General Electric Slams It Out Of The Park

by Daniel JonesSummary

- Contrary to fears from many market participants, General Electric appears to be turning a corner.

- The company's latest release reveals strong performance when it comes to cash flow and good results moving forward.

- This presents investors with attractive prospects in the long run, but that assumes recent results don't diminish in the future.

It's still early in 2020, but even now it's looking like industrial conglomerate General Electric (GE) is being set up for a great year. In its earnings release for the fourth quarter of its 2019 fiscal year released on January 29th, the management team at the firm posted robust results. These are indicative of a nice recovery at the entity's core businesses. Moving forward, investors should expect continued strong performance for the business, performance that in turn will help to propel shares higher.

Excellent results

By most accounts, General Electric managed to post strong results for the fourth quarter of its 2019 fiscal year. This helped to push shares up 10.3% on January 29th. There were so many bright spots that it's actually difficult to know where to start. Perhaps the best approach would be to provide a general overview of the company's results and dig in deeper from there. To begin with, let's look at free cash flow.

During 2019, industrial level free cash flow was a big area of pain for the conglomerate. Through the third quarter, free cash flow here totaled around -$1.562 billion. For a business divesting of assets and trying to reduce debt, this is a big negative. During the fourth quarter, however, things turned around and the company ended up reporting industrial free cash flow during this period of $3.884 billion, putting 2019's total industrial free cash flow up to $2.322 billion. Operational performance was a contributor to this naturally, but the largest individual contributor was a cash-positive change to working capital in the amount of $1.6 billion.

This cash flow generated by the firm, combined with the effects of its divestitures and other debt-reduction initiatives, was instrumental in driving net debt at the industrial level during the 2019 fiscal year down by $7 billion from $55 billion in 2018 to $48 billion today. This disparity translates to a net leverage ratio for General Electric as a whole of 4.2 vs. 4.8 a year earlier. With the sale of its BioPharma business, which management still believes will happen with net cash to the firm of about $20 billion, leverage is expected to fall to 4 for the entity's Capital operations while industrial net leverage should fall to less than 2.5 by the end of the year.

Another big win for the conglomerate came on the side of backlog. Backlog in 2019 ended at $404.6 billion. This represents an increase of 15% year-over-year and is up 5% from the third quarter last year. Total orders of $24.9 billion, though down year-over-year, eclipsed revenue and served as the driver here. Digging in deeper, it was General Electric's Aviation segment that really brought home the bacon.

During the fourth quarter, Aviation, due in part to a parts distribution deal for legacy engines, saw orders come in at $10.7 billion. Overall backlog for the business grew in 2019. For the fourth quarter, this was compared to just $8.9 billion in revenue. Renewable Energy's orders of $4.7 billion matched the segment's revenues, while orders of Power came in at $4.5 billion versus the $5.4 billion in sales the segment reported. Speaking of Aviation, it's important to point out that it once again was the biggest value-driver for the conglomerate. Fourth-quarter segment profit of $2.1 billion helped to generate segment-level free cash flow of $4.4 billion. In 2018, this figure was lower at $4.2 billion.

This may seem peculiar to those watching the entire Boeing (BA) fiasco regarding the company's 737 Max aircraft. Last year, the 737 Max was grounded in many countries across the globe. Though this was no fault on the part of General Electric, the company suffered anyways. According to management, Aviation missed out on $1.4 billion in cash during the year because of the issue. The fact that results were so strong despite this should serve as a testament to the business's resilience and quality.

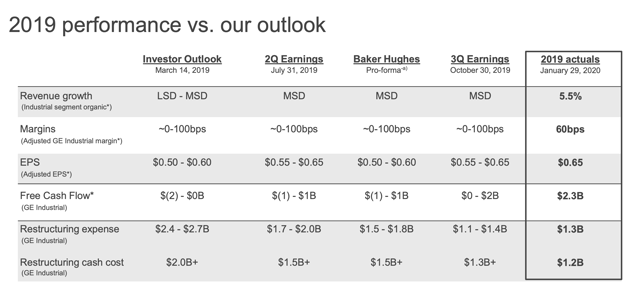

Taken from General Electric

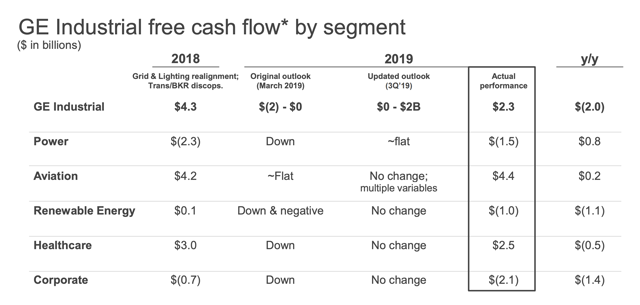

Aviation is not the only part of General Electric that is doing well though. As the image above illustrates, overall results for the company have been impressive. At the start of 2019, management expected cash costs related to restructuring to be $2 billion. This ended up lower at $1.2 billion. Management anticipated that Power and Aviation would do worse. They both fared better. On the whole, the company expected industrial free cash flow to range between $0 and -$2 billion. It ended up at $2.3 billion in the green. Power continues to show signs of stabilization and Aviation proves that it's the leader for the business. In the image below, you can see other ways at looking at how strong 2019 really was compared to management's expectations.

Taken from General Electric

Expected 2020 to be great

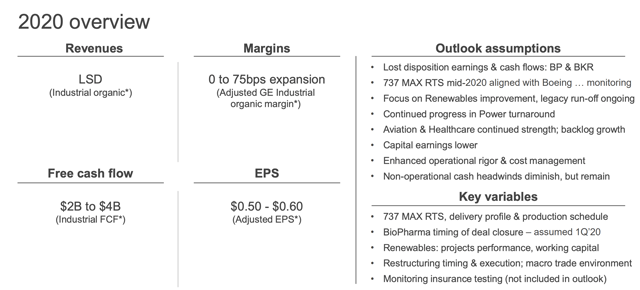

The way things are going, this current year will be great for General Electric. As the image below illustrates, the company believes that 2020 will be an improvement over what was seen in 2019. True, organic revenue growth will be weak at the low single digits range (versus 5.5% in 2019), but earnings per share will be between $0.50 and $0.60. Even better, though, is industrial free cash flow. This is slated to range between $3 billion and $4 billion.

Taken from General Electric

A year is a long time and a lot of things could happen during that period. Even so, it's likely that management is setting the bar low for this year, just as it seems to have done last year as well. It is possible that more pain could be ahead, but if the recent past is anything to base the future off of and if Power continues to recover, then we could be looking at a positive surprise by the end of 2020.

It is worth noting that these results for General Electric include two major assumptions. First, that BioPharma does end up selling. According to management, BioPharma brought General Electric $1.3 billion in cash flow and $1.5 billion in profit last year. Technically, the longer the company holds onto it, all other things remaining unchanged, the higher cash flow and earnings should be. A change in timing and/or price of the deal could affect results. Second, management's guidance assumes that the 737 Max will return to service mid-2020. If the aircraft remain grounded longer, this could be painful, but it's unlikely to harm the company materially in the very long run.

Takeaway

Right now, investors seem to be very excited with what they are seeing at General Electric. I don't blame them. The business managed to do exceptionally well during the quarter. Strong cash flows, combined with a forecast of better things to come and clarity on several fronts (BioPharma, the 737 Max issue, Power's turnaround, etc…), point toward a bright future for the business and its shareholders.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.