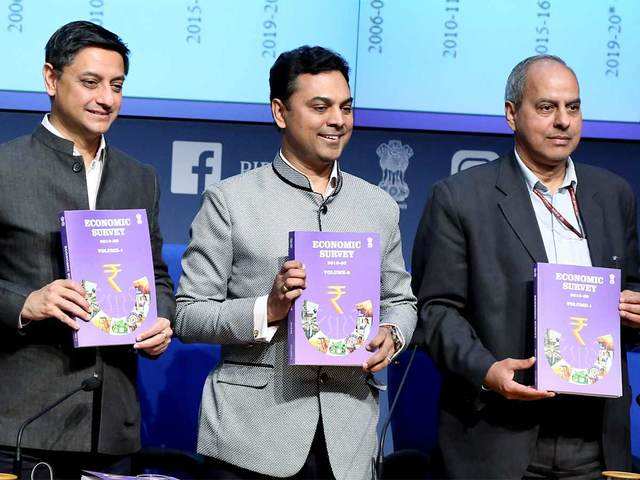

Production pattern is not in sync with the demand: The Economic Survey 2019-20

The survey said that the share of cereals declines steadily as MPCE level increases, from about 19 per cent for the bottom decile class of rural India to about 5-6 per cent for the top decile class, and from 15 per cent for the bottom decile class of urban India to under 3 per cent for the top decile class.

by Rituraj Tiwari

New Delhi: The Economic Survey 2019-20 says that the production pattern in Indian agriculture is not in sync with the demand trend. Citing National Sample Survey (NSS) 73rd round on consumer expenditure, the survey said that that the share of cereals in monthly per capita expenditure (MPCE) has fallen by about 33 per cent in rural India and about 28 per cent in urban India from 2004-05 to 2011-12 (latest estimates available).

The survey said that the share of cereals declines steadily as MPCE level increases, from about 19 per cent for the bottom decile class of rural India to about 5-6 per cent for the top decile class, and from 15 per cent for the bottom decile class of urban India to under 3 per cent for the top decile class. This is in line with decreasing consumption of food and increasing expenditure on non-food items as incomes rise.

“The declining share of cereals in consumer expenditure while the production of rice and wheat has reached new records. This trend of decreasing demand for cereals and increasing supply of cereals shows that the production pattern is not synchronized with the demand patterns,” the survey noticed.

The farmers are deriving their signals, not from the demand patterns (reflected in the actual market prices) but from the Government policies of procurement and distribution policies for grains. Thus, the intervention of Government has led to a disconnect between demand and supply of grains in foodgrain markets.

The government procures around 40-50 per cent of the total markets surplus of rice and wheat emerging as the dominant buyer of these grains. In some States like Punjab and Haryana, this share of purchase by Government reaches as high as 80-90 per cent. A record procurement of 44.4 million tonnes of rice and 34 million tonnes of wheat was done in 2018-19. Thus the government, as the single largest buyer of rice and wheat, is virtually a monopsonist in the domestic grain market and is a dominant player crowding out private trade. This disincetivizes the private sector to undertake long-term investments in procurement, storage and processing of these commodities. These procurement operations largely support the MSPs that are designed to be indicative prices for producers at the beginning of the sowing season and floor prices as an insurance mechanism for farmers from any fall in prices.