Macy's: An Iconic Brand Is Trading At A Discount

by Enterprising InvestorsSummary

- When an icon is on sale, you buy it.

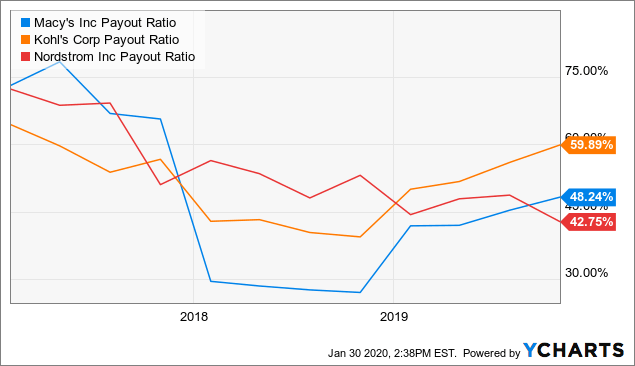

- Macy's offers a dividend yield above 8%. The dividend is well covered with a payout ratio below 50%.

- Macy's online strategy is paying off. The iconic name helps both online and offline sales.

- Macy's and Bloomingdale's are names that have been around for more than a century. They are not going to disappear anytime soon.

Investment Case

Macy's (NYSE:M) is an American icon that is far below its true value. Use the current sale to add this icon to your portfolio. This won't stay a bargain forever. The undervaluation is shown by the high dividend yield, the low PE ratio, and low EV/EBITDA ratio. I believe these ratios will come back to higher levels sooner or later. The dividend yield won't stay above 8% either as the share price recovers.

Stock markets continue to discover all-time highs in 2020. This also means a lot of stocks are trading at higher multiples. As a value investor, I'm looking for stocks that are below their true value. I found such a name in Macy's. This isn't just a value investment, but an investment in an iconic brand with a bright future as well.

Photo source

The online disruption is probably the biggest challenge it's facing since the IPO in 1992. I believe Macy's shows it can face this challenge head-on and the stock price will recover as soon investors find out. For now, the revenue is still slightly declining. As soon as revenue goes back to growth, I expect to see the same with the share price.

About Macy's As An Icon

Photo source

Macy's has been around for more than 100 years. The first Macy's store opened in 1858 in New York City. It started as a single store back then and grew to the chain of department stores as we know it today. The company changed a lot since the start. Along the way, it added Bloomingdale's and Bluemercury.

Macy's has been an icon for many years. A lot of US visitors will visit one of its stores to experience American shopping. It's mentioned in many pop songs. The flagship store in New York, Macy's Herald Square, alone was shown in over 50 movies. Macy's locations are often part of sightseeing tours and visits to large American cities.

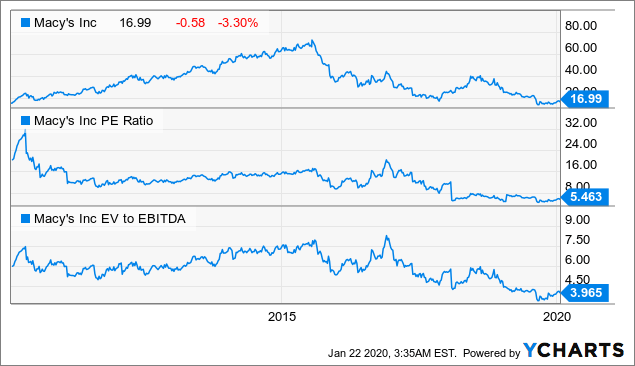

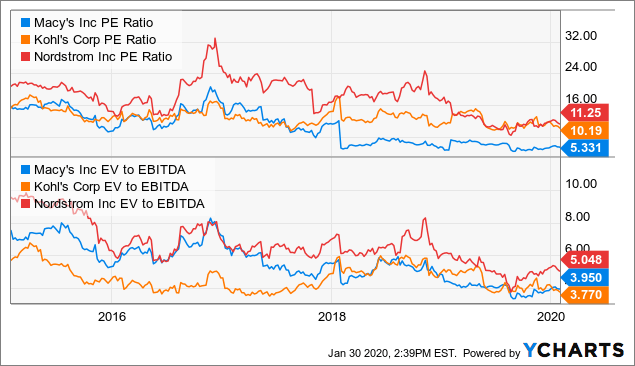

The Valuation Of Macy's

I'll take a look at the valuation of Macy's through two metrics: the classic PE and the EV to EBITDA. EV (Enterprise Value) to EBITDA is a more complete measurement because the enterprise value comprises the market cap (or share price, since market cap equals the number of shares times the share price) and the debt of the company. The PE ratio only counts in the share price and doesn't take debt into account. Another advantage of EV to EBITDA is the exclusion of one-offs in the EBITDA.

One thing is clear: over the past five years, the stock price has come down so far that the multiples Macy's is trading against are at an extremely low level as well. This is for me the most important reason to be bullish on Macy's. As the company continues to do business as expected, these multiples should come back to a more normal level as well. In the meantime, the dividend ensures a nice income while waiting.

Data by YCharts

The chart shows very well that both the PE and EV to EBITDA are far below the average of the past five years. This is attributable to the low share price. These current multiples count in a continuous decline of the business. Once the share price goes up, these multiples will be at a more normal level.

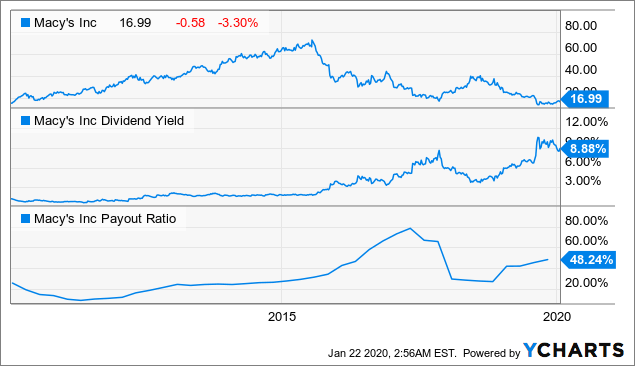

The Dividend Is As Safe As Ever

The deteriorating share price has pushed Macy's yield above 8%. The dividend yield is at the highest point ever. Sometimes this is a sign of an upcoming dividend cut. In my opinion, this isn't the case with Macy's. The payout ratio is just below 50%, which proves the dividend is well covered. In the latest earnings call, Macy's mentioned there are no plans to change the dividend:

So specifically to your question around dividends, our board approves our dividends quarterly. We review that with them. And we don't have plans near-term to change our dividend, but we continue to evaluate it in the context of our capital allocation as well as our strategic plans more broadly. And so we're well aware that with the drop in our share price, our dividend yield is now outsized. But having said that, dividend yield is but one metric that we think about when we're thinking about our dividends and our dividend policy, and it's not one that we wholly control. Source: Paula Price, CFO, during the Q3 2019 conference call

This graph shows the outsized dividend yield Paula Price talks about:

Data by YCharts

At this price, further dividend increases shouldn't be expected. Macy's would better use the money for buybacks. It mentioned buybacks would be an option with excess cash flow in the future in the latest conference call. A higher dividend yield wouldn't provide much extra value at this point. Continuing dividend payouts is enough to attract income investors today.

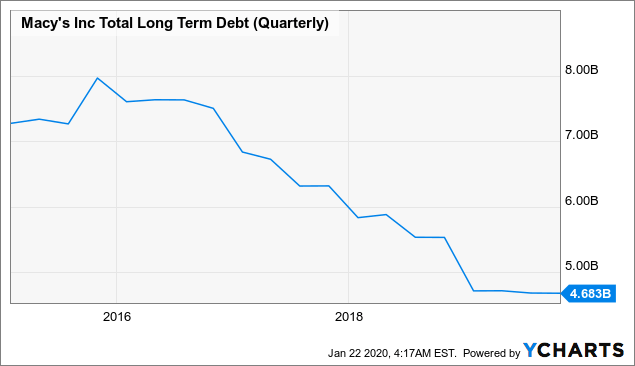

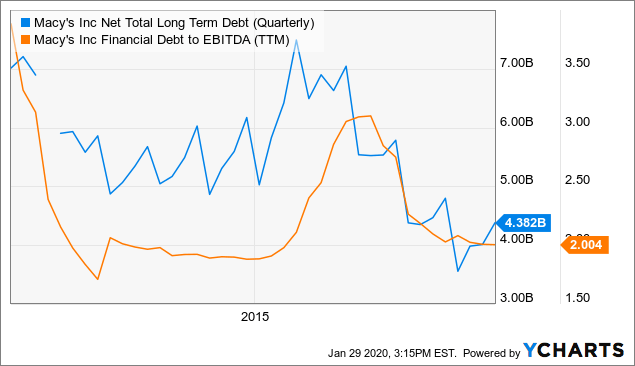

Buying Back Debt Opportunistically

While I've shown that Macy's pays a high dividend and I believe it will continue to do so, the company does use its cash flow in other ways as well. Recently it announced a tender offer to buy back notes. This tender offer was successful and is an effective way to reduce outstanding debt. Moves like this show management wants to continuously create value prudently.

Macy's has been reducing debt quickly in the past five years. I expect it will continue to pay down debt as far as the cash flow allows. Selling non-core assets like real estate could speed up these pay downs of debt.

Data by YCharts

In my opinion, this makes Macy's a solid long-term investment with no risk of failing due to its debt. As the debt is further reduced, this could also open up the possibility to use cash for share repurchases. Macy's has been doing these buybacks in the past, but stopped them in 2017.

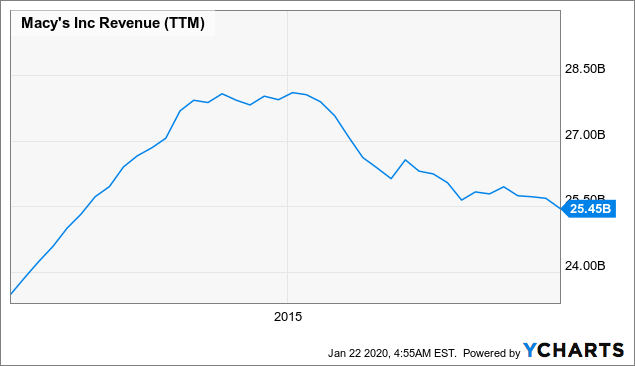

Getting Revenue Growing Again

The value of Macy's is so low because of some perceived risks in the market today. Macy's didn't adapt as quickly to the new online competition over the past few years. It is making up for that now with new initiatives, but investors remain skeptical. This has weighed on revenue and caused revenue to decline.

Data by YCharts

Macy's has several strategic actions to get revenue back growing like Growth150, Backstage, and Vendor Direct. These initiatives aim both at boosting online and offline sales. The initiatives are working. This was shown most recently by better-than-expected sales for November and December.

Growth150 is an upgrade of existing stores to improve facilities, fixtures, staffing, assortment, and customer service. This started successfully in 50 stores. It was scaled to another 100 locations in 2019. This comprises approximately 50% of Macy's brick & mortar sales and was ready before the holiday sales.

Backstage are stores within Macy's active in the off-price business. There are also standalone locations. These discounted products attract more customers to the stores. On average they lift total store sales by 5%.

Vendor Direct allows third-party vendors to add products in Macy's online shop. This increases the number of products available in the online shop. This makes the shop more attractive as customers get more choice. It adds to sales and profit directly without capital or inventory investment.

We will get an update about the strategic actions on February 5th, when Macy's has an investor day. Over the past year, the revenue did almost stabilize. Macy's expects a decline of about 1% over the full year.

Plans To Save Costs

Macy's has an ongoing multi-year productivity program running to change the way it works.

Targeting to reduce annual costs by $400 million to $550 million and improve working capital by approximately $100 million over two to four years. Source: Goldman Sachs Annual Global Retailing Conference Presentation

This cost reduction should translate immediately to a higher bottom line. Based on the 311 million diluted outstanding shares, this would result in a yearly increase of at least $1.28 EPS.

On top of these savings, the company hinted at possible higher savings in the future:

And so as I said, in September, productivity savings -- we get productivity savings, and that's what we're seeing, which is an opportunity to really accelerate those savings versus the road map that we laid out at the conference in September. And then just to remind, we said that we would deliver $400 million to $550 million of savings on top of the $100 million to $200 million of savings that we do normally in sort of as part of our normal DNA. So that will impact gross margin. It will impact SG&A and working capital. And again, we see opportunities to accelerate that, and we look forward to describing that in more detail at the conference. Source: Paula Price, CFO, during the Q3 2019 conference call

Risks

As I mentioned in the revenue section above, one of the main risks is a further decline in revenue. This would make it hard to keep margins at a decent level and would pressure cash flow and earnings as well. Macy's is active in the retail sector. This sector is going through a rough time. Additionally, Macy's does depend on tourism. Tourism could slow down further in the short term.

Macy's is a turnaround story at this point and the turnaround hasn't been completed yet. It could fail to achieve the predicted cost reductions. Strategic initiatives could fail to work as expected.

Debt could be a risk as well. Macy's carries a net debt of about $4.4 billion. As I mentioned, it has been buying back debt opportunistically and focusing on deleveraging the balance sheet. Today the financial debt to EBITDA is 2.0, which is about the same as five years ago. The EBITDA is lower than five years ago. The company kept the ratio at the same level by reducing debt as well.

Data by YCharts

Comparison To Peers

The retail sector in general has been in a tough spot on the stock market. This has pushed share prices and valuations lower. Even so, Macy's is cheap in comparison to its closest peers. I compared Macy's to Kohl's Corporation (NYSE:KSS) and Nordstrom, Inc. (NYSE:JWN). These are both department stores most similar to Macy's. Macy's used to trade at about the same PE and EV to EBITDA as these competitors. Right now the ratios are at a really low level in comparison.

Data by YChartsData by YCharts

The difference in PE ratio and dividend yield will come closer together. Macy's doesn't use an excessive payout ratio to offer this high yield. This is a good time to start collecting the 9% yield Macy's offers while waiting for a more reasonable valuation. This could take time as investors stay skeptical towards the retail sector. I believe common sense will return at some point.

Conclusion

When an American iconic brand like Macy's is on sale, it is a good time to buy. The department store has been an icon for more than 150 years and will remain to be so. It keeps creating value by buying back debt and continues to pay a high and safe dividend. The valuation is low in comparison to peers and historical ratios. A PE ratio of just above 5 and a dividend yield above 8% are proof of this low valuation.

Macy's is a turnaround story in progress. I believe it would be best to get in before the completion of the turnaround. The stock price won't stay this low once the turnaround is further along or completed.

There are probably only a few bargains left in this stock market. I don't expect the market will keep Macy's at such low levels for long. Of course, quarter to quarter results will fluctuate and the stock price will fluctuate along as ever. Right now, I see a nice time to get in.

Disclosure: I am/we are long M. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.