GE Keeps Proving The Doubters Wrong

by Adam Levine-Weinberg CFASummary

- GE posted better than expected earnings and cash flow in the fourth quarter of 2019.

- Management expects free cash flow to rise to between $2 billion and $4 billion in 2020, despite headwinds from asset sales.

- GE is also on track to achieve its leverage targets by the end of this year.

- Free cash flow could surge to $10 billion within five years, as long as GE can achieve modestly positive cash flow from its struggling power and renewables segments.

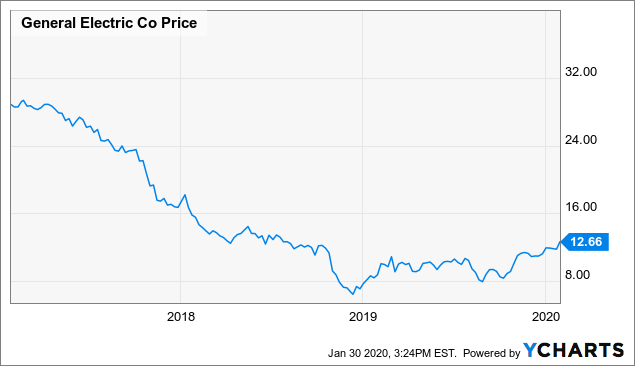

Shares of General Electric (GE) were trading for around $11 in the fall of 2018, when the company decided to replace short-lived CEO John Flannery with Larry Culp, who had joined the company's board earlier that year.

GE stock initially popped on the news that the highly-respected Danaher veteran was taking the helm. However, the gains quickly evaporated. The stock didn't bottom until December, when it touched its 2009 low below $7. For comparison, GE stock traded above $30 as recently as early 2017. Clearly, investors thought the situation at GE was so dire that even better management would not help very much.

However, over the past year, Culp and his team have demonstrated again and again that GE bears are underestimating the company's ability to recover from its recent troubles. The industrial conglomerate continued that trend earlier this week, posting better-than-expected Q4 results and predicting further improvement in 2020.

Earnings and cash flow smash expectations

In an investor presentation last March, GE provided downbeat guidance for 2019. Management projected low- to mid-single-digit organic revenue growth for its industrial segments and modest margin expansion, offset by high restructuring spending and other one-time costs, as well as other near-term cash flow headwinds.

As a result, GE's initial 2019 outlook called for adjusted EPS between $0.50 and $0.60. By contrast, it reported adjusted EPS of $0.65 for 2018. Most troubling, the company projected that it would burn $0-$2 billion of cash in 2019, after generating $4.3 billion of free cash flow a year earlier (adjusted for assets sold during 2018).

However, General Electric gradually improved its guidance over the course of 2019. By the end of the third quarter, it was calling for adjusted EPS between $0.55 and $0.65 (despite a $0.05 headwind from giving up its controlling stake in Baker Hughes) and positive industrial free cash flow of $0-$2 billion.

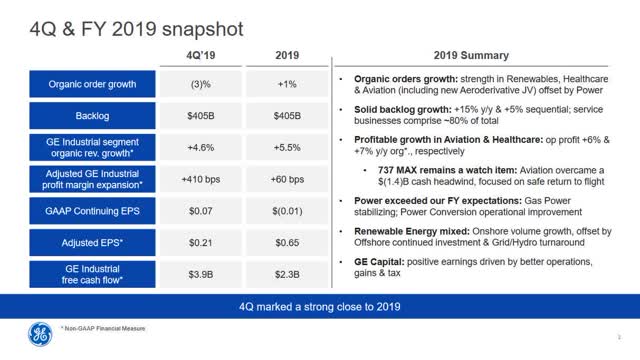

On Wednesday, GE announced that it met or exceeded the high end of its target ranges for both metrics. The company reported adjusted EPS of $0.21 for Q4, up from $0.14 a year earlier. That brought its full-year adjusted EPS to $0.65. Meanwhile, it generated $3.9 billion of industrial free cash flow in the quarter, lifting its full-year free cash flow to $2.3 billion.

(Source: General Electric Q4 2019 Earnings Presentation, slide 2)

Some of GE's cash flow outperformance was driven by lower-than-expected cash spending for restructuring. However, it only saved about $800 million on restructuring compared to its initial guidance, whereas the grounding of the Boeing 737 MAX reduced annual free cash flow by $1.4 billion.

Instead, GE Power was the biggest source of improvement relative to management's initial 2019 guidance. The company's March forecast called for GE Power to burn even more cash than the $2.3 billion it consumed in 2018 (adjusted for a realignment of its operating segments during 2019). Instead, GE Power's cash burn improved to $1.5 billion on a full-year basis.

The 2020 outlook is good

Looking ahead to 2020, GE expects low-single-digit organic revenue growth and 0-75 basis points of organic margin expansion for its industrial segments. On the other hand, the loss of its controlling stake in Baker Hughes and the pending sale of its BioPharma business to Danaher (expected to close this quarter) will weigh on earnings and cash flow this year.

Considering those factors, GE's initial 2020 guidance calls for adjusted EPS to decline to between $0.50 and $0.60. However, industrial free cash flow is expected to improve again, this time to between $2 billion and $4 billion.

Just as importantly, GE is on track to achieve its leverage targets by the end of this year, thanks to nearly $30 billion of expected proceeds from selling the BioPharma business and the rest of its Baker Hughes stake. Net debt should decline to less than 2.5 times EBITDA for GE's industrial business by year-end, while GE Capital will maintain a debt-to-equity ratio of less than 4-to-1. That will leave the company with ample room on its balance sheet to absorb any additional losses from its legacy insurance operations or other unexpected costs.

General Electric plans to provide more detail on its 2020 outlook in March. However, the company appears to expect higher cash burn in renewables, along with the loss of more than $1 billion of cash flow from the BioPharma and Baker Hughes asset sales. Improved performance across the rest of the company, lower corporate costs, and lower interest expense should more than make up for these headwinds, though.

Driving cash flow growth by not losing money

While GE's free cash flow far surpassed the company's initial guidance last year and is on track to rise again in 2020, skeptics might note that free cash flow remains rather low compared to GE's valuation. Indeed, as of Thursday afternoon, GE's market cap was approximately $110 billion, meaning the stock trades for 47 times 2019 free cash flow and more than 27 times the high end of management's 2020 free cash flow forecast.

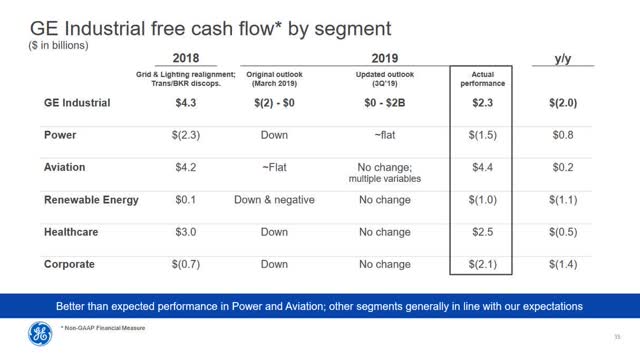

That said, GE's power and renewables segments together burned $2.5 billion of cash last year. The corporate segment also burned $2.1 billion in 2019, compared to just $700 million a year earlier.

(Source: General Electric Q4 2019 Earnings Presentation, slide 15)

Just getting the power and renewables businesses to cash breakeven while reducing corporate cash burn could bolster GE's free cash flow by $3 billion or more. If GE can get corporate cash burn back to 2018 levels within a few years, while achieving a paltry low-single-digit free cash flow margin for power and renewables, the upside (relative to 2019) could reach $5 billion.

The loss of cash flow from BioPharma and Baker Hughes is a known headwind of approximately $1.65 billion that will filter through over the next year or two. However, lower interest expense from GE's debt reduction could offset about half of that lost cash flow. Thus, even after factoring in these asset sales, free cash flow could at least double and possibly nearly triple compared to 2019 just by restructuring GE's underperforming businesses to make them slightly cash-positive.

Additional upside comes from the continued growth of GE Aviation and (to a lesser extent) the remaining part of GE Healthcare. Both segments participate in secular growth industries. GE Aviation in particular is poised to ride a wave of growth in high-margin services revenue due to a surge in new commercial jet deliveries in recent years.

As a result, GE's annual free cash flow could reach $10 billion by the mid-2020s. That provides plenty of additional upside for GE shares in 2020 and over the next few years, even after the stock's recent rally.

If you enjoyed this article, please scroll up and click the follow button to receive updates on my latest research covering the airline, auto, retail, and real estate industries.

Disclosure: I am/we are long GE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.