Plug Power - Business Update Call Takeaways - Company Signs Third Anchor Customer

by Henrik AlexSummary

- Discussing key takeaways from Thursday's business update call.

- Company reported FY2019 gross billings at the lower end of the projected range and guided for approximately 27% top-line growth and materially improved adjusted EBITDA this year.

- Management revealed a third anchor customer which appears to be Home Depot.

- Discussing ambitious long-term financial targets.

- Expect fuel cell- and alternative energy stocks in general to remain in demand going forward regardless of fundamental considerations.

Note: I have covered Plug Power (PLUG) previously, so investors should view this as an update to my earlier articles on the company.

Over the past couple of weeks, Plug Power's common shares have recovered nicely from a massive secondary offering in early December followed by a shortseller attack two weeks later as fuel cell- and hydrogen-related stocks remain in high demand with investors.

Source: Yahoo Finance, Author's own work

The hype correlates almost perfectly with the ongoing squeeze in Tesla's (NASDAQ:TSLA) heavily shorted shares so I would assume market participants have increasingly been picking up fuel cell- and other alternative energy stocks as sideplays here.

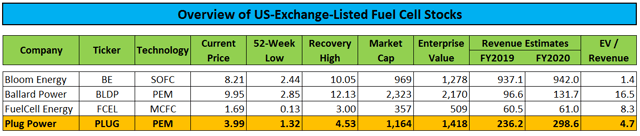

Despite the recent rally, Plug Power continues to look cheap when compared to its sole remaining U.S.-exchange listed peer Ballard Power (BLDP) but in reality trades already above the EV / FY2020e revenue multiple paid by Cummins (CMI) for Hydrogenics (former ticker: HYGS) last year.

I strongly advise investors to take a look at Spruce Point Capital's recent short report on the company or read my detailed discussion.

In sum, while certainly not flawless, the report correctly identifies the key challenges of Plug Power and provides some great illustrations of issues already raised by me in the past.

But with the hype feeding the hype, market participants couldn't care less about fundamental considerations as long as the trend remains intact and the stock keeps running on strong volume.

On Thursday, Plug Power held its traditional, beginning-of-the-year business update call and filed the respective presentation with the SEC.

The company reported preliminary gross billings (revenues before warrant-related charges) of between $93-95 million for Q4 and $235-237 million for the full year 2019 which is actually towards the low end of management's guidance of $235-245 million and will likely result in the company missing Q4 consensus top-line expectations as ongoing warrant charges will reduce reported revenues by a couple of million dollars.

On the call, management also stated that the company was "EBITDA-positive for the complete year" which likely means "adjusted EBITDA positive". After the first nine months, adjusted EBITDA was negative $4.1 million, so it's fair to assume Q4 adjusted EBITDA of at least $4.2 million, up from $2.5 million in Q3.

Unfortunately, management abstained from discussing all-important cash flow numbers on the call. Remember, the company guided for FY2019 cash flows to come in between "slightly negative to slightly positive" in the Q1/2019 investor letter but has remained silent on full year cash flow expectations ever since then. After having already used $51.8 million in cash from operations over the first three quarters, achieving the original cash flow guidance would have been quite a stretch. In fact, I firmly expect the company to have missed its target by a mile.

At least the company provided some more clarity on the recently announced $172 million GenKey order from a Fortune 100 customer. On the call, management confirmed that the order has been placed by an existing anchor customer which leaves only Walmart (WMT) and Amazon.com (AMZN).

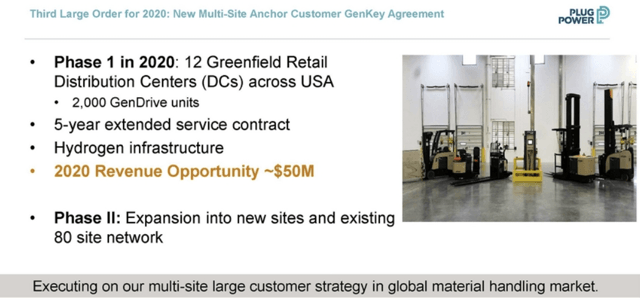

As the 2020 Walmart deployment schedule was laid out separately on the call ("12 sites with 2,000 GenDrive units which will generate over $50 million in revenue"), it is fair to assume Amazon having placed the large order ("30 sites for the next two years"). During the question-and-answer session, management also hinted to working on on-road vehicle trials "for a number of vehicles of different class types" with this particular customer.

In addition, the company disclosed the eagerly-awaited signing of a third anchor customer which, judging by the statements made on the call, appears to be Home Depot (NYSE:HD):

And today I'd like to announce our third anchor customer. This customer has been a Plug Power customer for four years. We have had a strong performance especially during the recent holiday season. This year we'll be deploying 12 sites with 2,000 GenDrive units which will generate over $50 million in revenue.

While Plug Power indeed deployed two sites with Home Depot in 2016, I was somewhat confused by management's statement regarding the strong holiday season performance at this customer as Q4 is actually the slowest quarter of the year for Home Depot. Moreover, the home improvement giant remains in an ongoing supply chain overhaul mostly targeted at improving the company's home delivery abilities. That said, during the question-and-answer session an analyst pointed directly at Home Depot as the new anchor customer and wasn't corrected by management.

Source: Company Presentation, Slide 10

With Phase 1 being limited to greenfield sites and inferior economics attributed to brownfield site conversions it remains to be seen if Plug Power will indeed expand into converting existing facilities with this new anchor customer. So far, only Walmart has committed to large-scale conversion of existing distribution centers.

In addition, it remains unclear if the customer will be paying upfront (like Amazon) or require vendor financing (like Walmart) and if the company was forced to enter into a similar warrant-based volume discount agreement like in case of Amazon and Walmart.

Lastly, management guided FY2020 gross billings to grow by approximately 25% to above $300 million, roughly in line with current consensus estimates. Management also pointed to more than 90% revenue visibility as compared to between 65-70% in past years:

Usually in this call in January, I tell you we have clear visibility to 65% to 70% of our year. This year that number is over 90%. We believe there is upside and we'll keep investors updated during the year.

In addition, adjusted EBITDA is projected to increase to $20 million this year.

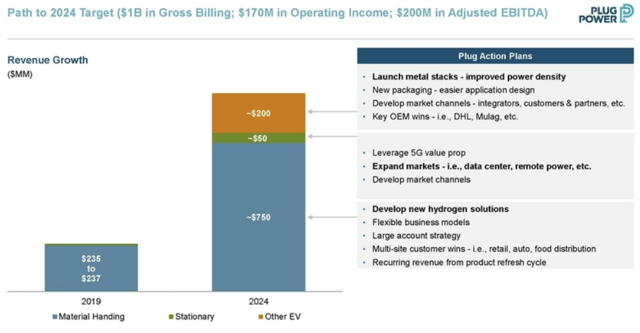

The company also reiterated its ambitious long-term targets with gross billings expected to increase to $1 billion by 2024 thus generating $200 million in adjusted EBITDA.

Source: Company Presentation, Slide 15

Given the company's abysmal track record, investors should take these projections with a huge grain of salt. Remember, back in 2015 CEO Andy Marsh projected Plug Power to reach $500 million in revenues by FY2020 and consolidated gross margin to increase to 35%.

Suffice to say, the company will miss these targets by a mile.

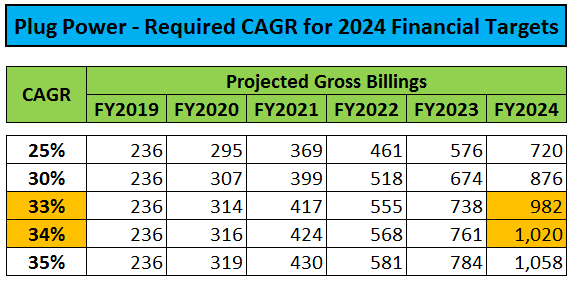

On the call, an analyst actually hinted to the growth forecast for this year being below the compound annual growth rate ("CAGR") required for the company to achieve its stated 2024 targets. With the company having guided 2020 CAGR at approximately 27%, growth would have to accelerate substantially over the next couple of years to come even close to management's projections:

Source: Author's own work

That said, with management looking for upside to its initial FY2020 projections, actual CAGR for this year might end up being higher.

Bottom Line:

Just like other fuel cell- and alternative energy stocks in general, Plug Power's shares have outperformed the broader market substantially in recent months despite considerable headwinds from a massive, secondary offering and a shortseller report in December.

On Thursday's business update call, management disclosed a new anchor customer which appears to be Home Depot with approximately $50 million in revenues expected for this year.

The company also guided FY2020 gross billings roughly in line with consensus expectations with management pointing to much better visibility relative to previous years thus providing opportunity for potential upside.

That said, some upside will actually be required for Plug Power to stay on course for its ambitious FY2024 financial targets.

Absent any major sell-off in the broader markets, I would expect alternative energy stocks to remain in demand for the foreseeable future which bodes well for additional upside in the company's shares.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.