7.3% Yield, Monthly Pay Opportunity From HFRO

by Rida MorwaSummary

- Most fixed income products are getting expensive, including preferred stocks and bonds.

- Yet we keep finding nice opportunities for fixed income investors.

- HFRO has traded flat recently while most fixed income investments have soared.

- The NAV is trending up and it now is an official addition to our portfolio at "High Dividend Opportunities".

- HFRO is a good addition for conservative investors looking for high yield with upside potential.

Co-produced with Trapping Value

If at first you do not succeed, skydiving is not for you.

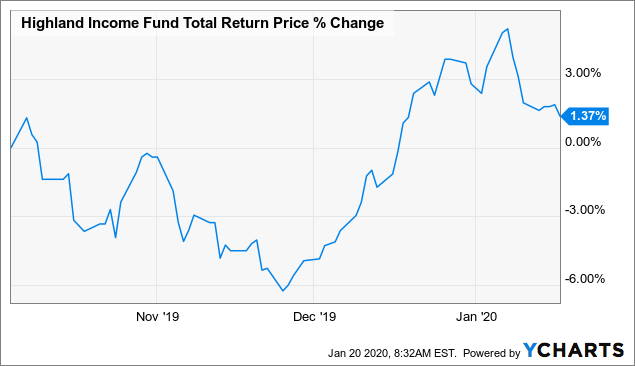

Investing on the other hand gives you quite a few opportunities to re-evaluate your position and decide whether you want to cut bait or double down. Assuming you are properly diversified with 40-60 positions, changes in your portfolio are opportunities to re-balance and take a stock of what is happening. Today we go over one such situation where we think is opportunistic for fixed income investors. Highland Income Fund (HFRO) first came into our vision when it dropped over 7% in October 2019. We highlighted it to our members as an optional pick. The price of HFRO remained mostly flat at a time when most fixed income investments have been soaring. The barely positive returns came about thanks to three distribution payments.

As we examined the case for owning this though, we figured that this was an improving opportunity rather than a misplaced bet. We go over the fundamentals for this investment below and make our case.

The Case for Owning Fixed Income

At "High Dividend Opportunities", we are recommending a 35% to 40% allocation to fixed income, as part of a balanced portfolio. The rest (60% to 65%) is allocated to high dividend stocks and funds. Our objective is to achieve an overall yield of 9-10% yield following a "value approach" by allocating to income producing assets trading at attractive valuations. For income investors, having an allocation to fixed income, rather than allocating all your funds to dividend stocks, tends to significantly lower the volatility of your portfolio. This is because many fixed income products have little correlation with the equity markets. In fact, many of our fixed income picks have gone up in price at times when the equity markets were seeing large pullbacks. If you are an income investor, we recommend that you remain well diversified to hedge your capital.

If you like investing in fixed income, you probably have noted that fixed income opportunities are becoming rare with many preferred stocks and bonds trading in bubble territory. At HDO, we continue to monitor the markets with the aim to identify undervalued opportunities for our investors.

HFRO's Assets

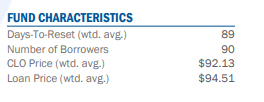

HFRO invests in a wide variety of asset classes with a focus on shorter term senior loans. The ultra-short duration of the fund can be seen when examining the reset frequency of its loans. At 89 days the fund resets almost as quickly as we have Federal Reserve meetings. That has good and bad consequences as rates can move up and down just as quickly.

Source: Highland Funds

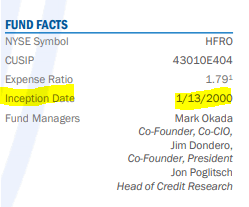

Yields that reset when short-term interest rates move are more useful in a changing interest rate environment. Such assets also have very low "duration risk", but tend to produce lower income in falling interest rate environments, like the one we are currently in. The fund has been around since early 2000 but recently converted to a closed-end format.

Source: Highland Funds

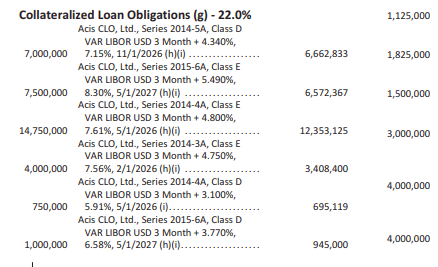

While the fund focuses on senior loans, there is a lot more to this one. For starters it has a pretty good exposure to Collateralized Loan Obligations or CLOs.

Source: Highland Funds

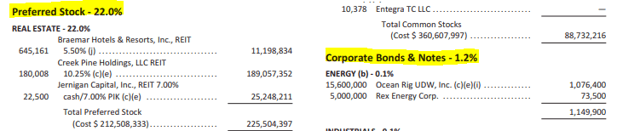

The fund also has a similar weight in preferred stock and holds a small amount of corporate bonds.

Source: Highland Funds

The fund's poor recent performance can be heavily attributed to its CLO and senior loan exposure where pricing has been rather horrendous. CLO funds like Eagle Point Credit (ECC), which yields 15.5%, and Oxford Lane Capital (OXLC), which yields 17.8%, have escaped from some of this pain as their funds have traded at a large premium to NAV. In HFRO's case, the fund had a double whammy of falling NAV and a newly opened up discount to NAV.

We expect a mean reversion of both the CLO pricing and the distance from NAV and hence we are bullish on this name.

Concentrated bets with moderately high leverage

The fund does make highly concentrated bets. For example, it has a very big bet on Creek Pine Holdings LLC, currently at 12.8%. Some investors do obsess over these things but it has never bothered us. The key reason is that we already have a wide diversified portfolio. No single investment generally makes more than 2 or 3% of our portfolio. So while the fund might be making a concentrated bet, the bet itself is a very small indirect percentage of our portfolio.

The second reason is that the fund does use leverage and that has usually been a net 40%. This is on the high side, but not unusual or a deal breaker. For comparison purposes, a fund consisting only of equity CLOs would be a more volatile asset class than HFRO. Even such funds (which invest almost exclusively in CLO equity) like ECC and OXLC, use similar levels of leverage.

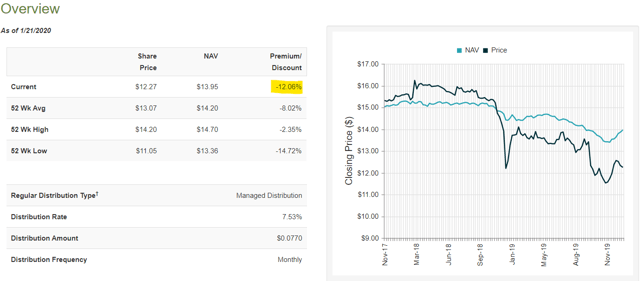

Distributions

This is a great fund for income and pays out 7.7 cents a month for $0.924 annually. The current Net Asset Value of the fund is $13.95, so the fund is generating 6.62% off "Net Asset Value". At the current price the yield is a rather strong 7.3%. Since you are buying this at a discount, you are getting the benefits of a much higher yield than if you bought these same investments at par. You are also getting to buy CLOs which are currently an extremely battered asset class, at a great discount. Remember this asset class based on market yields is currently poised to deliver over 20%-22% a year. The short term loans drive the bulk of the cash flow but the returns are powered by the CLOs. We examined the distribution and it is covered thanks to the 22% plus exposure to CLOs which bump up the overall yield.

Current backdrop

The fund is currently suing Credit Suisse for a whopping $295.2 million, which was also the reason for conversion to the CEF structure. Their preferred shares press release goes into this in detail.

The Trust and NexPoint Strategic Opportunities Fund, an affiliated fund, are the beneficiaries of a +$360 million judgment against Credit Suisse related to a syndicated real estate transaction fraudulently underwritten by Swiss bank. Credit Suisse is appealing the judgment against it. The two funds also are participants in a similar action against Credit Suisse related to five additional real estate deals in which the funds allege Credit Suisse committed fraud in relation to the underwriting. Case or Docket Number: 05-15-01463-CV. Full Names of Principal Parties: Claymore Holdings, LLC v. Credit Suisse AG, Cayman Islands Branch and Credit Suisse Securities LLC. The Trust would be entitled to 82% of any net amounts ultimately collected on the judgment against Credit Suisse.”

Source: HFRO Preferred Prospectus

If they won they would ultimately collect about $200 million net boosting NAV by about 20%. The fund has won this battle in the lower courts but recently this case was taken up by the Texas Supreme Court. The hearing was held on January 8, 2020. A follow up press release was issued by HFRO recently.

Per the order, the Texas Supreme Court will review the case at a hearing scheduled for January 8, 2020. While this prolongs the legal process, it does not affect Highland’s conviction in our claims against Credit Suisse or our commitment to recovering damages for investors. The total aggregate award stands at $393.2 million today; it is comprised of the $287.5 million judgment initially awarded by the trial court and now twice confirmed on appeal, plus $105.7 million in accrued interest. The award will continue to accrue interest in the event that the judgment becomes final. Any final judgment amount would be reduced by attorney’s fees and other litigation-related expenses. The net proceeds would then be allocated to the Funds based on respective damages (approximately 82% to HFRO and 18% to NHF). We do not know the exact timing of the Texas Supreme Court’s decision following the January hearing; however, the decision should be issued by the end of the Court’s term in June 2020 at the latest. We knew this would be a long process but have been committed to recovering damages for our investors since day one.

Source: Highland Funds

A Little Bit more About the Steep Discount

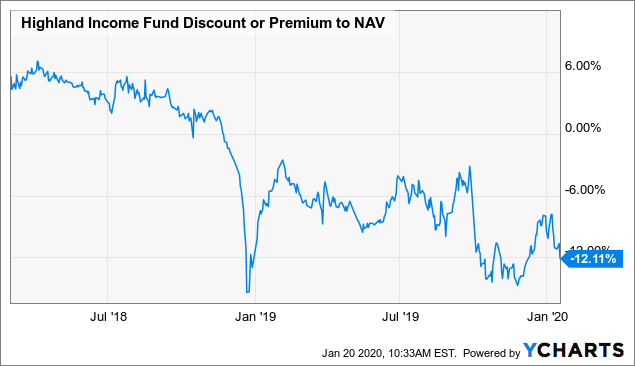

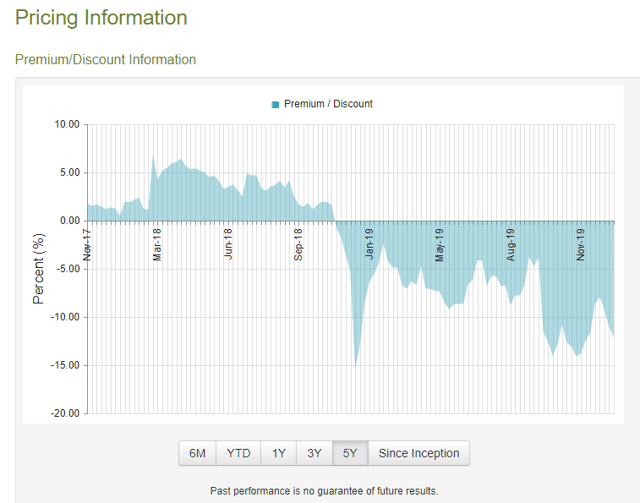

For one of the few funds here that will likely not have to cut their distribution even with falling rates, the NAV discount is rather steep and at the high end of its one year range.

Source: CEF Connect

The discount is also at the high end of where the fund has traded in its entire public history.

Source: CEF Connect

At present value the fund is pricing in that there will be a zero net gain from the court case and possibly also pricing in a moderate recession in the immediate future. We think HFRO has a very good chance of winning this but even if they do not, we see no reason why the fund should trade at this steep a discount. If they do win, the NAV would move to $16.75/share approximately, which would be a nice windfall to shareholders. About 80-85% of cases that reach Texas’ Supreme Court are reversed. This intuitively makes sense as the Texas Supreme Court just refuses to take on a case when it thinks that the lower court needs no coaching and got the decision perfectly right. However that word reversal used is rather misleading as it applies to any change made to the lower court decision. The facts here strongly support that there was wrongdoing by the counterparty and the most likely outcome is a moderation of the payout rather a complete reversal. By buying at a discount to NAV with no amounts booked, we have a good risk reward to our entry.

Conclusion

HFRO continues to go under the radar, although it is beginning to receive some extra attention by analysts. The fund appears to be bottoming out and with the senior loan and CLO markets staging a recovery, we see NAV moving up about 7%-8% over the year. The opportunity exists on multiple fronts here. We can summarize them below.

1) The higher expected NAV.

2) The high current yield as a result of the fund being at a big discount to NAV.

3) The potential for closing this discount to a more normalized level.

4) The potential for big gains from the litigation.

With most fixed income investments, including preferred stocks, and bonds, being very expensive at the current prices, income investors should look for value where they can find it. We are always looking for high-yield investments that have pulled back to points from where the reward is rather favorable, in term of both income and upside potential. HFRO meets this criterion in spades. We expect about 15% total return in a year as a base case (7.3% yield plus 7.5% capital appreciation) even if there are zero monies awarded from the pending case. In addition to senior loans, with HFRO you get juice of CLOs, without paying above NAV or very high fees like our other CLO funds. If the fund does win the case, the upside is rather steep. The fund also announced a buyback to reduce the gap with NAV and this is another key positive step that validates our confidence. HFRO is one of few fixed income opportunities available today for conservative income investors. We are always monitoring the markets for such opportunities in both the fixed income and high yield space for our investors who receive immediate alerts when we spot them.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +4000 members. We are looking for more members to join our lively group and get 20% off their first year! Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long HFRO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.