Boeing: A Lot Of Pain With Light At The End Of The Tunnel

by Daniel JonesSummary

- Boeing experienced a great deal of pain last year due to its 737 Max issues.

- These problems have extended into 2020 and will likely persist during at least the first half of the year.

- The balance sheet isn't as stable as management's presentation suggests, but the company should be fine long-term.

- This is a great long-term prospect, so long as 737 Max's grounding does not last too much beyond expectations.

If there is one major industrial conglomerate on the market that has been faced with an inordinate amount of pain in recent months, it would have to be Boeing (NYSE:BA). The airplane manufacturer and services provider has been slammed by the grounding of its 737 Max aircraft. For months, investors wondered what the full impact of this would be. With the release of its fourth-quarter earnings release for its 2019 fiscal year on January 29th, market participants are finally starting to get a glimpse at the damage. Truth be told, it ain't pretty, but when you consider where Boeing is and the resources at its disposal, this is a short-term bump (a big one), but not something that will affect the company's true, long-term potential much. As the saying goes, buy when there's blood in the streets, even if it's your own blood.

A lot of pain

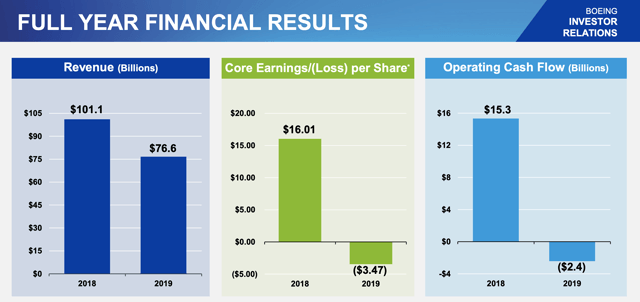

No matter how you stack it, the financial picture at Boeing is less than ideal. For starters, consider the revenue generated by the conglomerate during its fourth quarter last year. According to management, this figure came out to $17.91 billion. This represents a 37% decline from the $28.34 billion the company generated the same quarter a year earlier. The revenue figure was actually $3.85 billion lower than analysts anticipated, making this a rather substantial stumble for the firm. As a result of this, total annual revenue for 2019 came out to $76.56 billion, 24% below 2018's level of $101.13 billion.

Taken from Boeing

For those who think that the pain would have only come from the company's Commercial Airplanes business, think again. Year-over-year, that segment's revenue did tank 44%, but the company's Defense, Space, and Security segment also reported a decline in sales of 1%. This doesn't sound like much, but it's skewed by the early part of 2019 when results were still strong. In the fourth quarter, this latter segment's revenue was down 13% year-over-year. While its Global Services business saw annual revenue grow 8% compared to 2018, fourth-quarter results were down 5%.

Though it may be hard to believe, the bottom line was uglier for the business than the top line. Based on the data provided, Boeing saw a net loss in the quarter of $1.01 billion. This represented a decline of nearly $4 billion from the $3.42 billion gain the company saw during the fourth quarter of its 2018 fiscal year. As a result of this substantial loss, the company actually reported a loss of $636 million for 2019 as a whole. That's its first loss for a year in over two decades and compares to the $10.46 billion in earnings the company generated in 2018.

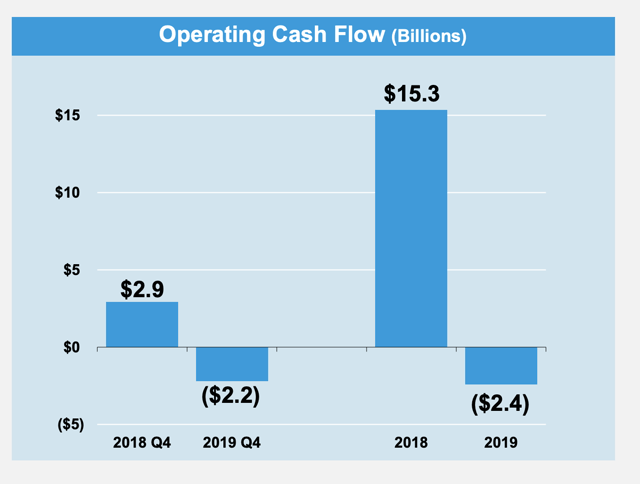

Net income/loss is incredibly important for a firm, but more important than that even is cash flow. Operating cash flow for the fourth quarter totaled -$2.22 billion while free cash flow was -$2.67 billion. A year ago, these figures were $2.95 billion and $2.45 billion, respectively. The fourth quarter wasn't the only tough time for Boeing from a cash flow perspective though. The company actually saw a net outflow of cash during 2019 in the amount of $4.28 billion. This is worlds apart from the net inflow of $15.32 billion management reported for the company's 2018 fiscal year.

Taken from Boeing

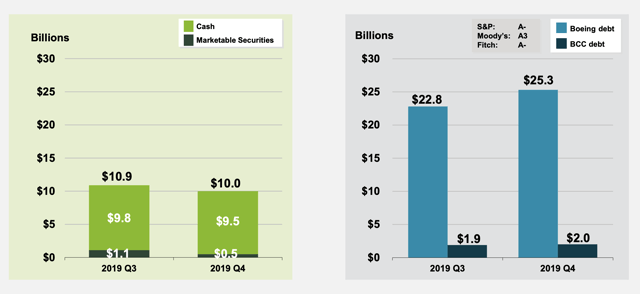

At first glance, it may seem amazing, then to know that the company's cash and debt position did not change all that much during 2019. The company ended the year with $10 billion in cash and cash equivalents on hand, down only $0.9 billion from 2018's end. Debt, meanwhile, rose from $24.7 billion to $27.3 billion. These are not monumental changes. That said, where cash changes show up, on a true net basis, can be deceiving. When a big firm like Boeing is struggling, it has the ability to stick it to suppliers and it looks like that's precisely what happened. Year-over-year, the business saw its accounts payable rise by $2.64 billion. Its accrued liabilities rose even further, a full $8.06 billion. There are other areas where, when examined, it becomes clear just how stretched the company was just to achieve the results that it did.

Taken from Boeing

By really every account, things were ugly during the quarter. This is just as most market watchers might have expected. In 2019, for instance, the company saw only 127 deliveries of its 737 Max. In 2018, this figure was 580. In the fourth quarter, Boeing delivered only 9 737 Max units. This compares to 173 a year earlier. This, combined with cancellations, also took a hammer to the company's backlog. In 2018, backlog ended at $490.48 billion. By the third quarter, this had dropped to $470.23 billion. The fourth quarter saw another drop, and this time to $463.40 billion. This is still a lot of backlog to deal with, but further drops, especially if they occur over several quarters, could start to harm the business.

The future will be better

According to latest expectations by management, the 737 Max will probably be ready to return to service sometime in the middle of this year. If this comes to pass, it will serve as a massive sigh of relief for the firm and signal a true turnaround in the business. Any extension beyond that, though, will only add to the pain. It's also true that even taking this into consideration, the pain is not over for Boeing. According to management, it saw increased costs in the fourth quarter associated with these problems in the amount of $2.6 billion. The plan moving forward is to eventually start 737 Max production again, but to maintain that production at some low (but undisclosed) level for a period of time. Management said that this resumption alone will eventually bring on an additional $4 billion worth of abnormal costs, most of which should be incurred later this year.

Though this revelation may leave investors worried about the future of the aviation giant, Boeing can very likely weather this storm. The company's net debt is still at a manageable level. What's more is the fact that the company just recently received a commitment for up to $12 billion in financing, the sole purpose of which is to survive these tough times. No doubt this will bloat the company's balance sheet further, but once the business can return to normal operations, its excess cash flows will help to offset any debt that it has. After all, if things return just to how they were in 2018, free cash flow should eventually come in at around $13.60 billion. More likely than not, this will not occur in 2020 though. A more realistic expectation would be 2021 for a full recovery.

Takeaway

Right now, there's a lot of pain facing Boeing shareholders. Having said that, from what I can see, it looks like most of that pain has already come to pass. Yes, some additional costs are around the corner, but once the company incurs these and the 737 Max is back up in the air, the company will grind itself back to its former self. This in turn could lead to a lot of value opportunities for investors looking to buy in now, but only if they can hang on for what will probably remain a bumpy ride for the foreseeable future.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.