Chevron posts steepest loss in a decade after gas writedown

by Kevin CrowleyChevron Corp. posted its biggest loss in a decade after it wrote down the value of North American natural gas fields and returns plunged from overseas refining and oil production.

- Most of the fourth-quarter loss stemmed from US$10.4 billion in previously announced impairments. Profit from the company’s international downstream and upstream divisions also sank.

Key Insights

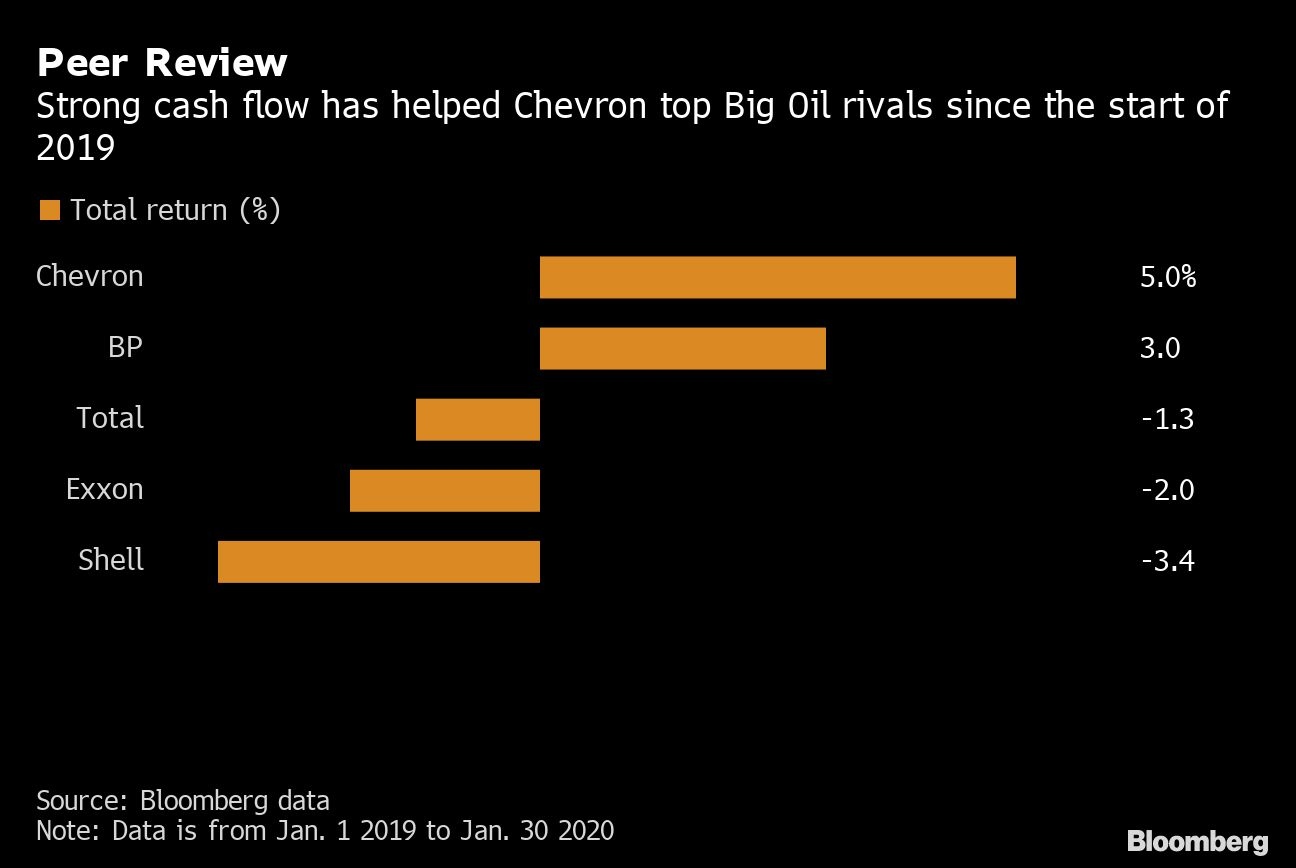

Chevron Chief Executive Officer Mike Wirth is differentiating the oil explorer from some of its biggest rivals by funding heftier shareholder payouts and buybacks with cash rather than borrowed money.

- Royal Dutch Shell Plc rowed back on buyback plans and Exxon is facing another quarter of resorting to debt or asset sales to cover dividends.

- Investors are keenly interested in whether the expansion of one of Chevron’s marquee fields in Central Asia will face additional cost increases.

Market Reaction

- Chevron fell as much as 1.4 per cent in pre-market trading in New York.