Zombies and Bears Beware, BABA Stock Will Defeat You!

There are plenty of reasons to buy BABA stock despite today’s selling contagion

If misery loves company, Alibaba Group (NYSE:BABA) bulls are not alone. But if you want to avoid having a more sickly trading account, sidestep today’s headline risks with a smarter BABA stock purchase on healthy price weakness in the weeks ahead.

For most Chinese stocks, the risk-off trade is back in action. The quick bearish shift in sentiment towards these companies is of course tied to the still growing coronavirus. The disease is also punishing China’s economy and many of its businesses in the short-term. And as one of the country’s largest enterprises, Alibaba’s stock is obviously not immune to these problems.

Still, as important as it is to not ignore the scope of damage done and what could become a larger problem, history is on the side of remaining optimistic. That means looking for investment opportunities amid the panic. The likely reality is a zombie apocalypse will have to wait. And again, BABA stock is a leading candidate to buy as the market rights itself back up.

From Alibaba’s attractive war chest of cash whose shares are much more reasonably priced than Apple’s (NASDAQ:AAPL) or Amazon’s (NASDAQ:AMZN), there are good reasons to see a positive endgame for the stock. Nevertheless, buying with less pain and suffering is increased if one turns the purchase decision over to the price chart and a bit of patient behavior.

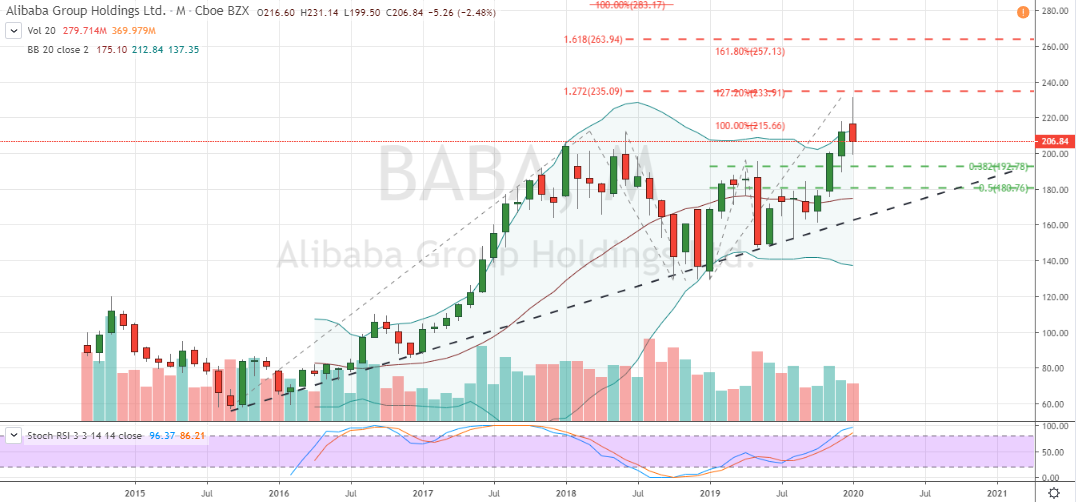

BABA Stock Monthly Chart

Source: Charts by TradingView

The provided detailed monthly chart shows 2019 was a good one for BABA stock. Shares gained nearly 55% on the year and finished the strong market-beating performance by breaking out of a large W-shaped base nearly two years in the making to fresh all-time highs.

As I wrote at InvestorPlace just over two months ago, an equal size leg out of the large corrective pattern could lead to Alibaba shares rallying towards $275 – $300 in 2020. Right now though, decent gains have resulted in an overbought condition. There’s also a possible topping candle against some lower layers of Fibonacci resistance to consider. It’s my view that the riskier price action needs to be respected in the near-term.

In my estimation, shares of Alibaba could correct down towards $181 – $195 before all is said and done. This support area is backed technically by a couple Fibonacci levels and a longstanding trend-line. Further, a correction of roughly 16% – 22% within an uptrend is not only healthy, it’s also common for a stock of Alibaba’s stature.

Still, to reduce the chance of failure, there’s more to look at than shares simply entering a trading range of interest before acting on a purchase.

Should BABA stock cooperate with the outlook and trade into our support zone, I’d suggest using the weekly chart to time a buying decision. If shares can then confirm a bottoming candlestick coupled with a bullish stochastics crossover, in either neutral or oversold territory, then, and only then, would I be willing to bet the zombie apocalypse is dead in its tracks.

Investment accounts under Christopher Tyler’s management do not currently own positions in securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits