore expensive.

Here is where the main risk comes in to the Ziopharm equation. Companies like Cellectis or Atara for instance, are shooting for the allogeneic off-the-shelf approach that would severely undercut a firm like Ziopharm in the market on a given indication. If the allogeneic approach proves effective against solid tumors as well, then Cellectis has the clear advantage across the board. If, however, the more expensive TCR autologous approach is what is required to successfully treat solid tumors, then Ziopharm could succeed here, keeping Cellectis primarily in the liquid cancer sphere.

Sleeping Beauty CAR-T

Mitigating the Cellectis/Ziopharm divide on this point somewhat is Ziopharm’s allogeneic Sleeping Beauty CAR-T treatment for those with blood cancers who have relapsed after a bone marrow or blood stem cell transplant. So yes, Ziopharm also has a purely allogeneic candidate as well, though progression free survival rates for patients on this therapy after blood stem cell transplant were 53% so far. Cellectis results for its UCART candidates have been higher.

Conclusion

Ultimately, if Ziopharm’s TCR approach pays off is a question that will only be answered with significant time, and any position in Ziopharm is purely speculative at this point. Volatility will continue for the foreseeable future. Longer term though, whether the TCR approach will be more effective in treating solid tumors than CAR-T, will be the operative question.

For investors who want a speculative stake in all permutations of the CAR-T space, Ziopharm occupies this specific TCR niche and will cover that base, but that doesn’t change the nature of the stock being essentially speculative.

As for cash runway, the company has over $100M in liquidity sufficient to fund its projects through the first half of 2021, which will cover three planned data readouts by then. At that point, where the stock will be, your guess is as good as mine, and my preference in terms of risk benefit analysis as well as near term upside catalysts continues to be Cellectis and secondarily Atara over others.

Disclosure: I am/we are long CLLS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.