The Light From The Gods Still Shines Bright - Raytheon Company Delivers In Q4

by Cestrian Capital ResearchSummary

- Raytheon Company just posted its Q4 numbers. 2019 was a great year, with strong growth at every level.

- Backlog is growing faster than bookings, bookings faster than revenue - so revenue growth can accelerate.

- We're in the fifth stage of grief (upturn) concerning the RTN/UTX "merger", which we dislike intently due to the dilution of RTN's defense sector purity.

- If you're at stage seven (acceptance and hope) you could justify buying RTN at these levels. We're at Neutral, but only because of the pending Q2 merger completion. We'll revisit thereafter.

DISCLAIMER: This article is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this article is not an offer to sell or buy any securities. Nothing in it is intended to be investment advice and it should not be relied upon to make investment decisions. Cestrian Capital Research Inc or its employees or the author of this article or related persons may have a position in any investments mentioned in this article. Any opinions or probabilities expressed in this report are those of the author as of the article date of publication and are subject to change without notice.

Background

Raytheon (RTN) (trans., "Light From The Gods", after the glow from the helium rectifier invented by the company in its early days) delivered a very good 2019. As this was either its final or its penultimate earnings release in its current corporate form, we thought we would give the stock a final writeup before it falls into the clutches of United Technologies (UTX) sometime in Q2.

RTN was a favorite of ours back before the UTX "merger" was announced.(Note, it's actually an acquisition of RTN by UTX - the UTX management team will be running the show, and UTX is driving the completion timetable) It's one of the purest of pureplay defense stocks out there.

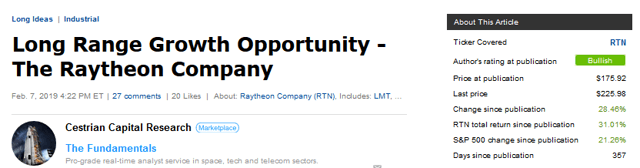

We went to Buy on RTN here on Seeking Alpha back in February 2019, a good call as it turned out.

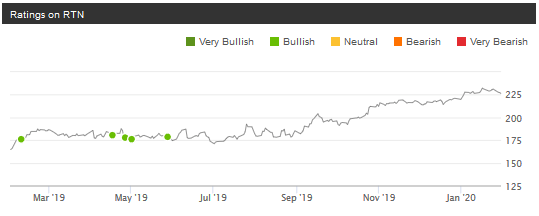

We posted a number of further notes too, all at Buy. Here's our history on SA:

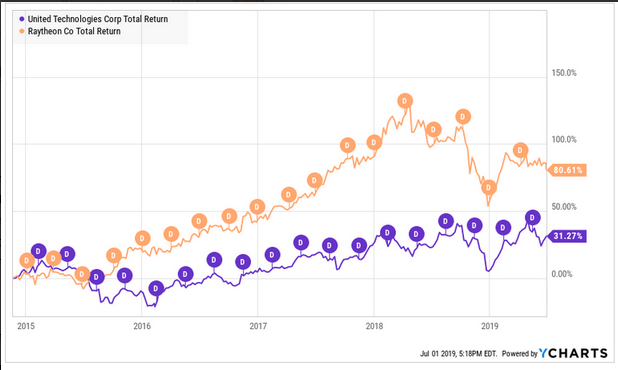

And then came the UTX merger news. This we felt was a poor move for RTN shareholders. The management team leading RTN had delivered significantly greater value than the team leading UTX - yet the latter would be running the show at the combined company. Here's the evidence - start date of the chart is the day UTX CEO Greg Hayes first got the big chair at that company. Final date of the chart is July 1 2019, a couple of weeks after the merger was announced. 81% total return for RTN versus 31% total return for UTX. Now clearly UTX may be more difficult to manage, but you get the point.

Mainly we were and are convinced that the dilution of RTN's defense purity will be bad news for RTN shareholders. Exposure to products like civilian airliner engines, as made by UTX, isn't all that appealing since the revenue tends to be more cyclical than defense.

No matter. Let's turn back to RTN's numbers in 2019.

2019

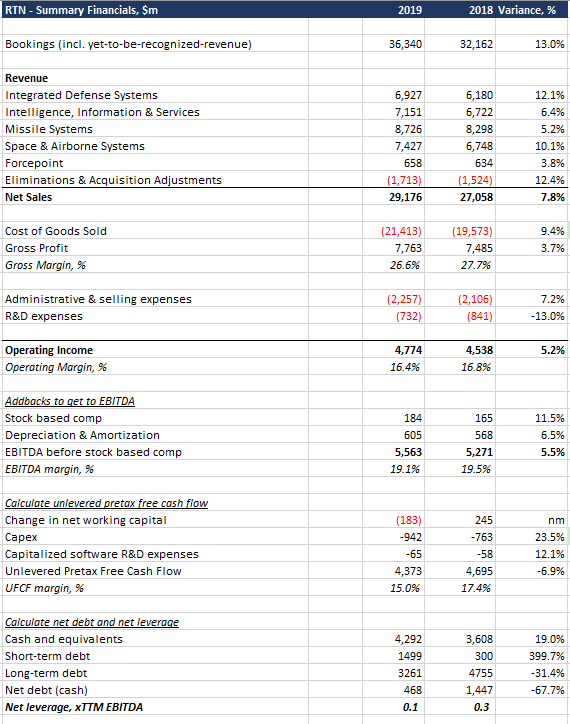

RTN just put in a great year. Here's the numbers.

The good:

Strong revenue growth at a touch under 8%;

Sound growth in profits howsoever defined (GAAP operating income +5.2%, non-GAAP EBITDA as we calculate above, +5.5%);

Balance sheet is almost in a net cash position at just 0.1x TTM EBITDA net leverage.

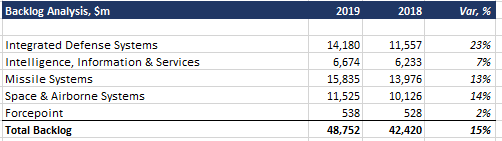

Backlog growth looks great too:

Backlog is important in companies like RTN - it's a pretty clear signpost telling you which direction the revenue is going to go in. Here, RTN's growing backlog tells you that revenue growth is likely to tick up over time, because backlog growth is +15%, bookings growth +13%, and revenue growth +7.8%.

If this stuff is new to you, basically, think of backlog as a very long range (multiple year) view, bookings as long range (1-2 yr) and revenue as what's happening sort-of-now. If backlog and bookings growth are faster than revenue growth then it's likely that rev growth will tick up - and the converse is also true. This isn't a very technical explanation but it's more or less correct!

The bad:

Not much. Margins are down (mainly because cost of goods sold grew a lot faster than revenue, and this is a low gross margin business so that depression in gross margin really hits the bottom line) and cashflow was impacted by a working capital outflow and a step-up in capex.

We asked the company about these items. On margins / COGS they feel that's a result of staff cost increases in those functions that fall under COGS. We don't have more detail available but we'd say there's probably a worsening bill-of-materials effect at work here too. Not a big deal right now but if that gross margin starts heading down towards 25% it needs watching. The capex increase was, they say, lower than flagged earlier in the year and was a result of factory upgrades and new test facilities being constructed. Certainly the overall capex as a % sales is fairly low so again no big deal here.

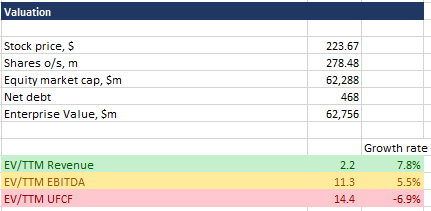

Valuation

We like to look at valuation as a function of growth. We've color coded it for ease of use. 2.2x TTM revenue for 8% growth is good, 11.3x EBITDA for 6% growth is OK, cashflow multiple isn't good because cashflow declined - but that's a function of capex and working capital outflow which we don't think are structural issues - so you can ignore that multiple as we expect it to shrink as cashflow grows.

So - on revenue and EBITDA multiples this would in other circumstances be a good solid buy.

And there's the rub. The stock you buy today - RTN - will tomorrow be a stock (UTX/RTN) in a company you don't know.

You can't even do a pro forma of RTN + UTX yet. UTX apparently plan to do a further disposal pre the merger completing - what is being sold we are not sure, but we've heard it said that it could be an optics business which competes with RTN (ie. a defense business) - which again will dilute the final quality of earnings.

So we'll sit tight, wait for the merger to complete, and review the combined stock then. The story is that Carrier and Otis will spin out of UTX on the same day that UTX/RTN completes. Lawyers billing a lot of hours on that day (and night!).

Cestrian Capital Research, Inc - 30 Jan 2020.

Thanks for reading our note. If you enjoyed it, try our SA subscription service, The Fundamentals.

We operate the ONLY space-sector service on SeekingAlpha.

Here's what you get:

- Deep sector expertise & broad coverage in the space sector.

- Pro-grade analysis, easy-to-understand presentation.

- 100% independent, clear and direct opinion of stocks' prospects.

- Long-term investment picks and short-term trading ideas.

- Absolute alignment with our own investing. We run a real-money service and we give you the heads up on every move we make. Any trade we make, you get to trade first.

We speak directly to our covered companies, often at CEO level.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.