A Much Better Alternative To Dollar-Cost Averaging

by D.M. Martins ResearchSummary

- Warren Buffett himself seems to like the dollar-cost average approach to investing in stocks, but I am skeptical.

- Today, I test a simple alternative to DCA that has produced higher absolute returns and much tamer drawdowns over the past 15 years.

- There is at least one much better way to protect a large sum of money from sizable losses, and it involves looking outside equity markets.

Dollar-cost averaging, the strategy of breaking down a large sum of money and slowly investing the smaller chunks into stocks (rather than all at once), is a topic of conversation that crosses my radar every so often.

Many experts argue that the approach makes sense because it can reduce an investor's exposure to losses. Even the oracle of Omaha himself has said that "the best way for the majority of people to invest is to dollar-cost average into a low-cost S&P 500 mutual fund." No one can predict where the market is going at any given time, and buying stocks at a peak is a dreadful proposition.

Credit: Fountain of Salvation

I, on the other hand, have argued against DCA (the strategy's popular acronym). In my March 2019 article, I pointed out that the approach "works best in a downward-moving market. When the market moves up (which it tends to do, over time), lump-sum investing will usually result in a lower average per-share cost."

The math seems clear enough: investing as early as possible in assets that have a positive expected return over time is the best logical course of action. Yet, I cannot ignore the emotional component of investing. In cognitive psychology and decision theory, loss aversion refers to people's tendency to prefer avoiding losses to acquiring equivalent gains - which seems to explain why DCA is such a popular investment technique.

But I believe an investor can have her cake and eat it too: in other words, achieve solid returns while limiting losses. Today, I propose an alternative to DCA that not only protects a portfolio better, but that has also produced superior average returns over at least the past decade and a half.

Jump first, fear later

Those who follow me know that I am a huge proponent of multi-asset class diversification. The idea is that investors can produce risk-adjusted performance (i.e., returns per given unit of risk) that is substantially better than that of equities by spreading the eggs across different baskets: domestic and international stocks, bonds of different maturities, REIT, TIPS, gold and other commodities.

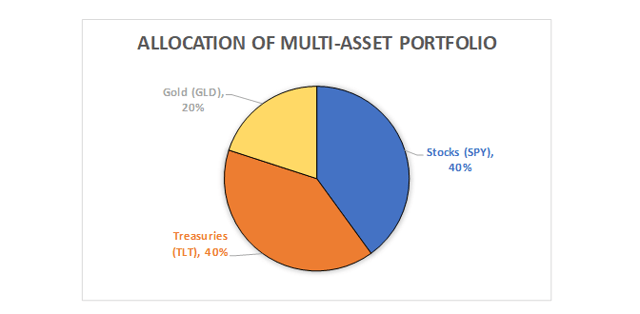

My flagship Storm-Resistant Growth portfolio is set up according to this idea. In this article, I propose an even simpler allocation. Imagine a portfolio constructed as follows:

- 40% domestic stock ETF, like the SPDR S&P 500 fund (SPY)

- 40% long duration treasury ETF, like the iShares 20+ Year fund (TLT)

- 20% gold ETF or equivalent, like the SPDR Gold shares (GLD)

Source: D.M. Martins Research

What I propose is that, instead of dollar-cost averaging a large sum of money into stocks over time, setting up a multi-asset class portfolio from day one might make much more sense. This is true, I hypothesize, because the low levels of historical (and expected, I would argue) correlation between the three underlying assets are very low. Therefore, in a dreaded scenario in which stocks fall off a cliff, treasuries and gold are there to break the portfolio's fall.

Testing the strategy

To confirm or refute the efficacy of my strategy, I propose the following test. Assume three different scenarios in which each investment is held for one full year:

- Strategy 1: lump sum investment into SPY on day one.

- Strategy 2: DCA approach in which 25% of the portfolio is placed into SPY on day one; 50% at the start of the second quarter; 75% at the start of the third quarter; and 100% at the start of the fourth quarter.

- Strategy 3: lump sum invested on day one into the multi-asset portfolio described above.

I ran each of the scenarios above for each month of the past 15 years - in other words, considering a number of different twelve-month periods through which an investment could have been held since late 2004. I then calculated key performance metrics that included (1) average annual return, (2) average volatility, and (3) worst twelve-month period. The results are summarized below:

- Average annual returns: no surprise here, a lump sum investment into SPY that is held for twelve months has historically generated the highest average returns, at +10.0%. DCA underperformed by quite a bit, at an average of +6.2%. Interestingly, the multi-asset strategy produced a very respectable +8.7%, securing the silver medal in this category.

- Average volatility: this is where things start to get interesting. A lump sum investment in SPY would have produced average annual volatility of 15.5% since 2004. DCA would have done better, at 10.4%. However, the gold medal goes to the multi-asset strategy, at only 7.7% volatility. If an investor's goal is to deploy DCA to lower portfolio risks, the approach is starting to look inferior to a diversified buy-and-hold strategy.

- Worst-case scenario: this is the nail in the coffin. Lump summing into SPY would have resulted in a worst-case twelve-month return of -43.4% (in February 2009, not surprisingly). In the case of DCA, the lowest return would have still been a pretty undesirable -37.3%. In the case of the multi-asset strategy, the worst period of the past 15 years would have produced a much more manageable loss of -15.4%.

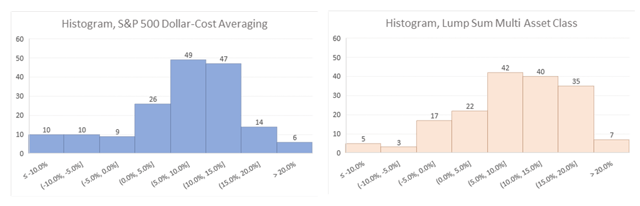

The histogram below helps to illustrate how much more effective multi-asset class diversification has historically been at protecting a portfolio against sizable losses.

On the left is the return distribution of twelve-month periods since 2004 when DCA is used, compared to the multi-asset class diversification strategy on the right. Notice that dollar-cost averaging wouldn't have stopped a portfolio from losing at least 5% over a twelve-month period on 20 occasions, against only eight for the multi-asset approach. On the upside, the former would have produced gains of 15% or more only 20 times, against 42 times in the case of the latter.

Source: D.M. Martins Research, using raw data from Yahoo Finance

Key takeaway

I have developed a better appreciation for why investors choose to dollar-cost average. The emotional toll of losing money can be devastating, much more so than the thrill of making money. But I believe that there is at least one much better way to protect a large sum of money from sizable losses, and it involves looking outside equity markets.

"Thinking outside the box" is what I try to do everyday alongside my Storm-Resistant Growth (or SRG) premium community on Seeking Alpha. Since 2017, I have been working diligently to generate market-like returns with lower risk through multi-asset class diversification. To become a member of this community and further explore the investment opportunities, click here to take advantage of the 14-day free trial today.

Disclosure: I am/we are long IAU, LTPZ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.