China - One Problem Ends And Another Begins

by Andrew HechtSummary

- Trade had been a problem for the Chinese economy.

- Hong Kong issues are ongoing.

- African Swine Fever caused a meat shortage.

- Did ASF lead to coronavirus?

- Commodities will move with the state of China's economy.

Over the past years, the world became accustomed to double-digit percentage economic growth in China. In late 2015 and early 2016, a slowdown in the world's most populous nation caused commodities prices to fall to multiyear lows as concerns over the Chinese economy rippled around the globe like a tsunami. President Xi rolled out his "new normal," a program that prepared the world for slower, but stable growth in China. Over the years that followed, GDP growth remained north of the 6% level but has been declining as the Asian nation continues to face growing problems.

When it comes to the expansion of the Chinese economy, GDP had grown to a level where 6% growth today translates to a higher level of nominal increases than when the economy grew by over 10% on an annual basis. However, China has faced one problem after another over the past years. Just as the trade war with the US calmed, an outbreak of a virus introduced a new set of concerns over the world's second-leading economy.

China remains the demand side of the fundamental equation for commodities. The Invesco DB Commodity Index Tracking Fund (DBC) holds futures positions in many of the leading raw materials products.

Trade had been a problem for the Chinese economy

In 2018 and throughout most of 2019, the trade dispute between the United States and China escalated into a war. On the campaign trail in 2016, President Trump promised to level the playing field on international trade. He pointed his finger as China as the leading culprit. Years of double-digit percentage growth pushed Chinese GDP to the second-highest level in the world. Even though the Asian nation's economy was a leader, exiting trade protocols treated China as an emerging market. President Trump told voters that he would renegotiate existing trade agreements and use tariffs if necessary, to force China's hand on the issue. In 2018, the US leader turned political rhetoric into action as he slapped protectionist tariffs on China. While the Chinese leadership retaliated, the protectionist policies weighed far more heavily on the Chinese than the US economy.

Trade issues reached a boiling point in August when President Trump became frustrated with the pace of trade negotiations and Chinese backtracking on matters. He upped the ante on tariffs, and China retaliated once again. However, negotiations continued, and by the end of 2019, the two sides reached a deal on a set of preliminary issues. The US and China signed the "phase one" trade agreement on January 15 in Washington and pledged to continue to move towards a "phase two" deal and comprehensive protocol on trade.

The phase one deal took some pressure off China's economy in late December and into early January.

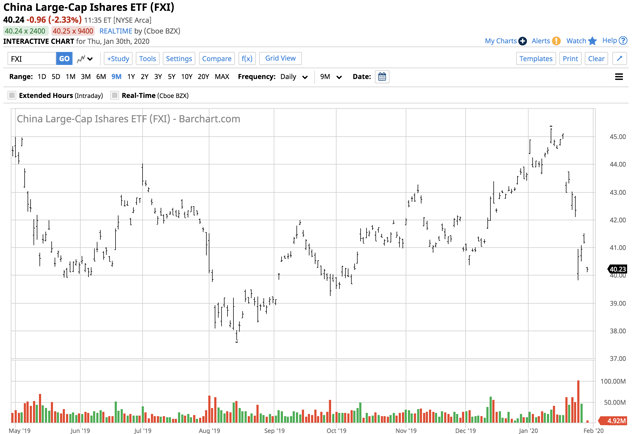

Source: Barchart

The chart of the Chinese Large-Cap ETF product (FXI) shows that the ETF that holds shares in some of the leading Chinese companies rose from $40.36 on December 3 to a high of $45.29 per share on January 13 or 12.2% as optimism over Chinese, and global, economic growth returned to the market. Confidence remains high that the US and China will continue to negotiate in good faith and work towards a comprehensive trade agreement in 2020. However, there is always a chance that the road to a deal could be bumpy. Meanwhile, the move back down to just over the $40 per share level on January 30 had nothing to do with trade.

Hong Kong issues are ongoing

Another problem facing the Chinese leadership in Beijing is the protests in Hong Kong. The people of Hong Kong are striving to retain their independence from China. Meanwhile, President Xi and the Chinese representatives on the ground in Hong Kong, like Carrie Lam, who holds the Chief Executive position, have faced growing protests over the past months. Students and others have been increasingly vocal and, in some cases, violent in their opposition to Chinese policies to incorporate Hong Kong into China. President Xi and the leadership have exercises restraint, but there are more than a few parallels that led to the tragic conclusion to the Tiananmen Square protests in 1989. Chinese troops have been moved into positions to defend the government if violent demonstrations escalate. While the trade issue threatened China's economy in 2018 and 2019, the protests in Hong Kong were a challenge to the communist political system.

African Swine Fever caused a meat shortage

In 2019, an outbreak of African Swine Fever killed a significant percentage of China's pig population. China is the world's leading consumer of pork. The nation had to dip deep into its strategy frozen pork reserves to satisfy domestic requirements. The trade war with the US-made pork imports a challenge and prohibitively expense. The price of the meat rose, and supplies were scarce.

As the Chinese faced a pork shortage, the nation of 1.4 billion consumers likely turned to other food sources for nutrition. In China, it is not uncommon for people to eat animal proteins we would never consider in the west.

Did ASF lead to coronavirus?

A trade war, protests in Hong Kong, and African Swine Fever in 2019 presented a set of challenges for China's leadership. It seemed that once the government figured out how to contain one problem, another popped up. In early 2020, a health emergency has developed with the outbreak of the coronavirus. While scientists around the world are working diligently to understand and locate the cause of the disease, the shortage of pork that led to the consumption of other animal proteins may be somehow involved.

Meanwhile, as the coronavirus spreads through the world's most populous nation, the government and citizens are taking unprecedented cautions. Cases in other countries have caused fears to rise that the world is on the verge of a global pandemic. coronavirus is another factor that will weigh on China's economy. If the virus spreads to other countries, it threatens a global economic slowdown and even a tsunami of risk-off price action in markets across all asset classes.

The prices of stocks, crude oil, copper, and many other commodities have declined over recent sessions as a coronavirus risk-off environment has gripped markets throughout the world. January began with optimism, the month is ending with fear.

Commodities will move with the state of China's economy

China is the world's leading consumer of most commodities. With the second-largest GDP and most people on earth, China is the demand side of the fundamental equation for raw materials. The ups and downs of the trade war caused volatility in a host of commodities markets in 2018 and 2019. Agricultural products, energy, and metals all moved higher and lower as optimism and pessimism over trade negotiations gripped markets.

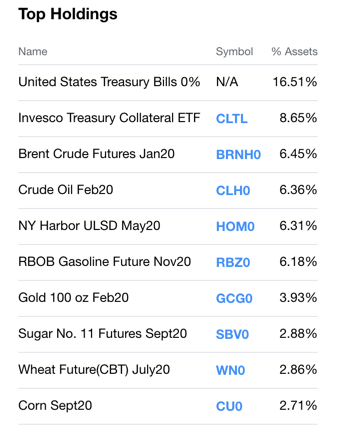

The coronavirus that could threaten China's supply chain and the overall economy has weighed on markets across all asset classes over the past trading sessions. Selling could intensify if the virus continues to spread throughout China and the rest of the world. The commodities asset classes are likely to be highly sensitive to the news cycle when it comes to the coronavirus. The Invesco DB Commodity Index Tracking Fund holds a diversified portfolio of commodities futures contracts including:

Source: Yahoo Finance

The fund summary for DBC states:

The investment seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Diversified Commodity Index Excess Return. The fund pursues its investment objective by investing in a portfolio of exchange-traded futures on Light Sweet Crude Oil, Heating Oil, RBOB Gasoline, Natural Gas, Brent Crude, Gold, Silver, Aluminum, Zinc, Copper Grade A, Corn, Wheat, Soybeans, and Sugar. The index is composed of notional amounts of each of these commodities. Source: Yahoo Finance

DBC has net assets of $1.43 billion, trades an average of over 1.2 million shares each day, and charges an expense ratio of 0.85%. The coronavirus has weighed on commodities prices and the DBC product.

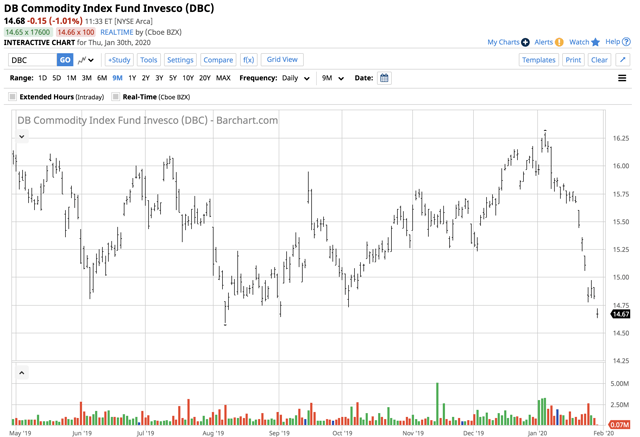

Source: Barchart

As the chart shows, DBC moved lower from $16.30 on January 6 to a low of $14.63 on January 30, a decline of 10.2% in under four weeks.

China has gone from one problem to the next over the past few years. coronavirus is only the latest in the issues facing the Asian nation and the rest of the world. Commodities prices continue to be a barometer of the Chinese economy.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.