Look for New Highs From CSX Stock as the Economy Heats Up

As goes the economy, so goes CSX stock

The simple overarching truth about North America railroad operator CSX (NYSE:CSX) is that, as goes the U.S. and global economies, so goes CSX stock.

When the global economy was rebounding from the 2008-09 Financial Crisis, CSX roared from $10 in 2010, to $25 by mid-2011. When the global economy started to flat-line in late 2011 amid escalating federal debt concerns, CSX dropped to $20. Over the next several years, the global economy regained its footing.

By mid-2015, CSX stock had soared to $40. Then, the economy slowed again in 2015/16 amid multiple geopolitical and economic risks (a slowdown in China, a debt crisis in Greece, Brexit, the devaluation of the Yuan, etc). CSX stock fell back to $20 by early 2016.

Lather, rinse, repeat over the past four years. An economic upturn from 2016 through 2018 thanks to tax cuts pushed CSX stock up near $80. An economic slowdown in 2019, thanks to rising trade tensions, has caused CSX stock to trade in a sideways choppy fashion ever since.

Long story short, history shows that as goes the economy, so goes CSX stock.

Fortunately for bulls, the economy is in the early innings of yet another upswing. This economic upswing will provide sufficient firepower to drive CSX stock to new all-time highs in 2020.

The Economy Is an Upswing

Looking at the big picture, the U.S. and global economies are in the early innings of yet another multi-quarter upswing. This upswing has mostly to do with two things.

First, what were rising U.S.-China trade tensions in 2019, are now easing trade tensions in 2020. This easing will continue for the foreseeable future since the U.S. doesn’t want to rock the boat ahead of the 2020 U.S. Presidential Election and China doesn’t really have the resources to rock the boat amid the Wuhan coronavirus outbreak.

Consequently, over the next several quarters, U.S.-China trade tensions will meaningfully ease, stability will be injected back into the global geopolitical landscape, corporations will re-up investment and spend, and the global economy will pick up steam.

Second, monetary policy across the globe remains supportive of sustained economic expansion. That is, rates everywhere remain at or near record lows, and central banks appear committed to keeping rates low for the foreseeable future. At the same time, the U.S. Federal Reserve, the European Central Bank, and the Bank of Japan are all injecting additional stimulus through significant asset purchases. Even further, the People’s Bank of China just dramatically expanded bank lending capacity.

Alongside easing trade tensions, these continued favorable monetary conditions will spark a multi-quarter recovery in the global economy.

Sure, there are risks out there. See the coronavirus outbreak in China. See tensions in the Middle East. But, such risks are either ephemeral (disease outbreaks historically are contained to small areas and last just a few months, before disappearing for good) or overstated (Iran doesn’t have the resources to provide a meaningful threat to the U.S. at the moment).

Net net, the economy is going to pick up steam in 2020, and that’s great news for CSX stock.

CSX Can Power to New Highs

At the risk of sounding like a broken record, let me repeat this one more time for emphasis purposes. As goes the U.S. and global economies, so goes CSX stock.

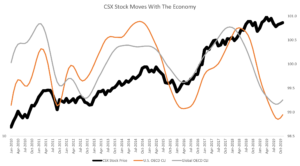

See the attached chart, which graphs the OECD’s Composite Leading Indicator (CLI) data for the U.S. and the world, next to CSX stock price, over the past decade. There’s a clear correlation.

When U.S. and global CLI data swings higher, so does CSX stock. When U.S. and global CLI data swings lower, CSX stock struggles for gains. Importantly, this correlation makes complete sense, because the better the economy is doing, the more companies are pushing goods across North America, and the more demand there is for CSX’s rail services to transport those goods.

As we’ve already discussed, the U.S. and global economies will pick up steam in 2020. Indeed, they already are. For the first time since late 2017, U.S. and global CLI data are rising, not falling, month-over-month. Such reversals usually aren’t short-lived. They last for several quarters, adding further support to the idea that the economy is in the first few innings of a multi-quarter upswing.

Against that backdrop, CSX should rally as it normally has. Valuation is a slight problem. At 18-times forward earnings, there isn’t much room for multiple expansion (the five-year-average forward earnings multiple is 17). But, there is room for CSX to deliver better-than-expected numbers throughout 2020 and for analysts to up their forward profit estimates, the sum of which should provide enough firepower to drive CSX to new highs.

Bottom Line on CSX Stock

As goes the economy, so goes CSX stock. The economy is going to improve over the next few quarters. As it does, CSX will push to new highs.

As of this writing, Luke Lango did not hold a position in any of the aforementioned securities.