IBM turns to technologist chief for cloud computing battle

Arvind Krishna has already pushed group to catch up with cloud computing leaders

by Richard WatersFor a company in the middle of a technological upheaval, who better to turn to for leadership than a technologist?

IBM became the latest big US tech company to employ that maxim on Thursday as it announced that Arvind Krishna, a 30-year veteran of the company whose career has included key technical and research roles, would take over as its chief executive in April.

Mr Krishna’s elevation echoes the rise of Satya Nadella at Microsoft and Shantanu Narayen at Adobe — and not just because they, too, were Indian-born engineers who took over at prominent US tech companies that were going through a midlife crisis.

Both also followed in the footsteps of executives who had risen in non-technical roles, before going on to carve out a new technology path that helped make their companies Wall Street darlings.

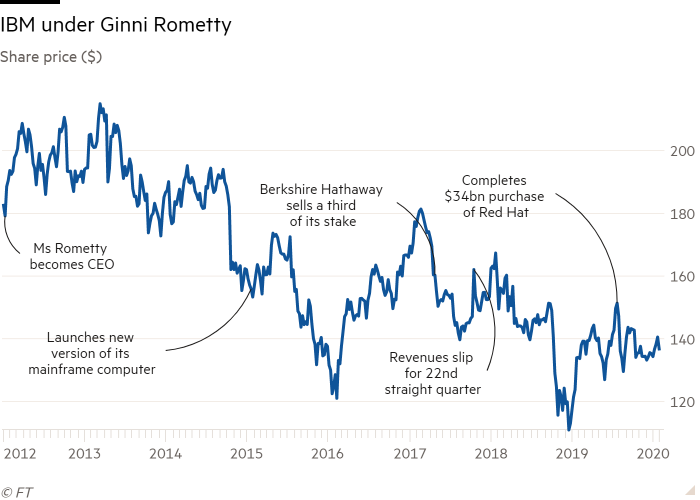

In contrast to Mr Krishna — an engineer trained at the Indian Institute of Technology and the University of Illinois and has 15 patents to his name — outgoing chief executive Ginni Rometty forged a career in sales and general management. Her elevation, at the start of 2012, appeared to coincide with a moment of technological stability.

Only weeks before, Warren Buffett, famed for an aversion to taking technology risk in his investments, had placed a huge bet on the company. But with cloud computing reshaping the tech world, that stability quickly turned out to be a mirage.

Shares in IBM stand about 25 per cent lower than when Ms Rometty, who will stay on as executive chairman until the end of the year, took over. In the same period the broader US stock market has risen more than 150 per cent.

“The challenge [Ms Rometty] had is that the tech industry had its foundation ripped out by the cloud,” said Frank Gens, an analyst at tech research firm IDC. The giant IT integration projects and outsourcing contracts that had been IBM’s bread and butter started to ebb, as customers shifted more of their computing workloads to the cloud.

That could make the problem before Mr Krishna greater than that faced by either Mr Nadella or Mr Shantanu, whose companies were also threatened by the cloud transition.

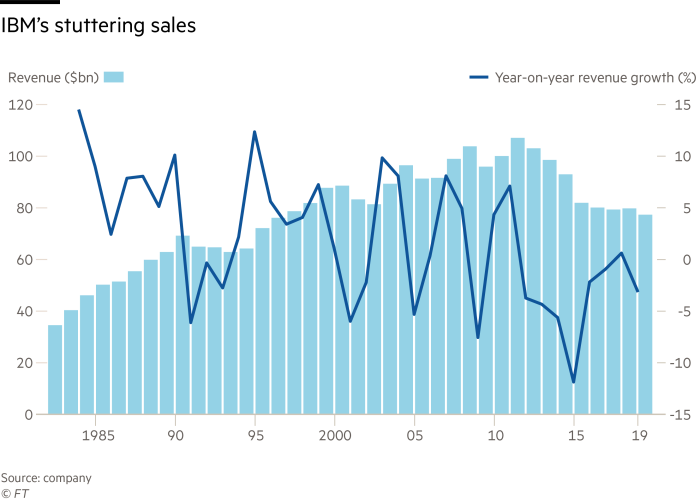

About 70 per cent of Big Blue’s business still comes from “legacy” hardware, software and services business, where revenue is shrinking 5-10 per cent a year, said Moshe Katri, an analyst at Wedbush Securities. Newer, growth businesses — like AI, security and the cloud — have not been enough to make up for the shortfall, and IBM’s revenue of $77bn in 2019 was 28 per cent below the peak year of 2011.

Things may finally be reaching a tipping point. After contracting in 26 out of the previous 30 quarters, IBM’s revenue edged up again in the final months of last year.

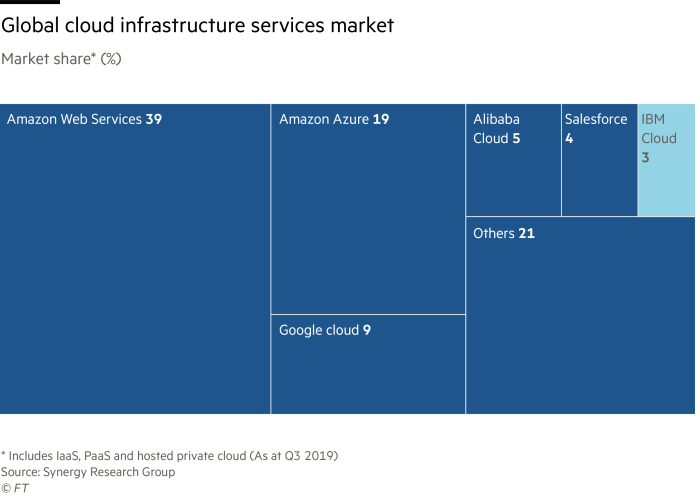

On its own, however, this has not produced an answer to the main question facing IBM: How it can thrive in a world where an ever-increasing share of the corporate IT market is being sucked into the clouds run by giants like Amazon Web Services, Google and Microsoft.

It was Mr Krishna who came up with a technological answer, and who has now been handed the job of seeing it through.

In 2018, he masterminded the $34bn purchase of Red Hat, by far the biggest acquisition IBM had ever attempted. The open source software company is known mainly for its work supporting the Linux operating system. But the acquisition has also brought IBM what could be a key piece of technology, making it possible for customers to shift their computing workloads between the huge clouds, something that could free them from a dependence on any of the new giants.

“Customers are going to demand their technology runs on any cloud,” said Mr Gens, putting IBM in a stronger position to act as the orchestrator of a client’s IT across this new IT landscape.

It is not alone in pursuing this new “multi-cloud” market, however: Google, Microsoft, Amazon and VMware have all developed similar software of their own, making this the next important front in the cloud computing wars.

Meanwhile, IBM is counting on Red Hat for much more than a strategic piece of technology. The acquisition will also bring IBM something it has been starved of, said Mr Gens: a way to tap into a much bigger community of developers. Drawing more people to innovate on top of its own technology is critical if IBM is to compete with cloud platforms like Amazon and Microsoft, which have come to exert a powerful gravitational pull over developers.

The significance of Red Hat to Big Blue’s future was underlined on Thursday when Jim Whitehurst, its head, was named president of IBM, a title that the company has traditionally reserved for the heir apparent to its own chief executive. Many IBM watchers had been expecting Mr Whitehurst to vault straight to the top, putting the remaking of IBM in the hands of an outsider, just as happened nearly 30 years ago when IBM reacted to an earlier crisis by turning to an outside chief executive.

Given the complexity of its business, picking a chief executive who lacked knowledge of its history and culture might have been a step too far, said Mr Katri. But at 52, five years younger than Mr Krishna, Mr Whitehurst is now in pole position for the next change at the top.