Even This Cheap, It’s Hard to Make a Case for Chesapeake Energy Stock

To be a buyer in the energy space, it first helps to be bullish on energy

It’s dark days for oil right now, and Chesapeake Energy (NYSE:CHK) is no exception. CHK stock just broke to new lows, hitting 51 cents per share. With all sorts of quality energy and oil stocks under pressure, even “cheap” can’t make a case for this name right now.

As if trading for about 50 cents a shares weren’t enough confirmation, CHK stock is down 80% over the past 12 months. It’s been a tough run and it highlights how dangerous it can be to hold onto stocks that are in a clear downtrend. There’s good reason that they say stop-losses save lives and Chesapeake highlights why.

Trading CHK Stock

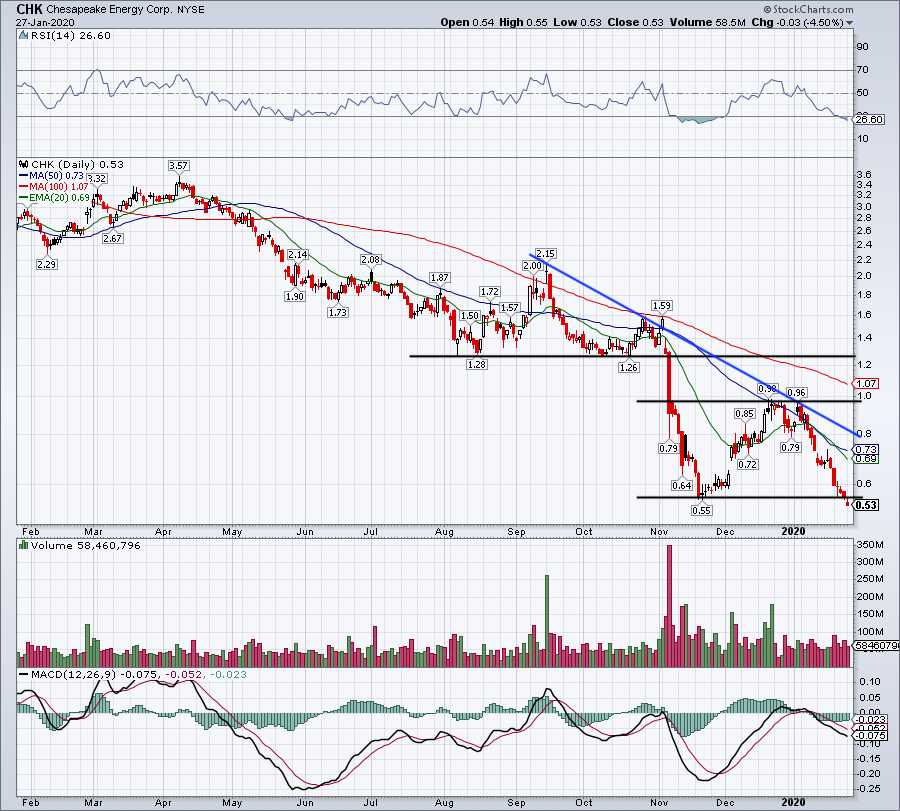

In September, it looked like CHK stock could actually get out of its funk. Shares were rallying off the $1.25 level, reclaiming $2 and pushing through its major moving averages. When that move ultimately failed though, it set the tone for what was to come.

Source: Chart courtesy of StockCharts.com

By November, shares burst below $1.25 support, crashing from a high of $1.59 to a 55-cent low in just a few weeks. As CHK stock rallied with the rest of the market in December, a very decisive stand took place: Chesapeake stock could not reclaim the $1 mark. It tried twice, topping at 98 cents and 96 cents, respectively.

So far in 2020, CHK stock has continued to struggle. Shares are down six straight sessions to new lows and are lower in 11 of the past 13 sessions.

Could Chesapeake shares reclaim the 55-cent low they just broke and rally to the declining 20-day and 50-day moving averages? Sure, and that’d be good for a 25-30% rally from current levels. Could it go even further, up to downtrend resistance (blue line), good for a 40%-plus move? Certainly.

But just because it has the potential to play out doesn’t mean it’s a worthwhile investment.

All Oil is Under Pressure

Right now, the entire oil space is under pressure. Energy stocks continue to push lower and even the strongest companies are struggling to advance their stocks. Just look at Exxon Mobil (NYSE:XOM), which is flirting with a move to its lowest level since 2010.

This is not a time to have weak financials.

The problem for Chesapeake? It’s not making money while the income statement is shrinking instead of growing. Analysts expect a loss of 25 cents per share for fiscal 2019 as revenue sinks 14% to $8.8 billion. That’s down big from the 90 cents per share in profit from the prior year. In 2020, estimates call for sales to fall another 8%, while losses expand to 30 cents per share.

The income statement isn’t inspiring, but the balance sheet is the most troubling. Current liabilities of $2.34 billion are significantly more than current assets of $1.4 billion. This suggests that CHK stock may have trouble meeting its short-term obligations.

Total assets of $16.57 billion do outweigh total liabilities of $11.84 billion, but there is still dire concern about Chesapeake making good on its obligations. If that weren’t the case, shares wouldn’t trade for under a buck.

That’s where lacking profitability and a free cash flow deficit really sap confidence.

Alternatives to Chesapeake

If not CHK stock, then what? To be a buyer in the energy space, it first helps to be bullish on energy! The technicals surely don’t say that’s the case, but the truth is, we’ll be dependent on oil and natural gas for quite some time.

Investors who then feel compelled to be a buyer of the space, may look to some of the long-lasting companies in the sector. There’s always the Energy Select Sector SPDR Fund (NYSEARCA:XLE) or the VanEck Vectors Oil Services ETF (NYSEARCA:OIH) that offer a diversified approach.

There’s also long-time stalwarts like the aforementioned Exxon or Chevron (NYSE:CVX). Although neither is flourishing at the moment, they will be around 10 and 20 years from now.

Others that have more flexibility, great assets and solid businesses include EOG Resources (NYSE:EOG), Pioneer Natural Resources (NYSE:PXD) and Concho Resources (NYSE:CXO).

Some may prefer to average down as these out-of-favor stocks sink lower. Others may prefer to wait until the technicals start to show signs of bullish momentum. As long as you have a plan, do what works best for you.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.