BlackRock Appears Interested In North American Small Cap Pharmaceuticals

by Just the Facts MaamSummary

- BlackRock sees North American Small Cap Pharmaceuticals as Undervalued. Will this trend continue?

- Comparing Blackrock and Vanguards asset allocation in North American Small Cap Pharmaceuticals.

- BlackRock’s top five bets in this sector include: Ani Pharmaceuticals, Amphastar Pharmaceuticals, Eagle Pharmaceuticals, Cytokinetics and Vanda Pharmaceuticals.

BlackRock Inc. (BLK) and Vanguard Group Inc. represent the world’s two largest Asset Management Companies. According to 2019 Q3 filing, BlackRock had $6.96 trillion USD in assets under management. While, according Vanguard, they had $5.6 trillion USD assets under management on August 31, 2019. This gives BlackRock 24.3 % more assets under management over Vanguard. However, according to the Form 13-F SEC filings, on September 30, 2019, Vanguard had 13.67% more assets invested in publicly traded companies.

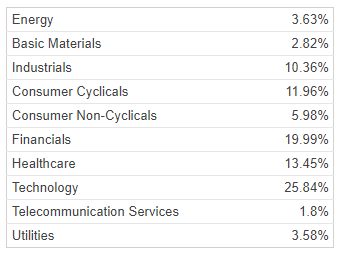

BlackRock Investment by Sector – Report Date 09/30/2019

Total market Value $2.603332 Trillion

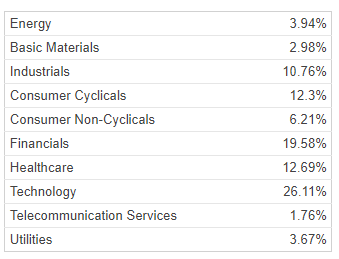

Vanguard Investment by Sector – Report Date 09/30/2019

Total market Value $ 2.959294 Trillion

North American Small Cap Pharmaceuticals

BlackRock has 13.61 % of its portfolio invested in the Healthcare sector. While, Vanguard has 12.84 % of its portfolio invested in Healthcare sector. This translates into BlackRock having approximately $350.148 billion invested in the Healthcare Sector, while Vanguard had $375.534 billion invested in the Healthcare Sector. This represents a 7.25% difference in asset allocation within this sector. However, both BlackRock and Vanguard may not share the same view of each subsector within the Healthcare Sector.

The following examines the North American Small Cap Major Pharmaceuticals, a sub-sector of the Healthcare sector, with market caps ranging between $500 million and $2 billion, where BlackRock or Vanguard are the largest or second largest institutional investors. When looking at thirty companies in North America’s Small Cap Major Pharmaceuticals meeting this criteria, you find that BlackRock and Vanguard were the largest two investors in 11 companies. However, when examining the positions that BlackRock has taken in these 30 companies in comparison to Vanguard, it appears that BlackRock sees greater value in this sub-sector and has taken a greater stake in this group of companies. On average BlackRock has taken 57. 34 % greater position over Vanguard in this sub-sector. BlackRock’s positions in this sub-sector represents, on average, approximately 11.45 % of each company’s public float.

A comparative analysis of the 30 Pharmaceutical Companies identified the following five pharmaceutical companies where BlackRock has taken a much larger position than Vanguard. The following also provides how much more, in terms of percentage, BlackRock invested in these companies along with a brief overview of the five pharmaceutical companies.

| Company | BlackRock # of Shares (% of Float) | Institutional Investment Ranking | Vanguard # of Shares % of Float | Institutional Investment Ranking | Position Difference BlackRock Vs Vanguard |

| Ani Pharmaceuticals (ANIP) | 1,538,550 (16.3%) | 1 | 585,741 (6.2%) | 2 | 163% |

| Amphastar Pharmaceuticals (AMPH) | 5,995,824 (16.9%) | 1 | 2,426,128 (6.8%) | 2 | 147% |

| Eagle Pharmaceuticals (EGRX) | 1,725,857 (13.3%) | 2 | 760,103 (5.8%) | 5 | 127% |

| Cytokinetics (CYTK) | 9,266,237 (17.1%) | 1 | 4,311,441 (8.0%) | 2 | 115% |

| Vanda Pharmaceuticals (VNDA) | 9,079,647 17.5% | 1 | 4,308,706 (8.3%) | 3 | 111% |

ANI Pharmaceuticals

According to the Ani Pharmaceuticals Inc.’s most recent quarterly filing, they are an integrated specialty pharmaceutical company focused on delivering value to their customers by developing, manufacturing, and marketing high quality branded and generic prescription pharmaceuticals. Their focus is in controlled substances, anti-cancer (oncolytics), hormones and steroids, and complex formulations, where there is niche opportunities and a high barrier to entry. Their strategy is to use their assets to develop, acquire, manufacture, and market branded and generic specialty prescription pharmaceuticals.

In Q3 2019 Black Rock increased its position in Ani Pharmaceuticals by 7.61% and Vanguard increased their position by 3.8%.

Refer to ANI Pharmaceuticals' Website for additional information.

Amphastar Pharmaceuticals

According to their most recent quarterly filing, Amphastar Pharmaceuticals, Inc. is a specialty pharmaceutical company that develops, manufactures, markets, and sells generic and proprietary injectable, inhalation, and intranasal products, including products with high technical barriers to market entry. Amphastar Pharmaceuticals also sells insulin active pharmaceutical ingredient products. The company’s products are primarily used in hospitals or urgent care clinical settings. The Company’s insulin active pharmaceutical ingredient products are also sold to other pharmaceutical companies for use in their own products and are being used by the Company in the development of injectable finished pharmaceutical products.

In Q3 2019 BlackRock increased its position in Amphastar Pharmaceuticals by 1.16% and Vanguard increased their position by 1.86%.

Refer to Amphastar Pharmaceuticals' website for additional information

Eagle Pharmaceuticals

According to their most recent quarterly filing, Eagle Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on developing and commercializing injectable products, primarily in the critical care and oncology areas, Their business model is to develop proprietary innovations to FDA-approved injectable branded reference drugs, that offer favorable attributes to patients and healthcare providers.

In Q3 2019 Black Rock decreased its position in Eagle Pharmaceuticals by 1.02% and Vanguard increased their position by 0.88%.

Refer to Eagle Pharmaceuticals' website for additional information.

Cytokinetics

According to their most recent quarterly filing, Cytokinetics is a late-stage biopharmaceutical company focused on discovering, developing and commercializing first-in-class muscle activators and best-in-class muscle inhibitors as potential treatments for debilitating diseases in which muscle performance is compromised and/or declining. They have discovered and are developing muscle-directed investigational medicines that may potentially improve the healthspan of people with devastating cardiovascular and neuromuscular diseases of impaired muscle function. They are developing small molecule drug candidates specifically engineered to impact muscle function and contractility.

In 2019 Q3 filings, Black Rock increased its position in Cytokinetics by 2.3% and Vanguard increased their position by 8.83%.

Refer to Cytokinetics' website for additional information.

Vanda Pharmaceuticals

According to their most recent quarterly filing, Vanda Pharmaceuticals Inc. is a leading global biopharmaceutical company focused on the development and commercialization of innovative therapies to address high unmet medical needs and improve the lives of patients. Their focus is in the treatment of sleeping disorders, schizophrenia, chronic pruritus in atopic dermatitis, gastroparesis and motion sickness and hematologic malignancies.

In Q3 2019 Black Rock increased its position in Vanda Pharmaceuticals by 1.02% and Vanguard increased their position by 19.34%.

Refer to Vanda Phamaceuticals' website for additional information.

Considerations

Since, the positions taken in this subsector by both BlackRock and Vanguard is as of September 30, 2019, it is possible that positions have changed significantly since then. Positions as of September 30, 2019 is not a confirmation of BlackRock’s present outlook of the sector or of these five companies. Additionally mirroring either BlackRock or Vanguards investment strategy does not guarantee future success. However, for those who factor in BlackRock's investments into their portfolio selections, it should be noted that BlackRock did decrease their position in Eagle Pharmaceuticals, whereas it increased its position in the other four identified pharmaceutical companies. Investors considering Eagle Pharmaceuticals may wish to see if this downward trend continues. Unlike the other four companies which generate various profits, Cytokinetics has yet to turn a profit. According to Cytokinetics’ 2019 third quarter, 10-Q SEC filing, they have incurred an accumulated deficit of $834.4 million since inception and cannot assure profitability. They anticipate that it will have operating losses and net cash outflows in future periods yet do have enough cash on hand to see them through the next 12 months.

Conclusion

Blackrock and Vanguard appear to see the growth opportunities in North American Small Cap Pharmaceuticals Sector differently and as such have allocated resources disproportionately. BlackRock has chosen to accumulate larger positions in North American Small Cap Pharmaceutical Sector and particularly Ani Pharmaceuticals, Amphastar Pharmaceuticals, Eagle Pharmaceuticals, CytoKinetics and Vanda Pharmaceuticals. Investors contemplating the Health Care Sector investments within their portfolio may want to look at this subsector as a whole and especially the five identified companies. In approximately two weeks both BlackRock and Vanguard will be making SEC Form 13F filings. It will be interesting to see if Blackrock continues seeing value in the North American Small Cap Pharmaceutical Sector and particularly these five companies.

Disclosure: I am/we are long ANIP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.