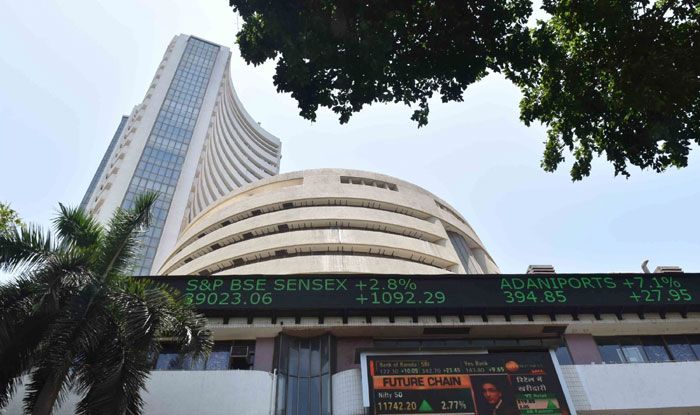

Markets Recoil as Economic Survey Stokes Fiscal Slippage Fears

The 30-share BSE Sensex closed 190.33 points, or 0.47 per cent, lower at 40,723.49. Likewise, the broader NSE Nifty shed 73.70 points, or 0.61 per cent, to finish at 11,962.10.

The Sensex skidded 190 points while the Nifty closed below the 12,000-mark on Friday after the Economic Survey suggested relaxing fiscal deficit target to boost growth from a decade low.

Related Stories

- Economic Survey 2019-20 Tabled in Parliament, Sees Pick up in Growth

- Economic Survey 2020: Why CEA Refers to Band Baaja Baaraat Movie

- Economic Survey 2020: Are Indians Paying More For a Thali? Enters Thalinomics

Markets had opened on a firm footing, but came under selling pressure in afternoon trade, coinciding with the opening of the Budget session of Parliament and tabling of the Economic Survey.

The 30-share BSE Sensex closed 190.33 points, or 0.47 per cent, lower at 40,723.49. Likewise, the broader NSE Nifty shed 73.70 points, or 0.61 per cent, to finish at 11,962.10.

The Economic Survey projected revival of economic growth to 6-6.5 per cent in the next fiscal from 5 per cent estimated in 2019-20. However, it recommended relaxing the budget deficit target to boost growth.

Traders said the prospects of increased government borrowing and crowding out of private sector investment spooked market participants, triggering unwinding of positions.

ONGC was the top laggard in the Sensex pack, dropping 5.80 per cent, followed by PowerGrid, HCL Tech, TCS, Tata Steel and Reliance Industries.

Kotak Mahindra Bank was the top gainer, spurting 3.87 per cent, after the lender settled its dispute with RBI regarding promoter Uday Kotak’s stake.

SBI rose 2.53 per cent after the country’s largest lender reported a 41 per cent jump in net profit to Rs 6,797.25 crore for the December quarter.

Other winners included IndusInd Bank, Bharti Airtel, Bajaj Auto and Hero MotoCorp.

Attention now shifts to the Union Budget, to be presented by Finance Minister Nirmala Sitharaman on Saturday. Markets will remain open on Budget Day.

“Investors stayed away from taking fresh positions ahead of the big event. Focus will turn to Union Budget as all eyes will be on how Centre is going to bring growth as any increase in spending would result in widening of fiscal deficit.

“Global economy is also on the edge with slow growth fears significantly high after the outbreak of the virus,” said Vinod Nair, Head of Research at Geojit Financial Services.

Sectorally, BSE oil and gas, energy, metal, utilities, power, basic materials, IT and auto indices fell up to 2.65 per cent.

Telecom, realty, consumer durables, bankex and finance rose up to 1.23 per cent.

Broader BSE midcap and smallcap indices ended in the red.

On the global front, sentiment remained weak as investors assessed the impact of the China coronavirus outbreak.

The death toll in China’s coronavirus epidemic spiked to 213 and total infections reached 9,692, the Chinese government said on Friday as the World Health Organisation declared the outbreak that has spread to more than a dozen countries, including India, as a global health emergency.

Bourses in Hong Kong and South Korea ended in the red, while Japan rose 1 per cent. Markets in China remained closed.

Stock exchanges in Europe opened on a negative note.

Brent crude oil futures rose 0.38 per cent to USD 57.55 per barrel.

Meanwhile, the Indian rupee appreciated 23 paise to 71.35 per US dollar (intra-day).

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Business Latest News on India.com.

Comments - Join the Discussion