Risky Time For A Valero Investment

by Robert BoslegoSummary

- VLO beat earnings estimates for 4Q19.

- But market conditions have since deteriorated.

- Product stocks are oversupplied and refinery margins have dropped.

- The virus in China is a headwind of unknown depth and duration.

- Holding VLO is risky and better timing is likely in the months ahead.

Valero Energy Corporation (VLO) beat earnings estimates for the fourth quarter 2019. Refining margins were strong in the quarter and the market was anticipating continuing strength as the IMO 2020 sulphur cap regulation approached, going into effect January first. VLO’s share price also rose in anticipation, closing over $100 in mid-November.

Source: Seeking Alpha.

Market Conditions

What practically no one expected was the outbreak of the coronavirus in China. “More than half-a-dozen doctors first discussed the threat of a potential coronavirus outbreak in early December only to be silenced by the local Communist Party, according to some critics of the government,” Reuters reported. “The Wuhan mayor said he was not ‘authorized’ to publicize the epidemic until Jan. 20.”

The virus is adversely impacting oil demand in the second largest oil consuming economy in the world as travel is being curtailed. The size of the demand destruction cannot yet be determined. But the hit is on top of the impact of warmer-than-normal temperatures in China and Japan, which reduced heating oil demand.

Adding to what is a large imbalance between oil supply and demand is a build-up of refined petroleum products in Asia. The country had added refining capacity in 2019 in preparation for IMO 2020. In December, the country processed 13.78 mmbd, which was 1.71 mmbd, or 14.1%, higher than a year ago, according to Reuters.

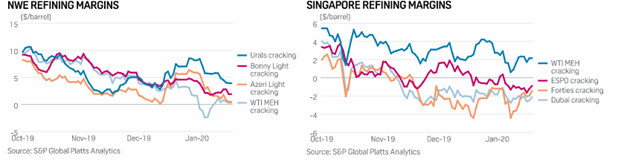

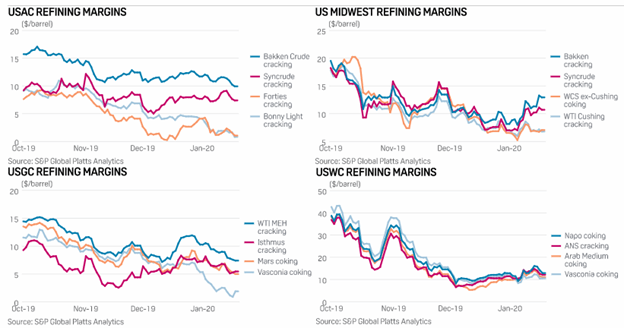

In Singapore and Northwest Europe, refining margins have resumed their trend downward after a small bump up at year-end. Singapore margins are also in negative territory for some crudes.

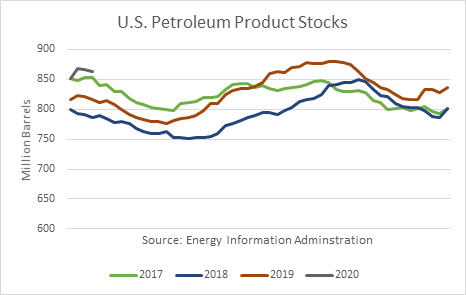

In the U.S., petroleum product stocks have swelled by 35 million barrels since the week ending December 20th. U.S. stocks are now the highest they have been for this time of year in at least 4 years.

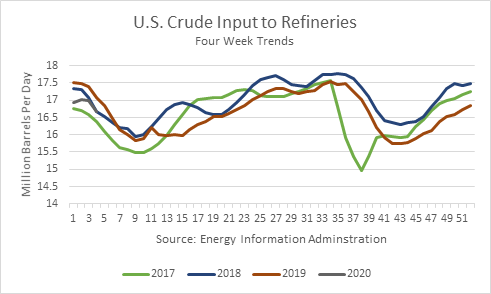

And the stock build occurred despite the fact that U.S. refinery runs lagged year-earlier levels. Over the past 4 weeks, refinery inputs were off 2.4 % vs. a year earlier.

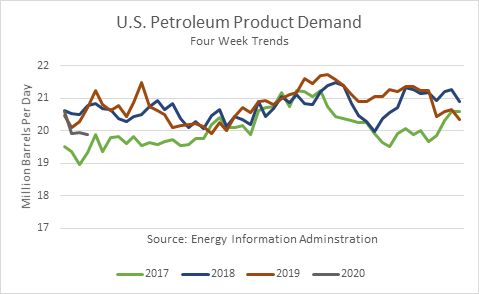

Demand for petroleum products has been unexpectedly weak. Over the past 4 weeks, demand is down 4.1 % vs. last year. And gasoline and distillate demand were 4.4% and 8.3% lower, respectively, in the same comparison.

Consequently, US refining margins have been sagging. In addition to lower margins on the Gulf Coast, Valero plans to cut its operating rate to 91 % in the first quarter of 2020, it disclosed in its conference call January 30th. The bulk of VLO’s refining capacity is located along the Gulf Coast.

In the fourth quarter, “Our refineries operated well at 96% utilization, allowing us to take advantage of wider sour crude oil differentials and weakness in high sulfur residual feedstocks in the fourth quarter,” Chairman and Chief Executive Officer Joe Gorder said.

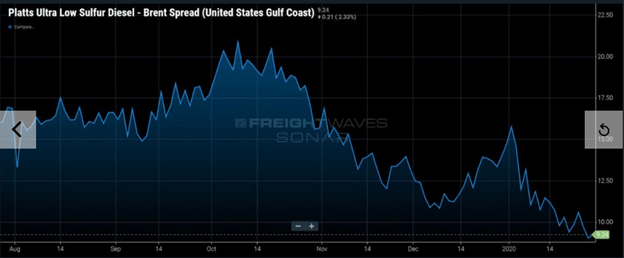

Valero was expected to benefit greatly from the IMO 2020 regulation. But the ultra-low sulfur diesel vs. Brent spread dropped from over $20 per barrel to under $10 per barrel over the past few months, according to Platts. VLO has upgraded its refineries to process a ‘cocktail’ of crudes, including high sulfur crudes, e.g., low-cost Canadian heavy crude.

Conclusions

Based on the unexpected deterioration of petroleum product market conditions in January, the outlook for VLO’s profitability in the first quarter of 2020 has to be lowered. Furthermore, the longer-term impact the virus may have on product demand and supplies in Asia and around the world is unknown. Therefore, owning VLO stock is a risky proposition at this time and there will likely be better conditions under which to purchase and hold the stock in the months ahead.

To guide investors who are interested in profiting from outstanding opportunities in the energy sector, I provide a service on Seeking Alpha’s Marketplace oriented toward individual investors, Boslego Risk Services. A long/short Model portfolio is continuously updated, along with on-going analysis of the oil market.

I am now accepting new members to Boslego Risk Services and invite you to sign-up. There are monthly and annual pricing options as described here. You may also read reviews posted by members here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.