Coca-Cola: A Solid Quarter, But Coke Is Maxed Out

by Wealth InsightsSummary

- Coca-Cola wrapped up its FY2019 with a solid quarter that saw organic revenues surpass analyst estimates.

- While the balance sheet is reaching an inflection point that should see deleveraging results in the years ahead, the dividend's high payout ratio will continue to slow this process.

- There is a lot to like at Coca-Cola, but the stock has already priced in the good news.

Legendary beverage company and famous dividend growth stock Coca-Cola Company (KO) reported Q4 earnings on Thursday to close out the company's 2019 fiscal year. While there are indicators of strong performance, there are also some points of emphasis that we would like to see better addressed considering the stock's valuation. While Coca-Cola is certainly "back" with continued strong revenue growth, there are enough drawbacks that make the stock's 27X earnings multiple difficult to swallow. We sort out the "good and bad" of Coca-Cola's quarter, and year before identifying what we see as an attractive entry point for shares.

Good: Coca-Cola's Continued Revenue Growth

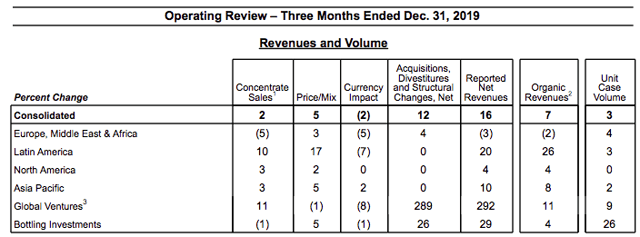

The most glaring takeaway that investors will focus on, is Coca-Cola's strong organic revenue growth for the quarter. This is deserved. The company's quarterly performance of 7% well exceeded the consensus 5% estimates from the analyst community. The driver behind this has been Coca-Cola's increasingly remarkable ability to positively impact revenues with clever pricing and product mix execution.

Source: The Coca-Cola Company

The company has a number of levers it can pull to influence this. This can include simply raising prices, but a lot of it has to do with the company's wide range of brands and beverage options. Non-soda beverages can often command a premium because they are healthier, the company can also play with packaging/serving sizes to incentivize buyers to spend more. Despite the black eye around sparkling beverages, Coca-Cola was also able to realize growth of concentrate sales across virtually all markets (this includes source water, etc. but sparkling products come out of this figure). The decline in EMEA was primarily driven by Brexit-related inventory issues.

This quarter was no fluke either, the company's full 2019 organic sales growth of 6% is a testament to that. While more than half of revenue growth for both the quarter and full year were driven by pricing/mix rather than case volume - it's the many levers that Coca-Cola is able to pull which is key.

Good: The Balance Sheet Is Making Progress

With Coca-Cola generating strong revenue growth, and FCF hitting $8.4 billion on an adjusted basis for the full year, the company has begun to show some signs of financial progress in addressing a bloated balance sheet.

Investors may notice that the company ended the 2019 fiscal year with more long-term debt than it started with ($27.5B from $25.3B). However, don't forget that the company closed on its multibillion acquisition of Costa in 2019.

source: The Coca-Cola Company

If we look at the cash flow statement, Coca-Cola had to do a bunch of refinancing, but the overall debt load shrunk about $1.8 billion. Given the size and freshness of the Costa acquisition - and the fact that Coca-Cola is enjoying sustained organic growth, we don't expect Coca-Cola to go M&A shopping in the near future. This will give the company a chance to deleverage the balance sheet by $1.5B-$2.5B per year over the coming years as top line growth starts to trickle down to FCF.

Bad: The Dividend Remains A Burden

The deleveraging process will take time, primarily because of how much the dividend is costing Coca-Cola. For investors, the company's legendary dividend is a key investment incentive (it's been increased each year for the past 57 years). Management knows this, and the dividend is not going anywhere. The point of emphasis, is how that payout is impacting the other aspects of Coca-Cola.

The company paid roughly $6.8 billion in dividends for the entire 2019 year. Based on management's final 2019 FCF levels of $8.4 billion, the resulting cash payout ratio remains quite elevated at approximately 81%. With Coca-Cola operating a non-capital-intensive business model, a payout ratio of about 80% is about as high as we would like to see.

Unfortunately, this will head in the wrong direction next year according to management. Part of management's 2020 forecast included expected FCF levels of $8.0 billion for the full year. Assuming that Coca-Cola increases the quarterly dividend by a penny per share (same as this year), the resulting total dividend outlay of $6.97 billion produces a payout ratio of 87%. Until the payout ratio consistently decreases, investors will receive inflation pacing dividend raises (not great with a current yield of 2.8%) and must endure a leveraged balance sheet.

Bad: Coca-Cola Is Already Fully Valued

Management issued solid guidance for the 2020 fiscal year. Revenue momentum is expected to continue with projected growth of 5% organic growth. Net revenue is projected to grow 8% on a currency-neutral basis. This will result in expected EPS growth of 7% (approximate EPS of $2.25).

Based on full year earnings, the stock is currently trading right at 27X earnings. Projected 2020 earnings would put the stock at a forward PE ratio of just over 25X. While we find that Coca-Cola has earned a premium to its 10-year median PE ratio of 22.69X due to its growth and higher-margin operating model (following the re-franchising of its bottling operations), the stock's valuation currently leaves no margin of safety. High single-digit earnings growth simply does not support a 30X multiple over time in our view.

With the company caught in a tight financial spot, buybacks are something that management cannot meaningfully afford. If organic growth slows down for any reason, there is nothing to prop up earnings growth. If we operate on a forward basis, an entry point of 22X 2020 earnings would be a solid opportunity for long-term investors to accumulate a great business. This would mean a share price of approximately $49-$50 per share. Total returns would be roughly 10% per annum based on 3% yield and high single-digit earnings growth. Investors would benefit from a valuation that protects against operational underperformance, and potentially provides PE expansion if investment circumstances further improve.

Wrapping Up

After a transition away from its bottling operations that lasted multiple years, Coca-Cola is on a solidified path of new growth. This is very exciting for long-term investors. The higher-margin business model will serve well as revenues continue to climb, generating higher FCF. The company's most recent quarter points to continued operational momentum. Despite these positives, valuation still greatly matters for what is still a mature company. Unfortunately, Coca-Cola's stock has already priced in the good news that the earnings report brought.

If you enjoyed this article and wish to receive updates on our latest research, click "Follow" next to my name at the top of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.